Continued resource expansion and fast-tracking of mine

development at ultra-high-grade Kakula Copper Discovery

in D.R. Congo among highlights of Ivanhoe’s 2017 achievements

TORONTO, CANADA ‒ Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF) today announced its financial results for the year ended December 31, 2017. All figures are in U.S. dollars unless otherwise stated. Ivanhoe Mines is a Canadian mining company focused on advancing its three mine-development projects in Southern Africa: The Platreef platinum-palladium-nickel-copper-gold discovery in South Africa; the Kamoa-Kakula copper discovery in the Democratic Republic of Congo (DRC); and the extensive upgrading of the historic Kipushi zinc-copper-lead-germanium mine, also in the DRC.

2017 HIGHLIGHTS

- On February 26, 2018, Ivanhoe announced results of an independently verified, updated Mineral Resource estimate showing that the ultra-high-grade Kakula Discovery alone now contains Indicated Mineral Resources of 174 million tonnes at 5.62% copper, at a 3% copper cut-off grade, and 585 million tonnes at 2.92% copper, at a 1% cut-off.

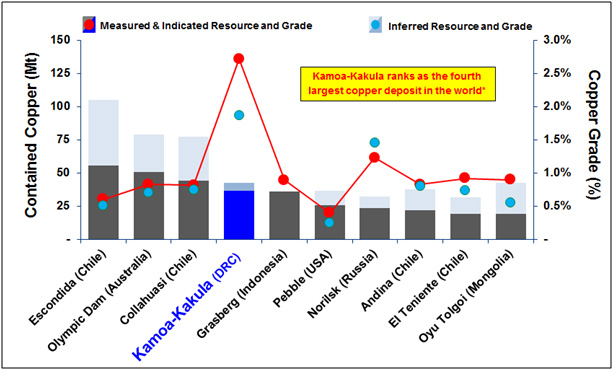

- The February 2018 Mineral Resource estimate boosts the combined Kamoa-Kakula Indicated Mineral Resources to 1.03 billion tonnes at 3.17% copper, containing approximately 72 billion pounds of copper, plus an additional 183 million tonnes of Inferred Mineral Resources at 2.31% copper, at a 1.5% cut-off. The new Mineral Resource estimate establishes the Kamoa-Kakula Project as the world’s fourth-largest copper discovery. Kamoa-Kakula’s copper grades are the highest, by a wide margin, of the world’s top 10 copper deposits.

- Kakula’s strike length now extends to more than 13 kilometres and remains open for significant expansion in multiple directions. A total of 13 rigs are continuing with resource expansion and delineation drilling at the Kakula Discovery. Geophysical surveys are underway at the Kamoa-Kakula Project to help identify new, high-priority targets in the untested parts of the 400-square-kilometre mining licence.

- Ivanhoe’s DRC exploration team is continuing with its regional drilling program targeting Kamoa-Kakula-style copper mineralization on its 100%-owned exploration licences in the Western Foreland region, just to the west of the Kamoa-Kakula mining-licence area. The company recently completed a regional, airborne gravity survey across the exploration licences to help identify additional high-priority drill targets.

- On November 28, 2017, Ivanhoe announced the findings of an independent, preliminary economic assessment (PEA) for the development of the Kakula and Kamoa deposits. The PEA analyzed options for an integrated, 12 million-tonne-per-annum (Mtpa), two-stage development, beginning with initial production from a six-Mtpa underground mine and surface processing facilities at Kakula, to be followed by a subsequent, separate, underground, six-Mtpa mining operation at the nearby Kansoko Mine, along with the construction of a smelter. The two-stage, modular, 12-Mtpa operation yields an after-tax NPV8% of $7.2 billion and an IRR of 33% over a 44-year mine life. Combined production of 12 Mtpa would rank Kamoa-Kakula among the world’s five largest copper mines, with projected annual production of more than 500,000 tonnes of copper.

- The planned initial, six-Mtpa mine at Kakula is estimated to cost $1.2 billion; subsequent expansions and a smelter can be funded from cash flows or project finance. With the new, expanded February 2018 Mineral Resource estimate, Ivanhoe and its joint-venture partner, Zijin Mining, are exploring options to accelerate building of the first two mines at Kamoa-Kakula, and the potential for expanding production to 18 Mtpa, and beyond.

