CITIC Metal and Zijin Mining invested more than C$800 million

to advance Ivanhoe’s three world-scale mine projects in Southern Africa

Fast-tracking of development at the initial Kakula Copper Mine

in D.R. Congo among highlights of Ivanhoe’s 2018 achievements

New, ultra-high-grade copper discovery at Kamoa North

highlights potential of making significant new discoveries

at the Kamoa-Kakula Project and on Ivanhoe’s wholly-owned

Western Foreland exploration area

TORONTO, CANADA ‒ Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF) today announced its financial results for the year ended December 31, 2018. All figures are in U.S. dollars unless otherwise stated. Ivanhoe Mines is a Canadian mining company focused on advancing its three mine-development projects in Southern Africa: the Platreef palladium-platinum-nickel-copper-gold-rhodium discovery in South Africa; the Kamoa-Kakula copper discovery in theDemocratic Republic of Congo (DRC); and the extensive upgrading of the historic Kipushi zinc-copper-lead-germanium mine, also in the DRC.

HIGHLIGHTS

- On September 19, 2018, China-based CITIC Metal completed a long-term, strategic cooperation and investment agreement that saw its direct subsidiary, CITIC Metal Africa Investments Limited (CITIC Metal Africa), invest C$723 million ($555 million) to advance Ivanhoe’s three projects in Southern Africa. Under the terms of the investment agreement, CITIC Metal Africa acquired a 19.5% stake in Ivanhoe Mines through a private placement at a price of C$3.68 per share.

- Also on September 19, 2018, Zijin Mining Group, Ivanhoe’s joint-venture partner at the Kamoa-Kakula Project, exercised its anti-dilution rights at a price of C$3.68 per share, generating additional proceeds for Ivanhoe of C$78 million ($60 million). This resulted in Zijin retaining a 9.7% ownership stake in Ivanhoe Mines – its level of ownership prior to the completion of CITIC Metal Africa’s strategic investment.

- Pursuant to the terms of the strategic cooperation and investment agreement with CITIC Metal, Yufeng “Miles” Sun, President of CITIC Metal Group Limited, and Tadeu Carneiro, former Chief Executive Officer of Brazil-based Companhia Brasileira de Metalurgia e Mineração, joined the Ivanhoe Mines Board of Directors. Mr. Sun was appointed Co-Chairman of Ivanhoe, alongside Robert Friedland.

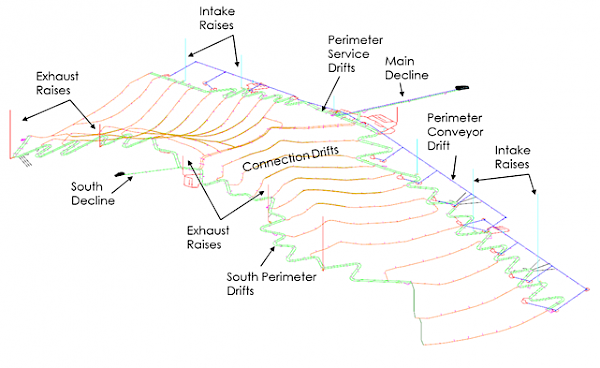

- Underground development at the planned initial Kakula copper mine in the Democratic Republic of Congo is making excellent progress. Construction of the twin northern declines has been completed, with ongoing underground development activities now focused on constructing lateral access drives and ventilation raises. In addition, development of a ventilation decline on the southern side of the Kakula orebody is underway.

- On February 6, 2019, Ivanhoe announced an independent pre-feasibility study (PFS) for the Kakula Mine. The stage one, six million-tonne-per-annum (6 Mtpa) operation at Kakula, with estimated development capital of $1.1 billion, yields an after-tax NPV8% of $5.4 billion and an IRR of 47% over a 25-year mine life. Initial production is scheduled for early 2021, and the mine is expected to average 6.8% copper over the first 5 years, with mine-site cash costs of $0.43 per pound of copper.

- Discussions for financing the construction of the initial 6 Mtpa mine at Kakula are progressing well with international and China-based financial institutions. CITIC Metal, Ivanhoe’s largest shareholder, is assisting with the discussions.

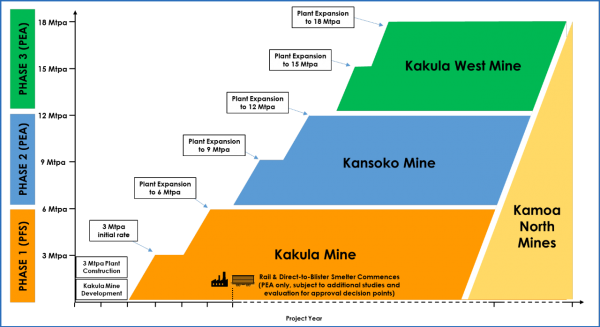

- On February 6, 2019, Ivanhoe also announced an updated independent preliminary economic assessment (PEA) for an expanded Kakula-Kamoa production rate of 18 Mtpa, supplied initially by a 6 Mtpa mine at Kakula, followed by two 6 Mtpa mines at Kansoko and Kakula West, and a direct-to-blister smelter. The PEA envisions the staged mine expansions and smelter will be funded from internal cash flows and yields an after-tax NPV8% of $10.0 billion and an IRR of 41%. All figures in the PFS and PEA are on a 100%-project basis.

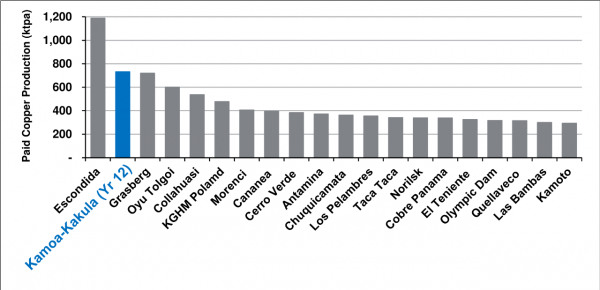

- Once the expanded PEA production rate of 18 Mtpa is achieved, Kamoa-Kakula is projected to become the world’s second largest copper mine, with peak annual production of more than 700,000 tonnes of copper.

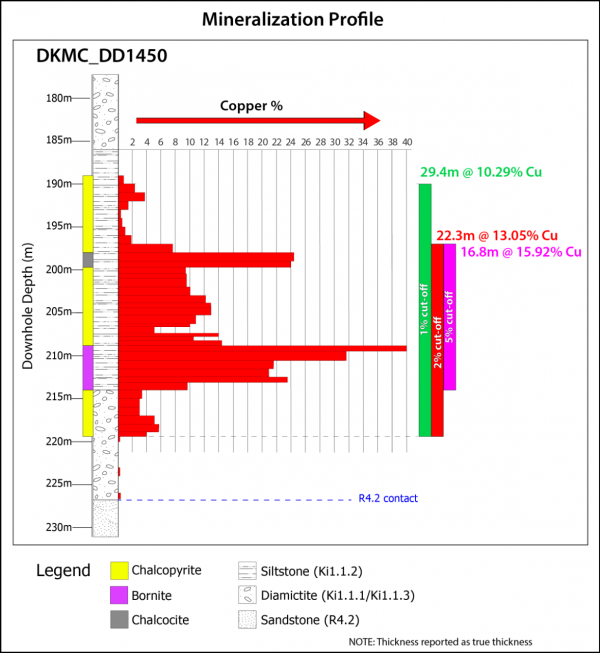

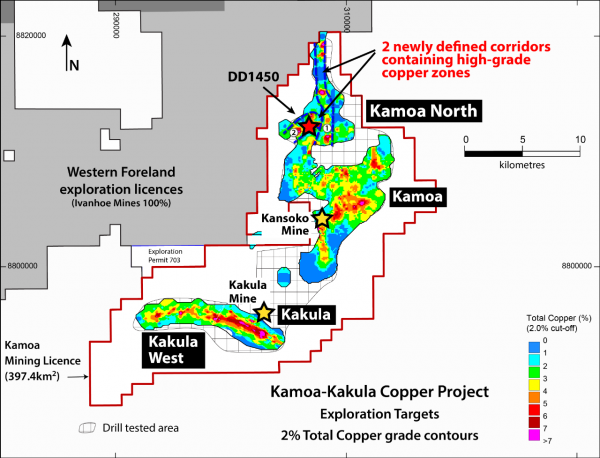

- On January 30, 2019, Ivanhoe reported a 22.3-metre intersection of 13.05% copper (at a 2% cutoff) in a shallow, flat-lying discovery within 190 metres of surface at the Kamoa North exploration area on the Kamoa-Kakula mining licence. The drill hole (DD1450) is the thickest, highest-grade copper intersection drilled to date at Kamoa-Kakula, highlighting the potential for significant additional resource expansion.

- Additional drilling is underway to test the strike and width of the east-west trending fault structure that hosts the bonanza-grade copper in hole DD1450. Nine holes now have been completed in the discovery area, and assays are pending for eight of the holes. Based on visual interpretation of massive bornite and chalcopyrite in the recent drill intersections, the new, high-grade zone of shallow, thick, flat-lying, copper mineralization has been extended over a strike length of at least 200 metres, a width of up to 80 metres, and drilled thickness of between 13 and 30 metres. The new discovery zone is approximately 170 to 200 metres below surface.

