MOKOPANE, SOUTH AFRICA – Ivanhoe Mines’ (TSX: IVN; OTCQX: IVPAF) Co-Chairmen Robert Friedland and Yufeng “Miles” Sun, and Ivanplats’ Managing Director Dr. Patricia Makhesha, announced today that the weighted price of the ‘basket’ of metals contained in the ore at the Platreef palladium-platinum-rhodium-nickel-copper-gold project has risen to a new, three-year high.

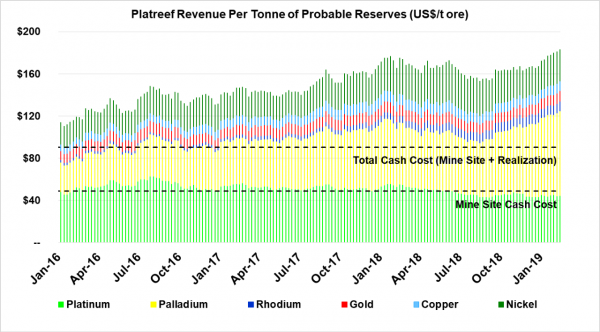

Figure 1. Revenue per tonne of ore at the Platreef Project has risen steadily since 2016 (shown in US dollars).

Source: Bloomberg. Based on historical weekly commodity prices at the end of each week.

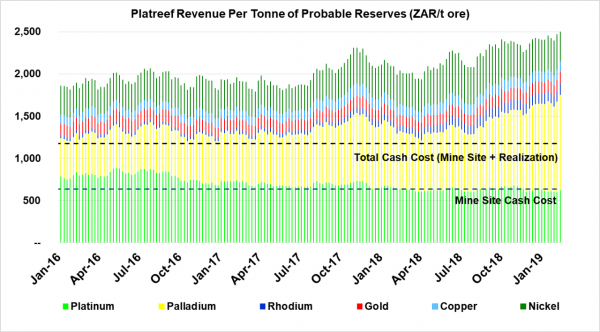

Figure 2. Revenue per tonne of ore at the Platreef Project has risen steadily since 2016 (shown in South African rand).

Source: Bloomberg. Based on historical weekly commodity prices at the end of each week.

Notes for figures 1 and 2:

- Based on Platreef Mineral Reserves with an effective date of May 24, 2017.

- Probable Mineral Reserve of 124.7 million tonnes at a grade of 1.95 grams per tonne (g/t) platinum, 2.01 g/t palladium, 0.30 g/t gold, 0.14 g/t rhodium, 0.34% nickel and 0.17% copper.

- A declining NSR cut-off of $155 per tonne (t) to $80/t was used for the Mineral Reserve estimates.

- The NSR cut-off is an elevated cut-off above the marginal economic cut-off.

- Metal prices used in the Mineral Reserve estimate: US$1,600 per ounce (oz) platinum, US$815/oz palladium, US$1,300/oz gold, US$1,500/oz rhodium, US$8.90 per pound (lb) nickel and US$3.00/lb copper.

- Metal prices used in the DFS economic analysis: US$1,250/oz platinum, US$825/oz palladium, US$1,300/oz gold, US$1,000/oz rhodium, US$7.60/lb nickel and US$3.00/lb copper.

- Tonnage and grade estimates include dilution and mining recovery allowances.

- Applies life-of-mine average recoveries of 87.4% for platinum, 86.9% for palladium, 78.6% for gold, 80.5% for rhodium, 87.9% for copper and 71.9% for nickel.

- Total cash cost includes mine site costs, plus realization costs such as treatment and refining charges, royalties and transportation.

While platinum prices have lagged in recent years, palladium and rhodium have been two of the best performing metals. The platinum-to-palladium ratio at Platreef is approximately 1:1. Nickel, copper and gold also add significant contributions to Platreef’s contained metal valuation.

“Following the Lantern Festival signifying the end of the Chinese New Year celebrations, and as we embrace the Year of the Pig, commodities in the Asian markets today are reaching the highest levels since December, buoyed by optimism over US-China trade talks,” said Mr. Friedland.