- Underground mine development at the planned initial mine at Kakula is making good progress and is expected to reach the high-grade copper mineralization later this year. The service and conveyor declines each have been advanced more than 316 metres through underground development work.

- In January 2018, Ivanhoe announced that ongoing upgrading work at the Mwadingusha hydropower plant in the DRC – the first of three existing, state-owned hydroelectric plants that Ivanhoe and Zijin Mining plan to modernize to supply power to Kamoa-Kakula – has increased power output to 32 megawatts (MW). Upgrading of the other two hydroelectric plants – Koni and Nzilo 1 – is expected to begin once Mwadingusha has been fully restored to its installed capacity of 71 MW. Kamoa-Kakula has been conducting project development activities with clean, hydroelectric power drawn from the national grid since October 2016.

- On March 9, 2018, DRC President Joseph Kabila Kabange signed a new mining code into effect that revises and updates the country’s 2002 mining code. The international mining companies that have operations in the DRC, including Glencore, Randgold, China Molybdenum, MMG, Ivanhoe Mines and Zijin Mining, collectively are negotiating with the DRC’s national government to resolve corporate concerns about anticipated impacts on their DRC operations from changes in the new mining code.

- The detailed, DRC mining-code negotiations are scheduled to begin March 26, following an initial, high-level meeting in Kinshasa on March 7 during which President Kabila gave an assurance that the companies’ concerns would be resolved through transitional arrangements, mining regulations and respect for existing agreements and guarantees.

- The international companies have confirmed their willingness to negotiate royalties and changes to other taxes as part of this process. The companies expect that the negotiations will give priority to respecting the legislated guarantee of stability and protection of rights specified in Article 276 of the 2002 mining code, and other protections afforded under established mining conventions and bilateral agreements.

- The Ivanhoe-sponsored Fionet program to improve malaria diagnostics and treatment was expanded in 2017 to 300 Deki Readers installed in 252 medical-service providers in Haut-Katanga and Lualaba provinces in southern DRC, which host Ivanhoe’s Kipushi and Kamoa-Kakula projects. Deki devices provide automated readings of rapid diagnostic tests to remove the human-error factor and avoid prescription of unnecessary medication.

- On December 13, 2017, Ivanhoe announced the findings of an independent, pre-feasibility study (PFS) for the redevelopment of the Kipushi zinc-copper-germanium-lead-silver mine in the DRC. The PFS analyzed the plan to bring Kipushi’s Big Zinc Zone into production in less than two years, with a life-of-mine, average annual production rate of 225,000 tonnes of zinc and cash costs of $0.48 per pound of zinc.

- The Kipushi PFS study anticipates annual production of an average of 381,000 tonnes of zinc concentrate over an 11-year, initial mine life at a total cash cost of approximately $0.48 per pound of zinc. The PFS focuses on the initial mining of Kipushi’s Big Zinc orebody, which has an estimated 10.2 million tonnes of Measured and Indicated Mineral Resources grading 34.9% zinc. The planned return to production would establish Kipushi as the world’s highest-grade, major zinc mine.

- On October 30, 2017, Ivanhoe announced that the company had agreed to rebuild 34 kilometres of track to connect the Kipushi Mine with the DRC national railway at Munama, south of the mining capital of Lubumbashi. The Kipushi-Munama spur line, which has been inactive since 2011, will be rebuilt under terms of a memorandum of understanding (MOU) signed by Ivanhoe Mines and the DRC’s state-owned railway company, Société Nationale des Chemins de Fer du Congo (SNCC).The DRC national railway is a key part of the international rail corridor that links the DRC Copperbelt to major seaports at Durban and Richards Bay in South Africa, Dar es Salaam in Tanzania and Lobito in Angola.

- Discussions are continuing with potential strategic partners and lenders to support Ivanhoe’s continuing advance toward a new era of production at Kipushi. Ivanhoe has made significant progress in upgrading the mine’s underground infrastructure and the company now has a much clearer path to a resumption of production from the incredibly high-grade Big Zinc orebody.

