CITIC Metal and Zijin Mining to invest an additional C$679 million

(US$515 million) in Ivanhoe Mines on August 16, 2019, positioning

Ivanhoe to fully finance its shareof capital costs to bring the

Kakula Copper Mine in D.R. Congo to commercial production

Drilling expands the new Kamoa North Bonanza Zone to at least

550 metres, with an implied strike length of 2.7 kilometres

of shallow, thick, massive sulphide mineralization,

with copper grades up to 18.48% over 13.6 metres

New Kamoa Far North extension discovery made on Ivanhoe’s

100%-owned Western Foreland licences, immediately north

of the Kamoa-Kakula mining licence

TORONTO, CANADA ‒ Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF) today announced its financial results for the quarter ended June 30, 2019. All figures are in U.S. dollars unless otherwise stated.

Ivanhoe Mines is a Canadian mining company focused on advancing its three mine-development projects in Southern Africa: the Platreef palladium-platinum-nickel-copper-gold-rhodium discovery in South Africa; the Kamoa-Kakula copper discovery in theDemocratic Republic of Congo (DRC); and the extensive upgrading of the historic Kipushi zinc-copper-lead-germanium mine, also in the DRC. The company also is exploring for new copper discoveries on its wholly-owned Western Foreland exploration licences, adjacent to the Kamoa-Kakula mining licence.

HIGHLIGHTS

- CITIC Metal Africa Investments Limited’s (CITIC Metal Africa) C$612 million ($464 million) second equity investment in Ivanhoe Mines is scheduled to close on August 16, 2019. The private placement transaction now has received all necessary internal approvals, as well as recordals and registration with Chinese government regulatory agencies. CITIC Metal Africa is a direct subsidiary of CITIC Metal Co., Ltd. (CITIC Metal).

- Ivanhoe’s joint-venture partner at Kamoa-Kakula, Zijin Mining Group Co., Ltd., exercised its existing anti-dilution rights on May 15, 2019, which will yield additional proceeds to Ivanhoe of C$67 million (approximately $51 million) to be received concurrently with the CITIC Metal Africa private placement.

- Upon closing, the additional funds from CITIC Metal Africa and Zijin Mining will position Ivanhoe to fully finance its share of the capital costs to bring the Kakula Copper Mine to commercial production.

- CITIC Metal Africa, currently Ivanhoe Mines’ largest shareholder with a 19.3% ownership stake, will come to own 29.4% of Ivanhoe’s issued and outstanding common shares when the placement is completed. Robert Friedland will remain Ivanhoe’s second-largest shareholder and Zijin will maintain its 9.8% ownership stake in Ivanhoe Mines.

- CITIC Metal’s existing standstill provision will be amended to a maximum ownership stake of 29.9% and extended until January 8, 2023 to provide sufficient time to bring the Kakula mine to production, and to advance subsequent, planned expansions at Kamoa-Kakula, as well as the Kipushi and Platreef projects.

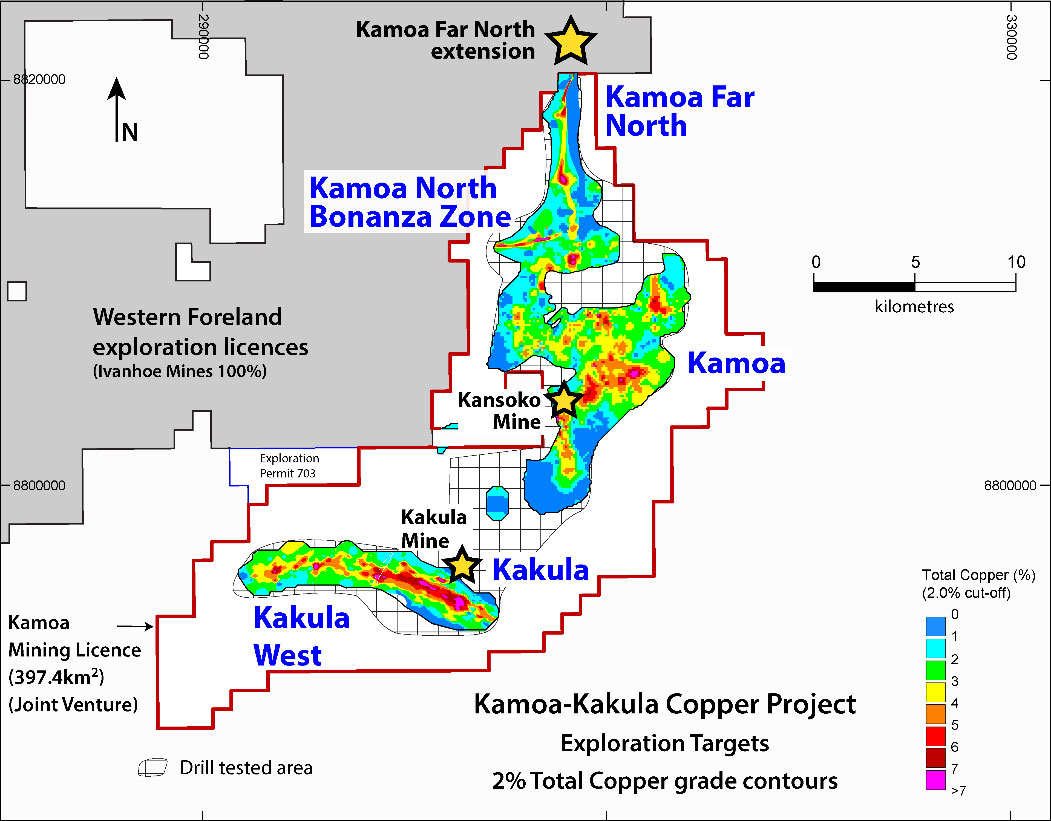

- On July 29, 2019, Ivanhoe announced that drilling on its 100%-owned Western Foreland licences, immediately north of the Kamoa-Kakula mining licence, had discovered the extension of the Kamoa Far North high-grade shallow copper corridor on Ivanhoe’s wholly-owned licences for at least 400 metres. Six holes have been completed in this new discovery area, two of which intersected visually strong copper mineralization, and assays are pending.

- On July 29, 2019, Ivanhoe announced assays from 19 new drill holes at the latest high-grade discovery at Kamoa-Kakula ─ the Kamoa North Bonanza Zone. Multiple, thick drill intercepts of more than 10% copper were recorded at the new discovery, including 13.80% over 15.50 metres in the central discovery area.

- The Kamoa North Bonanza Zone has been extended to at least 550 metres, with an implied strike length of at least 2.7 kilometres. Six rigs now are drilling at Kamoa North to extend the discovery’s strike length and fast track a resource estimate.

- The controlling east-west striking structure thought to be responsible for the massive copper sulphide mineralization in the Kamoa North Bonanza Zone is visible as a lineament on airborne magnetic images and can be traced over a distance of up to 20 kilometres. It trends west onto the adjacent Western Foreland exploration licences that are 100%-owned by Ivanhoe Mines.

- Development at the six million-tonne-per annum (6 Mtpa) Kakula Mine, the first of multiple, planned mining areas at Kamoa-Kakula, is making excellent progress. The first underground access drives are very close to intersecting Kakula’s initial high-grade ore, and Ivanhoe and its joint-venture partner Zijin Mining are advancing rapidly on earthworks for the processing plant and other surface infrastructure. The joint venture also has issued purchase orders or tenders for the long-lead mining and processing equipment. Initial copper concentrate production from the Kakula Mine currently is scheduled for the third quarter of 2021.

- Other engineering and construction activities underway at Kamoa-Kakula include construction of a permanent road between the mine site and the Kolwezi airport, construction of the first phase of accommodations for 1,000 employees and contractors, and earthworks for the processing plant and other surface infrastructure.

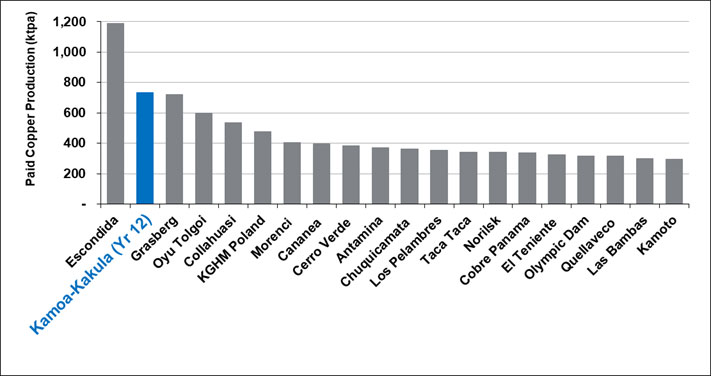

- An independent preliminary economic assessment (PEA) issued in February 2019 indicates that Kamoa-Kakula has a potential production rate of at least 18 Mtpa. Once this expanded rate is achieved, Kamoa-Kakula is projected to become the world’s second largest copper mine, with peak annual production of more than 700,000 tonnes of copper.

- At the Kipushi mine redevelopment project in the DRC, the definitive feasibility study (DFS), which will update and refine the findings of the PFS issued in December 2017, is being reviewed by Ivanhoe’s engineering team who continues to work toward completion. Similar to the PFS, the DFS will focus on the initial mining of Kipushi’s Big Zinc Zone.

