VANCOUVER, CANADA – An initial story published by Bloomberg News on July 18, 2017, misleads readers with its headline, erroneous reporting and the omission of critical contextual facts that were known to the news organization.

A second story, also published on July 18, contains a false allegation by Bloomberg that Ivanhoe Mines had corrected as part of a detailed statement of facts delivered to Bloomberg seven weeks ago.

On May 26, 2017, Ivanhoe Mines provided a letter to Bloomberg reporter Thomas Wilson that set out critical information related to a planned story that subsequently was published by Bloomberg early on July 18. It became apparent after the story was published that much of Ivanhoe’s factual information had been excluded, which Bloomberg indicated was due to “the limitations of the length of the story.” Of course, this deliberate withholding of critical details was not revealed to Bloomberg’s readers.

A review of the facts shows that Bloomberg’s omission of information makes the initial story misleading and one-sided. Basic journalistic principles of truth, accuracy and balance never should be compromised, particularly just to satisfy a predetermined limit on a story’s length.

This public statement by Ivanhoe Mines is intended to provide readers with relevant information ignored by Bloomberg’s reportorial short-cuts that sacrificed facts and completeness in an apparent determination to sensationalize. Bloomberg’s tactics succeeded in misrepresenting Ivanhoe Mines and its business successes in the Democratic Republic of Congo (DRC) in a prejudiced and harmful manner.

The truth, also not acknowledged by Bloomberg, is that Ivanhoe’s significant successes in the DRC have been founded on a 14-year commitment to international standards of professional exploration along the Central African Copperbelt. The facts prove that Ivanhoe’s first discovery in 2008, and subsequent discoveries, had nothing to do with relatively recent business transactions, as alleged by Bloomberg.

Bloomberg withheld essential facts about Ivanhoe’s DRC contracting procedures

Bloomberg knew, and failed to report, that Ivanhoe Mines is committed to using and supporting local DRC companies and service providers as part of its established business practices.

Bloomberg also knew, and also failed to report, that Ivanhoe always has adhered to a fair and objective tendering, procurement and adjudication process for all capital and construction-type contracts at all of its exploration and development projects. When the tender is material or involves technical matters, it is administered by Ivanhoe’s independent engineering, procurement and construction management (EPCM) companies that have the facilities and expertise to perform this task according to industry best practice. When they are supervising the tender, the EPCM companies prepare the tender, receive and review bids, and adjudicate and recommend the preferred bidder. Successful bidders are selected according to industry-standard parameters that include capability, expertise, quality, schedule and price.

Basic procurement tenders (for services such as fuel supply) are run by Kamoa Copper SA. Ivanhoe currently has a 39.6% indirect ownership percentage in Kamoa Copper following Ivanhoe’s transaction with Zijin Mining in December 2015 and its landmark agreement with the Government of the DRC of November 2016.

Contrived innuendo in Bloomberg’s attempt to discredit Ivanhoe’s DRC exploration success

The Bloomberg reporter advised Ivanhoe Mines on May 23 that a company of interest, Tanga Logistics & Mining (TLA), is 100% owned by a second Congolese company, Katanga Premier – which in turn is owned 60% by Zoe Kabila (member of the DRC parliament and brother of the DRC President), 30% by his son and 10% by his business partner Theophas Mahuku. The reporter stated that “Zoe’s ownership has never – to my knowledge – been reported or disclosed before” – although he said he knew some people were aware of it.

On May 26, Ivanhoe Mines asserted to the Bloomberg reporter that “Ivanhoe Mines (and, we are assured, our representatives) did not have any interaction with Zoe Kabila in the tendering and awarding of any contracts for work relating to the development of Ivanhoe’s Kamoa-Kakula and Kipushi projects, the disposal of exploration permits or any other assets, in the DRC.”

Bloomberg never has offered any evidence to suggest that Ivanhoe Mines even knew of Zoe Kabila’s ownership interests in any DRC companies at the time they were seeking and doing business with Ivanhoe’s projects in the DRC.

Despite a passing acknowledgement of this fundamental point, Bloomberg stooped to contrived innuendo with its deceptive headline on its July 18 story claiming: “Ivanhoe’s Congo Success Follows Deals With Kabila’s Brother”.

Bloomberg claimed that Ivanhoe had “never disclosed” Zoe Kabila’s indirect interests in companies involved in transactions with Ivanhoe. But then in the next sentence Bloomberg reported Ivanhoe’s statement that it had never dealt with Zoe Kabila “and had no knowledge of his involvement in the businesses”.