- Discovery hole DD1450 is associated with an east-west trending fault structure that allowed copper-rich fluids to flow into the stratigraphy above the conventional, Kamoa-Kakula mineralized zone and into a pyrite-rich, siltstone zone called the Kamoa Pyritic Siltstone (KPS). The shallow depth, remarkable thickness and massive copper mineralization in the KPS discovery could prove extremely significant if targeted early from a future Kamoa North decline.

- The controlling east-west striking fault responsible for the massive copper sulphide mineralization in the KPS is visible on airborne magnetic images and can be traced over a distance length at least 10 to 20 kilometres. It trends west of Kamoa-Kakula for a considerable distance onto the adjacent Western Foreland exploration licences that are 100%-owned by Ivanhoe Mines. Additional rigs will be added to accelerate the drill testing of this mineralizing structure. Assays for the outstanding drill holes have been expedited and Ivanhoe plans to provide an update on this important exploration program in the near future.

- Kamoa-Kakula geologists also are exploring another zone of shallow, high-grade copper mineralization in the far northern region of the Kamoa-Kakula mining licence. This mineralized corridor trends north and south for more than nine kilometres before swinging to the northwest and is projected to continue onto the adjacent Western Foreland exploration licences.

- Ivanhoe’s DRC exploration team is continuing with its regional drilling program targeting Kamoa-Kakula-style copper mineralization in the Western Foreland region, just to the west of the Kamoa-Kakula mining-licence area.

- On October 1, 2018, Ivanhoe announced the Makoko Copper Discovery at Western Foreland. Makoko, Ivanhoe’s third major copper discovery in the DRC, shows similar geological characteristics to the tier-one Kamoa-Kakula discoveries.

- On July 30, 2018, Ivanhoe announced a new Mineral Resource estimate for the Kipushi Mine in the DRC that increased zinc-rich Measured and Indicated Mineral Resources by 16%, from 10.2 million tonnes to 11.8 million tonnes. The new estimate also increased Kipushi’s zinc grade from 34.89% to 35.34%. In addition, the mine’s copper-rich Measured and Indicated Resources increased by 40% from 1.6 million tonnes to 2.3 million tonnes, with a slight increase in the copper grade from 4.01% to 4.03%.

- The updated Mineral Resource will be used in the preparation of the Kipushi definitive feasibility study (DFS), which is expected in the first half of this year. The DFS will update and refine the findings of the PFS issued in December 2017. Similar to the PFS, the DFS will focus on the initial mining of Kipushi’s Big Zinc Zone.

- The December 2017 PFS analyzed the plan to bring Kipushi’s Big Zinc Zone into production in less than two years, with a life-of-mine, average annual production rate of 225,000 tonnes of zinc and cash costs of $0.48 per pound of zinc. The planned return to production would establish Kipushi as the world’s highest-grade, major zinc mine.

- Discussions are continuing with potential strategic partners and lenders to support Ivanhoe’s continuing advance toward a new era of production at Kipushi. Ivanhoe has made significant progress in upgrading the mine’s underground infrastructure and the company now has a much clearer path to a resumption of production from the high-grade Big Zinc orebody.

- On October 8, 2018, Ivanhoe announced that the sinking of Shaft 1 at the Platreef palladium-platinum-nickel-copper-gold-rhodium discovery in South Africa reached the top of the Flatreef orebody, at a depth of approximately 780 metres. The orebody is 29 metres thick where Shaft 1 intersected it. Sinking now has reached a depth of 855 metres and will continue to its planned final depth of 982 metres. The Platreef mining team delivered the first ore from the underground mine development to surface stockpiles for metallurgical sampling.

- Surface construction for Platreef’s Shaft 2 is progressing. Construction now is focused on the concrete hitch for the headframe, whichis expected to be completed by mid-2019. Shaft 2 will have an internal diameter of 10 metres and will be equipped with two 40-tonne rock-hoisting skips with a capacity to hoist a total of six million tonnes of ore per year – the single largest hoisting capacity at any mine in Africa.

- On December 18, 2018, Ivanhoe announced that Ivanplats has finalized a long-term agreement with the Mogalakwena Local Municipality for the supply of local, treated waste water to supply most of the bulk water needed for the first phase of production at the Platreef Mine.

- Based on the findings of an independent DFS issued in July 2017, the Platreef Mine is projected to be Africa’s lowest-cost producer of platinum-group metals, with a cash cost of $351 per ounce of platinum, palladium, rhodium and gold, net of by-products, including sustaining capital costs.

- On February 18, 2019, Ivanhoe announced that the weighted price of the ‘basket’ of metals contained in the ore at the Platreef Project had risen to a new, three-year high.

- Ivanhoe continues to advance the arrangement of project financing for the development of the Platreef Project. Negotiation of a term sheet is progressing well with the Initial Mandated Lead Arrangers (IMLAs).

- At the end of 2018, Kamoa-Kakula had recorded 12.31 million work hours free of lost-time injuries, Kipushi 165,576 work hours, and Platreef 887,097 work hours.

Ivanhoe Mines’ Executive Co-Chairman Robert Friedland and CITIC Metal Group President Yufeng “Miles” Sun signed the landmark agreement to complete CITIC’s C$723 million equity investment in Ivanhoe during a ceremony in Beijing on September 19, 2018.

Principal projects and review of activities

1. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project is owned by Ivanplats (Pty) Ltd, which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically-disadvantaged, broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with approximately 150,000 people, project employees and local entrepreneurs.A Japanese consortium of ITOCHU Corporation; Japan Oil, Gas and Metals National Corporation and Japan Gas Corporation, owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper and gold mineralization on the Northern Limb of the Bushveld Igneous Complex in Limpopo Province, approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane.

On the Northern Limb, platinum-group metals mineralization is hosted primarily within the Platreef, a mineralized sequence that is traced more than 30 kilometres along strike. Ivanhoe’s Platreef Project, within the Platreef’s southern sector, is comprised of two contiguous properties: Turfspruit and Macalacaskop. Turfspruit, the northernmost property, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of mining operations and properties.

Since 2007, Ivanhoe has focused its exploration and development activities on defining and advancing the down-dip extension of its original discovery at Platreef, now known as the Flatreef Deposit, which is amenable to highly mechanized, underground mining methods. The Flatreef area lies entirely on the Turfspruit and Macalacaskop properties, which form part of the company’s mining right.

Health and safety at Platreef

As at the end of 2018, the Platreef Project had reached a total of 887,097 lost-time, injury-free hours worked in terms of South Africa’s Mine Health and Safety Act and Occupational Health and Safety Act. At the end of 2018, it had been nine months since the last lost-time injury occurred at the Platreef Project, which continues to strive toward its workplace objective of an environment that causes zero harm to employees, contractors, sub-contractors and consultants.

Positive independent, definitive feasibility study for Platreef’s first-phase development; Platreef projected to be Africa’s lowest-cost producer of platinum-group metals

On July 31, 2017, Ivanhoe Mines announced the positive results of an independent, definitive feasibility study (DFS) for the planned first phase of the Platreef Project’s palladium-platinum-nickel-copper-gold-rhodium mine in South Africa.

The Platreef DFS covers the first phase of development that would include construction of a state-of-the-art underground mine, concentrator and other associated infrastructure to support initial production of concentrate. As Phase 1 is being developed and commissioned, there would be opportunities to refine the timing and scope of subsequent phases of expanded production.

The 2017 DFS highlights include:

- Indicated Mineral Resources containing an estimated 41.9 million ounces of platinum, palladium, rhodium and gold, with an additional 52.8 million ounces of platinum, palladium, rhodium and gold in Inferred Resources.

- Increased Mineral Reserves containing 17.6 million ounces of platinum, palladium, rhodium and gold following stope optimization and mine sequencing work.

- Development of a large, safe, mechanized, underground mine, with an initial four-Mtpa concentrator and associated infrastructure.

- Planned initial average annual production rate of 476,000 ounces of platinum, palladium, rhodium and gold (3PE+Au), plus 21 million pounds of nickel and 13 million pounds of copper.

- Estimated pre-production capital requirement of approximately $1.5 billion, at a ZAR:USD exchange rate of 13 to 1.

- Platreef would rank at the bottom of the cash-cost curve, at an estimated $351 per ounce of 3PE+Au produced, net of by-products and including sustaining capital costs, and $326 per ounce before sustaining capital costs.

- After-tax net present value (NPV) of $916 million, at an 8% discount rate.

- After-tax internal rate of return (IRR) of 14.2%.

All figures are on a 100%-project basis unless otherwise stated. The DFS was prepared for Ivanhoe Mines by principal consultant DRA Global, with economic analysis led by OreWin, and specialized sub-consultants including Amec Foster Wheeler E&C Services (Amec Foster Wheeler), Stantec Consulting, Murray & Roberts Cementation, SRK Consulting, Golder Associates and Digby Wells Environmental.

The northern excavation at Shaft 1’s 750-metre station, showing the large scale of the underground workings − ideal for safe, mechanized mining.