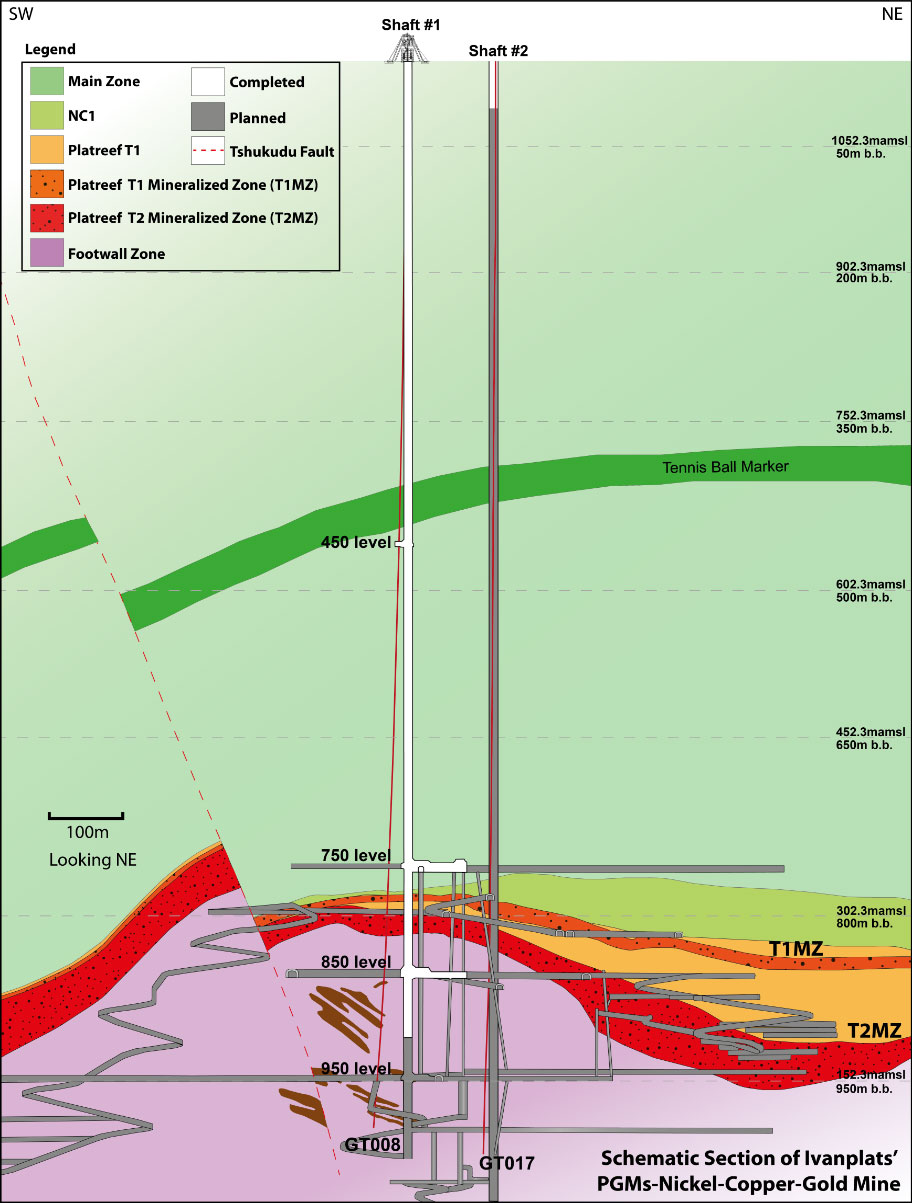

- At the Platreef mine development project in South Africa, the project’s first shaft (Shaft 1) has been extended to a depth of more than 900 metres below surface. The next station development for Shaft 1 is at 950 metres, with completion of the shaft to a final depth of 982 metres planned for early 2020.

- The concrete foundation (hitch) for the headframe was completed in mid-July. Shaft 2 will have an internal diameter of 10 metres and will be equipped with two 40-tonne rock-hoisting skips with a capacity to hoist a total of six million tonnes of ore per year – the single largest hoisting capacity at any mine in Africa.

- Ivanhoe is investigating an alternative early production plan for the Platreef Project, targeting significantly lower initial capital, to accelerate first production by using Shaft 1 as the mine’s initial production shaft, followed by expansions to the production rate as outlined in the DFS.

- On June 10, 2019, Ivanhoe issued its second annual Sustainability Report, which provides an overview of the company’s sustainability programs and initiatives conducted in 2018, and highlights the significant accomplishments achieved at its three mine development projects and the new goals set for current and future corporate activities.

- At the end of Q2 2019, Kamoa-Kakula had recorded 15.0 million work hours free of lost-time injuries, Kipushi 432,000 work hours free of lost-time injuries, and Platreef 1.7 million work hours free of lost-time injuries. Regrettably, a lost time injury occurred at both the Platreef and Kipushi projects in July 2019.

Principal projects and review of activities

1. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project is owned by Ivanplats (Pty) Ltd, which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically-disadvantaged, broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with approximately 150,000 people, project employees and local entrepreneurs. In Q2 2019, Ivanplats reached Level 2 contributor status in its verification assessment on a B-BBEE scorecard. A Japanese consortium of ITOCHU Corporation, Japan Oil, Gas and Metals National Corporation and Japan Gas Corporation, owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper and gold mineralization on the Northern Limb of the Bushveld Igneous Complex in Limpopo Province, approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane.

On the Northern Limb, platinum-group metals mineralization is hosted primarily within the Platreef, a mineralized sequence that is traced more than 30 kilometres along strike. Ivanhoe’s Platreef Project, within the Platreef’s southern sector, is comprised of two contiguous properties: Turfspruit and Macalacaskop. Turfspruit, the northernmost property, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of mining operations and properties.

Since 2007, Ivanhoe has focused its exploration and development activities on defining and advancing the down-dip extension of its original discovery at Platreef, now known as the Flatreef Deposit, which is amenable to highly mechanized, underground mining methods. The Flatreef area lies entirely on the Turfspruit and Macalacaskop properties, which form part of the company’s mining right.

Health and safety at Platreef

As at the end of Q2 2019, the Platreef Project had reached a total of 1,700,812 lost-time, injury-free hours worked in accordance with South Africa’s Mine Health and Safety Act and Occupational Health and Safety Act. Unfortunately a lost-time injury (LTI) occurred in July 2019 after the project had reached 14 months without a LTI. The Platreef Project continues to strive toward its workplace objective of an environment that causes zero harm to employees, contractors, sub-contractors and consultants.

Platreef alternative production plan

Ivanhoe Mines is investigating an alternative production plan for the Platreef Project, targeting significantly lower initial capital, to accelerate first production by using Shaft 1 as the mine’s initial production shaft. This plan will focus on initially targeting the development of mining zones accessible from Shaft 1 and maximizing the hoisting capacity of this shaft, followed by expansions to the production rate as outlined in the DFS.

Shaft 1 now extends to a depth of more than 900 metres below surface

Shaft 1 reached the top of the high-grade Flatreef Deposit (T1 mineralized zone) at a depth of 780.2 metres below surface in Q3 2018 and has since been extended to a depth of more than 900 metres below surface. The thickness of the mineralized reef (T1 and T2 mineralized zones) at Shaft 1 is 29 metres, with grades of platinum-group metals ranging up to 11 grams per tonne (g/t) 3PE (platinum, palladium and rhodium) plus gold, as well as significant quantities of nickel and copper. The 29-metre intersection yielded approximately 3,000 tonnes of ore, estimated to contain more than 400 ounces of platinum-group metals. The ore is stockpiled on surface for further metallurgical sampling.

The 750-metre-level and 850-metre-level stations have both been completed and will provide initial, underground access to the high-grade orebody, enabling mine development to proceed during the construction of Shaft 2. As sinking of Shaft 1 advances, one more station will be developed at a mine-working depth of 950 metres. Shaft 1 is expected to reach its projected, final depth of 982 metres below surface in early 2020.

The DFS planned for Shaft 1 to ultimately become the primary ventilation shaft during the project’s four-Mtpa production case.

Shaft 2 box cut and concrete foundation completed in July

Shaft 2, to be located approximately 100 metres northeast of Shaft 1, will have an internal diameter of 10 metres. It will be lined with concrete and sunk to a planned, final depth of more than 1,104 metres below surface. It will be equipped with two, 40-tonne, rock-hoisting skips capable of hoisting a total of six million tonnes of ore a year – the single largest hoisting capacity at any mine in Africa.

The headgear for the permanent hoisting facility was designed by South Africa-based Murray & Roberts Cementation. The box-cut excavation to a depth of approximately 29 metres below surface, including the concrete foundation (hitch), was successfully completed and will form the foundation of the 103-metre-tall concrete headgear that will house the shaft’s permanent hoisting facilities and support the shaft collar.

Construction of Platreef’s Shaft 2 headframe foundation has successfully been completed.

Testing the ventilation at Shaft 1’s 750-metre-level station. The shaft currently is at approximately 900 metres below surface. The next station is at 950 metres, and completion of the shaft to a depth of 982 metres is planned for early 2020.

Figure 1: Schematic section of the Platreef Mine, showing Flatreef’s T1 and T2 thick, high-grade mineralized zones (red and dark orange), underground development work completed to date in shafts 1 and 2 (white) and planned development work (gray).

Underground mining to incorporate highly productive, mechanized methods

The mining zones in the current Platreef mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below surface.

Planned mining methods will use highly productive, mechanized methods, including long-hole stoping and drift-and-fill mining. Each method will utilize cemented backfill for maximum ore extraction. As per the DFS, the ore will be hauled from the stopes to a series of internal ore passes and fed to the bottom of Shaft 2, where it will be crushed and hoisted to surface.

Long-term supply of bulk water secured for the Platreef Mine

On May 7, 2018, Ivanhoe announced the signing of a new agreement to receive local, treated water to supply most of the bulk water needed for the first phase of production at Platreef. The Mogalakwena Local Municipality has agreed to supply a minimum of five million litres of treated water a day for 32 years, beginning in 2022, from the town of Mokopane’s new Masodi Treatment Works. Initial supply will be used in Platreef’s ongoing underground mine development and surface infrastructure construction.

Under terms of the agreement, which is subject to certain suspensive conditions, Ivanplats will provide financial assistance to the municipality for certified costs of up to a maximum of R248 million (approximately $19.6 million) to complete the Masodi treatment plant. Ivanplats will purchase the treated wastewater at a reduced rate of R5 per thousand litres for the first 10 million litres per day to offset a portion of the initial capital contributed.

Ivanplats received its Integrated Water Use Licence in January 2019, which is valid for 30 years and enables the Platreef Project to make use of water as planned in the 2017 DFS.

Development of human resources and job skills

The Platreef Project’s Social and Labour Plan (SLP), toward which it pledged a total of R160 million ($11 million) during the past five years, expires in November 2019. The approved plan included R67 million ($5 million) for the development of job skills among local residents and R88 million ($6 million) for local economic development projects. Consultation regarding the project’s second SLP has commenced.

2. Kipushi Project

68%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kipushi copper-zinc-germanium-lead mine, in the Democratic Republic of Congo, is adjacent to the town of Kipushi and approximately 30 kilometres southwest of Lubumbashi. It is located on the Central African Copperbelt, approximately 250 kilometres southeast of the Kamoa-Kakula Project and less than one kilometre from the Zambian border. Ivanhoe acquired its 68% interest in the Kipushi Project in November 2011; the balance of 32% is held by the state-owned mining company, La Générale des Carrières et des Mines (Gécamines).

Health, safety and community development

At the end of Q2 2019, the Kipushi Project reached a total of 432,275 work hours free of lost-time injuries. It had been more than seven months since the last lost-time injury occurred at the Kipushi Project. Regrettably, a lost-time injury occurred at Kipushi in July 2019.

The Kipushi Project operates a potable-water station to supply the municipality with water. This includes power supply, disinfectant chemicals, routine maintenance, security and emergency repair of leaks to the primary reticulation. The Kipushi Project also installed and commissioned new overhead powerlines to the pump station. Other community development projects continued during Q2 2019 and included a new enrolment into the Kipushi women’s literacy project, the continuation of the sewing training centre project and the upgrading of a school.

Installing Kipushi’s new P2 winder.

Refurbished overhead crane at Kipushi’s 850-metre-level pump chamber.

Pre-feasibility study for Kipushi completed in December 2017 and definitive feasibility study progressing

The Kipushi Project’s PFS, announced by Ivanhoe Mines on December 13, 2017, anticipated annual production of an average of 381,000 tonnes of zinc concentrate over an 11-year, initial mine life at a total cash cost of approximately $0.48 per pound (lb) of zinc.

Highlights of the PFS, based on a long-term zinc price of $1.10/lb include:

- After-tax net present value (NPV) at an 8% real discount rate of $683 million.

- After-tax real internal rate of return (IRR) of 35.3%.

- After-tax project payback period of 2.2 years.

- Pre-production capital costs, including contingency, estimated at $337 million.

- Existing surface and underground infrastructure allows for significantly lower capital costs than comparable greenfield development projects.

- Life-of-mine average planned zinc concentrate production of 381,000 dry tonnes per annum, with a concentrate grade of 59% zinc, is expected to rank Kipushi, once in production, among the world’s largest zinc mines.

