Mine development work now focused on equipping Shaft 1 as Platreef’s initial production shaft

Project team achieves South African shaft-sinking industry leader status for safety performance

Updated Definitive Feasibility Study expected to be finalized in Q3 2020; will include a scoping study on the phased development production plan

MOKOPANE, SOUTH AFRICA – Ivanhoe Mines’ (TSX: IVN; OTCQX: IVPAF) Co-Chairmen Robert Friedland and Yufeng “Miles” Sun announced today that the company’s South African subsidiary, Ivanplats, has successfully completed the sinking of Shaft 1 to a final depth of 996 metres below surface, at the company’s palladium, platinum, nickel, copper, gold and rhodium Platreef mining licence.

The Platreef Project, which contains the thick, high-grade, flat-lying, underground Flatreef Deposit, is a Tier One discovery by Ivanhoe Mines’ geologists on the Northern Limb of South Africa’s Bushveld Igneous Complex; the world’s premier platinum producing region.

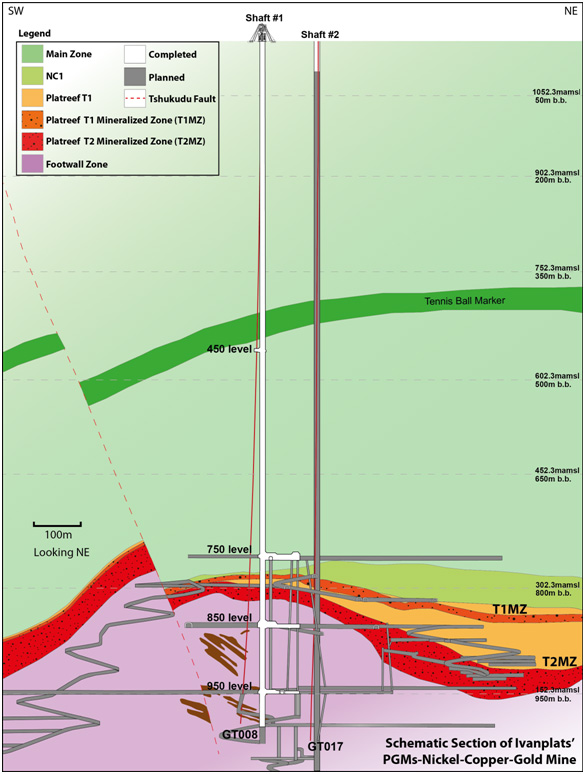

Underground mine development work now will focus on the construction of the 996-metre-level station at the bottom of the shaft, with final completion forecasted by the end of July 2020, well ahead of the contractual schedule. The shaft can then be reconfigured and equipped for rock, personnel and material hoisting.

The new auxiliary winder for the 7.25-metre diameter Shaft 1, which is scheduled to be delivered to Platreef later this year, will be used to assist in equipping the shaft and thereafter for logistics, shaft examination and auxiliary functions. The auxiliary winder will provide a second means of ingress and egress from the shaft after removal of the stage winder. Shaft 1 is located approximately 350 metres away from a high-grade area of the Flatreef orebody, planned for bulk-scale, mechanized mining.

“The Platreef Project has long been recognized as one of the world’s largest deposits of high-grade platinum-group metals, (PGMs) nickel and copper. With the sinking of Shaft 1 now complete, we are exploring near-term development pathways at Platreef that will allow us to expedite production at the next world-class mine on the Northern Limb,” said Mr. Friedland. “We are particularly pleased that the project remains ‘Fall-of-Ground’ incident free since shaft-sinking operations began in July 2016, which is a tribute to the excellent work by the Platreef Project team and its South African sinking contractor, Moolmans.”

The Platreef team has proudly achieved South African shaft-sinking industry leader status in terms of safety performance.

Members of the Platreef team celebrate the completion of sinking Shaft 1 to a final depth of 996 metres below surface. Shaft 1’s headframe is in the background.

Updated DFS is nearing completion, which includes a scoping study on the phased development production plan for the Platreef Project

Ivanhoe is updating the Platreef Project’s 2017 definitive feasibility study (DFS) to take into account development schedule advancement since 2017 when the DFS was completed, updated costs and refreshed metal prices and foreign exchange assumptions.

Concurrently, Ivanhoe is finalizing a Preliminary Economic Assessment (PEA) for the phased development production plan for the Platreef Project. The plan targets significantly lower initial capital, to accelerate first production by using Shaft 1 as the mine’s initial production shaft, followed by expansions to the production rate as outlined in the 2017 DFS.

The re-evaluation is being done in parallel with the ongoing mine development work to access the thick, high-grade, flat-lying Flatreef deposit that was discovered in 2010 and outlined in the Platreef 2017 Feasibility Study.

“The pending study will assess phased development options at Platreef with substantially lower upfront capital. The goal is to prioritize near-term production while safeguarding our strong balance sheet. We are confident that the project will, in time, become one of the world’s largest and lowest-cost primary producers of platinum-group metals and provide long-lasting and meaningful benefits to all of our stakeholders, including the 20 local communities − comprising approximately 150,000 local Mokopane area residents − that are our equity partners,” Mr. Friedland added.