Critical details about TLM and GICC contracts

Ivanhoe Mines has had business dealings with two companies based in the Democratic Republic of Congo – Tanga Logistics and Mining (TLM) and La Generale Industrielle et Commerciale au Congo SPRL (GICC) – noted in the Bloomberg story.

Bloomberg failed to disclose that the TLM and GICC contracts were the result of Ivanhoe Mines’ commitment to using and supporting local DRC companies and service providers, and to maintain a fair and objective tendering, procurement and adjudication process for all capital and construction-type contracts.

Both TLM and GICC have been invited to submit bids in multiple bidding competitions on construction and supply contracts in accordance with Ivanhoe’s standard tendering procedure. TLM and GICC are not always among invited bidders.

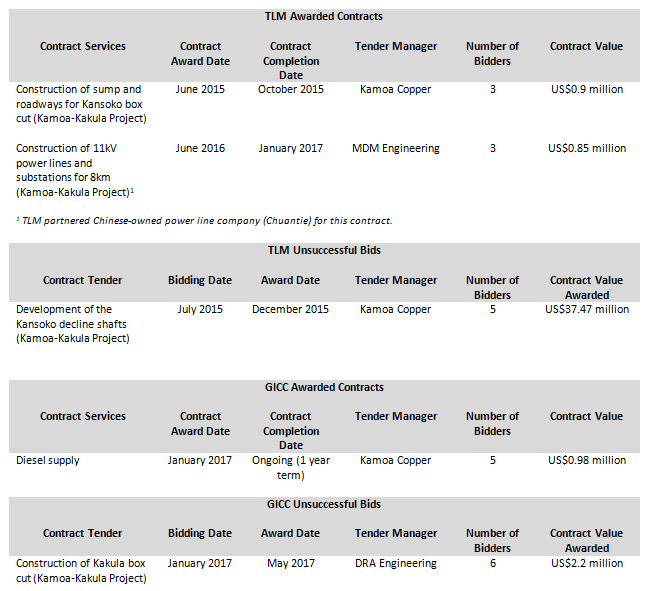

Ivanhoe has contracted with TLM on two occasions. On one other occasion, TLM participated in the tendering process but was not the winning bidder. Ivanhoe Mines has contracted once with GICC. But also on one other occasion, GICC was not the successful bidder. The bid dates, amounts awarded and terms of the tenders are summarized below.

Bloomberg failed to disclose any information provided by Ivanhoe that gives readers the context of the value of these contracts relative to these projects

- In the two years in which TLM was a successful bidder, Ivanhoe Mines’ operational and capital expenditures at the Kamoa-Kakula Project totalled US$37.59 million (2015) and US$97.99 million (2016), of which TLM’s bids amounted to 2.4% and 0.9% respectively of all expenditures in those years at the Kamoa-Kakula Project. Considered on a consolidated group financial basis on which Ivanhoe Mines’ report under Canadian securities legislation, those percentages drop to 0.7% and 0.6% respectively.

- With respect to GICC, so far in 2017, Ivanhoe Mines has incurred operational and capital expenditures at the Kamoa-Kakula Project totalling approximately US$50 million, of which GICC’s successful bid amounted to 2% of the total expenditure at the project. Viewed at an Ivanhoe Mines’ consolidated level, this falls to 1.7% so far in 2017.

This essential information was provided to Bloomberg in May 2017, but was omitted from the story, which means readers do not have the critical context to understanding the scale and scope of the contracts entered into with TLM and GICC.

A second Bloomberg story published July 18 falsely claimed Ivanhoe was involved in “partnerships” with a Zoe Kabila company

A second Bloomberg story distributed on July 18 claimed that a company in Zoe Kabila’s “business empire” had “contracts and partnerships” with Ivanhoe Mines. The truth is that no such partnerships ever existed.

On May 23, Bloomberg advised Ivanhoe Mines that TLM had claimed on GICC’s website that it had entered into a partnership with Kamoa Copper to obtain future contracts on the Kamoa-Kakula Project. (Kamoa Copper, as previously noted in this statement, is 39.6%-owned by Ivanhoe Mines.) The partnership claim was removed from the GICC website two days later – which was seven weeks ago.

In a comprehensive response to Bloomberg’s questions on May 26, Ivanhoe President and Chief Executive Officer Lars-Eric Johansson emphasized, “there is no current partnership and there never has been any partnership with Ivanhoe Mines. TLM may be invited to participate in any tender for which it would qualify, and would compete with other DRC and foreign companies for our contracts in a fair and objective process.”