All figures are on a 100%-project basis unless otherwise stated. Estimated life-of-mine average cash cost of $0.48/lb of zinc is expected to rank Kipushi, once in production, in the bottom quartile of the cash-cost curve for zinc producers internationally.

The project team continues to work towards the completion of the Kipushi Project’s definitive feasibility study (DFS).

Geology and exploration

Geological work in Q1 2019 was focused on obtaining additional information required for the DFS, as well as planning the geological delineation-drilling and grade-control program for underground mine development. The design criteria for the delineation drilling will target areas along the edge of the Big Zinc, which presently are inaccessible from the historic workings. No new geological and exploration work was conducted during Q2 2019.

Project development and infrastructure

Significant progress has been made in modernizing the Kipushi Mine’s underground infrastructure as part of preparations for the mine to resume commercial production, including upgrading a series of vertical mine shafts to various depths, with associated head frames, as well as underground mine excavations and infrastructure. A series of crosscuts and ventilation infrastructure still is in working condition and have been cleared of old materials and equipment to facilitate modern, mechanized mining. The underground infrastructure also includes a series of pumps to manage the mine’s water levels, which now are easily maintained at the bottom of the mine.

Shaft 5 is eight metres in diameter and 1,240 metres deep. It now has been upgraded and re-commissioned. The main personnel and material winder has been upgraded and modernized to meet international industry standards and safety criteria. The Shaft 5 rock-hoisting winder now is fully operational with new rock skips, new head- and tail-ropes, and attachments installed. The two newly manufactured rock conveyances (skips) and the supporting frames (bridles) have been installed in the shaft to facilitate the hoisting of rock from the main ore and waste-storage silos feeding rock on the 1,200-metre level.

The main haulage way on the 1,150-metre level between the Big Zinc access decline and Shaft 5 rock load-out facilities has been resurfaced with concrete so the mine now can use modern, trackless, mobile machinery. A new truck-tipping bin, which feeds into the large-capacity rock crusher located directly below, has been installed on this level. The old winder at P2 Shaft has been removed and construction of the new foundation, assembly and installation of the new modern winder has been completed.

With the underground upgrading program nearing completion, the project’s focus now will shift to upgrading Kipushi’s surface infrastructure to handle and process Kipushi’s high-grade zinc and copper resources.

Kabamba Ngoie, a Kipushi employee, constructing new walls for a community potable water pumping station that Kipushi is renovating as part of its community support program.

3. Kamoa-Kakula Project

39.6%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kamoa-Kakula Project, a joint venture between Ivanhoe Mines and Zijin Mining, has been independently ranked as the world’s fourth largest copper deposit by international mining consultant Wood Mackenzie, with adjacent prospective exploration areas within the Central African Copperbelt in the Democratic Republic of Congo, approximately 25 kilometres west of the town of Kolwezi and about 270 kilometres west of Lubumbashi.

Ivanhoe sold a 49.5% share interest in Kamoa Holding to Zijin Mining in December 2015 for an aggregate consideration of $412 million. In addition, Ivanhoe sold a 1% share interest in Kamoa Holding to privately-owned Crystal River for $8.32 million – which Crystal River will pay through a non-interest-bearing, 10-year promissory note. Since the conclusion of the Zijin transaction in December 2015, each shareholder has been required to fund expenditures at the Kamoa-Kakula Project in an amount equivalent to its proportionate shareholding interest in Kamoa Holding.

A 5%, non-dilutable interest in the Kamoa-Kakula Project was transferred to the DRC government on September 11, 2012 for no consideration, pursuant to the 2002 DRC mining code. Following the signing of an agreement with the DRC government in November 2016, in which an additional 15% interest in the Kamoa-Kakula Project was transferred to the DRC government, Ivanhoe and Zijin Mining now each hold an indirect 39.6% interest in the Kamoa-Kakula Project, Crystal River holds an indirect 0.8% interest and the DRC government holds a direct 20% interest. Kamoa Holding holds an 80% interest in the project.

Figure 2: Kamoa-Kakula mining licence, showing the Kamoa North Bonanza and Kamoa Far North zones, the new Kamoa Far North extension discovery on Ivanhoe’s 100%-owned exploration licences, and the planned mines at Kakula and Kansoko.

Kamoa-Kakula surpasses 15 million hours worked without a lost-time injury

The project achieved a significant milestone during June 2019 when it recorded a combined total of 15 million hours of work without a lost-time injury. By the end of Q2 2019, a total of 15,006,878 hours had been worked free of lost-time injuries. It has been more than seven years since the last lost-time injury occurred at the project. This outstanding achievement reflects the dedication to a safety-focused culture of the entire Kamoa-Kakula exploration and development teams.

In July, members of the Kamoa-Kakula Copper Project team celebrated 15 million lost-time-accident-free hours.

PFS for Kakula and updated PEA for an expanded Kamoa-Kakula production rate of 18 Mtpa announced

On February 6, 2019, Ivanhoe announced the results from the Kakula 2019 PFS. The study assesses the potential development of the Kakula Deposit as a 6 Mtpa mining and processing complex. The Kakula mill would be constructed in two smaller phases of 3 Mtpa each as the mining operations ramp-up to full production of 6 Mtpa. The life-of-mine production scenario provides for 119.7 million tonnes to be mined at an average grade of 5.48% copper, producing 9.8 million tonnes of high-grade copper concentrate, containing approximately 12.4 billion pounds of copper. All figures are on a 100%-project basis unless otherwise stated.

On March 22, 2019, Ivanhoe filed an updated NI 43-101 technical report for the Kamoa-Kakula Copper Project covering the independent pre-feasibility studies for the development of the Kakula and Kansoko copper mines, and an updated, expanded preliminary economic assessment for the overall integrated development plan for the project. The report, titled “Kamoa-Kakula Integrated Development Plan 2019”, is available on the company’s website and under the company’s SEDAR profile at www.sedar.com.

Highlights of the PFS, based on a consensus, long-term copper price of $3.10/lb include:

- Very high-grade, stage-one production is projected to have a grade of 7.1% copper in the second year of production and an average grade of 6.4% copper over the initial 10 years of operations, resulting in estimated average annual copper production of 291,000 tonnes.

- Annual copper production is estimated at 360,000 tonnes in year four.

- Initial capital cost, including contingency, is estimated at $1.1 billion.

- Average total cash cost of $1.11/lb of copper during the first 10 years, inclusive of royalties.

- After-tax NPV, at an 8% discount rate, of $5.4 billion.

- After-tax internal rate of return (IRR) of 46.9%, and a payback period of 2.6 years.

- Kakula is expected to produce a very high-grade copper concentrate in excess of 55% copper, with extremely low arsenic levels.

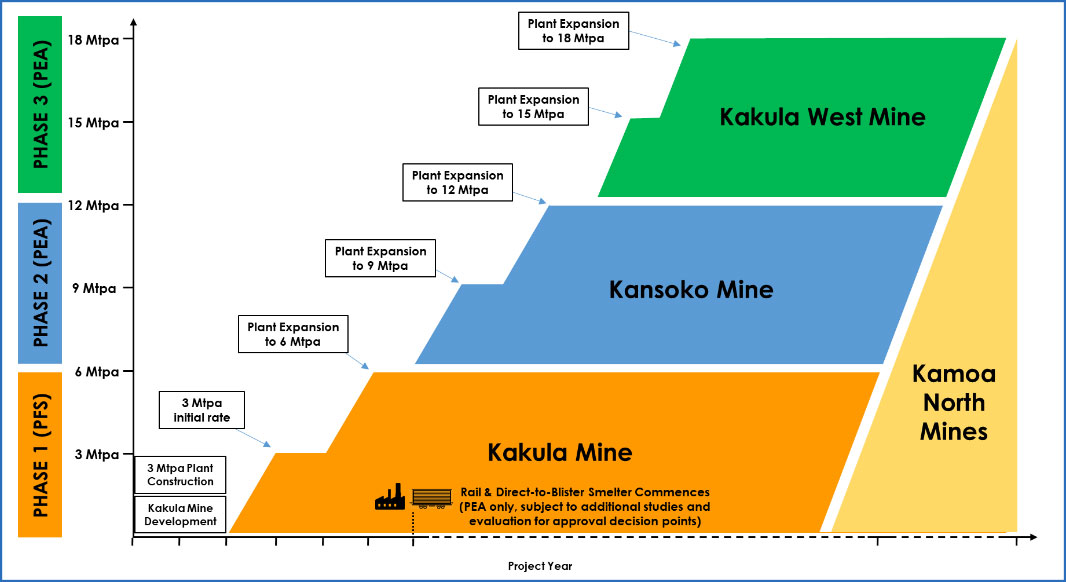

Ivanhoe also announced an updated independent PEA for an expanded Kamoa-Kakula production rate of 18 Mtpa, supplied initially by a 6 Mtpa mine at Kakula, followed by two 6 Mtpa mines at Kansoko and Kakula West, and a world-scale direct-to-blister smelter.

In July, the reaming of Kakula’s first ventilation shaft was completed. The 5.5-metre diameter shaft is the first of five ventilation shafts to be raise bored in Kakula’s first phase of development.

Highlights of the PEA, based on a consensus, long-term copper price of $3.10/lb include:

- Very high-grade initial phase projected to have a grade of 7.1% copper in the second year of production and an average grade of 5.7% copper during the first 10 years of operations, resulting in estimated average annual copper production of 386,000 tonnes.

- Recovered copper production is estimated at 740,000 tonnes in year 12, which would rank the Kamoa-Kakula Project as the second largest copper producer in the world.

- Initial capital cost, including contingency, is $1.1 billion, with subsequent expansions at Kansoko, Kakula West, and other mining areas, as well as the smelter, to be funded by cash flows from the Kakula Mine.

- Average total cash costs of $0.93/lb of copper during the first 10 years, including sulphuric acid credits.

- After-tax NPV, at an 8% discount rate, of $10.0 billion.

- After-tax IRR of 40.9% and a payback period of 2.9 years.

Figure 3: Kamoa-Kakula 18 Mtpa PEA long-term development plan.

Figure by OreWin 2019.

Figure 4: Projected 18 Mtpa Kamoa-Kakula PEA production (year-12 peak copper production shown) compared to the world’s projected top 20 producing mines in 2025 by paid copper production.

Note: Kamoa-Kakula 2019 PEA production based on projected peak copper production (which occurs in year 12) of the 18 Mtpa alternative development option. Source: Wood Mackenzie (based on public disclosure, the Kakula 2019 PFS has not been reviewed by Wood Mackenzie).

Underground development progressing at the Kakula Deposit

The underground development work at Kakula is being performed by mining crews operating large-capacity, semi-autonomous mining equipment, such as jumbo drilling rigs and 50-tonne trucks. More than 2,700 metres of underground development was completed in the six months ending June 30, 2019. Lower-grade development ore is being stockpiled on surface near the site of the concentrator plant. This ore will be used for plant commissioning. Mine access drives 1 and 2 (interconnected, parallel tunnels that will provide access to ore zones) continue to progress, with access drive 2 being prioritized to access the high-grade mining zone that will be reached in August 2019.

