34.5-metre intercept graded 35.1% zinc, 10.7% copper,

479 grams/tonne silver, 77 g/t germanium and 0.30 g/t gold

Additional high-grade zinc intersections

recorded outside the historical Big Zinc resource

LUBUMBASHI, THE DEMOCRATIC REPUBLIC OF CONGO – Robert Friedland, Executive Chairman of Ivanhoe Mines (TSX: IVN), and Lars-Eric Johansson, Chief Executive Officer, announced today that additional, exceptionally high-grade silver, zinc and copper drill intercepts have been reported in the third batch of assay results from the company’s underground diamond-drilling program at the Kipushi copper-zinc-germanium-lead and precious-metals mine.

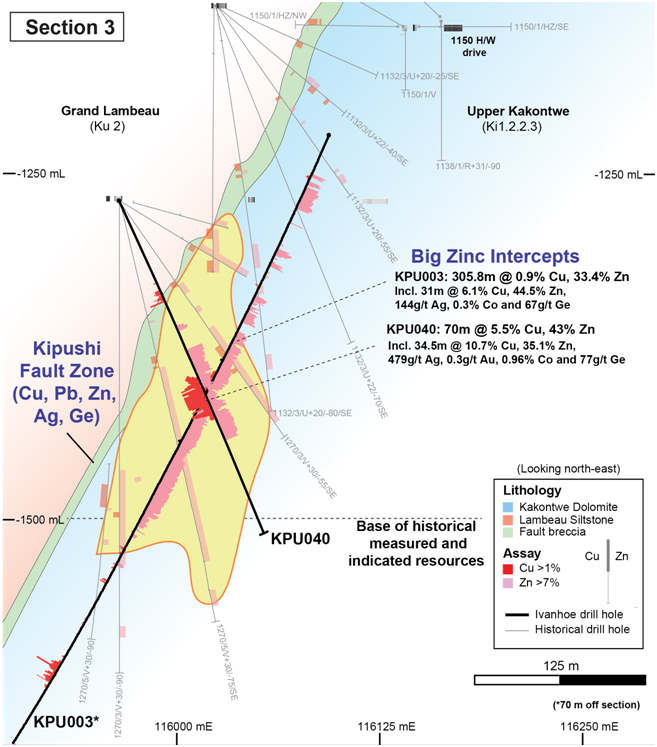

The new results include those from the first hole, KPU040, drilled through the historical Big Zinc zone from the hanging-wall drill drift on the 1,272-metre level, which provides the geometry for near-true-width intercepts. KPU040 was drilled on section 3 North and intersected high grades of base and precious metals mineralization:

- 70 metres grading 43.0% zinc, 5.5% copper, 244 grams per tonne (g/t) (7.8 oz/tonne) silver and 71 g/t germanium and 0.1 g/t gold.

Approximately one-half of the KPU040 intercept consists of a precious-metals-rich, very high-grade copper-zinc zone, which returned:

- 34.5 metres grading 35.1% zinc, 10.7% copper, 479 g/t silver (15.4 oz/tonne), 77 g/t germanium and 0.30 g/t gold.

Within the same interval, KPU040 also intercepted a zone of exceptionally rich silver, zinc and copper mineralization, which returned:

- 9.7 metres grading 19.9% zinc, 21.1% copper, 1,573g/t silver (50.6 oz/tonne), 65g/t germanium and 0.80 g/t gold.

This intercept correlates with the previously reported high-grade copper-zinc intercept in nearby hole KPU003, which returned 31 metres grading 44.5% zinc, 6.1% copper, 144 g/t silver, 67 g/t germanium and 0.1 g/t gold.

Mr. Friedland noted that although Kipushi was one of Africa’s richest copper and zinc mines, the records from its first 68 years as a producing mine did not mention the actual production of precious metals.