- At the Platreef platinum-palladium-nickel-copper-gold discovery in South Africa, sinking of Shaft 1 now has reached a depth of more than 700 metres below surface. Development of the second of four planned shaft stations – the 750-metre-level substation – is expected to begin in late April. Shaft 1 is expected to reach the top of the Flatreef orebody, at a depth of approximately 780 metres, in the third quarter of this year. Sinking of the shaft will continue to a planned final depth of 980 metres.

- Early-works surface construction for Platreef’s Shaft 2 began last May, with initial curtain grouting around the box cut. Excavation of a surface box cut to a depth of approximately 29 metres is underway and the construction of the concrete hitch for the headframe is expected to be completed by the end of this year.

- Ivanhoe is focused on advancing the Platreef Project along its critical path. The continued development of shafts 1 and 2 will provide access to the Flatreef orebody and help to ensure that the project is able to meet the scheduled, first-phase start-up of the underground mine and concentrator by 2022.

- On July 31, 2017, Ivanhoe announced the positive results of an independent, definitive feasibility study for the planned first phase of the Platreef Mine. The study envisages an initial annual throughput rate of four million tonnes a year, producing 476,000 ounces of platinum, palladium, rhodium and gold (3PE+Au), plus 33 million pounds of nickel and copper.

- The Platreef Mine is projected to be Africa’s lowest-cost producer of platinum-group metals, with a cash cost of $351 per ounce of 3PE+Au, net of by-products, including sustaining capital cost. There is good potential for relatively quick and capital-efficient expansion to six and eight million tonnes a year, and beyond, using start-up infrastructure.

- Ivanhoe has appointed five leading mine-financing institutions as Initial Mandated Lead Arrangers to arrange debt financing for the Platreef Mine’s development. They are: KfW IPEX-Bank, a German government-owned institution; Swedish Export Credit Corporation; Export Development Canada; Nedbank Limited (acting through its Corporate and Investment Banking division); and Societe Generale Corporate & Investment Banking. Expressions of interest have been received for approximately $900 million of the targeted $1 billion project financing.

- Continuing strategic discussions concerning Ivanhoe Mines and its projects are ongoing with several significant mining companies and investors across Asia, Europe, Africa and elsewhere. Several investors that have expressed interest have no material limit on the provision of capital.

- On March 12, 2018, Egizio Bianchini was appointed Ivanhoe Mines’ Executive Vice Chairman and a member of the Board of Directors. He joined Ivanhoe Mines after a 29-year career at BMO Capital Markets, a member of Canada-based BMO Financial Group, where he served as Co-Head of the Global Metals & Mining Group, and as Vice Chairman from April 2011 to March 2018. With more than 30 years’ experience in the metals and mining financial services sector, Mr. Bianchini has an extensive track record in advising a wide range of metals and mining companies around the world and in structuring and executing capital raisings.

- Ivanhoe Mines’ three projects achieved a combined 9.4 million work hours free of lost-time injuries (LTI) during 2017. Platreef recorded 215,000 LTI free hours for the year, Kipushi 458,000 hours and Kamoa-Kakula more than 8.7 million hours.

Principal projects and review of activities

1. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project is owned by Ivanplats (Pty) Ltd, which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically-disadvantaged, broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with a total of approximately 150,000 people, project employees and local entrepreneurs.In January 2017,Ivanplats reconfirmed its Level 3 status in its third verification assessment on a B-BBEE scorecard. A Japanese consortium of ITOCHU Corporation; Japan Oil, Gas and Metals National Corporation and Japan Gas Corporation, owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper and gold mineralization in the Northern Limb of the Bushveld Igneous Complex in Limpopo Province, approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane.

On the Northern Limb, platinum-group metals mineralization is hosted primarily within the Platreef, a mineralized sequence that is traced more than 30 kilometres along strike. Ivanhoe’s Platreef Project, within the Platreef’s southern sector, is comprised of two contiguous properties: Turfspruit and Macalacaskop. Turfspruit, the northernmost property, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of mining operations and properties.

