20,000-metre drilling program set for 2014 designed to confirm,

upgrade and expand Kipushi’s high-grade zinc and copper resources

LUBUMBASHI, DRC – Robert Friedland, Executive Chairman of Ivanhoe Mines (TSX: IVN; formerly Ivanplats, TSX: IVP), and Lars-Eric Johansson, Chief Executive Officer, announced today that the company’s ongoing dewatering program has achieved its key initial objective of restoring access to the main underground working level of the historic, high-grade Kipushi copper-zinc-germanium-lead and precious-metals mine in the Democratic Republic of Congo (DRC) before the end of this year.

The water level, which reached 851 metres below surface at its peak, now has been reduced to the mine’s main working level at 1,150 metres below surface. This progress puts the company in a position to begin its planned, 20,000-metre underground diamond-drilling program early in 2014. The program is designed to confirm the mine’s estimated, remaining high-grade resources – which were included in the September 2012 Kipushi Technical Report prepared by IMC Group Consulting – and to seek to further expand the resources on strike and at depth.

“Steelwork and equipment are being progressively replaced and upgraded as the water level drops, providing access for drilling and advancing us to a very significant milestone in the redevelopment of the Kipushi Mine,” said Mr. Johansson.

“Now we are in a position to begin our aggressive drilling program, which we believe will confirm and expand the mine’s historical resources and set the stage for Kipushi to return to production as one of the world’s highest-grade mines.”

Ivanhoe expects to complete dewatering to the bottom of the mine’s lowest level, at 1,270 metres below surface, during the first quarter of 2014.

100-hole underground drilling program set for 2014

Ivanhoe’s planned 2014 drilling program is scheduled to complete approximately 100 holes totalling more than 20,000 metres.

Among the program’s objectives is to conduct confirmatory drilling to validate the historical resources within Kipushi’s Big Zinc and Fault zones and qualify them as current resources in conformance with standards established by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM).

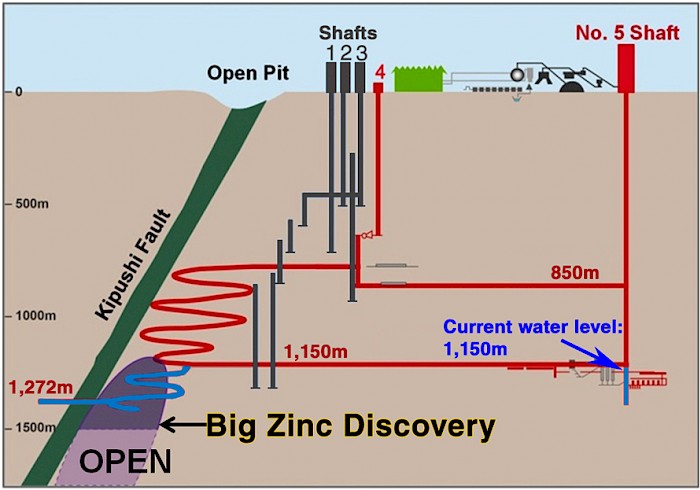

Previous mining at Kipushi was conducted to a below-surface depth of 1,207 metres on the Kipushi Fault Zone, a deposit of high-grade, copper-zinc-lead mineralization that has a strike length of 600 metres (see accompanying graphic). The Fault Zone is known to extend to at least 1,800 metres below surface, based on drilling reports by state-owned mining company Gécamines (La Générale des Carrières et des Mines).

Kipushi cross-section showing current water level and unmined Big Zinc Discovery

Kipushi also contains the Big Zinc, an extremely high-grade zinc deposit, adjacent to the Fault Zone, that was discovered shortly before the mine ceased production in 1993 and has never been mined. From its top at approximately the 1,200-metre level, the Big Zinc Deposit extends downward to at least the 1,640-metre level, as indicated by Gécamines’ drilling.

Accessible from existing underground workings, the Big Zinc has a strike length of at least 100 metres, a true thickness calculated at 40 to 80 metres and is open to depth. Gécamines also reported that multiple, steeply-dipping, Big Zinc exploratory holes intersected exceptionally high-grade zinc mineralization, grading 42% to 45% zinc, between the 1,375-metre and 1,600-metre levels, with estimated, apparent thicknesses of between 60 and 100 metres.

Ivanhoe’s planned 2014 drilling program also is designed to:

- Conduct extension drilling to test and upgrade the deeper portions of the Big Zinc and Fault zones, below the 1,500-metre level, that previously were classified as Inferred Resources.

- Conduct exploration drilling to test areas that have not been previously evaluated, such as the deeper portions of the Fault Zone and extensions to the high-grade copper mineralization of the mine’s Northern Deposit.

- Obtain large-diameter drill core from the Big Zinc for confirmatory metallurgy test work.

New, underground drill holes also may provide a platform for geophysical exploration of Kipushi’s deep mineral potential, leveraging the Ivanhoe group’s proprietary in-house expertise. Kipushi has never been evaluated using modern geophysical techniques.

Most of the underground infrastructure already is in place to support the drilling program. The majority of the drilling will be conducted from sites on the hanging-wall development drift at the 1,270-metre level and from the footwall ramp below the 1,150-metre level. Initial drilling will start on the 1,215-metre level until access is available on the 1,270-metre level. A 280-metre step-back extension of the drift also will be driven to allow the drill crews to test the down-dip extensions of the Big Zinc and Fault zones.

Independent consultant MSA Group of South Africa has been appointed to prepare a current estimate of the Big Zinc resources to CIM standards following completion of the confirmation drilling program.