“Now, our discovery of high-grade copper-zinc-silver mineralization with significant gold and germanium values within the Big Zinc zone confirms our hypothesis that copper zones, which also are rich in precious metals, exist within the deep, unmined portions of the Kipushi Mine. These zones now present new and compelling targets for our ongoing exploration.”

New intersections show potential to expand southern limit of historical Big Zinc resource

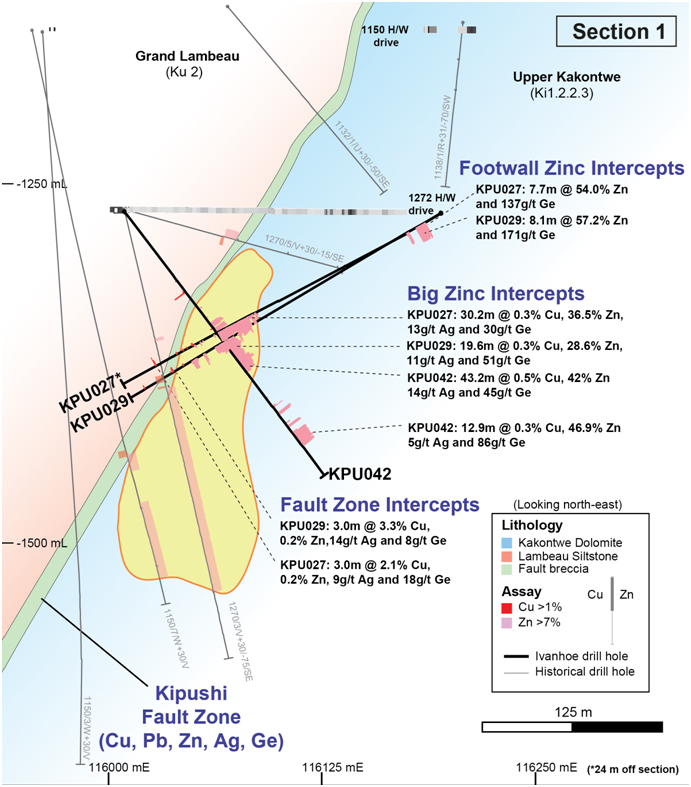

Hole KPU042 on the southern margin of the historical Big Zinc resource returned the following intersections of high-grade mineralization:

- 43.2 metres grading 42.0% zinc, 0.5% copper, 14 g/t silver and 45 g/t germanium, and a second intercept of 12.9 metres grading 46.9% zinc, 0.3% copper, 5.0 g/t silver and 86 g/t germanium.

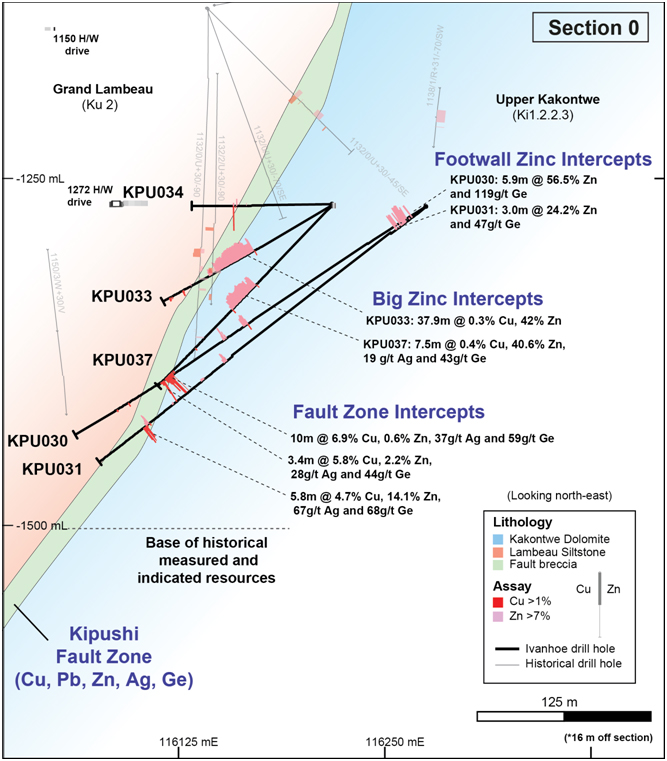

Two drill holes completed south and outside of the historical Big Zinc resource returned zones of high-grade mineralization:

- KPU033 drilled on section line 1: 37.9 metres grading 42.0% zinc, 0.3% copper, 10 g/t silver and 36 g/t germanium.