Shaft 1 now extends to a depth of 850 metres below surface

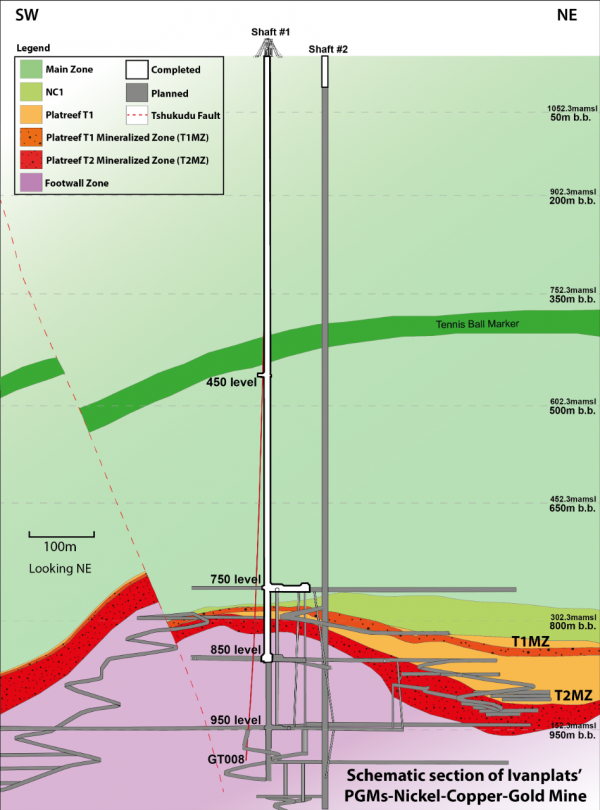

Shaft 1 reached the top of the high-grade Flatreef Deposit (T1 mineralized zone) at a depth of 780.2 metres below surface in Q3 2018 and has since been extended to the 850-metre level with the 850-metre-level station development underway.

The thickness of the mineralized reef (T1 & T2 mineralized zones) at Shaft 1 is 29 metres, with grades of platinum-group metals ranging up to 11 grams per tonne (g/t) 3PE (platinum, palladium and rhodium) plus gold, as well as significant quantities of nickel and copper. The 29-metre intersection yielded approximately 3,000 tonnes of ore, estimated to contain more than 400 ounces of platinum-group metals. The ore is stockpiled on surface for metallurgical sampling.

The 750-metre-level station, including the steelwork and concrete construction, was successfully completed in Q4 2018. The 750-metre-level and 850-metre-level stations will provide initial, underground access to the high-grade orebody, enabling mine development to proceed during the construction of Shaft 2.

As sinking of Shaft 1 advances, one more station will be developed at a mine-working depth of 950 metres. Shaft 1 is expected to reach its projected, final depth of 982 metres below surface in early 2020. Shaft 1 ultimately will become the primary ventilation shaft during the project’s initial four-Mtpa production case.

Ongoing development work at Shaft 1’s 850-metre-level mine access station, showing the northern top-cut excavation.

Spraying shotcrete over 6.5-metre anchor bolts and wire mesh to reinforce the brow at Shaft 1’s 850-metre-level mine access station.

Shaft 2 early-works construction progressing

Shaft 2, to be located approximately 100 metres northeast of Shaft 1, will have an internal diameter of 10 metres. It will be lined with concrete and sunk to a planned, final depth of more than 1,104 metres below surface. It will be equipped with two 40-tonne rock-hoisting skips capable of hoisting a total of six million tonnes of ore a year – the single largest hoisting capacity at any mine in Africa.

The headgear for the permanent hoisting facility was designed by South Africa-based Murray & Roberts Cementation. Nine blasts were successfully completed in 2018 enabling the excavation of Shaft 2’s box cut to a depth of approximately 29 metres below surface and the construction of the concrete hitch (shaft collar foundation) for the 103-metre-tall concrete headgear that will house the shaft’s permanent hoisting facilities and support the shaft collar. Excavation of the box cut and construction of the hitch foundation is expected to be completed in Q2 2019, enabling the beginning of the pre-sink, that will extend 84 metres below surface.

Ongoing construction of the foundation that will support Shaft 2’s 103-metre-tall concrete headframe.

Figure 1: Schematic section of the Platreef Mine, showing Flatreef’s T1 and T2 thick, high-grade mineralized zones (red and dark orange), underground development work completed to date in shafts 1 and 2 (white) and planned development work (gray).

Underground mining to incorporate highly productive, mechanized methods

Ivanhoe plans to develop the Platreef Mine in phases. The initial annual production rate of four million tonnes a year is designed to establish an operating platform to support future expansions. This is expected to be followed by a potential doubling of production to eight Mtpa, and then a third expansion phase to a steady-state 12 Mtpa, which would establish Platreef among the largest platinum-group-metals mines in the world.

The mining zones in the current Platreef mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below surface. Shaft 2 will provide primary access to the mining zones; secondary access will be via Shaft 1. During mine production, both shafts also will serve as ventilation intakes. Three additional ventilation exhaust raises are planned to achieve steady-state production.

Planned mining methods will use highly productive, mechanized methods, including long-hole stoping and drift-and-fill mining. Each method will utilize cemented backfill for maximum ore extraction. The ore will be hauled from the stopes to a series of internal ore passes and fed to the bottom of Shaft 2, where it will be crushed and hoisted to surface.

Platreef project financing continuing to advance

Ivanhoe continues to advance the arrangement of project financing for the development of the Platreef Project. Negotiation of a term sheet is progressing well with the Initial Mandated Lead Arrangers (IMLAs).

In addition, preliminary discussions are underway with leading South African financial institutions regarding the financing of the black economic empowerment partners’ contribution to the development capital which would thereby reduce the amount that would otherwise have to be contributed by Ivanhoe on their behalf.

Long-term supply of bulk water secured for the Platreef Mine

On May 7, 2018, Ivanhoe announced the signing of a new agreement to receive local, treated water to supply most of the bulk water needed for the first phase of production at Platreef. The Mogalakwena Local Municipality has agreed to supply a minimum of five million litres of treated water a day for 32 years, beginning in 2022, from the town of Mokopane’s new Masodi Treatment Works. Initial supply will be used in Platreef’s ongoing underground mine development and surface infrastructure construction.

Under terms of the agreement, which is subject to certain suspensive conditions, Ivanplats will provide financial assistance to the municipality for certified costs of up to a maximum of R248 million (approximately $19.6 million) to complete the Masodi treatment plant. Ivanplats will purchase the treated wastewater at a reduced rate of R5 per thousand litres for the first 10 million litres per day to offset a portion of the initial capital contributed.

Ivanplats received its Integrated Water Use Licence in January 2019, which is valid for 30 years and enables the Platreef Project to make use of water as planned in the 2017 DFS.

Development of human resources and job skills

Work progressed on the implementation of Ivanhoe’s Social and Labour Plan (SLP). The company has pledged a total of R160 million ($11 million) during the first five years, culminating in November 2019, of which R98 million ($7 million) already had been spent by December 2018. The approved plan includes R67 million ($5 million) for the development of job skills among local residents and R88 million ($6 million) for local economic development projects.

A digital trainer from Ivanplats (right) demonstrates the use of the free Wi-Fi system to a local resident. The Ivanplats Maru a Mokopane initiative – a digital communication system – is designed for people living in Mokopane, Limpopo to learn more about the Platreef Project, and provides complimentary access to wireless internet.

2. Kipushi Project

68%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kipushi copper-zinc-germanium-lead mine, in the Democratic Republic of Congo, is adjacent to the town of Kipushi and approximately 30 kilometres southwest of Lubumbashi. It is located on the Central African Copperbelt, approximately 250 kilometres southeast of the Kamoa-Kakula Project and less than one kilometre from the Zambian border. Ivanhoe acquired its 68% interest in the Kipushi Project in November 2011; the balance of 32% is held by the state-owned mining company, La Générale des Carrières et des Mines (Gécamines).

Health, safety and community development

At the end of 2018, the Kipushi Project reached a total of 165,576 work hours free of lost-time injuries. One lost-time injury occurred in November 2018 when the Kipushi Project had reached 2,092,924 work hours – more than a year since a lost-time injury had previously occurred.

The Kipushi Project operates a potable-water station to supply the municipality with water. This includes power supply, disinfectant chemicals, routine maintenance, security and emergency repair of leaks to the primary reticulation. The Kipushi Project also installed and commissioned new overhead powerlines to the pump station. Other community development projects continued during Q4 2018 included the Kipushi women’s literacy project, the setup of a new sewing training centre, scholarships and more water boreholes drilled and equipped for community use.

Kipushi Mineral Resources

The Kipushi Project’s current Mineral Resource estimate was updated with an effective date of June 14, 2018, and was prepared by the MSA Group of Johannesburg, South Africa, in compliance with 2014 CIM Definition Standards. Ivanhoe plans to file an updated National Instrument 43-101 (NI 43-101) technical report for the Kipushi Project covering the June 2018 Mineral Resource estimate by the end of March 2019. The technical report will be filed on the company’s website and under the company’s SEDAR profile at www.sedar.com.

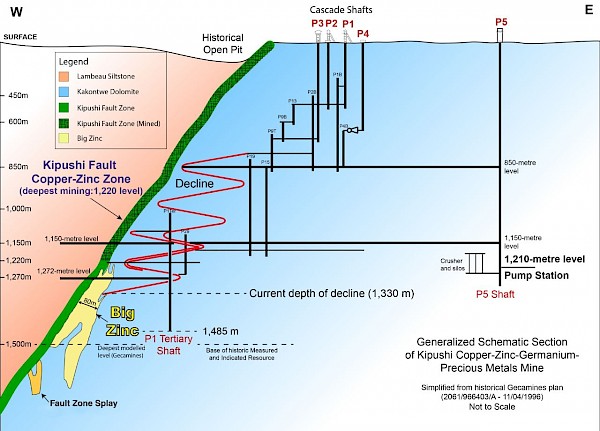

Zinc-rich Measured and Indicated Mineral Resources, primarily in the Big Zinc Zone total 11.78 million tonnes at grades of 35.34% zinc, 0.80% copper, 23 g/t silver and 64 g/t germanium, at a 7% zinc cut-off – containing an estimated 9.2 billion pounds of zinc. Zinc-rich Inferred Mineral Resources total an additional 1.14 million tonnes at grades of 33.77% zinc, 1.24% copper, 12 g/t silver and 62 g/t germanium. The Inferred Mineral Resources are contained partly in the Big Zinc Zone and partly in the Southern Zinc Zone.