“The strong, upward price appreciation since 2016 of the collective basket of metals that Platreef will be producing when commercial operations commence at the Tier One discovery is encouraging as we advance the project toward production. Adding to our bullish long-term outlook for metal prices is that platinum, copper and nickel are forecast to be among the biggest beneficiaries of the accelerating global transition to zero-emission, pure electric and fuel-cell electric vehicles, and clean energy.

“On the heels of a very successful Mining Indaba conference in Cape Town, where South African President Cyril Ramaphosa provided a confidence boost for the country’s mining industry, we have seen significant renewed investor interest in the Platreef Project.”

Dr. Makheshanoted that the company conducted a high-level site visit to the Platreef Project immediately following the Mining Indaba and took investors and analysts on an underground tour to see the scope and quality of development work being performed by Ivanplats’ South African shaft-sinking crew, comprised of South African men and women ─ many of whom are from the communities surrounding the project.

“After more than 25 years of intense exploration and development efforts in South Africa by Ivanplats and its predecessor company, African Minerals, it was immensely gratifying for our team to show our Japanese partners and international investors the immense thickness of the underground orebody at Platreef. The visitors also saw surface stockpiles containing the first 3,500 tonnes of high-grade mineralization extracted from the 29-metre mineralized intersection in Shaft 1.

“A site visit is an excellent way to showcase the unique features of the Platreef orebody ─ in particular its remarkable thickness and relatively flat-lying nature ─ that will allow this mine to be radically different from the traditional South African underground platinum-group-metals mines on the eastern and western limbs of the Bushveld Complex. Those mines extract their ore from narrow veins several kilometres below surface,” Dr. Makhesha added. “In contrast, the orebody at our Platreef Project is much shallower, and is ideal for safe, bulk-scale, mechanized mining.

“We already have begun training a new generation of highly-skilled, young South Africans to operate the mine’s cutting-edge, computerized, underground bulk-mining equipment. As a South African, I take great pride in the work of my fellow citizens in developing Platreef into the world’s next great platinum-group-metals mine. As with any large-scale, developing mine, our focus is to keep advancing the project along its critical path while we work to arrange project debt financing for construction of the first-phase, four million-tonne-per-annum mine.”

Steady development progress on Platreef’s first two shafts

Good progress continues to be made on Shaft 1’s 850-metre-level station ─ the second of three horizontal mining access stations planned for Shaft 1 at the company’s Platreef Project on the northern limb of the Bushveld Complex, adjacent to Anglo Platinum’s Mogalakwena Mine.

The first underground mining access station has been constructed at the 750-metre level, following earlier development of a water-pumping station at the 450-metre level. The third mining access station will be developed at a mine-working depth of 950 metres. Shaft 1 is expected to reach its projected, final depth of approximately 980 metres below surface, complete with all four of the stations, in early 2020. The mining zones in the current Platreef Mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below surface.

The northern excavation at Shaft 1’s 750-metre station, showing the large scale of the underground workings − ideal for safe, mechanized mining.

Ongoing development work at Shaft 1’s 850-metre-level mine access station, showing the northern top-cut excavation.

Construction also is underway on the concrete foundation for the project’s main production shaft ─ Shaft 2. This foundation will support the 103-metre-tall concrete headgear (headframe) that will house Shaft 2’s permanent hoisting facilities and support the shaft collar. Shaft 2 will have an internal diameter of 10 metres and will be equipped with two 40-tonne rock-hoisting skips with a capacity to hoist a total of six million tonnes of ore per year – the single largest hoisting capacity at any mine in Africa.

Ongoing construction of the foundation that will support Shaft 2’s 103-metre-tall concrete headframe. Shown below is the 11.5-metre shaft ring set-up for the 10-metre internal diameter shaft.

Platreef’s flat-lying mineralized zones are up to 90 metres thick, and with platinum-group-metals (PGM) grades that are as high, or higher, than many of the narrow-veined PGM mines on South Africa’s eastern and western limbs. Platreef also has large quantities of nickel, copper and gold, which are expected to enable Platreef to become the lowest-cost PGM producer in Africa.