- KPU037 drilled on section line 0: 27.5 metres grading 40.6% zinc, 0.4% copper, 19 g/t silver and 43 g/t germanium.

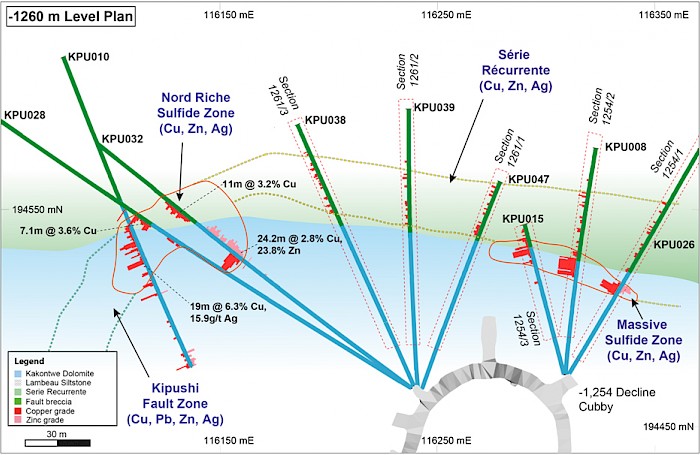

The new assay results also include the following intersections from the Nord Riche (North Rich) and Série Récurrente (Recurring Series) zones:

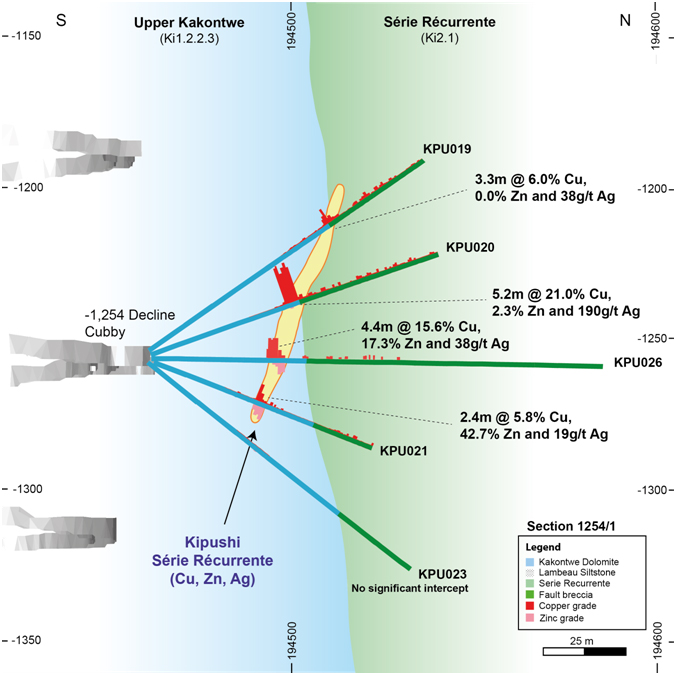

- KPU026 (Série Récurrente zone): 4.4 metres grading 15.6% copper, 17.3 % zinc and 38.0 g/t silver.

