Third consecutive monthly underground development record of 1.7 kilometres achieved at the Kakula Copper Mine; development now approximately 4.2 kilometres ahead of schedule

Copper ore grading 8% being mined and stockpiled at the flagship Kamoa-Kakula Copper Project

KOLWEZI, DEMOCRATIC REPUBLIC OF CONGO─Ivanhoe Mines (TSX: IVN; OTCQX:IVPAF) Co-Chairs Robert Friedland and Yufeng “Miles” Sun announced today that underground development at the Kakula Copper Mine continues to advance ahead of schedule and that more than 13.5 kilometres of underground development is now completed, which is 4.2 kilometres ahead of plan. This month, the mining team is on pace to set a new monthly development record of 1.7 kilometres of advancement ─ 562 metres ahead of plan for the month.

While Ivanhoe Mines is in a strong financial position going into this period of global uncertainty with cash and cash equivalents of US$603 million at the end of March and no significant debt, the company has identified several cost-reduction initiatives to generate cash savings of up to US$75 million through 2021. The savings will be generated through reducing discretionary spending at the company’s projects, lowering general and administrative costs and corporate overheads, voluntary salary reduction for senior management and deferral of certain exploration activities previously planned for 2020 and will be fully directed towards developing the company’s flagship Kakula Copper Mine to commercial production on schedule and on budget.

Kamoa-Kakula Project progress update

At the Kamoa-Kakula Project in the Democratic Republic of Congo (DRC), the first phase of development at the Kakula Copper Mine is in many respects exceeding the published plans. Crews now are mining and stockpiling development ore with an average grade greater than 8% copper. Almost all the underground development is in ore and, as a result, each blast in Kakula’s high-grade mining zone produces approximately 550 tonnes of ore, which is transported to a dedicated, high-grade pre-production surface stockpile. Kakula’s high-grade ore stockpile is expected to total approximately 1.5 million tonnes prior to the start of initial production.

Underground development at Kakula is 4.2 kilometres ahead of plan. More than 13.5 kilometres of underground development is now complete, against the original plan of 9.3 kilometres. The outstanding mining team has again broken the record of the previous 30 days and is on pace to set its third consecutive monthly development record with 1.7 kilometres of advancement in April ─ 560 metres ahead of plan. Approximately 29.5 kilometres of underground development is scheduled for the remainder of 2020 and 2021 until scheduled first concentrate production.

Members of Kamoa-Kakula’s multi-national team of geologists and engineers that is helping to build the Tier One Kakula Mine, in front of the mine’s high-grade ore stockpile that is expected to grow to approximately 1.5 million tonnes prior to the start of production.

(L-R) Magloire Kashiba (Production Manager), Jinha Numbi (Surveyor Assistant), Nadege Muzala (Explosive Master), Joel Maweji (Surveyor), Daniel Jila (Data Clerk), Dorcas Tabitha (JMMC Explosive Master), Amisi Mwanana (Safety Officer), Didier Masengo (Senior mine Geologist), Haram Kazadi (Ventilation observer), Wivine Mutango (Ventilation Observer Assistant), Reagan Ngandu (Surveyor Assistant) and Pontien Kalala (Mine Overseer).

In parallel with the construction of Kamoa-Kakula’s phase 1 Kakula Mine, the independent Kakula definitive feasibility study (DFS) and an updated Integrated Development Plan for the entire Kamoa-Kakula mining complex also remain on schedule for Q3 2020. The Kakula DFS will provide a high level of accuracy for the project economics for Kakula’s initial phase of mine development, as most construction contracts and orders for significant capital items have been placed at fixed prices. The Integrated Development Plan will include details on the planned expansion phases for the greater Kamoa-Kakula mining complex; incorporating updates for mineral resources, production rates and economic analysis.

Mr. Friedland commented, “The company is fully focused on bringing the Kakula Copper Mine to production on schedule and on budget. The extraordinary protective measures that we put in place to safeguard the health and safety of our employees and contractors have enabled our outstanding multi-national mining team to repeatedly set new underground development records. This accomplishment positions us to deliver a world-class copper mine fortuitously timed for the highly probable recovery of the world economy by the third quarter of 2021.”

Mr. Sun added, “We’re not just investing in a new mine, roads, hydro-power plants, power lines and other important infrastructure, we’re investing in good-paying jobs and new opportunities for people who live in the DRC.”

Two of Kakula’s 63-tonne dump trucks hauling ore to the high-grade stockpile.

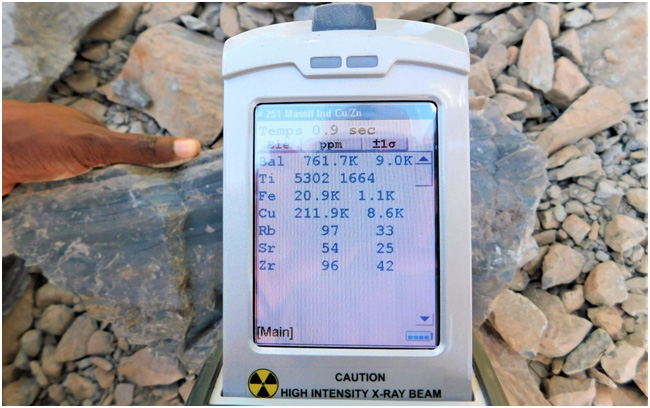

(L-R) Magloire Kashiba (Production Manager), Didier Masengo (Senior Mine Geologist) and Qiao Wei (JMMC Production Manager) examine samples of ore on the high-grade stockpile with a portable Niton analyzer (X-ray fluorescence).