Since 2007, Ivanhoe has focused its exploration and development activities on defining and advancing the down-dip extension of its original discovery at Platreef, now known as the Flatreef Deposit, which is amenable to highly mechanized, underground mining methods. The Flatreef area lies entirely on the Turfspruit and Macalacaskop properties, which form part of the company’s mining right.

Health and safety at Platreef

At the end of 2017, the Platreef Project reached a total of 215,496 lost-time-injury (LTI) free hours worked in terms of South Africa’s Mines Health and Safety Act and Occupational Health and Safety Act. The Platreef Project continues to strive toward its workplace objective of an environment that causes zero harm to employees, contractors, sub-contractors and consultants.

Positive independent, definitive feasibility study for Platreef’s first-phase development; Platreef projected to be Africa’s lowest-cost producer of platinum-group metals

On July 31, 2017, Ivanhoe Mines announced the positive results of an independent, definitive feasibility study (DFS) for the planned first phase of the Platreef Project’s platinum-group metals, nickel, copper and gold mine in South Africa.

The Platreef DFS covers the first phase of development that would include construction of a state-of-the-art underground mine, concentrator and other associated infrastructure to support initial production of concentrate by 2022. As Phase 1 is being developed and commissioned, there would be opportunities to refine the timing and scope of subsequent phases of expanded production.

DFS highlights include:

- Indicated Mineral Resources containing an estimated 41.9 million ounces of platinum, palladium, rhodium and gold, with an additional 52.8 million ounces of platinum, palladium, rhodium and gold in Inferred Resources.

- Increased Mineral Reserves containing 17.6 million ounces of platinum, palladium, rhodium and gold – an increase of 13% – following stope optimization and mine sequencing work.

- Development of a large, safe, mechanized, underground mine, with an initial four-Mtpa concentrator and associated infrastructure.

- Planned initial average annual production rate of 476,000 ounces of platinum, palladium, rhodium and gold (3PE+Au), plus 21 million pounds of nickel and 13 million pounds of copper.

- Estimated pre-production capital requirement of approximately $1.5 billion, at a ZAR:USD exchange rate of 13 to 1.

- Platreef would rank at the bottom of the cash-cost curve, at an estimated $351 per ounce of 3PE+Au produced, net of by-products and including sustaining capital costs, and $326 per ounce before sustaining capital costs.

- After-tax net present value (NPV) of $916 million, at an 8% discount rate.

- After-tax internal rate of return (IRR) of 14.2%.

The DFS was prepared for Ivanhoe Mines by principal consultant DRA Global, with economic analysis led by OreWin, and specialized sub-consultants including Amec Foster Wheeler E&C Services (Amec Foster Wheeler), Stantec Consulting, Murray & Roberts Cementation, SRK Consulting, Golder Associates and Digby Wells Environmental.

Benjamin Sekano (centre), Platreef’s Mine Manager, reviews shaft sinking plans with geotechnical engineers at the 450-metre-level substation in Shaft 1.

Preliminary expressions of interest received for approximately $900 million

of the targeted $1 billion Platreef project financing

On July 19, 2017, Ivanhoe Mines announced the appointment of another two leading mine-financing institutions – KfW IPEX-Bank, a German government-owned institution, and the Swedish Export Credit Corporation (SEK) – as Initial Mandated Lead Arrangers (IMLAs) to arrange debt financing for the ongoing development of the Platreef Mine.

KfW IPEX-Bank and SEK joined the three initial IMLAs – Export Development Canada, Nedbank Limited (acting through its Corporate and Investment Banking division) and Societe Generale Corporate & Investment Banking – that were appointed last year.

The five IMLAs will make best efforts to arrange a total debt financing of up to $1 billion for the development of Platreef’s first-phase, four-Mtpa mine. Preliminary expressions of interest now have been received for approximately $900 million of the targeted $1 billion project financing. Negotiation of a term sheet is ongoing. In addition, preliminary discussions have begun with leading financial institutions around the financing of the contribution by the black economic empowerment partners to the development capital.