Sifiso Mblangwe and his shaft-sinking teammates at a pre-shift safety meeting. The team achieved a South African shaft-sinking industry leader status for its safety performance.

Underground mining to incorporate highly-productive, mechanized methods

Planned mining methods will use highly-productive, mechanized methods, including long-hole stoping and drift-and-fill mining. Each method will utilize cemented backfill for maximum ore extraction. The ore will be hauled from the stopes to a series of internal ore passes and fed to the primary ore silos adjacent to Shaft 2, where it will be crushed and hoisted to surface.

Shaft 1 reached the top of the high-grade Flatreef Deposit (T1 mineralized zone) at a depth of 780.2 metres below surface in Q3 2018. The thickness of the mineralized orebody (T1 and T2 mineralized zones) at Shaft 1 is 29 metres, with grades of platinum-group metals ranging up to 11 grams per tonne (g/t) 3PE (platinum, palladium and rhodium) plus gold, as well as significant quantities of nickel and copper. The 29-metre intersection yielded approximately 3,000 tonnes of ore, estimated to contain more than 400 ounces of platinum-group metals. The ore is stockpiled on surface and is being used for metallurgical test work.

Platreef’s shaft-sinking team operating the six-boom jumbo to drill the final round to a depth of 996 metres below surface. Underground development work now will focus on the construction of the 996-metre-level station.

The development of the three primary mining access level stations has been completed with only the 996 metre spillage clearing level remaining, which will be completed by end July 2020. The three development stations will provide initial, underground access to the high-grade orebody. Shaft 1 changeover detailed designs are being completed and will enable Shaft 1 to be configured for permanent hoisting and dewatering.

The mining zones in the current Platreef Mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below surface. When completed, Shaft 2 is expected to provide primary access to the mining zones; secondary access is expected to be via Shaft 1. During mine production, both shafts also are expected to serve as ventilation intakes. Three additional ventilation exhaust raises are planned to achieve steady-state production.

Ivanplats received its Integrated Water Use Licence in January 2019, which is valid for 30 years and enables the Platreef Project to make use of water as planned in the 2017 DFS.

Figure 1: Schematic section of the Platreef Mine, showing Flatreef’s T1 and T2 thick, high-grade mineralized zones (red and dark orange), underground development work completed to date in shafts 1 and 2 (white) and planned development work (gray).

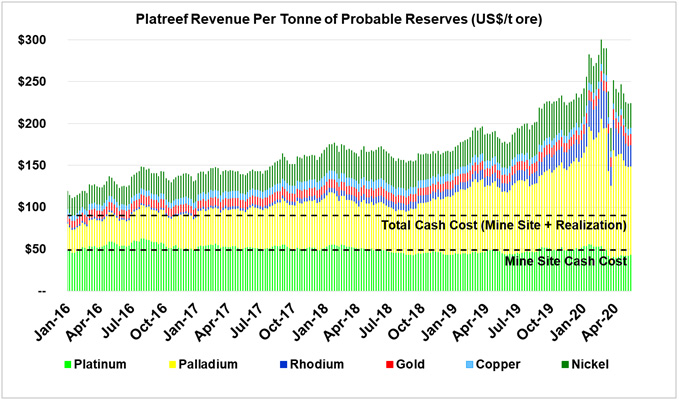

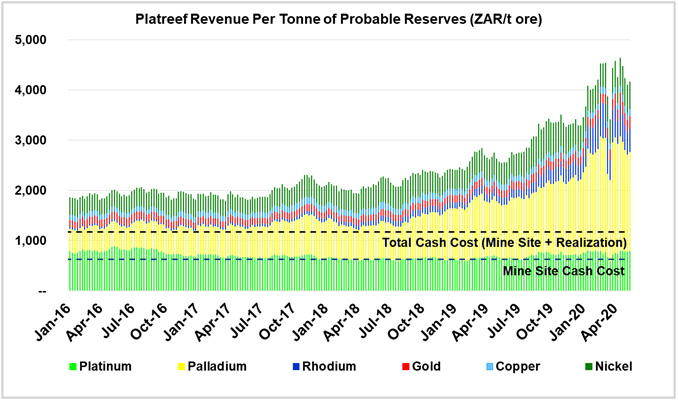

Revenue per tonne of ore at the Platreef Project in South African Rand near all-time highs

Significant increases in the price of palladium, rhodium, gold and nickel over the last three years has resulted in the weighted price of the ‘basket’ of metals contained in the ore at the Platreef palladium-platinum-rhodium-nickel-copper-gold project to rise to levels that are significantly higher than when the 2017 DFS was completed. In addition, the South African Rand has depreciated significantly against the US dollar in recent years, resulting in the weighted price of Platreef’s ‘basket’ of metals in South African Rand trading near all-time highs.