Copper-rich Measured and Indicated Mineral Resources contained in the adjacent Fault Zone, Fault Zone Splay and Série Récurrente Zone total an additional 2.29 million tonnes at grades of 4.03% copper, 2.85% zinc, 21 g/t silver and 19 g/t germanium, at a 1.5% copper cut-off – containing 144 million pounds of copper. Copper-rich Inferred Mineral Resources in these zones total an additional 0.44 million tonnes at grades of 3.89% copper, 10.77% zinc, 19 g/t silver and 55 g/t germanium.

Figure 2: Schematic underground section of the Kipushi Mine.

Pre-feasibility study for Kipushi completed in December 2017; definitive feasibility study expected in Q2 2019

The Kipushi Project’s PFS, announced by Ivanhoe Mines on December 13, 2017, anticipated annual production of an average of 381,000 tonnes of zinc concentrate over an 11-year, initial mine life at a total cash cost of approximately $0.48 per pound (lb) of zinc.

Highlights of the PFS, based on a long-term zinc price of $1.10/lb include:

- After-tax net present value (NPV) at an 8% real discount rate of $683 million.

- After-tax real internal rate of return (IRR) of 35.3%.

- After-tax project payback period of 2.2 years.

- Pre-production capital costs, including contingency, estimated at $337 million.

- Existing surface and underground infrastructure allows for significantly lower capital costs than comparable greenfield development projects.

- Life-of-mine average planned zinc concentrate production of 381,000 dry tonnes per annum, with a concentrate grade of 59% zinc, is expected to rank Kipushi, once in production, among the world’s largest zinc mines.

All figures are on a 100%-project basis unless otherwise stated. Estimated life-of-mine average cash cost of $0.48/lb of zinc is expected to rank Kipushi, once in production, in the bottom quartile of the cash-cost curve for zinc producers internationally.

The planned primary mining method for the Big Zinc Deposit in the PFS is sublevel long-hole, open stoping, with cemented backfill. The crown pillars are expected to be mined once adjacent stopes are backfilled using a pillar-retreat mining method. The Big Zinc Deposit is expected to be accessed via the existing decline and without any significant new development. The main levels are planned to be at 60-metre vertical intervals, with sublevels at 30-metre intervals.

The Kipushi Project’s definitive feasibility study is progressing and is expected to be completed in Q2 2019.

Project development and infrastructure

Significant progress has been made in modernizing the Kipushi Mine’s underground infrastructure as part of preparations for the mine to resume commercial production. In Q4 2018, the Kipushi Project successfully hoisted previously mined ore from Shaft 5 to surface. This was the first time that ore had been hoisted to surface since the mine was placed on care and maintenance by Gécamines in 1993.

Earlier in 2018, the Kipushi Project successfully completed initial, pre-production testing as part of the equipment commissioning process for the new, large-capacity rock crusher that has been installed 1,150 metres below surface. The Sandvik jaw crusher has a maximum capacity of 1,085 tonnes an hour. The 54-tonne machine was re-assembled and installed in the crusher chamber after it was disassembled on surface and its pieces were lowered down Shaft 5, which is the Kipushi Mine’s main production shaft.

Kipushi’s fully-assembled Sandvik jaw crusher, capable of crushing up to 1,085 tonnes of ore an hour.

Construction of the rock load-out facility on Kipushi’s 1,150-metre level. Ore from the Big Zinc Deposit will be unloaded here, for crushing and hoisting to surface.

Ivanhoe completed the upgrading of a significant amount of underground infrastructure at the Kipushi Project, including a series of vertical mine shafts to various depths, with associated head frames, as well as underground mine excavations and infrastructure. A series of crosscuts and ventilation infrastructure still is in working condition and has been cleared of old materials and equipment to facilitate modern mechanized mining. The underground infrastructure also includes a series of pumps to manage the influx of water into the mine and water levels are easily maintained at the bottom of the mine.

Shaft 5 is eight metres in diameter and 1,240 metres deep. It now has been upgraded and re-commissioned. The main personnel and material winder has been upgraded and modernized to meet international industry standards and safety criteria. The Shaft 5 rock-hoisting winder now is fully operational with new rock skips, new head- and tail-ropes and attachments installed. The two newly manufactured rock conveyances (skips) and the supporting frames (bridles) have been installed in the shaft to facilitate the hoisting of rock from the main ore and waste storage silos feeding rock on the 1,200-metre level.

The main haulage way on the 1,150-metre level between the Big Zinc access decline and Shaft 5 rock load-out facilities has been resurfaced with concrete so the mine now can use modern, trackless, mobile machinery.

With the underground upgrading program nearing completion, the project’s focus now will shift to modernizing and upgrading Kipushi’s surface infrastructure to handle and process Kipushi’s high-grade zinc and copper resources.

Modern, new control room at Kipushi’s Shaft 5.

New electrical panels installed underground at Kipushi.

High-volume water pipes to keep Kipushi’s underground workings dry.

Kipushi Project’s proposed site layout.

3. Kamoa-Kakula Project

39.6%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kamoa-Kakula Project, a joint venture between Ivanhoe Mines and Zijin Mining, has been independently ranked as the world’s fourth largest copper deposit by international mining consultant Wood Mackenzie, with adjacent prospective exploration areas within the Central African Copperbelt in the Democratic Republic of Congo, approximately 25 kilometres west of the town of Kolwezi and about 270 kilometres west of Lubumbashi.

Ivanhoe sold a 49.5% share interest in Kamoa Holding to Zijin Mining in December 2015 for an aggregate consideration of $412 million. In addition, Ivanhoe sold a 1% share interest in Kamoa Holding to privately-owned Crystal River for $8.32 million – which Crystal River will pay through a non-interest-bearing, 10-year promissory note. Since the conclusion of the Zijin transaction in December 2015, each shareholder has been required to fund expenditures at the Kamoa-Kakula Project in an amount equivalent to its proportionate shareholding interest in Kamoa Holding.

A 5%, non-dilutable interest in the Kamoa-Kakula Project was transferred to the DRC government on September 11, 2012, for no consideration, pursuant to the 2002 DRC mining code. Following the signing of an agreement with the DRC government in November 2016, in which an additional 15% interest in the Kamoa-Kakula Project was transferred to the DRC government, Ivanhoe and Zijin Mining now each hold an indirect 39.6% interest in the Kamoa-Kakula Project, Crystal River holds an indirect 0.8% interest and the DRC government holds a direct 20% interest. Kamoa Holding holds an 80% interest in the project.

Kamoa-Kakula surpassed 12 million hours worked without a lost-time injury in 2018, and recently broke the 13-million-hour mark

At the end of 2018, the Kamoa-Kakula Project had achieved a total of 12,305,545 work hours free of lost-time injuries. It has been approximately seven years since the last lost-time injury occurred at the project. During 2018 the project achieved three significant milestones in safety which include 10-, 11- and 12 million hours free of lost-time injuries. This outstanding achievement reflects the dedication to a safety-focused culture of the entire Kamoa-Kakula exploration and development teams.

In March 2019, Kamoa-Kakula celebrated achieving more than 13 million work hours free of lost-time injuries.

Also in March 2019, members of Kamoa’s drilling team marked the completion of the 1,500th exploration hole drilled at the Kamoa-Kakula Project.

Map of the Kamoa-Kakula mining licence showing the Kakula and Kansoko mining areas, as well as Kakula West, Kamoa North and drill hole DD1450, and a portion of Ivanhoe’s adjacent, 100%-owned Western Foreland exploration area.

PFS for Kakula and updated PEA for an expanded Kamoa-Kakula production rate of 18 Mtpa announced

On February 6, 2019, Ivanhoe announced the results from the Kakula 2019 PFS. The study assesses the potential development of the Kakula Deposit as a 6 Mtpa mining and processing complex. The Kakula mill would be constructed in two smaller phases of 3 Mtpa each as the mining operations ramp-up to full production of 6 Mtpa. The life-of-mine production scenario provides for 119.7 million tonnes to be mined at an average grade of 5.48% copper, producing 9.8 million tonnes of high-grade copper concentrate, containing approximately 12.4 billion pounds of copper. All figures are on a 100%-project basis unless otherwise stated.

On March 22, 2019, Ivanhoe filed an updated NI 43-101 technical report for the Kamoa-Kakula Copper Project covering the independent pre-feasibility studies for the development of the Kakula and Kansoko copper mines, and an updated, expanded preliminary economic assessment for the overall integrated development plan for the project. The report, titled Kamoa-Kakula Integrated Development Plan 2019, is available on the company’s website and under the company’s SEDAR profile at www.sedar.com.

Highlights of the PFS, based on a consensus, long-term copper price of $3.10/lb include:

- Very high-grade, stage-one production is projected to have a grade of 7.1% copper in the second year of production and an average grade of 6.4% copper over the initial 10 years of operations, resulting in estimated average annual copper production of 291,000 tonnes.