Production history at Kipushi

From its start-up in 1924 as the Prince Léopold Mine, Kipushi produced a total of 6.6 million tonnes of zinc and 4.0 million tonnes of copper – from 60.0 million tonnes of ore grading 11% zinc and approximately 7% copper – until operations were halted in 1993 due to political instability. The mine also produced 278 tonnes of germanium between 1956 and 1978. Underground workings were extensively flooded during Kipushi’s 18 years of care-and-maintenance as a former state-owned asset before Ivanhoe Mines acquired a 68% interest in the mine in 2011. Gécamines retains a 32% interest in the mine.

In addition to the recorded production of copper, zinc, lead and germanium, historical Gécamines mine-level plans for Kipushi also reported the presence of precious metals. There is no formal record of gold and silver production; the concentrate was shipped to Belgium and the recovery of precious metals was not disclosed during the colonial era.

The Kipushi Mine is on the Central African Copperbelt in Katanga province, adjacent to the town of Kipushi and approximately 30 kilometres southwest of the provincial capital of Lubumbashi.

Historical resources estimate

IMC Group Consulting, which prepared the current Kipushi Technical Report, considers the historical estimate prepared by Techpro Mining and Metallurgy in 1997 to be the most relevant and reliable. Techpro reported the following resources:

| Resource Category | Tonnes | Copper % | Zinc % |

| Measured | 8,899,979 | 2.53 | 9.99 |

| Indicated | 8,029,127 | 2.09 | 24.21 |

| Total | 16,929,106 | 2.32 | 16.76 |

| Inferred | 9,046,352 | 1.93 | 23.32 |

| Totals shown above include the following Big Zinc resources: | |||

| Measured | 793,086 | 1.16 | 33.52 |

| Indicated | 3,918,366 | 0.68 | 39.57 |

| Measured & Indicated | 4,711,452 | 0.76 | 38.55 |

IMC is of the opinion that the Techpro estimate generally is fair and reasonable for demonstrated Measured plus Indicated resources and that Inferred mineral resource estimates largely represent the projection of Kipushi’s Fault Zone mineralization from the 1,500-metre level to the 1,800-metre level.

The historical Measured and Indicated Resources for the Big Zinc are stated only to the mine’s 1,500-metre level. However, Gécamines’ drilling confirmed that the Big Zinc continues down to at least the 1,640-metre level.

Gécamines principally was interested in the copper content of the Kipushi Mine, not its zinc content. Ivanhoe therefore considers that the density estimation factor used by Gécamines to calculate resources is approximate and may be inappropriate for the estimation of zinc in high-grade, iron-poor sphalerite, such as occurs in the Big Zinc, and potentially understating the Big Zinc’s historical resources.

A Qualified Person has not done sufficient work to classify the historical estimates as current Mineral Resources and Ivanhoe Mines is not treating such estimates as current Mineral Resources. The historical estimate was prepared in accordance with the JORC Code. Ivanhoe Mines will validate previous work through new drilling, sampling, assaying and other procedures to produce a mineral resource that is current for CIM purposes.

Further information relating to the historical resource estimate is included in the Kipushi Technical Report, dated September 2012, prepared by IMC and available at www.sedar.comand www.ivanhoemines.com.

Qualified Person, Quality Control and Assurance

The scientific and technical information in this release has been reviewed and approved by Stephen Torr, P.Geo., Ivanhoe Mines’ Vice President, Project Geology and Evaluation, a Qualified Person under the terms of National Instrument 43-101. Mr. Torr has verified the technical data disclosed in this press release.

About Ivanhoe Mines

Ivanhoe Mines, with offices in Canada, the United Kingdom and South Africa, is advancing and developing its three principal projects:

- The Kamoa copper discovery in a previously unknown extension of the Central African Copperbelt in the DRC’s Province of Katanga.

- The Platreef Discovery of platinum, palladium, nickel, copper, gold and rhodium on the Northern Limb of the Bushveld Complex in South Africa.

- The historic, high-grade Kipushi zinc, copper and germanium mine, also on the Copperbelt in the DRC and now being dewatered and upgraded to support a future return to production of copper, zinc and other metals following a care-and-maintenance program conducted between 1993 and 2011.

Ivanhoe Mines also is evaluating other opportunities as part of its objective to become a broadly based, international mining company.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Bob Williamson +1.604.512.4856

South Africa: Jeremy Michaels +27.11.088.4300

Website www.ivanhoemines.com

FORWARD-LOOKING STATEMENTS

Statements in this release that are forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed here and elsewhere in the company’s periodic filings with Canadian securities regulators. When used in this document, the words such as “could,” “plan,” “estimate,” “expect,” “intend,” “may,” “potential,” “should” and similar expressions, are forward-looking statements. Information provided in this document is necessarily summarized and may not contain all available material information.

Statements in this release that constitute forward-looking statements or information include, but are not limited to: statements regarding the expectation to complete the dewatering program to the bottom of the ramp decline at 1,272 metres below surface during Q’1 2014; statements regarding plans to commence an underground drilling program in early 2014 consisting of approximately 100 holes totalling more than 20,000 metres; statements regarding the primary goals of the 2014 drilling program; statements regarding plans to confirm and expand the mine’s historical high-grade resources and set the stage for Kipushi to return to production as one of the world’s highest grade mines; and statements regarding MSA Group being appointed to prepare an updated resource estimation of the Big Zinc Deposit. All such forward-looking information and statements are based on certain assumptions and analyses made by Ivanhoe Mines’ management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believe are appropriate in the circumstances. These statements, however, are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information or statements. Important factors that could cause actual results to differ from these forward-looking statements include those described under the heading “Risk Factors” in the company’s most recently filed MD&A. Readers are cautioned not to place undue reliance on forward-looking information or statements.

English

English Français

Français 日本語

日本語 中文

中文