Bloomberg failed to disclose the necessary historical context around the transactions with GICC and Nzuri Copper – which was provided by Ivanhoe Mines in May 2017

Ivanhoe Mines did engage in the permit sales reported in the first Bloomberg article published on July 18.

For context, however, it should be understood that Ivanhoe Mines initially assembled a portfolio of exploration permits covering an area of more than 50,000 square kilometres in the DRC in the 1990s. This is roughly the size of Slovakia. DRC mining law requires that 50% of exploration permit areas be “dropped” with each renewal. By the time of Ivanhoe’s 2012 Initial Public Offering (IPO), the company’s DRC regional exploration portfolio (excluding the Kamoa-Kakula and Kipushi projects) had, as a result, been whittled down to permits covering approximately 9,000 square kilometres. That still constituted a large land area, which was only slightly smaller than Cyprus.

Junior exploration companies, and certainly not Ivanhoe Mines, do not have the financial means to continue to explore and maintain title over such vast areas. As well, the results of exploration may not be as successful as anticipated. Both of these factors resulted in the sale of the Kalongwe permit.

Bloomberg failed to disclose that Ivanhoe’s sale of Kalongwe was motivated by lack of exploration success and lack of prospectivity

Also for context, the initial exploration results obtained at Kalongwe did not show that the prospect had the potential to be of the scale of mining operation Ivanhoe Mines was seeking. The Kalongwe permit also contained uranium that would adversely impact the ability to produce copper concentrates, making the project less attractive. In 2008, the Kamoa Project was discovered and Ivanhoe turned its financial resources to exploration activity on that project.

Artisanal miners also began working the Kalongwe permit, making it very difficult to resume any exploration activities on it. The artisanal miners also were mining the uranium mineralization, creating a potential liability for Ivanhoe as the permit holder. Given these factors, Ivanhoe Mines’ determined to focus on what now is Kamoa-Kakula, recognized as one of the world’s largest copper deposits, and to dispose of the Kalongwe permit, a strategic decision more than justified as the results at Kamoa-Kakula have demonstrated.

Again, the same strategic decision making was behind the subsequent permit dispositions to GICC. Ivanhoe Mines had decided to end its regional exploration activities in the DRC. This was done for the strategic reason that Ivanhoe, by that time, had three world-scale projects to advance, which collectively will require billions of dollars in development capital. Exploration was no longer a priority as Ivanhoe focussed on building its three concurrent developmental mining projects, thereby enabling non-core exploration projects and their permits to be selected for disposal.

This strategic sales process also was followed in other markets. At the time of its 2012 IPO, Ivanhoe had exploration projects in Australia, Gabon and Zambia, all of which were strategically disposed of in recent years – except in the case of Gabon, where the disposal process is underway. The objective was to enable Ivanhoe to focus its management, strategic resources and capital on those priority projects that management considers to be the most prospective. The transaction values of these permits are quite modest, and very immaterial relative to Ivanhoe’s roughly Cdn$3.7 billion market capitalization.

Bloomberg failed to disclose that all of these sales were part of an orderly, ordinary course of business strategic process by Ivanhoe Mines to focus its financial and exploration resources on its most prospective projects, and not on non-core assets in the DRC, Australia, Gabon or Zambia

For context, on May 17, 2017, Ivanhoe announced combined mineral resources at its Kamoa-Kakula Project of 31,391 Ktonnes of copper in the Indicated Mineral Resource category and a further 5,178 Ktonnes of copper in the Inferred Mineral Resource category. Nzuri Copper Limited, on the other hand, has defined 302 Ktonnes in combined Indicated and Inferred categories (combinations that are permitted under ASX rules but prohibited under Canadian rule NI 43-101.)

Bloomberg failed to disclose that Ivanhoe has defined 121 times more copper than Nzuri. Ivanhoe’s strategic decision to dispose of Kalongwe so it could concentrate more resources on advancing what now is the Kamoa-Kakula Project – an entirely greenfield discovery by Ivanhoe – was the warranted and immensely superior course of action.

Ivanhoe Mines’ business activities in the DRC relating to these permits, and to TLM and GICC, have been entirely ordinary course, transparent and strategically motivated. Bloomberg has described the transactions but has deliberately omitted the important context that would give readers an understanding of “why” these transactions were conducted. In doing so, Bloomberg creates the opportunity for itself to speculate that all the transactions were motivated by any one of many reasons, including to benefit Mr. Zoe Kabila. However, when the full circumstances are presented, they dissipate the sensationalism that Bloomberg has sought to create.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Bob Williamson +1.604.512.4856

South Africa: Jeremy Michaels +27.82.939.4812

English

English Français

Français 日本語

日本語 中文

中文