Shaft 1 has reached a depth of more than 700 metres below surface;

now within 72 metres of the top of the Flatreef orebody

Sinking of Platreef’s Shaft 1 had reached a depth of 584 metres at the end of December 2017 and further advanced to 711 metres on March 19, 2018. The shaft is expected to intersect the upper contact of the Flatreef Deposit (T1 mineralized zone), at an approximate shaft depth of 783 metres, during the third quarter of this year. The grade for the T1 mineralized zone at this location is 4.83 grams per tonne of 3PE (platinum, palladium and rhodium) plus gold, 0.33% nickel and 0.15% copper over a vertical thickness of 12 metres.

Shaft 1, with an internal diameter of 7.25 metres, will provide access to the Flatreef Deposit and enable the initial underground development to take place during the development of Shaft 2. Ultimately, Shaft 1 will become the primary ventilation intake shaft during the project’s four-million-tonne-per-annum production case.

The average sinking rate has ranged between 40 to 50 metres a month. The shaft includes a 300-millimetre-thick, concrete-lined shaft wall. The main sinking phase is expected to reach its projected, final depth of 980 metres below surface in 2019.

Shaft stations to provide access to horizontal mine workings for personnel, materials, pump stations and services will be developed at depths of 450 metres, 750 metres, 850 metres and 950 metres.

The first off-shaft lateral development on the 450-metre level, which will serve as an intermediate water-pumping and shaft cable-termination station, was successfully completed in September 2017. The next off-shaft lateral development will be at the 750-metre level and will serve as the first mine-working level. The 750-metre-level station development is expected to be completed by September 2018.

Shaft 2 early-works construction progressing

Shaft 2, to be located approximately 100 metres northeast of Shaft 1, will have an internal diameter of 10 metres, will be lined with concrete and sunk to a planned, final depth of more than 1,104 metres below surface. It will be equipped with two, 40-tonne, rock-hoisting skips capable of hoisting a total of six million tonnes of ore a year – the single largest hoisting capacity at any mine in Africa.

The headgear for the permanent hoisting facility was designed by South Africa-based Murray & Roberts Cementation. The early-works for Shaft 2 include the excavation of a surface box cut to a depth of approximately 29 metres below surface and the construction of the concrete hitch (foundation) for the 103-metre-tall concrete headgear (headframe) that will house the shaft’s permanent hoisting facilities and support the shaft collar. Excavation of the box cut commenced in January 2018 and is expected to be completed by the end of 2018.

Excavation of a surface box cut now underway as part of early-works

construction for Shaft 2 at the Platreef Mine in South Africa.

Shaft 2 engineered to allow for future expansion options

Shaft 2 has been engineered with a crushing and hoisting capacity of six Mtpa. This will allow a relatively quick and capital-efficient first expansion of the Platreef Project to six Mtpa by increasing underground development and commissioning a third, two-Mtpa processing module and associated surface infrastructure as required.

A further expansion to more than eight Mtpa would entail converting Shaft 1 from a ventilation shaft into a hoisting shaft. This would require additional ventilation exhaust raises, as well as a further increase of underground development, commissioning of a fourth, two-Mtpa processing module and associated surface infrastructure, as described in the Platreef preliminary economic assessment as Phase 2 of the project.

Underground mining to incorporate highly productive, mechanized methods

Ivanhoe plans to develop the Platreef Mine in phases. The initial annual production rate of four million tonnes per annum (Mtpa) is designed to establish an operating platform to support future expansions. This is expected to be followed by a potential doubling of production to eight Mtpa, and then a third expansion phase to a steady-state 12 Mtpa, which would establish Platreef among the largest platinum-group-metals mines in the world.

The mining zones in the current Platreef mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below surface. Primary access to the mining zones will be by way of Shaft 2; secondary access will be via Shaft 1. During mine production, both shafts also will serve as ventilation intakes. Three additional ventilation exhaust raises are planned to achieve steady-state production.

Planned mining methods will use highly productive, mechanized methods, including long-hole stoping and drift-and-fill. Each method will utilize cemented backfill for maximum ore extraction. The ore will be hauled from the stopes to a series of internal ore passes and fed to the bottom of Shaft 2, where it will be crushed and hoisted to surface.