- Annual copper production is estimated at 360,000 tonnes in year four.

- Initial capital cost, including contingency, is estimated at $1.1 billion.

- Average total cash cost of $1.11/lb of copper during the first 10 years, inclusive of royalties.

- After-tax NPV, at an 8% discount rate, of $5.4 billion.

- After-tax internal rate of return (IRR) of 46.9%, and a payback period of 2.6 years.

- Kakula is expected to produce a very high-grade copper concentrate in excess of 55% copper, with extremely low arsenic levels.

Ivanhoe also announced an updated independent PEA for an expanded Kakula-Kamoa production rate of 18 Mtpa, supplied initially by a 6 Mtpa mine at Kakula, followed by two 6 Mtpa mines at Kansoko and Kakula West, and a world-scale direct-to-blister smelter.

Highlights of the PEA, based on a consensus, long-term copper price of $3.10/lb include:

- Very high-grade initial phase projected to have a grade of 7.1% copper in the second year of production and an average grade of 5.7% copper during the first 10 years of operations, resulting in estimated average annual copper production of 386,000 tonnes.

- Recovered copper production is estimated at 740,000 tonnes in year 12, which would rank the Kamoa-Kakula Project as the second largest copper producer in the world.

- Initial capital cost, including contingency, is $1.1 billion, with subsequent expansions at Kansoko, Kakula West, and other mining areas, as well as the smelter, to be funded by cash flows from the Kakula Mine.

- Average total cash costs of $0.93/lb of copper during the first 10 years, including sulphuric acid credits.

- After-tax NPV, at an 8% discount rate, of $10.0 billion.

- After-tax IRR of 40.9% and a payback period of 2.9 years.

Figure 3: Kamoa-Kakula 18 Mtpa PEA long-term development plan.

Figure 4: Projected 18 Mtpa Kamoa-Kakula PEA production (year-12 peak copper production shown) compared to the world’s projected top 20 producing mines

in 2025 by paid copper production.

Note: Kamoa-Kakula 2019 PEA production based on projected peak copper production (which occurs in year 12) of the 18 Mtpa alternative development option.

Source: Wood Mackenzie (based on public disclosure, the Kakula 2019 PFS has not been reviewed by Wood Mackenzie).

Kamoa-Kakula Mineral Resources

Ivanhoe issued an updated Mineral Resource estimate for the Kamoa-Kakula Project on February 6, 2019. Details of the updated Mineral Resource estimate are contained in the March 2019, independent NI 43-101 technical report for the Kamoa-Kakula Project.

The updated Mineral Resource estimate includes an updated Kakula Mineral Resource estimate and was prepared by Ivanhoe Mines under the direction of Amec Foster Wheeler E&C Services Inc. of Reno, USA, in accordance with the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves. The Qualified Persons for the 2019 Kamoa-Kakula Mineral Resource estimate are Dr. Harry Parker, RM, SME and Gordon Seibel, RM, SME both of Amec Foster Wheeler E&C Services Inc.

Indicated Mineral Resources for the combined Kamoa-Kakula Project now total 1,387 million tonnes grading 2.64% copper, containing 80.6 billion pounds of copper at a 1.0% copper cut-off grade and a minimum thickness of three metres. Kamoa-Kakula also has Inferred Mineral Resources of 316 million tonnes grading 1.76% copper and containing 12.2 billion pounds of copper, also at a 1.0% copper cut-off grade and a minimum thickness of three metres.

The Kakula Mineral Resource estimate covers a mineralized strike length of 13.3 kilometres and is based on results from 323 holes completed by November 1, 2018. Indicated Mineral Resources total 628 million tonnes at a grade of 2.72% copper, containing 37.6 billion pounds of copper at a 1% copper cut-off. At a 2% copper cut-off, Indicated Mineral Resources total 319 million tonnes at a 3.99% copper grade, containing 28.1 billion pounds of copper. At a 3% copper cut-off, Indicated Mineral Resources total 164 million tonnes at a grade of 5.50% copper, containing 19.9 billion pounds of copper.

Inferred Mineral Resources total 114 million tonnes at a grade of 1.59% copper, containing 4.0 billion pounds of copper at a 1% copper cut-off. At a 2% copper cut-off, Inferred Mineral Resources total 23 million tonnes at a 2.62% copper grade, containing 1.3 billion pounds of copper. At a 3% copper cut-off, Inferred Mineral Resources total 5.0 million tonnes at a grade of 3.52% copper, containing 0.4 billion pounds of copper.

The average true thickness of the selective mineralized zone (SMZ) at a 1% copper cut-off is 10.5 metres in the Indicated Mineral Resources area and 6.9 metres in the Inferred Mineral Resources area. At a higher 3% copper cut-off, the average true thickness of the SMZ is 4.9 metres in the Indicated Mineral Resources area and 3.9 metres in the Inferred Mineral Resources area.

The Kakula Mineral Resources are defined within a total area of 27.4 square kilometres at a 1% copper cut-off. At the same cut-off grade, the areal extent of Indicated Mineral Resources is 21.5 square kilometres and the areal extent of the Inferred Mineral Resources is 5.9 square kilometres.

Underground development progressing at the Kakula Deposit

Development of the twin access declines at the northern side of the Kakula Deposit started with the first blast on November 16, 2017. At the end of 2018, each of the twin declines at Kakula had been advanced more than 1,180 metres from the portal face toward the mineralized zone for a total advancement of 3,430 metres. Both declines currently are passing through the lower diamictite, approaching the high-grade mineralization. Construction of the 1,050-metre-level dam and the two access drifts also were initiated in Q4 2018.

Preparing an explosive charge underground at Kakula. The main twin declines intersected the northern edge of the mineralized reef in January 2019.

Lateral underground mine development now is progressing toward the initial, high-grade mining area.

A system of ‘through-ventilation’ has been constructed with fresh air being pulled down the service decline and exhausted up the conveyor decline. This will allow the project to increase the underground work force to four development crews and will enable fresh air to be pushed further into the mine than had been possible with forced vent ducts from surface.

A single decline also is being developed on the south side of the Kakula Deposit to provide bottom access to Ventilation Shaft 2, enabling this shaft to be constructed by raise boring instead of sinking. This decline also will be used as a second means of egress from the mine.

Construction is underway on a third decline tunnel on the southern side of the Kakula Deposit to provide access and ventilation to the high-grade copper.

The design for the main Kakula decline conveyor system and initial two truck tips at the bottom of the decline is well advanced. Most of the major procurement packages had been ordered by the end of 2018, including steel fabrication, conveyor drives, idlers and apron feeders. Construction is expected to start in late-March 2019 and it is scheduled to be operational by the end of 2019. This will reduce the truck traffic in the declines with consequent reduction in costs, congestion and ventilation requirements.

The contract for raise boring of Ventilation Shaft 1 was awarded in November 2018. The shaft will be 5.5 metres in diameter and 200 metres deep.

Figure 5: Kakula 2019 PFS mine development plan prepared by Stantec.

Contractors wiring up explosives for Ventilation Shaft 1 that will provide fresh air to Kakula’s underground workings.

Exploration activities continue at Kakula and Kamoa North

Exploration drilling in Q4 2018 was completed with eight contractor drill rigs and two company-owned drill rigs. The number of drill rigs was gradually reduced in December 2018 to allow for a shut down over the holiday period and for scheduled reduction in drilling for 2019. A total of 85,593 metres were drilled in 2018 from 272 diamond drill-holes.

Exploration drilling during Q4 2018 was split between Kakula and Kamoa North, with 21,198 metres drilled for exploration purposes in 58 holes. The reduction from the previous quarter was due to geotechnical drilling for the decline and planned tailings storage facility site. A total of 36 holes, totalling 16,178 metres, were completed in Kamoa North in which two rigs were drilling shallow holes.

Unprecedented exploration drilling results at Kamoa North

On January 30, 2019, Ivanhoe released assay results from ongoing exploration drilling at Kamoa North. Assays for 22 holes were released. The results included an unprecedented 22.3-metre intersection (true thickness) of 13.05% copper at a cut-off of 2% copper, in a shallow, flat-lying discovery at the Kamoa North copper exploration area.

Drill hole DD1450 includes multiple one-metre intersections with copper grades higher than 20% copper, including a 40%-copper interval.

At a cut-off of 5% copper, DD1450’s intersection is 15.92% copper over 16.8 metres (true thickness). Using a lower cut-off grade of 1% copper, the intersection is 10.29% copper over 29.4 metres (true thickness), beginning at a depth of only 190 metres below surface.

One of two rigs currently drilling in the Kamoa North area. One rig is pursuing extensions of high-grade mineralization intersected in the far northern region of the Kamoa-Kakula mining licence, while the other rig is targeting extensions of the ultra-high-grade copper intersected in drill hole DD1450.

Figure 6: Mineralization profile for drill hole DD1450 at Kamoa North, beginning at a depth of only 190 metres below surface.

Additional drilling is underway to test the strike and width of the east-west trending fault structure that hosts the bonanza-grade copper in hole DD1450. Nine holes now have been completed in the discovery area, and assays are pending for eight of the holes. Based on visual interpretation of massive bornite and chalcopyrite in the recent drill intersections, the new, high-grade zone of shallow, thick, flat-lying, copper mineralization has been extended over a strike length of at least 200 metres, a width of up to 80 metres, and drilled thickness of between 13 and 30 metres. The new discovery zone is approximately 170 to 200 metres below surface.