Three underground mining crews are working at Kakula and an additional three crews will be mobilized by October 2019 to accelerate mine development. Development around Ventilation Shaft 1 and the rock handling infrastructure was completed in Q2 2019 and reaming of the 5.5-metre diameter ventilation shaft was completed in July 2019. Approximately 40 metres of development had been completed at the southern ventilation decline by the end of Q2 2019. The southern ventilation decline will facilitate the acceleration of critical, early mine development. Initial copper concentrate production from the Kakula Mine currently is scheduled for the third quarter of 2021.

Construction is underway on the foundations for the conveyor that will transport ore from the Kakula underground mine to the processing plant on surface.

Basic engineering, early works engineering and construction at Kakula

The basic engineering design currently is being carried out by DRA Global as the main contractor. Design of the plant and surface infrastructure has been completed and the cost estimate currently is under review. The initial, five-year, detailed mine design now has been finalized and design and costing of the underground infrastructure is in progress. The basic engineering package will advance engineering and provide a detailed capital cost estimate by which the project costs can be controlled and will be included in the independent definitive feasibility study that is expected to be published early next year.

The processing plant flow diagrams, process control descriptions, and processing equipment lists have been completed and piping and instrumentation diagrams are being finalized. Major long-lead items including cone crushers, ball mills, thickeners and flotation cells have been ordered. The design and procurement of the underground rock handling system has been completed and the tender for the plant civil works has been adjudicated.

Construction of the new road linking Kamoa-Kakula with the Kolwezi airport is progressing well and is expected to be operational by the end of 2019. Other engineering and construction activities underway at Kamoa-Kakula include construction of the first phase of accommodations for 1,000 employees and contractors, and earthworks for the processing plant and other surface infrastructure.

Surface terracing of the site for the Kakula processing plant.

Construction of the new 34-kilometre highway directly linking the Kamoa-Kakula Project to the Kolwezi airport, located southeast of the city of Kolwezi. The new highway is expected to be fully operational by the end of 2019.

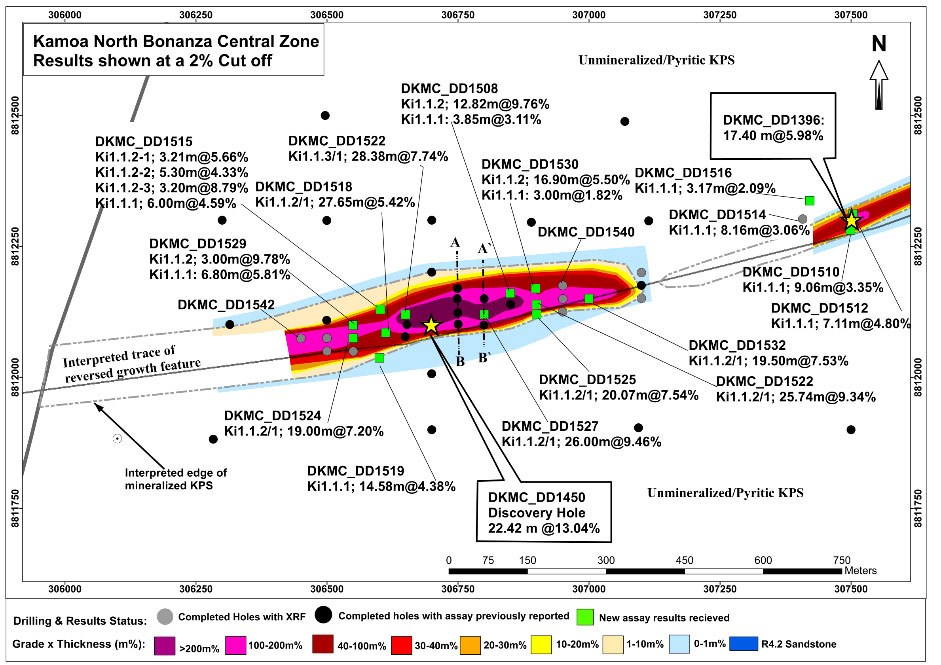

Exploration success leads to discovery of new shallow thick ultra-high grade Kamoa North Bonanza Zone

Drilling during Q2 2019 confirmed the discovery of a new shallow, thick, ultra-high grade mineralized zone in the Kamoa North exploration area originally intersected in hole DD1450 (13.05% copper over 22.3 metres (true thickness). Drill results released in May 2019 and then again in July 2019 confirmed that the strike length of the Kamoa North Bonanza Zone extended along strike to at least 550 metres, with a width of up to 60 metres across strike (see Figure 5).

Five rigs are extending and infilling the central and eastern portions of the implied 2.7-kilometre Kamoa North Bonanza mineralized corridor, and a sixth rig is drilling high-grade mineralization around holes DD0015 and DD1200 located to the west of the major north-south trending West Scarp Fault, which down drops the high-grade discovery zone by approximately 250 metres.

The central and eastern portions of the Kamoa North Bonanza Zone have drilled thicknesses of between six and 36 metres, and are approximately 170 to 220 metres below surface, with grades ranging as high as 18.48% copper over 13.6 metres, at both a 2% and a 3% cut-off grade.

The Kamoa North Bonanza Zone represents a new style of copper mineralization at Kamoa-Kakula, where massive to semi-massive chalcopyrite, bornite and chalcocite have locally replaced pyrite in the Kamoa Pyritic Siltstone (KPS) – a pyritic siltstone that lies immediately above the basal diamictite unit that typically hosts the copper mineralization at Kamoa-Kakula.

Drilling along strike of the Kamoa North Bonanza Zone. Six drill rigs are operating to accelerate the delineation of this extremely high-grade discovery.

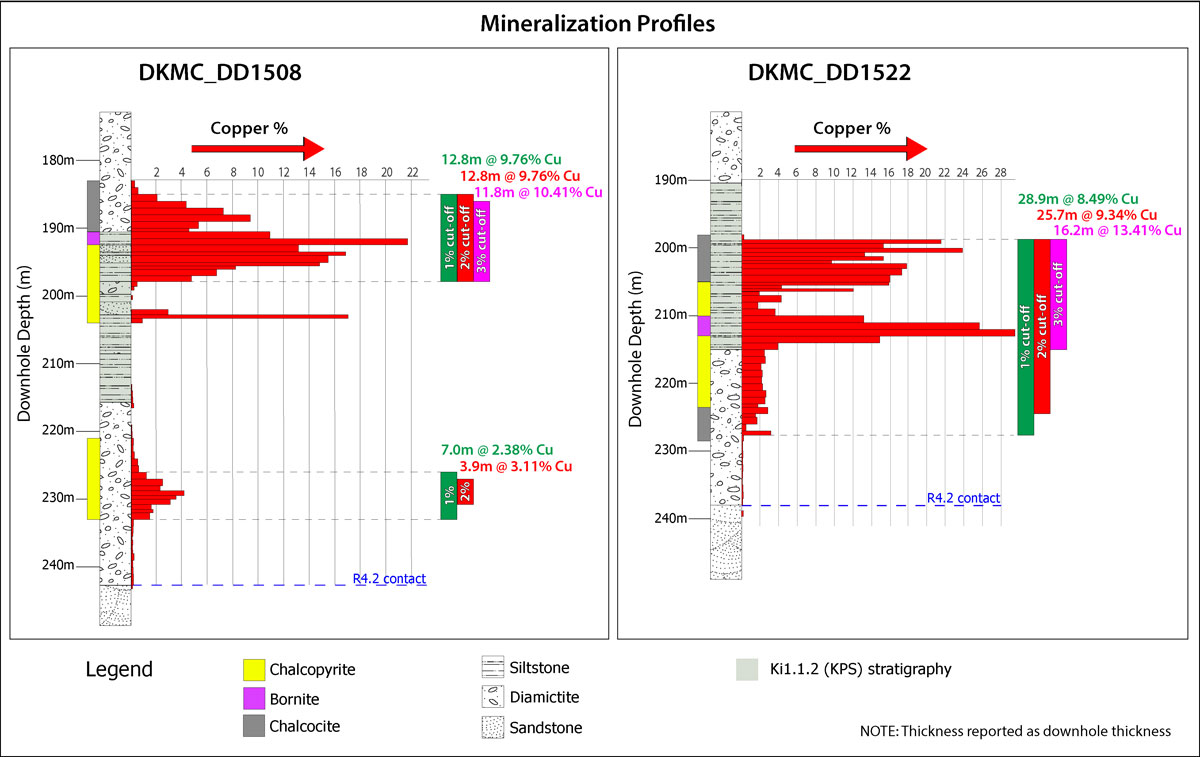

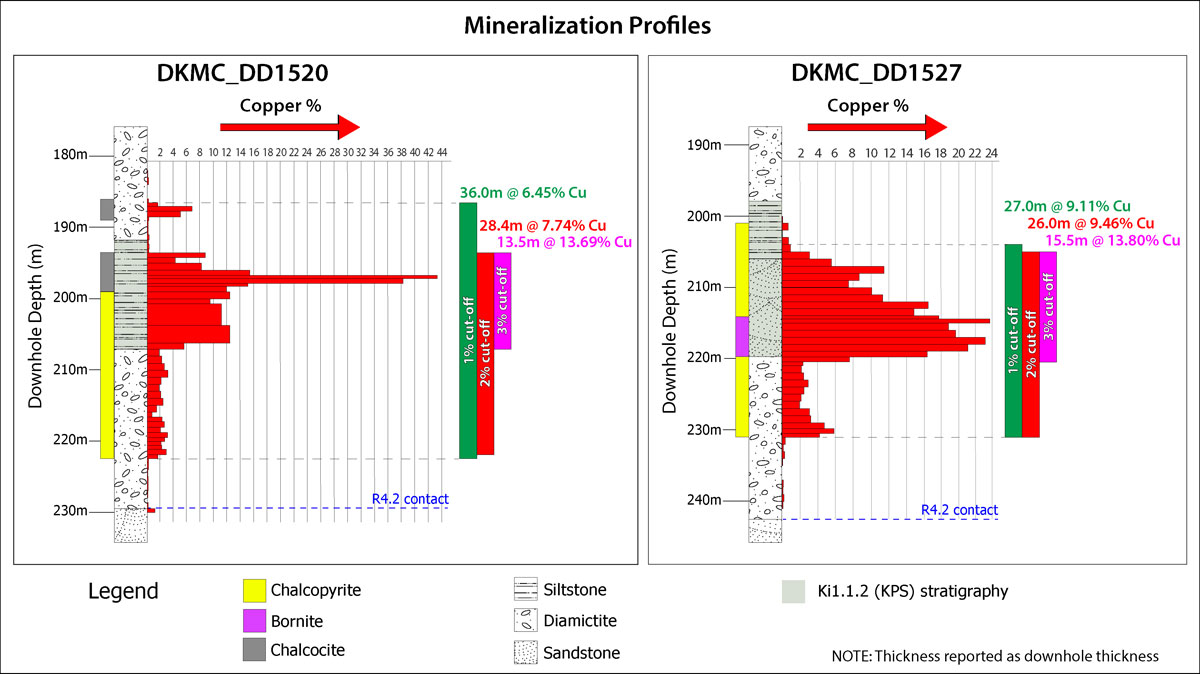

Assay results were released for 19 new holes in Ivanhoe’s July 29, 2019 news release. Selected significant drilling intercepts from the drilling included:

- DD1508 intersected 11.82 metres of 10.41% copper, at a 3% copper cut-off, and 12.82 metres of 9.76% copper, at a 1% and 2% copper cut-off, in semi-massive sulphide KPS-hosted mineralization, beginning at a downhole depth of 185.0 metres.