The current mine plan has been improved beyond the earlier projections in the 2015 PFS mine plan by optimizing stope design, employing a declining Net Smelter Return (NSR) strategy and targeting higher-grade zones early in the mine’s life. This strategy has increased the grade profile by 23% on a 3PE+Au basis in the first 10 years of operation and by 10% during the life of the mine.

Bulk water and electricity supply

The Olifants River Water Resource Development Project (ORWRDP) is designed to deliver water to the Eastern and Northern limbs of South Africa’s Bushveld Complex. The project consists of the new De Hoop Dam, the raised wall of the Flag Boshielo Dam and related pipeline infrastructure that ultimately is expected to deliver water to Pruissen, southeast of the Northern Limb. The Pruissen Pipeline Project is expected to be developed to deliver water onward from Pruissen to the municipalities, communities and mining projects on the Northern Limb. Ivanhoe Mines is a member of the ORWRDP’s Joint Water Forum.

The Platreef Project’s water requirement for the first phase of development is projected to peak at approximately 7.5 million litres per day, which is expected to be supplied by the water network. Ivanhoe also is investigating various alternative sources of bulk water, including an allocation of bulk grey-water from a local source.

The Platreef Project’s electrical power requirement for the phase one, four-Mtpa, underground mine, concentrator and associated infrastructure has been estimated at approximately 100 million volt-amperes (MVA). An agreement has been reached with Eskom, South Africa’s public electricity utility, for the supply of phase-one power. Ivanhoe chose a self-build option for permanent power that will enable the company to manage the construction of the distribution lines from Eskom’s Burutho sub-station to the Platreef Mine. The self-build and electricity-supply agreements are being formulated.

Development of human resources and job skills

Work progressed well on the implementation of Ivanhoe’s Social and Labour Plan (SLP) during 2017, to which the company has pledged a total of R160 million ($13 million) during the first five years, culminating in November 2019. The approved plan includes R67 million ($6 million) for the development of job skills among local residents and R88 million ($7 million) for local economic development projects. Additional internal training is ongoing to upskill the current work force.

2. Kipushi Project

68%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kipushi copper-zinc-germanium-lead mine, in the Democratic Republic of Congo, is adjacent to the town of Kipushi and approximately 30 kilometres southwest of Lubumbashi. It is located on the Central African Copperbelt, approximately 250 kilometres southeast of the Kamoa-Kakula Project and less than one kilometre from the Zambian border. Ivanhoe acquired its 68% interest in the Kipushi Project in November 2011; the balance of 32% is held by the state-owned mining company, La Générale des Carrières et des Mines (Gécamines).

Health, safety and community development

The Kipushi Project achieved a total of 458,884 work hours free of lost-time injuries by December 31, 2017. One lost-time injury occurred in September 2017.

In an effort to reduce the incidence of malaria in the Kipushi community, a Water Sanitation and Health (WASH) program has been initiated in cooperation with the Territorial Administrator and the local community. The main emphasis of the program’s first phase is cleaning storm drains in the municipality to prevent accumulations of ponded water, where malarial mosquitos breed.

The Ivanhoe-sponsored Fionet program to improve malaria diagnostics and treatment was expanded in 2017 to 300 Deki Readers installed in 252 medical-service providers in Haut-Katanga and Lualaba provinces in southern DRC, which host Ivanhoe’s Kipushi and Kamoa-Kakula projects. Deki devices provide automated readings of rapid diagnostic tests to remove the human-error factor and avoid prescription of unnecessary medication. The data are uploaded to a cloud server for analysis by the Ministry of Health in planning malaria-control measures. Deki Readers provided diagnostic testing in more than 30,000 patient encounters during the past year, with approximately 63% of patients testing negative for malaria.

Underground drilling program completed in November 2017;

updated Mineral Resource estimate expected in Q2 2018

Ivanhoe initiated a second phase of underground drilling at Kipushi in April 2017 with the goal of upgrading Inferred Mineral Resources on the Southern Zinc and Fault Zone to Indicated, expanding Mineral Resources in the Série Recurrent Zone and collecting additional sample material for metallurgical flotation testing.