Figure 2. Revenue per tonne of ore at the Platreef Project since 2016 (shown in US dollars)

Figure 3. Revenue per tonne of ore at the Platreef Project has risen steadily since 2016 (shown in South African rand).

Source for figures 1 & 2: Bloomberg. Based on historical weekly commodity prices at the end of each week.

Notes for Figures 1 and 2:

- Based on Platreef Mineral Reserves with an effective date of May 24, 2017.

- Probable Mineral Reserve of 124.7 million tonnes at a grade of 1.95 grams per tonne (g/t) platinum, 2.01 g/t palladium, 0.30 g/t gold, 0.14 g/t rhodium, 0.34% nickel and 0.17% copper.

- A declining NSR cut-off of $155 per tonne (t) to $80/t was used for the Mineral Reserve estimates.

- The NSR cut-off is an elevated cut-off above the marginal economic cut-off.

- Metal prices used in the Mineral Reserve estimate: US$1,600 per ounce (oz) platinum, US$815/oz palladium, US$1,300/oz gold, US$1,500/oz rhodium, US$8.90 per pound (lb) nickel and US$3.00/lb copper.

- Tonnage and grade estimates include dilution and mining recovery allowances.

- Applies life-of-mine average recoveries of 87.4% for platinum, 86.9% for palladium, 78.6% for gold, 80.5% for rhodium, 87.9% for copper and 71.9% for nickel.

- Total cash cost includes mine site costs, plus realization costs such as treatment and refining charges, royalties and transportation.

About the Platreef Project

The Platreef Project is owned by Ivanplats (Pty) Ltd, which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically-disadvantaged, broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with approximately 150,000 people, project employees and local entrepreneurs. In Q2 2019, Ivanplats reached Level 2 contributor status in its verification assessment on the B-BBEE scorecard. A Japanese consortium of ITOCHU Corporation, Japan Oil, Gas and Metals National Corporation and Japan Gas Corporation owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

Boilermaker, Aide Samuel Teffo (left), Millwright, Lerato Maake (centre), and Rigger, Innocent Nchabeleng (right), display medals they received for their excellent safety performance during the sinking of Shaft 1.

Qualified Person

Disclosures of a scientific or technical nature in this news release have been reviewed and approved by Stephen Torr, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Project Geology and Evaluation. Mr. Torr has verified the technical data disclosed in this news release.

Ivanhoe has prepared a current, independent, NI 43-101-compliant technical report for the Platreef Project, titled The Platreef 2017 Feasibility Study Technical Report dated September 4, 2017, prepared by DRA Global, OreWin Pty. Ltd., Amec Foster Wheeler, Stantec Consulting, Murray & Roberts Cementation, SRK Consulting, Golder Associates, and Digby Wells Environmental. This technical report include relevant information regarding the effective dates and the assumptions, parameters and methods of the mineral resource and reserve estimates on the Platreef Project cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the Platreef Project.

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on advancing its three principal joint-venture projects in Southern Africa: the development of major new, mechanized, underground mines at the Kamoa-Kakula discoveries in the Democratic Republic of Congo (DRC) and at the Platreef palladium-platinum-nickel-copper-rhodium-gold discovery in South Africa; and the extensive redevelopment and upgrading of the historic Kipushi zinc-copper-germanium-silver mine, also in the DRC. Kamoa-Kakula and Kipushi will be powered by clean, renewable hydroelectricity and will be among the world’s lowest greenhouse gas emitters per unit of metal produced. Ivanhoe also is exploring for new copper discoveries on its wholly-owned Western Foreland exploration licences in the DRC, near the Kamoa-Kakula Project.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

Matthew Keevil +1.604. 558.1034

Website www.ivanhoemines.com

Cautionary statement on forward-looking information

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

Forward-looking statements in this release include, but are not limited to: (1) statements regarding the forecasted completion of construction of the 996-metre-level station at the bottom of the shaft by the end of July 2020; (2) statements regarding the expected delivery of the new auxiliary winder for Shaft 1 to Platreef later this year; (3) statements regarding the high-grade area of the Flatreef orebody that is planned for bulk-scale, mechanized mining, located approximately 350 metres away from Shaft 1; (4) statements regarding Ivanhoe’s confidence that the Platreef Project will, in time, become one of the world’s largest and lowest-cost primary producers of platinum-group metals and provide long-lasting and meaningful benefits to all of our stakeholders; (5) statements regarding planned mining methods will use highly-productive, mechanized methods, including long-hole stoping and drift-and-fill mining; and (6) statements regarding the updated Definitive Feasibility Study is expected to be finalized in Q3 2020 and will include a scoping study on the phased development production plan.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to, the factors discussed under “Risk Factors” and elsewhere in the company’s MD&A, as well as the inability to obtain regulatory approvals in a timely manner; the potential for unknown or unexpected events to cause contractual conditions to not be satisfied; unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors set forth in the “Risk Factors” section and elsewhere in the company’s MD&A for the quarter ended March 30, 2020 and its latest Annual Information Form.

English

English Français

Français 日本語

日本語 中文

中文