- DD1520 intersected 13.49 metres of 13.69% copper, at a 3% copper cut-off, and 28.38 metres of 7.74% copper, at a 2% copper cut-off, in semi-massive sulphide KPS-hosted mineralization, beginning at a downhole depth of 193.5 metres; and 36.00 metres of 6.45% copper at a 1% cut-off.

- DD1522 intersected 16.24 metres of 13.41% copper, at a 3% copper cut-off, and 25.74 metres of 9.34% copper, at a 2% copper cut-off, in semi-massive sulphide KPS-hosted mineralization, beginning at a downhole depth of 198.7 metres; and 28.89 metres of 8.49% copper at a 1% cut-off.

- DD1527 intersected 15.50 metres of 13.80% copper, at a 3% copper cut-off, and 26.00 metres of 9.46% copper, at a 2% copper cut-off, in semi-massive sulphide KPS-hosted mineralization, beginning at a downhole depth of 205.0 metres; and 26.00 metres of 9.46% copper at a 1% cut-off.

- DD1531 intersected 4.37 metres of 12.37% copper, at a 3% copper cut-off, and 5.06 metres of 11.09% copper, at a 2% copper cut-off, in semi-massive sulphide KPS-hosted mineralization, beginning at a downhole depth of 205.0 metres; and 12.87 metres of 5.35% copper at a 1% cut-off.

Infill drilling in the shallow central core of the Kamoa North Bonanza Zone is focused on delineating an initial mineral resource estimate.

Figure 5: The Bonanza structure trends east-west and extends out of the Kamoa-Kakula mining licence. The previously drilled holes of DD1396, DD1200 and DD0015 clearly intersect mineralization of similar style, and recently drilling has shown a continuous high-grade zone of at least 550 metres in strike.

Figure 6: Copper grade profiles of recent holes across the Kamoa North Bonanza Zone, showing dominant copper sulphide, copper assay values and composite grades at 1%, 2% and 3% copper cut-offs.

The potential to fast-track Kamoa North under initial assessment

Given the shallow depth, remarkable thickness and massive copper sulphide mineralization discovered within the Kamoa North Bonanza Zone, Kamoa-Kakula’s engineers are evaluating potential options to accelerate the development of this new discovery.

Based on the shallow depth of the high-grade mineralized intercepts to date at the Kamoa North Bonanza Zone, the discovery zone may be accessed by way of a surface box-cut and decline, similar to those at the Kakula and Kansoko deposits, in a relatively short time-frame.

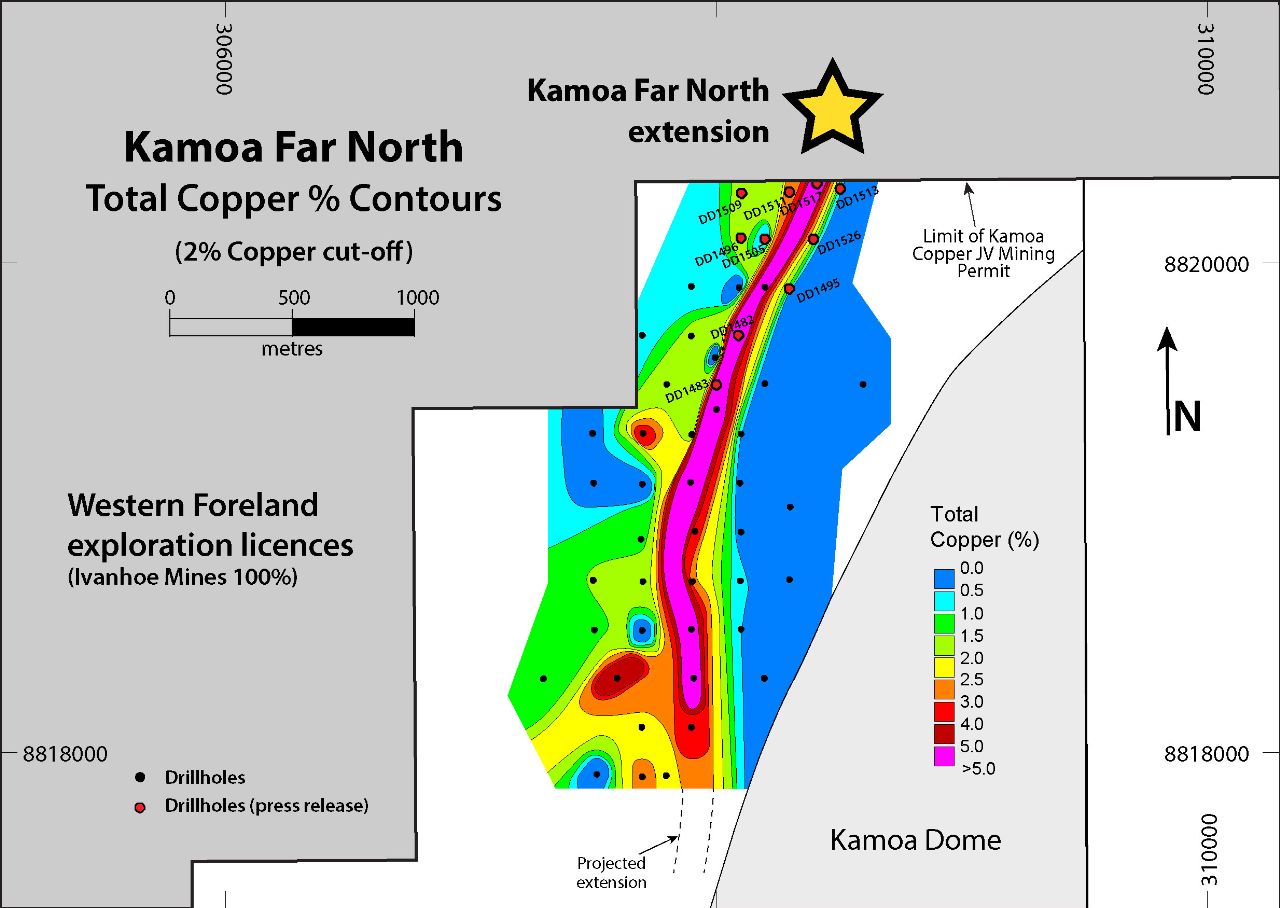

Additional assays received from 11 holes drilled along the 10-kilometre Kamoa Far North high-grade copper corridor, with grades ranging up to 9.37% copper over 6.46 metres

Assay results also were recently received for the final 11 drill holes completed in the Kamoa Far North Area. The results confirm earlier visual and portable Niton (X-ray fluorescence or XRF) estimates that the high-grade mineralized trend that had been defined over a distance of 10 kilometres in the Kamoa North region has been traced to the northern boundary of the Kamoa-Kakula mining licence. More than 29,000 metres have been drilled so far this year on the Kamoa-Kakula mining licence, and an additional 26,000 metres currently are planned.

Highlights of recent Kamoa Far North drilling include:

- DD1482 intersected 6.46 metres (true thickness) of 9.37% copper, at a 3% copper cut-off, and 8.31 metres (true thickness) of 7.84% copper, at a 1% and 2% copper cut-off beginning at a downhole depth of 250.0 metres.

- DD1492 intersected 10.36 metres (true thickness) of 6.99% copper, at a 3% and 2% copper cut-off, and 11.16 metres (true thickness) of 6.59% copper, at a 1% copper cut-off, beginning at a downhole depth of 226.9 metres.

- DD1502 intersected 9.56 metres (true thickness) of 5.59% copper, at a 3%, 2% and 1% copper cut-off, beginning at a downhole depth of 262.0 metres.

- DD1517 intersected 3.10 metres (true thickness) of 6.62% copper, at a 3%, 2% and 1% copper cut-off, beginning at a downhole depth of 325.38 metres.

Ongoing upgrading work enables Mwadingusha hydropower station to supply clean electricity to the national grid

Ongoing upgrading work at the Mwadingusha hydropower plant in the DRC has significantly progressed with the major equipment being delivered on site. The power station was shut down to replace sections of penstocks that were found to be in an advanced stage of corrosion. The progressive re-commissioning of the turbines, fully refurbished and modernized with state-of-the-art control and instrumentation, is underway and is expected to be completed in Q3 2020. The refurbished plant is projected to deliver approximately 72 megawatts (MW) of power to the national power grid.

The work at Mwadingusha, part of a program to eventually overhaul and boost output from three hydropower plants, is being conducted by engineering firm Stucky of Lausanne, Switzerland, under the direction of Ivanhoe Mines and Zijin Mining, in conjunction with the DRC’s state-owned power company, La Société Nationale d’Electricité (SNEL). Once fully reconditioned, the three plants will have a combined installed capacity of approximately 200 MW of electricity for the national grid, which is expected to be more than sufficient for the Kamoa-Kakula Project.

The Kansoko Mine, Kakula Mine and Kamoa camp have been connected to the national hydroelectric power grid since the completion of a 12-kilometre, 120-kilovolt, dual-circuit power line between Kansoko and Kakula in December 2017. The design of permanent, 11-kilovolt reticulation to the vent shafts and mine has started, which includes substations, overhead lines and surface cables.

Continued focus on community and sustainability

The Kamoa-Kakula Sustainable Livelihoods Program is committed to sustainable development in the communities within the project’s footprint. The main objective of the livelihoods program is to enhance food security and the living standards of the people who reside within the project’s footprint. The program is mainly implemented through fish farming and food crops, including farming of maize (corn), vegetables and bananas, plus poultry production and beekeeping.

Additional non-farming related activities for Q2 2019 included education and literacy programs, the continuation of a community brick-making program, a basic training program, the construction of a school and housing for teachers and the supply of fresh water to a number of communities.

Farmers tending to crops near fish ponds at the village of Kamisange. Given the tremendous success of the fish farms to date, the Kamoa-Kakula team is constructing an additional five fish ponds in the village.

The Kamoa-Kakula construction team commencing the second phase of construction on the school at the nearby village of Kamisange.

4.Western Foreland Exploration Project

100%-owned by Ivanhoe Mines

Democratic Republic of Congo

Drilling on Ivanhoe’s 100%-owned Western Foreland licences, immediately north of the Kamoa-Kakula mining licence, has discovered the extension of the Kamoa Far North high-grade shallow copper corridor on Ivanhoe’s wholly-owned licences for at least 400 metres

Two east-west section lines located at 200 metres and 400 metres north of the Kamoa-Kakula mining licence have been drill tested at 100-metre intervals. Visually strong copper mineralization has been intersected in a single hole on both section lines. The copper mineralization intersected is consistent in downhole depth and stratigraphic location with the copper mineralization intercepted in the Kamoa Far North high-grade trend.

Six holes have been completed in this new discovery area and assays are pending. Ivanhoe also is continuing exploration drilling, ground geophysics and airborne geophysics on other DRC exploration targets.

Figure 7: Location of recent drilling results in the Kamoa Far North Exploration Area, and the Kamoa Far North extension on Ivanhoe’s 100%-owned Western Foreland exploration licences.