A total of 9,706 metres were drilled in 58 holes. Eight holes were drilled for metallurgy, 31 holes in the Southern Zinc and Big Zinc, five holes in the Nord Riche and 14 holes in the Série Récurrente.

Logging and sampling of the holes was completed at the end of 2017 and the final assays are expected soon. Geology interpretation of the results is ongoing and a new resource update is planned for release in Q2 2018. The updated Mineral Resource will be used in the preparation of the Kipushi Feasibility Study.

The current Mineral Resource estimate for Kipushi was prepared by MSA Group on January 27, 2016. Zinc-rich Measured and Indicated Mineral Resources totalled 10.18 million tonnes at 34.89% zinc, 0.65% copper, 0.96% lead, 19 grams per tonne (g/t) silver, 15 parts per million (ppm) cobalt and 51 g/t germanium at a 7% zinc cut-off, containing 7,833 million pounds of zinc. Zinc-rich Inferred Mineral Resources totalled 1.87 million tonnes at 28.24% zinc, 1.18% copper, 0.88% lead, 10 g/t silver, 15 ppm cobalt and 53 g/t germanium at a 7% zinc cut-off, containing 1,169 million pounds of zinc.

Copper-rich Measured and Indicated Mineral Resources totalled an additional 1.63 million tonnes at grades of 4.01% copper, 2.87% zinc and 22 g/t silver, at a 1.5% copper cut-off, containing 144 million pounds of copper. Copper-rich Inferred Mineral Resources totalled an additional 1.64 million tonnes at grades of 3.30% copper, 6.97% zinc and 19 g/t silver at a 1.5% copper cut-off, containing 119 million pounds of copper.

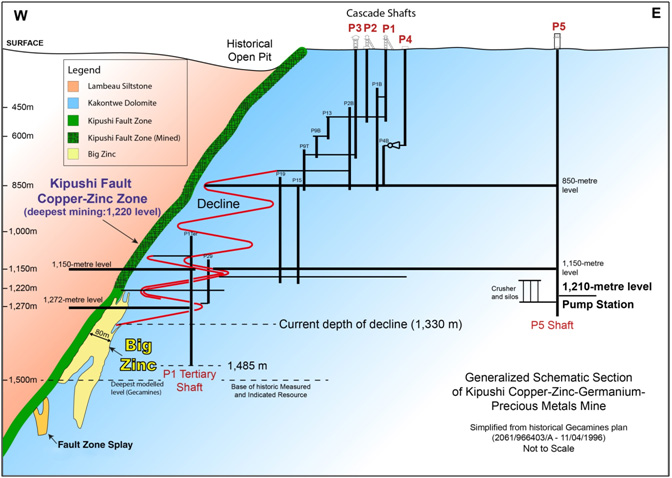

Figure 1: Schematic underground section of Kipushi Mine.

Control-room operator at Kipushi’s Shaft 5.

Project development and infrastructure

Ivanhoe completed the refurbishment of a significant amount of underground infrastructure at the Kipushi Project, including a series of vertical mine shafts to various depths, with associated head frames, as well as underground mine excavations. A series of crosscuts and ventilation infrastructure still are in working condition. The underground infrastructure also includes a series of pumps to manage the influx of water into the mine. A schematic layout of the existing development is shown in Figure 1.

Shaft 5, the main production shaft for the Kipushi Mine, is eight metres in diameter and 1,240 metres deep. It now has been upgraded and re-commissioned. The main personnel and material winder has been upgraded and modernized to meet international industry standards and safety criteria. The Shaft 5 rock-hoisting winder now is fully operational.

Underground upgrading work is continuing on the crusher and the rock load-out facilities at the bottom of Shaft 5 and the main haulage way on the 1,150-metre level, between the Big Zinc access decline and Shaft 5.

Pre-feasibility study for Kipushi completed in December 2017;

definitive feasibility study underway

On December 13, 2017, Ivanhoe Mines announced the results of a pre-feasibility study for the rebirth of the historic Kipushi Mine. The study anticipates annual production of an average of 381,000 tonnes of zinc concentrate over an 11-year, initial mine life at a total cash cost of approximately $0.48 per pound of zinc.