Discovery hole DD1450 is associated with an east-west trending fault structure that allowed copper-rich fluids to flow into the stratigraphy above the conventional, Kamoa-Kakula mineralized zone and into a pyrite-rich, siltstone zone called the Kamoa Pyritic Siltstone (KPS). The shallow depth, remarkable thickness and massive copper mineralization in the KPS discovery could prove extremely significant if targeted early from a future Kamoa North decline.

The controlling east-west striking fault responsible for the massive copper sulphide mineralization in the KPS is visible on airborne magnetic images and can be traced over a distance length at least 10 to 20 kilometres. It trends west of Kamoa-Kakula for a considerable distance onto the adjacent Western Foreland exploration licences that are 100%-owned by Ivanhoe Mines. Additional rigs will be added to accelerate the drill testing of this mineralizing structure. Assays for the outstanding drill holes have been expedited and Ivanhoe plans to provide an update on this important exploration program in the near future.

Kamoa-Kakula geologists also are exploring another zone of shallow, high-grade copper mineralization in the far northern region of the Kamoa-Kakula mining licence. This mineralized corridor trends north and south for more than nine kilometres before swinging to the northwest and is projected to continue onto the adjacent Western Foreland exploration licences.

David Edwards, Kamoa-Kakula’s Geology Manager (right) identifies the location of the next drill hole at Kamoa North with one of Kamoa’s contract drillers.

Ongoing upgrading work enables Mwadingusha hydropower station to supply clean electricity to the national grid

Ongoing upgrading work at the Mwadingusha hydropower plant in the DRC has significantly progressed with the major equipment being delivered on site. The power station was shut down to replace sections of penstocks that were found to be in an advanced stage of corrosion. The progressive re-commissioning of the turbines, fully refurbished and modernized with state-of-the-art control and instrumentation will start in 2019 and be completed in Q3 2020. The refurbished plant will deliver an output increased by 10% to a capacity of approximately 72 megawatts (MW) of power.

The work at Mwadingusha, part of a program to eventually overhaul and boost output from three hydropower plants, is being conducted by engineering firm Stucky of Lausanne, Switzerland, under the direction of Ivanhoe Mines and Zijin Mining, in conjunction with the DRC’s state-owned power company, La Société Nationale d’Electricité (SNEL). Once fully reconditioned, the three plants will have a combined installed capacity of approximately 200 MW of electricity for the national grid, which is expected to be more than sufficient for the Kamoa-Kakula Project.

The Kansoko Mine, Kakula Mine and Kamoa camp have been connected to the national hydroelectric power grid since the completion of a 12-kilometre, 120-kilovolt, dual-circuit power line between Kansoko and Kakula in December 2017. The design of permanent, 11-kilovolt reticulation to the vent shafts and mine has started, which includes substations, overhead lines and surface cables.

Construction has commenced on a 220-kilovolt electrical substation at the Kakula Mine that will allow the mine to be powered by clean, sustainable hydro-generated electricity from the country’s national power grid.

Surveying and construction is underway on a new, 20-kilometre by-pass road linking the Kamoa-Kakula Project to the Kolwezi airport, located approximately six kilometres south of Kolwezi. When completed, this new road will significantly improve the transportation corridor between Kolwezi and Kamoa-Kakula.

Continued focus on community and sustainability

The Kamoa-Kakula Sustainable Livelihoods Program is committed to sustainable development in the communities within the project’s footprint. The main objective of the livelihoods program is to enhance food security and the living standards of the people who reside within the project’s footprint. The program is mainly implemented through fish farming and food crops, including farming of maize (corn) and vegetables, plus poultry production and beekeeping.

Additional non-farming-related activities for 2018 included education and literacy programs, the completion of a community water program, the continuation of the brick-making program and the creation of unskilled job opportunities.

The resettlement and fencing for the 16-kilometre mine perimeter fence was completed in October 2018. A total of 45 households were successfully resettled in newly constructed houses in the Muvunda village and a new school was constructed in Muvunda.

Farmers weeding newly-planted cabbage at one of the new community farms established near the Kamoa-Kakula Project. Two fish-farming ponds are in the background, where local community members raise tilapia until they are big enough to harvest. The initiatives are part of Kamoa-Kakula’s Sustainable Livelihoods Program to support and expand food production in nearby communities.

4.Western Foreland Exploration Project

100%-owned by Ivanhoe Mines

Democratic Republic of Congo

Ivanhoe’s DRC exploration group is targeting Kamoa-Kakula-style copper mineralization through a regional drilling program on its 100%-owned Western Foreland exploration licences, located to the north and west of the Kamoa-Kakula Project.

During Q4 2018, exploration drilling continued with three rigs. A total of 7,339 metres in 19 diamond drill holes were completed during the quarter, bringing the total to 29,271 metres in 66 holes.

Drilling continued at Makoko throughout the quarter, with 13 holes completed. Ivanhoe commissioned a Toyota Landcruiser-mounted drill rig during September 2018 that is being used to test for geochemical anomalies and prospective stratigraphy along the margin of the Western Foreland, where access is difficult. Seven of the 13 completed Makoko holes were drilled by the Landcruiser rig for a total of 821 metres.

Processing of seismic data has been ongoing through the quarter with additional processing completed at Velseis Integrated Seismic Technologies in Brisbane, Australia. The 2D sections are being combined with detailed ground gravity data, airborne magnetics and drilling data to create a predicted geological interpretation from Kakula to Makoko. This work is providing an intricate insight into the behaviour of the mineralizing system in the Western Foreland area.

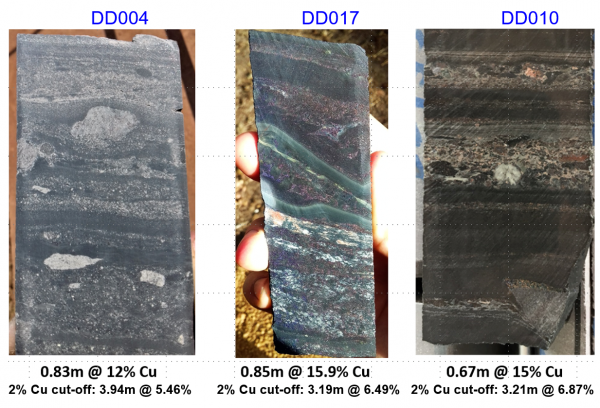

Makoko Copper Discovery

On October 1, 2018, Ivanhoe announced the Makoko Copper Discovery on its 100%-owned Western Foreland exploration licences, near Kamoa-Kakula in the DRC. The Makoko Discovery is Ivanhoe’s third major copper discovery in the DRC and shows characteristics identical to Ivanhoe’s tier-one Kamoa-Kakula discoveries.

Selected drill holes at the Makoko Discovery include:

- DD004 (the Makoko discovery hole) intersected 3.94 metres (true width) of 5.46% copper, at a 2.0% copper cut-off, and 3.94 metres (true width) of 5.46% copper at a 1.0% copper cut-off, from a downhole depth of 306 metres.

- DD010 intersected 3.21 metres (true width) of 6.78% copper, at a 2.0% copper cut-off, and 3.95 metres (true width) of 5.81% copper at a 1.0% copper cut-off, from a downhole depth of 441 metres.

- DD017 intersected 3.19 metres (true width) of 6.49% copper at a 2.0% copper cut-off, and 4.64 metres (true width) of 4.88% copper, at a 1.0% copper cut-off, from a downhole depth of 471.7 metres.

- DD025 intersected 3.00 metres (true width) of 7.61% copper at a 2.0% copper cut-off, and 3.00 metres (true width) of 7.61% copper, at a 1.0% copper cut-off, from a downhole depth of 406 metres.

- DD046 intersected 7.44 metres (true width) of 7.81% copper at a 2.0% copper cut-off, and 9.39 metres (true width) of 6.51% copper, at a 1.0% copper cut-off, from a downhole depth of 523.51 metres.

The initial discovery hole at Makoko, DD004, was drilled in September 2017; follow-up and infill drilling has been ongoing since then. Drilling to date at Makoko has defined a flat-lying, near-surface stratiform copper deposit, similar to the Kamoa and Kakula deposits. The structure contour map indicates that the mineralized formation in the Makoko area is within 1,000 metres of surface.

The majority of the drilling to date at Makoko has intersected the copper-rich zone between 400 metres and 800 metres below surface. The mineralized zone at Makoko strikes approximately south-southeast. It has been tested over a strike length of 4.5 kilometres and a dip extent of between one and two kilometres. Copper mineralization remains open both along strike and down dip.

A drill rig in action at the Makoko Discovery.

Silstone-hosted mineralization in Makoko drill holes DD004, DD017 and DD010. DD004 is one of the holes where chalcocite is the dominant copper sulphide mineral. The purple-coloured copper mineral is bornite.