A high-grade piece of Kakula ore grading 21.1% copper.

(L-R) Saphot Kabangue (Boilermaker), Tresor Mwangal (Mechanical Assistant), Gustave Kasonde (Mechanical Assistant), Pierre Katshitshi (Tyre Technician) and Motheba Katayi (Environmental Services) in front of one of Kakula’s new 63-tonne Sandvik dump trucks in the newly commissioned mining fleet wash bays.

Platreef, Kipushi and Western Foreland projects update

As previously announced and in compliance with the initial 21-day, country-wide lock down imposed by the South African Government, the company has temporarily suspended site activities at its Platreef palladium-platinum-nickel-copper-gold-rhodium project in South Africa. The board of directors has allocated a reduced 2020 budget of US$41.7 million for the Platreef Project. The sinking of Platreef’s Shaft 1 will continue and be completed to facilitate a relatively quick transition to production. In addition, the company also has modestly reduced activities at the historic Kipushi zinc-copper-lead-germanium mine in the DRC and allocated a 2020 budget of US$28.7 million. Exploration activities on the Western Foreland’s exploration project in DRC will continue with a budget of US$8 million.

Streamlining company offices and senior management

Following the appointment of Marna Cloete as President in March 2020, Ivanhoe Mines announced a review of its organizational structure and cost base, which has now been concluded.

The company will reduce its global office footprint and its corporate and senior management headcount, in addition to implementing several other company-wide, cash-saving measures. As a result, Toronto-based Executive Vice-Chairman Egizio Bianchini will relinquish his executive role but remain as Vice-Chairman and a Director of the company. Ivanhoe’s head office will remain in Sandton (South Africa) and be supported by satellite offices in Beijing (China) and London (United Kingdom).

In order to further optimize the management structure and strengthen Ivanhoe’s executive team, Pierre Joubert has been promoted to Executive Vice President Technical Services and will join Ivanhoe’s Executive Committee. Mr. Joubert, who was General Manager of Kipushi Corporation, is a qualified Mining Engineer and has had progressively senior responsibilities in the South African operations of Johannesburg-based Anglo American Platinum (Amplats), African Rainbow Minerals (ARM) and with Ivanhoe Mines.

The Executive Committee is led by Marna Cloete, President and CFO, and includes Dr. Patricia Makhesha, Executive Vice President, Sustainability & Special Projects; Matthieu Bos, Executive Vice President Africa; and Peter Zhou, Executive Vice President China. Warwick Morley-Jepson, Ivanhoe’s Chief Operating Officer, will depart the company after a short transition period.

Finally, senior management has accepted a voluntary salary reduction of up to 35% for a period of six months and the company has suspended all short-term incentive award payments for 2020 to align itself with the short and long-term interests of all its shareholders and stakeholders.

Ms. Cloete commented, “Our initiatives announced today are designed to further build on our robust cash and cash equivalents of approximately US$600 million and essentially no debt. Through this current period of temporary uncertainty, we are acting now to protect this position all while continuing to act in the best interests of our shareholders, our employees, and our broad range of stakeholders across society.”

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on advancing its three principal joint-venture projects in Southern Africa: the development of major new mines at the Kamoa-Kakula discoveries in the Democratic Republic of Congo (DRC) and at the Platreef palladium-platinum-nickel-copper-rhodium-gold discovery in South Africa; and the extensive redevelopment and upgrading of the historic Kipushi zinc-copper-germanium-silver mine, also in the DRC. Ivanhoe also is exploring for new copper discoveries on its wholly-owned Western Foreland exploration licences in the DRC, near the Kamoa-Kakula Project.

Information contacts

Investors: Bill Trenaman +1.604.331.9834 / Media: Matthew Keevil +1.604. 558.1034

Forward-looking statements

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of this news release.

Such statements include without limitation, (i) statements regarding cost reduction initiatives to generate cash savings of up to US$75 million through 2021; (ii) statements regarding Kakula’s high-grade ore stockpile is expected to total approximately 1.5 million tonnes prior to the start of initial production; (iii) statements regarding the independent Kakula definitive feasibility study and updated Integrated Development Plan for the entire Kamoa-Kakula mining complex remain on schedule for Q3 2020; (iii) statements regarding the sinking of Platreef’s Shaft 1 will continue and be completed to facilitate a relatively quick transition to production; (iv) and statements regarding planned activities and budgets for the Platreef, Kipushi and Western Foreland projects for the balance of 2020.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to, the factors discussed below and under “Risk Factors”, and elsewhere in the company’s MD&A for the year ended December 31, 2019, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors set forth in the “Risk Factors” section of the company’s Annual Information Form for the year ended December 31, 2019 and elsewhere in the company’s MD&A for the year ended December 31, 2019.

English

English Français

Français 日本語

日本語 中文

中文