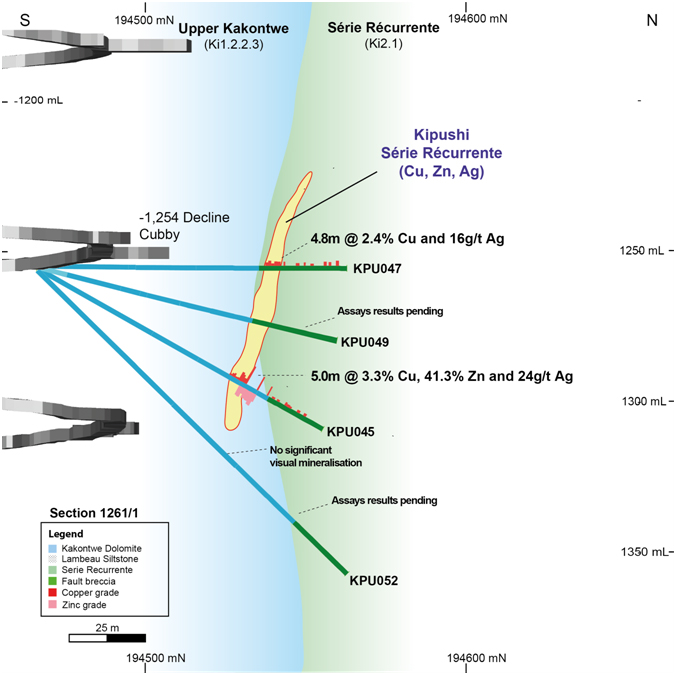

- KPU045 (Série Récurrente zone): 5.0 metres grading 3.3% copper, 41.3% zinc and 24.0 g/t silver.

- KPU028 (Nord Riche zone): 7.1 metres grading 3.6% copper, 0.1% zinc and 6.0 g/t silver.

- KPU032 (Nord Riche zone): 24.2 metres grading 2.8% copper, 23.8% zinc and 8.0 g/t silver, including:

- 6.0 metres grading 10.9% copper, 24.2% zinc and 31 g/t silver.

The Série Récurrente intercepts are true widths. The Nord Riche intercepts are not true widths as Ivanhoe does not yet know the geometry of the zones. A complete summary of recent assay results at Kipushi is in Table 1, on page 14.

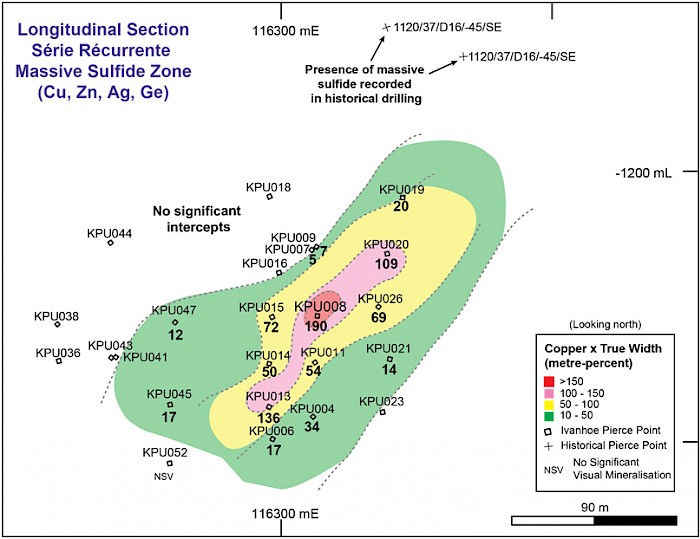

A compilation of Ivanhoe’s drill results to date indicates that the Série Récurrente zone forms a westerly-plunging shoot of high-grade copper-rich massive sulphide that is open up-plunge, and requires more drilling to define its down-plunge extent (Figure 10). Historical drilling by Gécamines intersected this zone up-plunge but it was not mined.

“These latest assay results demonstrate the world-class grades and untapped potential of the Kipushi deposit,” Mr. Friedland added.

“Our continuing exploration drilling will continue to test for extensions to the Big Zinc and the newly discovered high-grade precious metals mineralization.”