During Q2 2019, exploration drilling continued in the Makoko area with two drill rigs. A total of 3,169 metres were completed in 12 diamond drill holes during the quarter.

Two deeper holes were completed at Makoko, testing the western and eastern limits of the currently defined Makoko system. To the north, up-dip of Makoko, Ivanhoe used a project-owned drill rig to test the up-dip limit of the Nguba (host) stratigraphy along the basin margin, as well as the limit of the Roan sub-basin associated with mineralization.

Ground gravity and magnetic surveys are ongoing at Kamoa North and on the Western Foreland licences in an attempt to identify growth faults, basin structures (transfer faults) and potentially stratigraphic changes in the target areas. Both the ground magnetic and ground gravity surveys have been completed over the Kiala high-grade target at the Kamoa North extension discovery area. From the results, some trends and anomalies have been identified that will be followed up during the second half of 2019.

Exploration activities planned for the third quarter will focus on the Lufupa South East licences, as well as continuing to follow the Kiala high-grade target to the north.

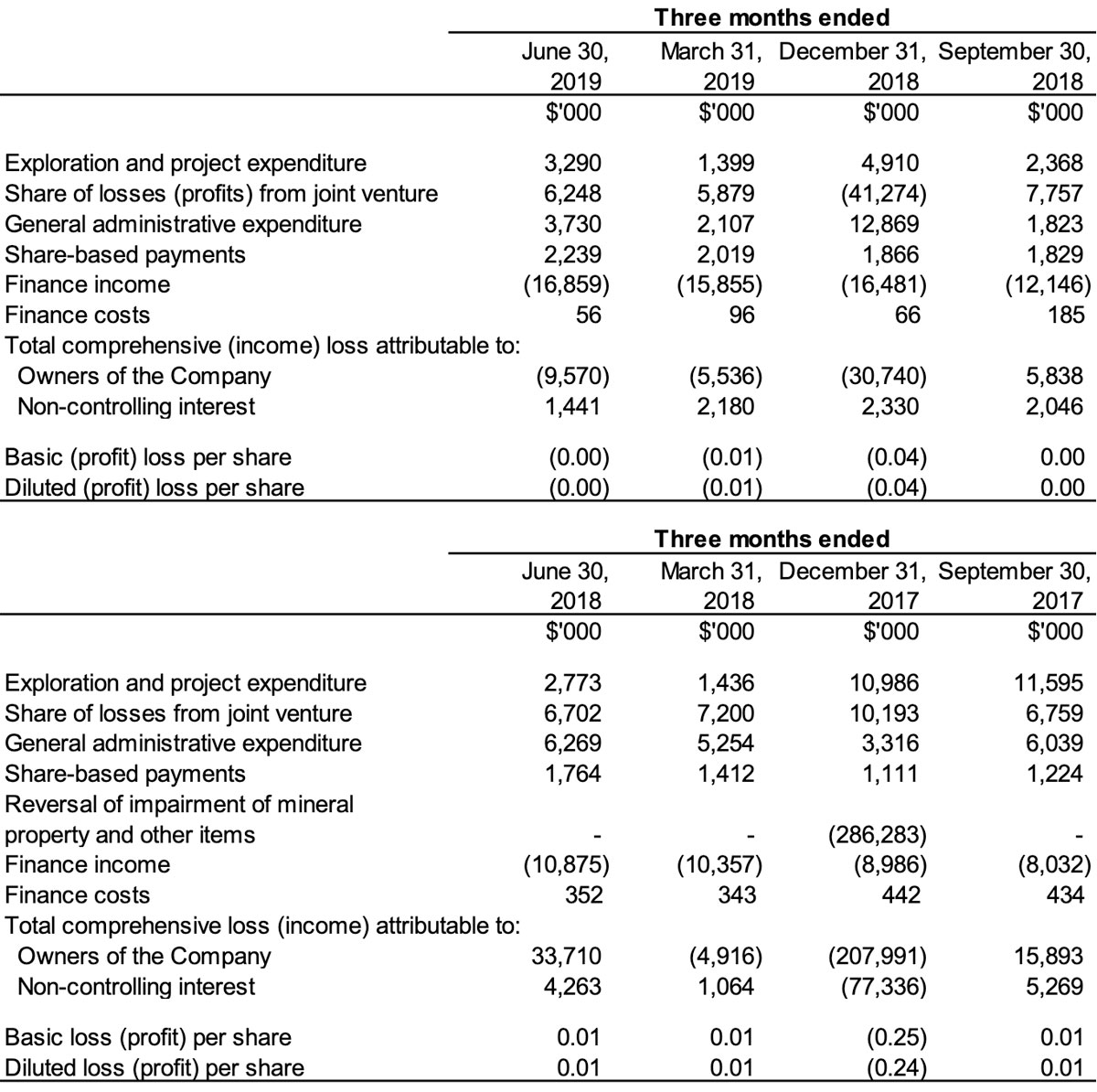

SELECTED QUARTERLY FINANCIAL INFORMATION

The following table summarizes selected financial information for the prior eight quarters. Ivanhoe had no operating revenue in any financial reporting period and did not declare or pay any dividend or distribution in any financial reporting period.

DISCUSSION OF RESULTS OF OPERATIONS

Review of the three months ended June 30, 2019 vs. June 30, 2018

The company recorded a total comprehensive income of $8.1 million for Q2 2019 compared to a loss of $38.0 million for the same period in 2018. The majority of the loss in Q2 2018 mainly was due to an exchange loss on translation of foreign operations of $30.0 million resulting from the weakening of the South African Rand by 16% from March 31, 2018, to June 30, 2018. The company recognized an exchange gain on translation of foreign operations in Q2 2019 of $6.3 million.

Finance income for Q2 2019, amounted to $16.9 million, and was $6.0 million more than for the same period in 2018 ($10.9 million). The increase mainly was due to interest earned on loans to the Kamoa Holding joint venture to fund operations as the accumulated loan balance increased. This amounted to $12.7 million for Q2 2019, and $9.7 million for the same period in 2018. Interest received on cash and cash equivalents also increased due to a higher cash balance during Q2 2019.

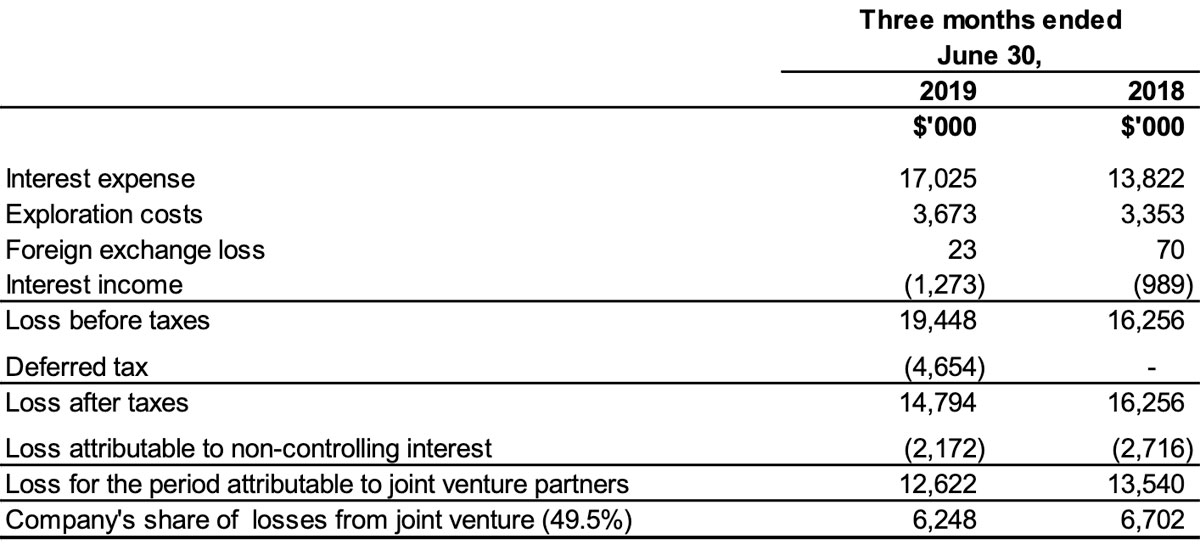

The company’s share of losses from the Kamoa Holding joint venture decreased from $6.7 million in Q2 2018 to $6.2 million in Q2 2019. The following table summarizes the company’s share of the losses of Kamoa Holding for the three months ended June 30, 2019, and for the same period in 2018:

Exploration and project expenditure for Q2 2019 amounted to $3.3 million and was $0.5 million more than for the same period in 2018 ($2.8 million). With the focus at the Kipushi and Platreef projects being on development and the Kamoa-Kakula Project being accounted for as a joint venture, all exploration and project expenditure in both periods related to exploration at Ivanhoe’s 100%-owned Western Foreland exploration licences.

Review of the six months ended June 30, 2019 vs. June 30, 2018

The company recorded a total comprehensive income of $11.5 million for the six months ended June 30, 2019 compared to a loss of $34.1 million for the same period in 2018. The company recognized a loss on translation of foreign operations of $18.8 million for the six months ended June 30, 2018 mainly due to the weakening of the South African Rand by 11% from December 31, 2017, to June 30, 2018, compared to an exchange gain on translation of foreign operations recognized for the same period in 2019 of $5.8 million.

Finance income for the six months ended June 30, 2019, amounted to $32.7 million, and was $11.5 million more than for the same period in 2018 ($21.2 million). The increase mainly was due to interest earned on loans to the Kamoa Holding joint venture to fund operations that amounted to $24.7 million in 2019, and increased by $6.3 million when compared to the same period in 2018 as the accumulated loan balance increased. Interest received on cash and cash equivalents also increased from $1.7 million for the six months ended June 30, 2018 to $6.1 million for the same period in 2019 due to a higher cash balance in 2019.

Exploration and project expenditure for the six months ended June 30, 2019, amounted to $4.7 million and was $0.5 million higher than for the same period in 2018 ($4.2 million). Exploration and project expenditure in both periods related to exploration at Ivanhoe’s 100%-owned Western Foreland exploration licences.

The company’s share of losses from the Kamoa Holding joint venture decreased to $12.1 million for the six months ended June 30, 2019, from $13.9 million for the same period in 2018. The following table summarizes the company’s share of the profits and losses of Kamoa Holding for the six months ended June 30, 2019, and for the same period in 2018:

Financial position as at June 30, 2019 vs. December 31, 2018

The company’s total assets increased by $25.1 million, from $1,884.8 million as at December 31, 2018, to $1,909.9 million as at June 30, 2019. The company utilized $11.8 million of its cash resources in its operations and received interest of $6.1 million during the six months ended June 30, 2019.