Based on independent analysis prepared in the 2017 definitive feasibility study (DFS), Platreef is projected to have a cash cost of US$351 per ounce of 3PE+Au, net of nickel and copper by-products, and including sustaining capital costs. The DFS estimated that Platreef’s initial, average annual production rate will be approximately 219,000 ounces of palladium, 214,000 ounces of platinum, 30,000 ounces of gold and 14,000 ounces of rhodium (combined 477,000 ounces of 3PE+Au), plus 21 million pounds of nickel and 13 million pounds of copper.

Ivanhoe Mines indirectly owns 64% of the Platreef Project through its subsidiary,Ivanplats, and is directing all mine development work. The South African beneficiaries of the approved broad-based, black economic empowerment structure have a 26% stake in the Platreef Project. The remaining 10% is owned by a Japanese consortium ofITOCHU Corporation; Japan Oil, Gas and Metals National Corporation; and Japan GasCorporation.

Qualified person

The scientific and technical information in this news release has been reviewed and approved by Stephen Torr, P.Geo., Ivanhoe Mines’ Vice President, Project Geology andEvaluation, a Qualified Person under the terms of National Instrument (NI) 43-101. Mr.Torr is not independent of Ivanhoe Mines. Mr. Torr has verified the technical data disclosed in this news release.

Ivanhoe has prepared a current, independent, NI 43-101-compliant technical report for the Platreef Project titled “The Platreef 2017 Feasibility Study Technical Report” dated September 4, 2017, prepared by DRA Global, OreWin, Amec Foster Wheeler, Stantec Consulting, Murray & Roberts Cementation, SRK Consulting, Golder Associates and Digby Wells Environmental. Detailed information about assay methods and data verification measures used to support the scientific and technical information is set out in the Platreef Technical Report, which is available under Technical Reports at www.ivanhoemines.com and on Ivanhoe Mines’ SEDAR profile at www.sedar.com.

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on advancing its three principal projects in Southern Africa: the development of new mines at the Kamoa-Kakula copper discovery in the Democratic Republic of Congo (DRC) and the Platreef palladium-platinum-nickel-copper-gold discovery in South Africa; and the extensive redevelopment and upgrading of the historic Kipushi zinc-copper-germanium-silver mine, also in the DRC.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Kimberly Lim +1.778.996.8510

South Africa: Jeremy Michaels +27.82.939.4812

Cautionary statement on forward-looking information

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements involve known and unknown risks, uncertainties and other factors, which may cause actual results , performance or achievements of the company, the Platreef Project, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results, and speak only as of the date of this news release.

The forward-looking statements and forward-looking information in this news release include without limitation, (i) statements regarding the expectation that Shaft 1 will reach its projected, final depth of 980 metres below surface, complete with the stations, in 2020; (ii) statements regarding Platreef is projected to have a cash cost of US$351 per ounce of 3PE+Au, net of nickel and copper by-products, and including sustaining capital costs; (iii) and statements regarding Platreef’s initial, average annual production rate will be approximately 219,000 ounces of palladium, 214,000 ounces of platinum, 30,000 ounces of gold and 14,000 ounces of rhodium (combined 477,000 ounces of 3PE+Au), plus 21 million pounds of nickel and 13 million pounds of copper.

Readers are cautioned that actual results may vary from those presented.

All such forward-looking information and statements are based on certain assumptions and analyses made by Ivanhoe Mines’ management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believe are appropriate in the circumstances. These statements, however, are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information or statements including, but not limited to, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts to perform as agreed; social or labour unrest; changes in commodity prices; unexpected failure or inadequacy of infrastructure, industrial accidents or machinery failure (including of shaft sinking equipment), or delays in the development of infrastructure; and the failure of exploration programs or other studies to deliver anticipated results or results that would justify and support continued studies, development or operations. Other important factors that could cause actual results to differ from these forward-looking statements also include those described under the heading “Risk Factors” in the company’s most recently filed MD&A, as well as in the most recent Annual Information Form filed by Ivanhoe Mines. Readers are cautioned not to place undue reliance on forward-looking information or statements. Certain of the factors and assumptions used to develop the forward-looking information and statements, and certain of the risks that could cause the actual results to differ materially are presented in the “Platreef 2017 Feasibility Study, September 2017” available on SEDAR at www.sedar.com and on the Ivanhoe Mines website at www.ivanhoemines.com.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

English

English Français

Français 日本語

日本語 中文

中文