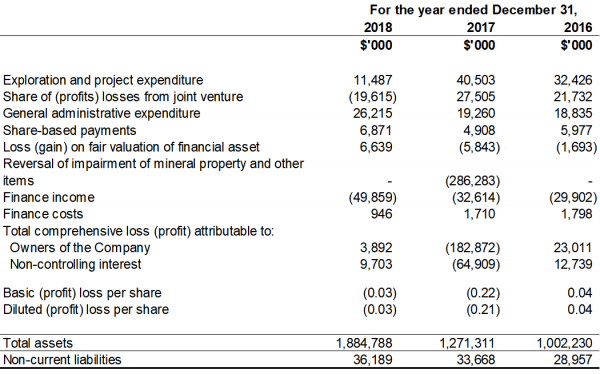

SELECTED ANNUAL FINANCIAL INFORMATION

This selected financial information is in accordance with IFRS as presented in the annual consolidated financial statements. Ivanhoe had no operating revenue in any financial reporting period and did not declare or pay any dividend or distribution in any financial reporting period.

DISCUSSION OF RESULTS OF OPERATIONS

Review of the year ended December 31, 2018 vs. December 31, 2017

The company recorded a total comprehensive loss of $13.6 million for the year ended December 31, 2018, compared to a total comprehensive profit of $247.8 million for the year ended December 31, 2017. The profit in 2017 was attributable mainly to the reversal of the impairment of mineral property and other items of the Kipushi Project of $286.3 million.

When excluding the 2017 reversal of impairment of $286.3 million, the company’s total comprehensive loss for the year ended December 31, 2017, would have amounted to $38.5 million. This is $24.9 million higher than the total comprehensive loss of $13.6 million for the same period in 2018. The decrease mainly was due to the company recording its share of a profit from the Kamoa Holding joint venture of $19.6 million for the year ended December 31, 2018, compared to a loss of $27.5 million in 2017.

The costs associated with mine development are capitalized as development costs in Kamoa Holding, while the exploration expenditure is expensed. Capitalization of costs at Kakula commenced during Q2 2017, coinciding with the start of the Kakula box cut. Expenditure attributable to exploration at Kamoa North, Kakula West and in the saddle area between Kakula West and Kakula still was expensed in 2018.

The interest expense in the Kamoa Holding joint venture relates to shareholder loans where each shareholder is required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest. The company is advancing Crystal River’s portion on its behalf in return for an increase in the promissory note due to Ivanhoe.

With the Kamoa-Kakula Project quickly advancing towards production and as supported by the excellent economics in the recently completed pre-feasibility study on Kakula, future taxable income now is deemed probable at the Kamoa-Kakula Project and the previously unrecognized deferred tax asset has been recognized by the Kamoa Holding joint venture as a result. Furthermore, with revenue deemed probable, the Kamoa Holding joint venture also has reversed the impairment of previously impaired VAT receivables that will be available for set-off once income tax is payable.

The company’s total comprehensive loss included an exchange loss on translation of foreign operations of $33.0 million for the year ended December 31, 2018, resulting from the weakening of the South African Rand by 17% from December 31, 2017, to December 31, 2018, compared to an exchange gain on translation of foreign operations recognized in 2017 of $13.8 million.

Exploration and project expenditure for the year ended December 31, 2018, amounted to $11.5 million and was $29.0 million less than for the same period in 2017 ($40.5 million). Exploration and project expenditure for 2018 related solely to Ivanhoe’s 100%-owned Western Foreland exploration licences, while $36.7 million for 2017 related to the Kipushi Project.

Finance income for the year ended December 31, 2018, amounted to $49.9 million, and was $17.2 million more than for the same period in 2017 ($32.6 million). The increase mainly was due to interest earned on loans to the Kamoa Holding joint venture to fund operations that amounted to $40.4 million in 2018, and increased by $13.0 million as the accumulated loan balance increased.

Financial position as at December 31, 2018 vs. December 31, 2017

The company’s total assets increased by $613.5 million, from $1,271.3 million as at December 31, 2017, to $1,884.8 million as at December 31, 2018. The increase mainly was due to the proceeds received on completion of the equity investment by CITIC Metal Africa Investments Limited (CITIC Metal Africa) and Zijin exercising its anti-dilution rights, for gross proceeds of $555 million and $60 million respectively.

Cash and cash equivalents increased by $392.6 million. The company utilized $14.7 million of its cash resources in its operations, which includes interest of $7.1 million received during the year ended December 31, 2018.

The company’s investment in the Kamoa Holding joint venture increased by $129.3 million from $552.4 million as at December 31, 2017, to $681.7 million as at December 31, 2018, with each of the current shareholders funding the operations equivalent to their proportionate shareholding interest. The company’s portion of the Kamoa Holding joint venture cash calls amounted to $69.3 million during 2018, while the company’s share of comprehensive profit from the joint venture amounted to $19.6 million.

The net increase of property, plant and equipment amounted to $96.4 million, with a total of $127.9 million being spent on project development and to acquire other property, plant and equipment. Of this total, $59.9 million and $69.1 million pertained to development costs and other acquisitions of property, plant and equipment at the Platreef Project and Kipushi Project respectively.

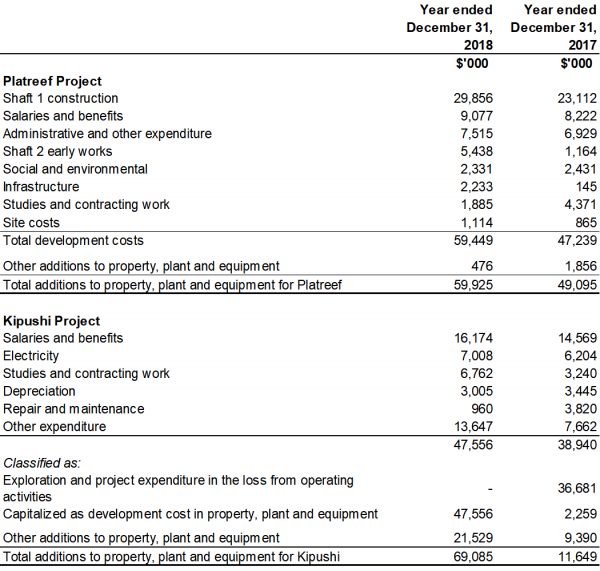

The main components of the additions to property, plant and equipment – including development costs – at the Platreef and Kipushi projects for the year ended December 31, 2018, and for the same period in 2017, are set out in the following table:

Costs incurred at the Kipushi Project subsequent to the finalization of its pre-feasibility study, have been capitalized as property, plant and equipment. Costs incurred at the Platreef Project are deemed necessary to bring the project to commercial production and are therefore also capitalized.

The company’s total liabilities increased by $6.2 million to $66.0 million as at December 31, 2018, from $59.8 million as at December 31, 2017. The increase was mainly due to a $2.9 million increase in trade and other payables and a $2.0 million increase in borrowings resulting from un-paid interest.

SELECTED QUARTERLY FINANCIAL INFORMATION

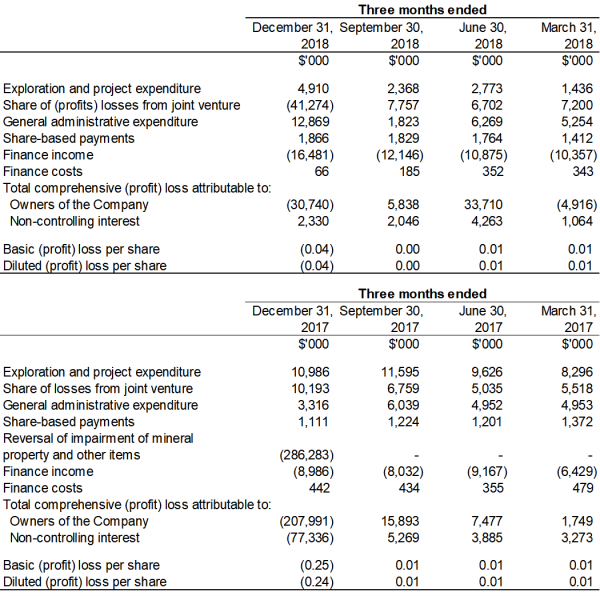

The following table summarizes selected financial information for the prior eight quarters. Ivanhoe had no operating revenue in any financial reporting period and did not declare or pay any dividend or distribution in any financial reporting period.

Review of the three months ended December 31, 2018 vs. 2017

The company recorded a total comprehensive profit of $28.4 million for Q4 2018 compared to a profit of $285.3 million for the same period in 2017. The profit in 2017 was attributable mainly to the reversal of the impairment of mineral property and other items of the Kipushi Project of $286.3 million as described above, while the profit in 2018 mainly was due to the company recording its share of a profit from the Kamoa Holding joint venture of $41.3 million for the three months ended December 31, 2018, compared to a loss of $10.2 million for the same period in 2017.

Finance income for Q4 2018, amounted to $16.5 million, and was $7.5 million more than for the same period in 2017 ($9.0 million). The increase mainly was due to interest earned on loans to the Kamoa Holding joint venture to fund operations that increased by $3.6 million as the accumulated loan balance increased and increase in interest received on cash and cash equivalents due to a higher cash balance during Q4 2018.

The company’s total comprehensive profit for Q4 2018 included an exchange loss on translation of foreign operations of $9.1 million for the three months ended December 31, 2018, resulting from the weakening of the South African Rand from September 30, 2018, to December 31, 2018, compared to an exchange gain on translation of foreign operations recognized in Q4 2017 of $12.4 million.

Exploration and project expenditure for the three months ended December 31, 2018, amounted to $4.9 million and was $6.1 million less than for the same period in 2017 ($11.0 million). The decrease in exploration and project expenditure is attributable to the capitalization of costs incurred at the Kipushi Project that began following the finalization of its PFS in December 2017.