Ivanhoe now has completed 62 holes totalling approximately 12,000 metres of its planned 20,000-metre underground diamond drilling program. Assays for holes one through 47 have been released, while assays for hole 46 and holes 48 through 62, are pending. The company has streamlined its sample dispatch process to the analytical laboratory in Australia, which is expected to improve the turnaround time for future assays from Kipushi.

Two diamond-drill rigs continue to complete confirmatory drilling of the Big Zinc zone from the hanging-wall drill drift on the 1,272-metre level. Deep drilling is planned to test for depth extensions to the Big Zinc zone, including the recently discovered precious metals-rich high-grade copper-zinc zone in hole KPU040.

“We are delighted by our discovery of a significant zone of high-grade copper, germanium and precious metals within the Big Zinc. We will continue drilling off the Big Zinc from the 1,272-metre hanging-wall drift to delineate and explore this remarkable mineral discovery,” said Mr. Johansson.

Germanium is a key component of high-efficiency solar cells that are up to twice as efficient in converting solar energy into electricity than traditional, silicon-based cells.

“At current spot prices of approximately $1,900 a kilogram (approximately $59 per troy ounce) for germanium and $16.50 an ounce for silver, the germanium and silver grades have the potential to significantly add to the overall metal value at Kipushi,” Mr. Johansson added.

“The Big Zinc is sulphur rich, which also represents a potentially significant value addition given the scarcity of primary sulphur supply in the Copperbelt region, and the demand for acid in conventional in-country oxide recovery circuits.”

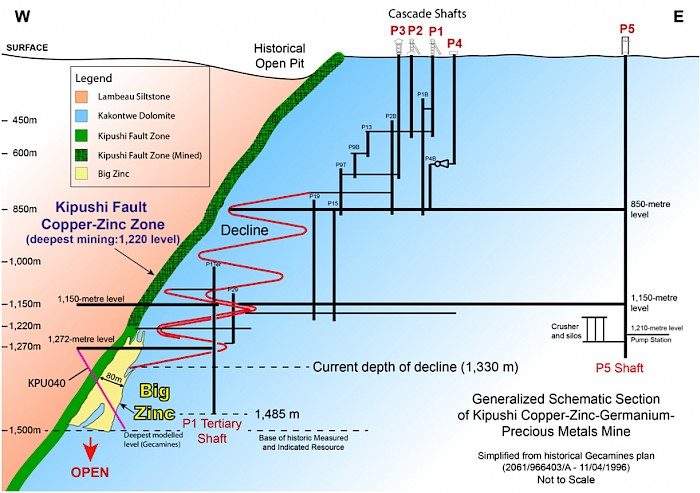

Figure 1: Schematic Kipushi cross-section showing mine infrastructure and the Big Zinc and Kipushi Fault zones.

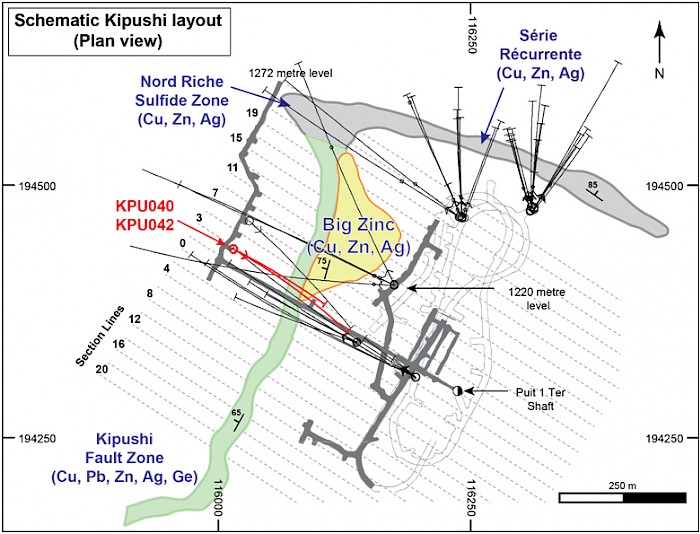

Figure 2: Plan of the 1,272-metre level with drill sections, showing schematically the location of the mineralized zones and infrastructure in the Cascades side of the mine. The Big Zinc zone is interpreted to plunge steeply to the south.