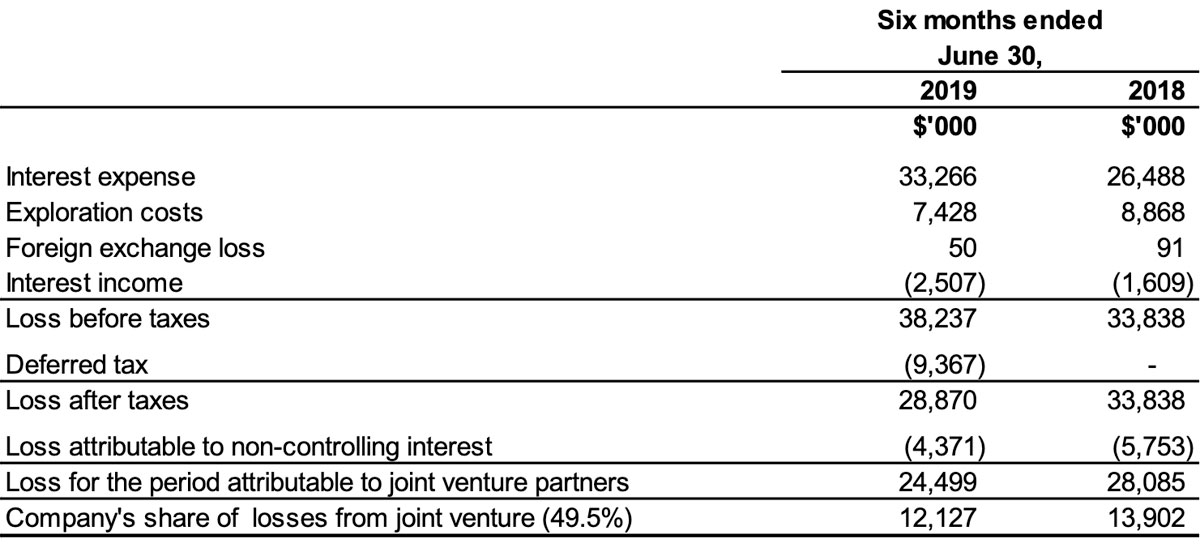

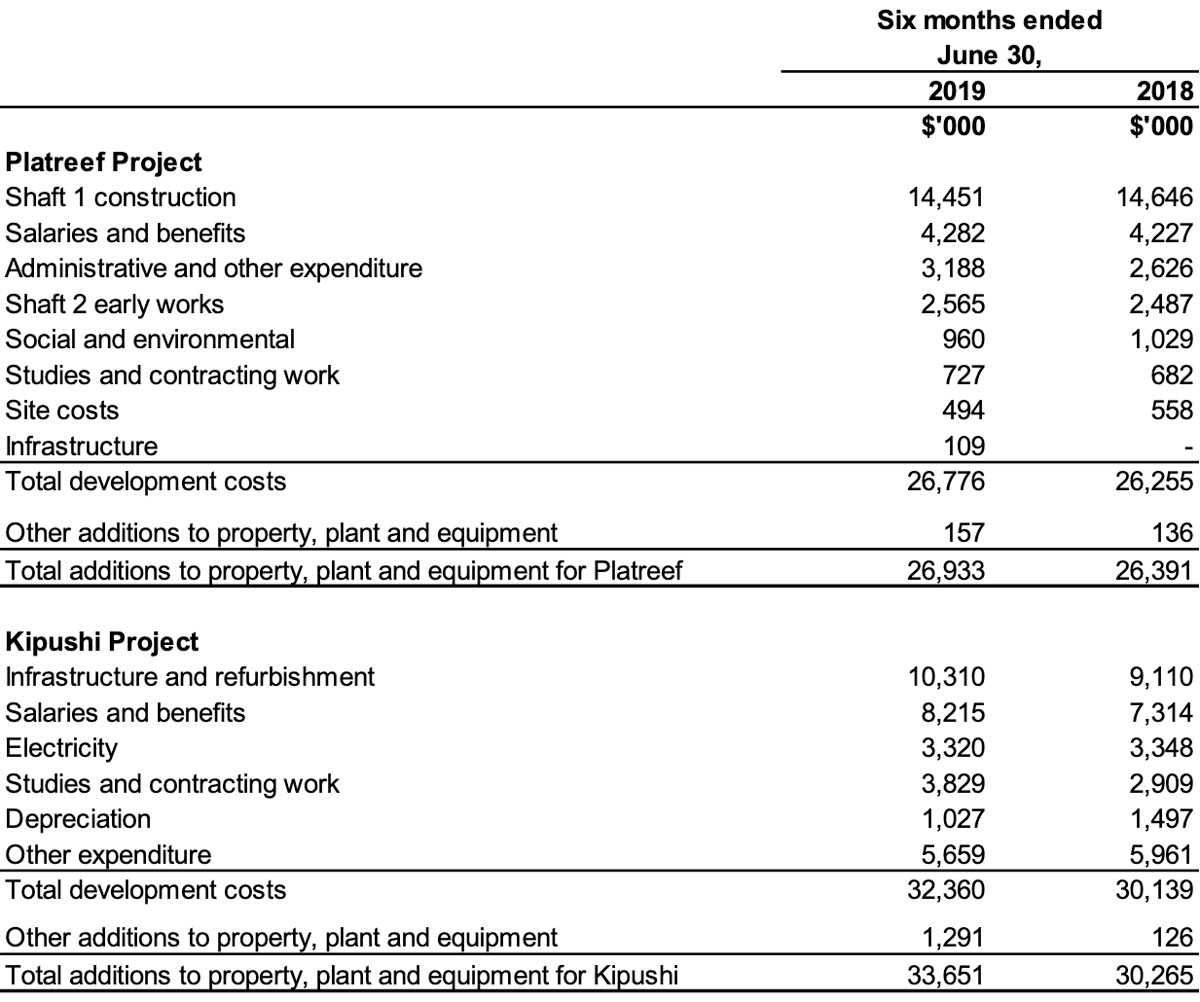

The net increase of property, plant and equipment amounted to $65.5 million, with a total of $60.3 million being spent on project development and to acquire other property, plant and dequipment. Of this total, $26.9 million and $33.7 million pertained to development costs and other acquisitions of property, plant and equipment at the Platreef Project and Kipushi Project respectively.

The main components of the additions to property, plant and equipment − including capitalized development costs – at the Platreef and Kipushi projects for the six months ended June 30, 2019, and for the same period in 2018, are set out in the following table:

Costs incurred at the Platreef and Kipushi projects are deemed necessary to bring the projects to commercial production and are therefore capitalized as property, plant and equipment.

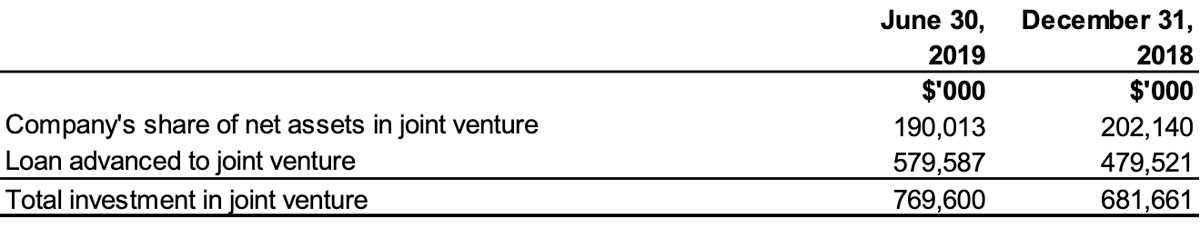

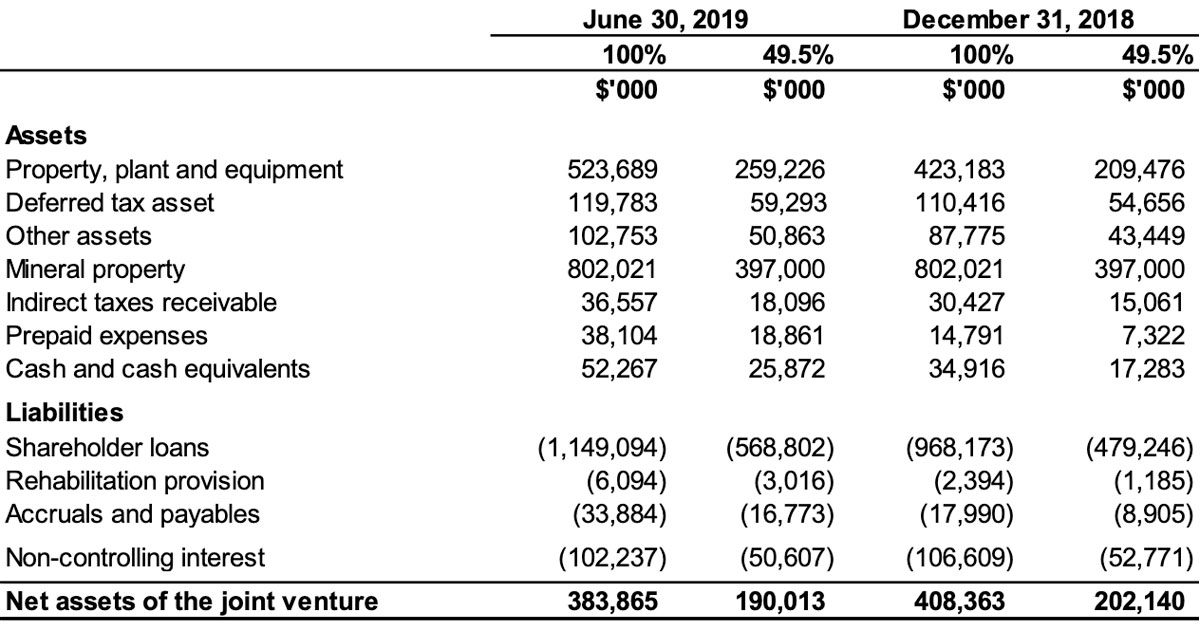

The company’s investment in the Kamoa Holding joint venture increased by $87.9 million from $681.7 million as at December 31, 2018, to $769.6 million as at June 30, 2019, with each of the current shareholders funding the operations equivalent to their proportionate shareholding interest.

The company’s portion of the Kamoa Holding joint venture cash calls amounted to $75.4 million during the six months ending June 30, 2019, while the company’s share of losses from the joint venture amounted to $12.1 million.