With the focus at the Kipushi and Platreef projects being on development and the Kamoa-Kakula Project being accounted for as a joint venture, the total $4.9 million exploration and project expenditure for the three months ended December 31, 2018, related to exploration at Ivanhoe’s 100%-owned Western Foreland exploration licences. In Q4 2017, $8.3 million of the total $11.0 million exploration and project expenditure related to the Kipushi Project.

LIQUIDITY AND CAPITAL RESOURCES

The company had $574.0 million in cash and cash equivalents as at December 31, 2018. At this date, the company had consolidated working capital of approximately $562.9 million, compared to $182.0 million at December 31, 2017.

On September 19, 2018, Ivanhoe announced the completion of a major strategic equity investment totalling C$723 million ($555 million) in Ivanhoe Mines by CITIC Metal Africa, a direct subsidiary of CITIC Metal Co., Ltd. (CITIC Metal), one of China’s leading international resources companies. Ivanhoe Mines issued 196,602,037 common shares to CITIC Metal Africa through a private placement at a price of C$3.68 per share. Zijin exercised its anti-dilution rights, generating additional proceeds for Ivanhoe of C$78 million ($60 million). The exercise by Zijin of its anti-dilution rights also was at a price of C$3.68 per share.

The Platreef Project’s restricted cash, which were funds of $290 million invested by the Japanese consortium of ITOCHU Corporation, Japan Oil, Gas and Metals National Corporation and Japan Gas Corporation, has been fully utilized and the project’s current expenditure is being funded solely by Ivanhoe as the Japanese consortium has elected not to contribute to current expenditures. Since the Platreef Project’s restricted cash was fully utilized, Ivanhoe has contributed a total of $11.2 million on behalf of the Japanese consortium through an interest bearing loan to Ivanplats.

Since December 8, 2015, each shareholder in Kamoa Holding has been required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest. The company is advancing Crystal River’s portion on its behalf in return for an increase in the promissory note due to Ivanhoe.

The company’s main objectives for 2019 at the Platreef Project are the continuation of Shaft 1 construction and the completion of early-works construction of Shaft 2. At Kipushi, the principal objectives are the completion of the feasibility study and continued upgrading of mining infrastructure. At the Kamoa-Kakula Project, priorities are the continuation of development at Kakula and the completion of the feasibility study for Kakula. The company has budgeted to spend $90 million on further development at the Platreef Project; $57 million at the Kipushi Project; $16 million on regional exploration in the DRC; and $30 million on corporate overheads for 2019 – as well as its proportionate funding of the Kamoa-Kakula Project, expected to be $101 million for 2019.

This news release should be read in conjunction with Ivanhoe Mines’ audited 2018 Financial Statements and Management’s Discussion and Analysis report available at www.ivanhoemines.com and at www.sedar.com.

Qualified Person

Disclosures of a scientific or technical nature in this news release have been reviewed and approved by Stephen Torr, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Project Geology and Evaluation. Mr. Torr has verified the technical data disclosed in this news release.

Ivanhoe has prepared a current, independent, NI 43-101-compliant technical report for each of the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project, which are available under the company’s SEDAR profile at www.sedar.com:

- The Kamoa-Kakula Integrated Development Plan 2019 dated March 18, 2019, prepared by OreWin Pty Ltd., Amec Foster Wheeler E&C Services Inc. (a division of Wood PLC), SRK Consulting Inc., KGHM Cuprum R&D Centre Ltd., Stantec Consulting International LLC, DRA Global, Golders Associates, and Epoch Resources (Pty) Ltd., covering the company’s Kamoa-Kakula Project;

- The Platreef 2017 Feasibility Study Technical Report dated September 4, 2017, prepared by DRA Global, OreWin Pty. Ltd., Amec Foster Wheeler, Stantec Consulting, Murray & Roberts Cementation, SRK Consulting, Golder Associates, and Digby Wells Environmental, covering the company’s Platreef Project; and

- The Kipushi 2017 Prefeasibility Study Technical Report dated January 25, 2018, prepared by OreWin Pty Ltd, The MSA Group (Pty) Ltd, SRK Consulting (South Africa) (Pty) Ltd, and MDM (Technical) Africa Pty Ltd, covering the company’s Kipushi Project.

These technical reports include relevant information regarding the effective dates and the assumptions, parameters and methods of the mineral resource estimates on the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the Platreef Project, Kipushi Project and Kamoa-Kakula Project.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Kimberly Lim +1.778.996.8510

South Africa: Jeremy Michaels +27.82.772.1122

Website www.ivanhoemines.com

Forward-looking statements

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of the company’s MD&A for the year ended December 31, 2018.

Such statements include without limitation, the timing and results of: (i) statements that one more station will be developed at a mine-working depth of 950 metres at Shaft 1; (ii) statements regarding Shaft 1 reaching the planned, final depth at 982 metres below surface in early 2020; (iii) statements regarding the timing of Shaft 2 development; (iv) statements regarding the operational and technical capacity of Shaft 1; (v) statements regarding the internal diameter and hoisting capacity of Shaft 2, including that the excavation of the box cut and construction of the hitch foundation is expected to be completed in Q2 2019, enabling the beginning of the pre-sink, that will extend 84 metres below surface; (vi) statements regarding the company’s plans to develop the Platreef Mine in three phases: an initial annual rate of four Mtpa to establish an operating platform to support future expansions; followed by a doubling of production to eight Mtpa; and then a third expansion phase to a steady-state 12 Mtpa; (vii) statements regarding the planned underground mining methods of the Platreef Project including long-hole stoping and drift-and-fill mining; (viii) statements regarding supply of treated water from the town of Mokopane’s new Masodi treatment plant including that it will supply 5 million litres of treated water a day for 32 years; (ix) statements regarding the development of a single decline on the south side of the Kakula deposit to provide bottom access to Ventilation Shaft 2 enabling this shaft to be constructed by raise boring and the use of this decline as a second means of egress from the mine; (x) statements regarding the timing, size and objectives of drilling and other exploration programs for 2019 and future periods; (xi) statements regarding exploration on the Western Foreland exploration licences; (xii) statements regarding the timing and completion of a definitive feasibility study at the Kipushi Project in Q2 2019; (xiii) statements regarding the progressive re-commissioning of the turbines, fully refurbished and modernized with state-of-the-art control and instrumentation at Mwadingusha power station, will start in 2019 and be completed in Q3 2020 with an output increased to a capacity of approximately 72 MW of power; (xiv) statements regarding expected expenditure for 2019 of $90 million on further development at the Platreef Project; $57 million at the Kipushi Project; $16 million on regional exploration in the DRC; and $30 million on corporate overheads in 2019 – as well as its proportionate funding of the Kamoa-Kakula Project, expected to be $101 million for 2019; (xv) statements regarding Platreef projecting it to be Africa’s lowest-cost producer of platinum-group metals; (xvi) statements regarding Ivanhoe plans to file an updated NI 43-101 technical report for the Kipushi Project covering the June 2018 Mineral Resource estimate by the end of March 2019; (xvii) statements regarding the construction of a 1,050-metre-level-dam at the Kakula deposit to be commissioned in mid-2019; and (xviii) statements with respect to adding additional rigs to accelerate the drill testing of the mineralizing structure at Kamoa North; and (xv) statements regarding Ivanhoe’s plans to provide an update on the Kamoa North exploration program in the near future.

As well, all of the results of the pre-feasibility study for the Kakula copper mine and the updated and expanded Kamoa-Kakula Project preliminary economic assessment, the feasibility study of the Platreef Project and the pre-feasibility study of the Kipushi Project, constitute forward-looking statements or information, and include future estimates of internal rates of return, net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs and the size and timing of phased development of the projects. Furthermore, with respect to this specific forward-looking information concerning the development of the Kamoa-Kakula, Platreef and Kipushi projects, the company has based its assumptions and analysis on certain factors that are inherently uncertain. Uncertainties include: (i) the adequacy of infrastructure; (ii) geological characteristics; (iii) metallurgical characteristics of the mineralization; (iv) the ability to develop adequate processing capacity; (v) the price of copper, nickel, zinc, platinum, palladium, rhodium and gold; (vi) the availability of equipment and facilities necessary to complete development; (vii) the cost of consumables and mining and processing equipment; (viii) unforeseen technological and engineering problems; (ix) accidents or acts of sabotage or terrorism; (x) currency fluctuations; (xi) changes in regulations; (xii) the compliance by joint venture partners with terms of agreements; (xiii) the availability and productivity of skilled labour; (xiv) the regulation of the mining industry by various governmental agencies; (xv) the ability to raise sufficient capital to develop such projects; and (xiv) political factors.

This news release also contains references to estimates of Mineral Resources and Mineral Reserves. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Estimates of Mineral Reserves provide more certainty but still involve similar subjective judgments. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production from the company’s projects, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that ultimately may prove to be inaccurate. Mineral Resource or Mineral Reserve estimates may have to be re-estimated based on: (i) fluctuations in copper, nickel, zinc, platinum group elements (PGE), gold or other mineral prices; (ii) results of drilling; (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates and/or changes in mine plans; (vi) the possible failure to receive required permits, approvals and licences; and (vii) changes in law or regulation.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to, the factors discussed under “Risk Factors” and elsewhere in the company’s MD&A, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors set forth in the “Risk Factors” section and elsewhere in the company’s MD&A for the year ended December 31, 2018 and its Annual Information Form.

English

English Français

Français 日本語

日本語 中文

中文