Figure 3: Drill section 3 containing confirmation drill holes KPU003 and KPU040 through Big Zinc zone.

Figure 4: Drill section 1 adjacent southern limit of historical Big Zinc resource.

Figure 5: Drill section 0 south of historical Big Zinc resource.

Figure 6: Close-up photographs of massive copper sulphides (chalcopyrite and bornite) with high silver and gold values in drill hole KPU040 through the Big Zinc zone.

Figure 7: Drill plan of 1,260-metre level showing recent drilling through Nord Riche and Série Récurrente zones.

Figure 8: Drill section showing recently assayed drill hole KPU026 through the Série Récurrente zone.

Figure 9: Drill section showing recently assayed drill holes KPU045 and KPU047 through the Série Récurrente zone.

Figure 10: Longitudinal section through Série Récurrente massive sulphide zone, with contoured grade x true thickness of copper.

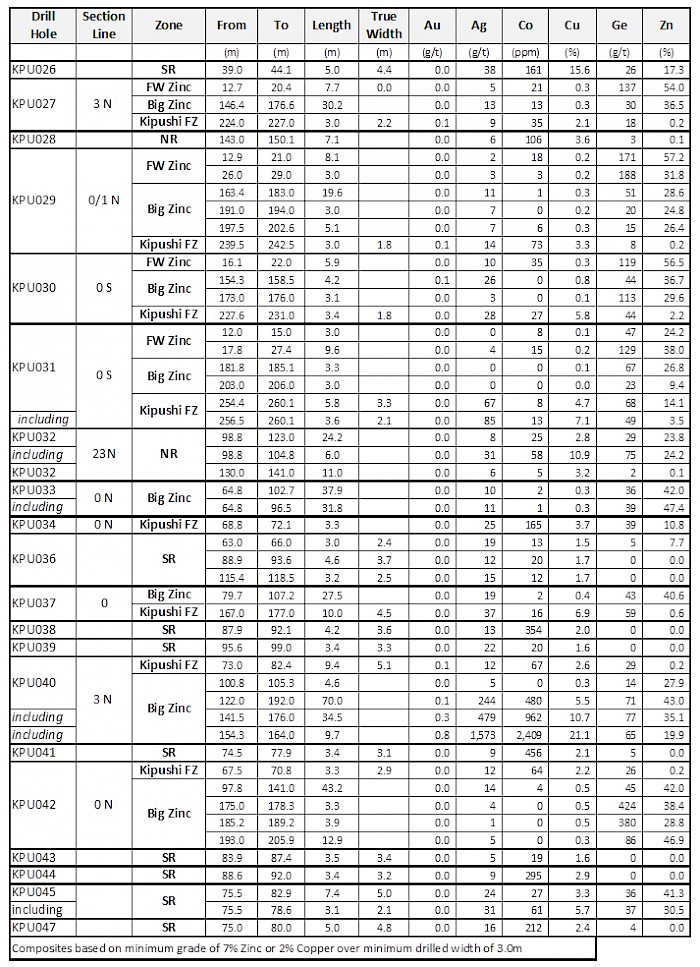

Table 1: Summary of recent assay results by Ivanhoe Mines at Kipushi.

SR = Série Récurrente; Kipushi FZ = Kipushi Fault Zone; NR = Nord Riche, FW Zinc = Footwall Zinc: massive sphalerite zones of uncertain geometry and correlation intersected in the footwall of the Big Zinc.

About the Kipushi Mine

The Kipushi Mine forms part of the Central African Copperbelt in the D.R. Congo’s southern province of Katanga, approximately 30 kilometres southwest of the provincial capital of Lubumbashi and less than one kilometre from the international border with Zambia.