The company’s investment in the Kamoa Holding joint venture can be broken down as follows:

The Kamoa Holding joint venture principally uses loans advanced to it by its shareholders to advance the Kamoa-Kakula Project through investing in development costs and other property, plant and equipment, as well as continuing with exploration. This can be evidenced by the movement in the company’s share of net assets in the Kamoa Holding joint venture which can be broken down as follows:

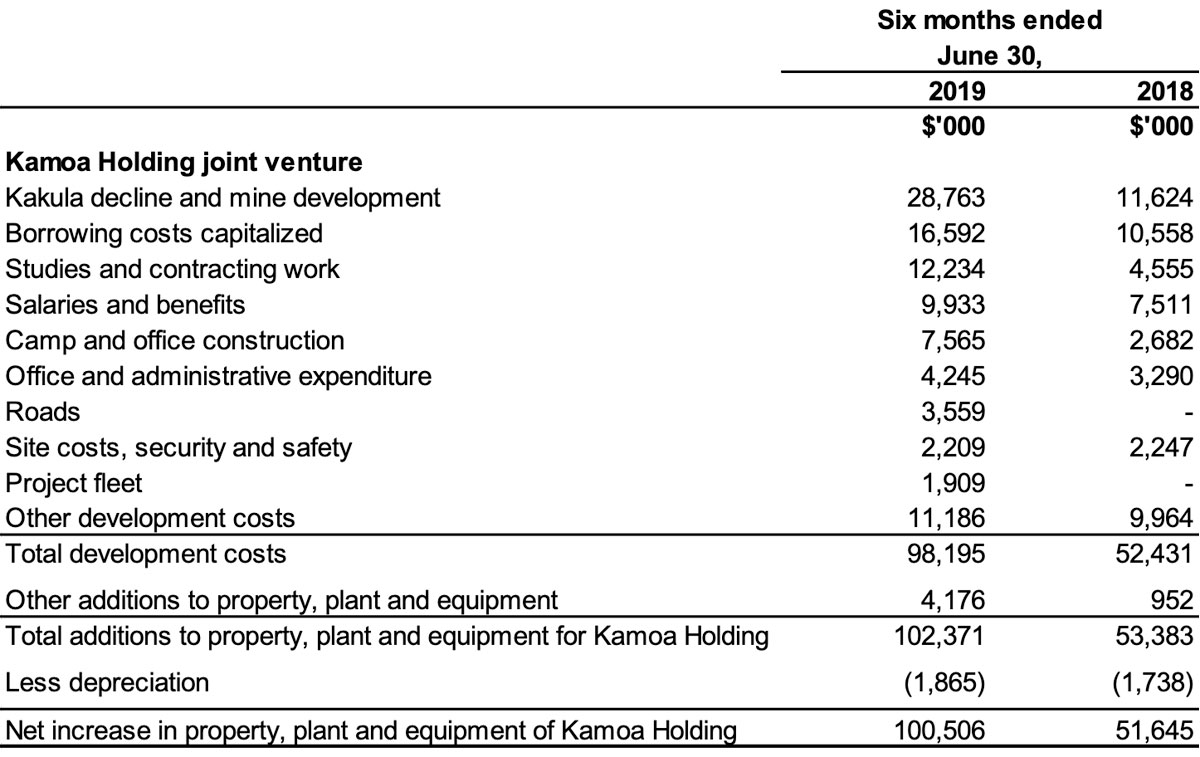

The Kamoa Holding joint venture’s net increase in property, plant and equipment from December 31, 2018, to June 30, 2019, amounted to $100.5 million and can be further broken down as follows:

LIQUIDITY AND CAPITAL RESOURCES

The company had $380.9 million in cash and cash equivalents as at June 30, 2019. At this date, the company had consolidated working capital of approximately $373.3 million, compared to $562.9 million at December 31, 2018.

On July 30, 2019, the company announced that the private placement transaction with CITIC Metal Africa Investments Limited (CITIC Metal Africa), a direct subsidiary of CITIC Metal Co., Ltd. (CITIC Metal), announced on April 25, 2019, now has received all necessary recordals and registration with Chinese government regulatory agencies and the transaction is scheduled to close on August 16, 2019.

Upon closing, the company will receive gross proceeds of C$612 million (approximately $465 million) from CITIC Metal Africa and will issue 153,821,507 common shares to CITIC Metal Africa through a private placement at a price of C$3.98 per share.

Zijin Mining Group Co., Ltd., exercised its existing anti-dilution rights on May 15, 2019, which will yield additional proceeds to the company of C$67 million (approximately $51 million). These funds will be received concurrently with the CITIC Metal Africa private placement. The exercise by Zijin of its anti-dilution rights also was at a price of C$3.98 per share.

Since December 8, 2015, each shareholder in Kamoa Holding has been required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest. The company is advancing Crystal River’s portion on its behalf in return for an increase in the promissory note due to Ivanhoe.

The Platreef Project’s current expenditure is being funded solely by Ivanhoe, through an interest bearing loan to Ivanplats, as the Japanese consortium has elected not to contribute to current expenditures.

The company’s main objectives for 2019 at the Platreef Project are the continuation of Shaft 1 construction and the completion of early-works construction of Shaft 2. At Kipushi, the principal objectives are the completion of the feasibility study and continued upgrading of mining infrastructure. At the Kamoa-Kakula Project, priorities are the continuation of development at Kakula. The company has budgeted to spend $63 million on further development at the Platreef Project; $24 million at the Kipushi Project; $8 million on regional exploration in the DRC; and $16 million on corporate overheads for the remainder of 2019 – as well as its proportionate funding of the Kamoa-Kakula Project, expected to be $150 million for the remainder of 2019. With private placements expected to close on August 16, 2019, the expenditure at Kamoa-Kakula has been increased in order to achieve the planned initial copper concentrate production from the Kakula Mine currently scheduled for the third quarter of 2021.

This news release should be read in conjunction with Ivanhoe Mines’ 2019 Second Quarter Financial Statements and Management’s Discussion and Analysis report available at www.ivanhoemines.com and at www.sedar.com.

Qualified Person

Disclosures of a scientific or technical nature in this news release have been reviewed and approved by Stephen Torr, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Project Geology and Evaluation. Mr. Torr has verified the technical data disclosed in this news release.

Ivanhoe has prepared a current, independent, NI 43-101-compliant technical report for each of the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project, which are available under the company’s SEDAR profile at www.sedar.com:

- The Kamoa-Kakula Integrated Development Plan 2019 dated March 18, 2019, prepared by OreWin Pty Ltd., Amec Foster Wheeler E&C Services Inc. (a division of Wood PLC), DRA Global, SRK Consulting (South Africa) (Pty) Ltd. and Stantec Consulting International LLC, covering the company’s Kamoa-Kakula Project;

- The Platreef 2017 Feasibility Study Technical Report dated September 4, 2017, prepared by DRA Global, OreWin Pty. Ltd., Amec Foster Wheeler, Stantec Consulting, Murray & Roberts Cementation, SRK Consulting, Golder Associates, and Digby Wells Environmental, covering the company’s Platreef Project; and

- The Kipushi 2019 Mineral Resource Update dated March 28, 2019, prepared by prepared by OreWin Pty Ltd., MSA Group (Pty) Ltd., SRK Consulting (South Africa) (Pty) Ltd., and MDM (Technical) Africa Pty Ltd. (a division of Wood PLC), covering the company’s Kipushi Project.

These technical reports include relevant information regarding the effective dates and the assumptions, parameters and methods of the mineral resource estimates on the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the Platreef Project, Kipushi Project and Kamoa-Kakula Project.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

Kimberly Lim +1.778.996.8510

Website www.ivanhoemines.com

Forward-looking statements

Certain statements in this news release constitute “forward-looking statements”or “forward-looking information”within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict”and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might”or “will”be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of the company’s Q2 2019 MD&A.

Such statements include without limitation, the timing and results of: (i) statements that one more station will be developed at a mine-working depth of 950 metres at Shaft 1; (ii) statements regarding Shaft 1 reaching the planned, final depth at 982 metres below surface in early 2020; (iii) statements regarding the timing of Shaft 2 development; (iv) statements regarding the operational and technical capacity of Shaft 1; (v) statements regarding the internal diameter and hoisting capacity of Shaft 2; (vi) statements regarding the planned underground mining methods of the Platreef Project including long-hole stoping and drift-and-fill mining; (vii) statements regarding supply of treated water from the town of Mokopane’s new Masodi treatment plant including that it will supply 5 million litres of treated water a day for 32 years; (viii) statements regarding the timing, size and objectives of drilling and other exploration programs for 2019 and future periods; (ix) statements regarding exploration on the Western Foreland exploration licences; (x) statements regarding construction of the new road linking Kamoa-Kakula with the Kolwezi airport being operational by the end of 2019; (xi) statements that the project team continues to work towards the completion of the Kipushi Project’s definitive feasibility study; (xii) statements regarding the progressive re-commissioning of the turbines, fully refurbished and modernized with state-of-the-art control and instrumentation at Mwadingusha power station, will be completed in Q3 2020 with an output increased to a capacity of approximately 72 megawatts (MW) of power; (xiii) statements regarding timing and completion of the basic engineering design of the plant and surface infrastructure and the underground design at Kakula; (xiv) statements that initial copper concentrate production from the Kakula Mine currently is scheduled for the third quarter of 2021; (xv) statements that the definitive feasibility study for the Kamoa-Kakula Project will be published early next year; (xvi) statements regarding expected expenditure for the remainder of 2019 of $63 million on further development at the Platreef Project; $24 million at the Kipushi Project; $8 million on regional exploration in the DRC; and $16 million on corporate overheads – as well as its proportionate funding of the Kamoa-Kakula Project, expected to be $150 million for the remainder of 2019; (xvii) statements regarding Platreef projecting it to be Africa’s lowest-cost producer of platinum-group metals; (xviii) statements regarding the mobilization of additional crews at Kamoa-Kakula by October 2019 to accelerate mine development; (xix) statements regarding accessing the Kamoa North Bonanza Zone by way of a surface box-cut and decline in a relatively short time-frame (xx) all statements regarding the timing and scheduled completion on August 16, 2019, of the planned private placement of 153,821,507 common shares to CITIC Metal Africa at a price of C$3.98 per share for gross proceeds to Ivanhoe of approximately C$612 million; and (xxi) statements regarding the timing and completion on August 16, 2019, of the issuance of anti-dilution shares to Zijin Mining for proceeds of C$67 million.

As well, all of the results of the pre-feasibility study for the Kakula copper mine and the updated and expanded Kamoa-Kakula Project preliminary economic assessment, the feasibility study of the Platreef Project and the pre-feasibility study of the Kipushi Project, constitute forward-looking statements or information, and include future estimates of internal rates of return, net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs and the size and timing of phased development of the projects. Furthermore, with respect to this specific forward-looking information concerning the development of the Kamoa-Kakula, Platreef and Kipushi projects, the company has based its assumptions and analysis on certain factors that are inherently uncertain. Uncertainties include: (i) the adequacy of infrastructure; (ii) geological characteristics; (iii) metallurgical characteristics of the mineralization; (iv) the ability to develop adequate processing capacity; (v) the price of copper, nickel, zinc, platinum, palladium, rhodium and gold; (vi) the availability of equipment and facilities necessary to complete development; (vii) the cost of consumables and mining and processing equipment; (viii) unforeseen technological and engineering problems; (ix) accidents or acts of sabotage or terrorism; (x) currency fluctuations; (xi) changes in regulations; (xii) the compliance by joint venture partners with terms of agreements; (xiii) the availability and productivity of skilled labour; (xiv) the regulation of the mining industry by various governmental agencies; (xv) the ability to raise sufficient capital to develop such projects; and (xiv) political factors.

This news release also contains references to estimates of Mineral Resources and Mineral Reserves. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Estimates of Mineral Reserves provide more certainty but still involve similar subjective judgments. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production from the company’s projects, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that ultimately may prove to be inaccurate. Mineral Resource or Mineral Reserve estimates may have to be re-estimated based on: (i) fluctuations in copper, nickel, zinc, platinum group elements (PGE), gold or other mineral prices; (ii) results of drilling; (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates and/or changes in mine plans; (vi) the possible failure to receive required permits, approvals and licences; and (vii) changes in law or regulation.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to, the factors discussed under “Risk Factors”and elsewhere in the company’s MD&A, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors set forth in the “Risk Factors”section and elsewhere in the company’s Q2 2019 MD&A, unaudited condensed consolidated interim financial statements for the three and six months ended June 30, 2019 and its Annual Information Form.

English

English Français

Français 日本語

日本語 中文

中文