Following its start-up in 1924 as the Prince Léopold Mine, Kipushi produced a total of 6.6 million tonnes of zinc and 4.0 million tonnes of copper – from 60 million tonnes of material grading 11% zinc and approximately 7% copper – until political instability prompted the suspension of operations in 1993. The mine also produced 278 tonnes of germanium between 1956 and 1978.

In addition to the recorded production of copper, zinc, lead and germanium, historical mine-level plans for Kipushi also report the presence of precious metals, specifically silver and rhenium. There is no formal record of precious metal production on the property.

The lower levels of the mine flooded in early 2011 due to a lack of pumping maintenance over an extended period. Ivanhoe Mines (formerly Ivanplats) acquired a 68% interest in Kipushi in November 2011 and has assumed responsibility for ongoing redevelopment, dewatering and drilling. The state-owned mining company Gécamines holds the remaining 32% interest in Kipushi.

Qualified Person, Quality Control and Assurance

The scientific and technical information in this news release has been reviewed and approved by Stephen Torr, P.Geo., Ivanhoe Mines’ Vice President, Project Geology and Evaluation, a Qualified Person under the terms of National Instrument 43-101. Mr. Torr has verified the technical data disclosed in this news release.

Ivanhoe Mines maintains a comprehensive chain of custody and QA-QC program on assays from its Kipushi Project. Half-sawn core is processed at its preparation laboratory in Kolwezi, DRC, before being shipped to Bureau Veritas Minerals (BVM) Laboratories in Australia for external assay. Industry-standard certified reference materials and blanks are inserted into the sample stream prior to dispatch to BVM. Ivanhoe Mines’ QA-QC program has been set up in consultation with MSA Group (Pty.) Ltd., of Johannesburg.

About Ivanhoe Mines

Ivanhoe Mines, with offices in Canada, the United Kingdom and South Africa, is advancing and developing its three principal projects:

- The Kamoa copper discovery in a previously unknown extension of the Central African Copperbelt in the DRC’s Katanga Province.

- The Platreef Discovery of platinum, palladium, nickel, copper, gold and rhodium on the Northern Limb of the Bushveld Complex in South Africa.

- The historic, high-grade Kipushi zinc-copper mine, also on the Copperbelt in the DRC.

Ivanhoe is evaluating other opportunities as part of its objective to become a broadly based, international mining company.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Bob Williamson +1.604.512.4856

South Africa: Jeremy Michaels +27.82.939.4812

Website www.ivanhoemines.com

FORWARD-LOOKING STATEMENTS

Statements in this news release that are forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed here and elsewhere in the company’s periodic filings with Canadian securities regulators. When used in this document, the words such as “could,” “plan,” “estimate,” “expect,” “intend,” “may,” “potential,” “should” and similar expressions, are forward-looking statements. Information provided in this document is necessarily summarized and may not contain all available material information.

Statements in this release that constitute forward-looking statements or information include, but are not limited to statements regarding the potential for extensions to historical Big Zinc, Recurring Series and Northern Rich mineralization; statements regarding the number of drill rigs and drilling plans and progress; statements regarding the expected improvement in the turnaround time for future assays from Kipushi; statements regarding the potential for germanium and silver to significantly add to the overall metal value at Kipushi; and statements regarding the sulphur in the Big Zinc to represent a potentially significant value addition.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indicators of whether or not such results will be achieved. All such forward-looking information and statements are based on certain assumptions and analyses made by Ivanhoe Mines’ management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believe are appropriate in the circumstances. These statements, however, are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information or statements including, but not limited to, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations. Other important factors that could cause actual results to differ from these forward-looking statements also include those described under the heading “Risk Factors” in the company’s most recently filed MD&A as well as in the most recent Annual Information Form filed by Ivanhoe Mines. Readers are cautioned not to place undue reliance on forward-looking information or statements.

English

English Français

Français 日本語

日本語 中文

中文