Highlights of the PFS, based on a long-term zinc price of $1.10 per pound, include:

- After-tax net present value (NPV) at an 8% real discount rate of $683 million.

- After-tax real internal rate of return (IRR) of 35.3%.

- After-tax project payback period of 2.2 years.

- Pre-production capital costs, including contingency, estimated at $337 million.

- Existing surface and underground infrastructure allows for significantly lower capital costs than comparable greenfield development projects.

- Life-of-mine average planned zinc concentrate production of 381,000 dry tonnes per annum, with a concentrate grade of 59% zinc, is expected to rank Kipushi, once in production, among the world’s largest zinc mines.

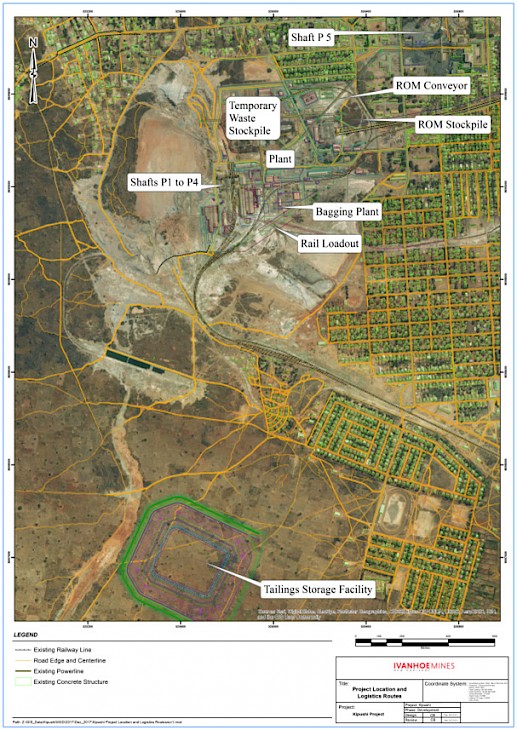

Figure 2: Kipushi Project’s proposed site layout.

Estimated life-of-mine average cash cost of $0.48 per pound of zinc is expected to rank Kipushi, once in production, in the bottom quartile of the cash-cost curve for zinc producers globally.

The definitive feasibility study, to further refine and optimize the project’s economics, is underway and is expected to be completed in the second half of 2018.

Shaft 5 main pumping station at Kipushi’s 1,200-metre level.

The new ore conveyor belt installed as part of Kipushi’s upgrading work.

Agreement to rebuild railway spur line to support the Kipushi Project

On October 30, 2017, Ivanhoe Mines and the DRC’s state-owned railway company, Société Nationale des Chemins de Fer du Congo (SNCC), signed a Memorandum of Understanding (MOU) to rebuild 34 kilometres of track to connect the Kipushi Mine with the DRC national railway at Munama, south of the mining capital of Lubumbashi.

Under the terms of the MOU, Ivanhoe has appointed R&H Rail to conduct a front-end engineering design study to assess the scope and cost of rebuilding the spur line from the Kipushi Mine to the main Lubumbashi-Sakania railway at Munama. The study has begun and construction on the Kipushi-Munama spur line could start in late 2018. Ivanhoe will finance the estimated $32 million (plus contingency) capital cost for the rebuilding, which is included within the overall Kipushi 2017 PFS capital cost.

The proposed export route is to utilize the SNCC network from Kipushi to Ndola, connecting to the north-south rail corridor from Ndola to Durban. The rail corridor to Durban via Zimbabwe is fully operational and has significant excess capacity.

3. Kamoa-Kakula Copper Project

39.6%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kamoa-Kakula Copper Project, a joint venture between Ivanhoe Mines and Zijin Mining, has been independently ranked as the largest copper discovery ever made on the African continent, with adjacent prospective exploration areas within the Central African Copperbelt in the Democratic Republic of Congo, approximately 25 kilometres west of the town of Kolwezi and about 270 kilometres west of Lubumbashi.

Ivanhoe sold a 49.5% share interest in Kamoa Holding to Zijin Mining in December 2015 for an aggregate consideration of $412 million. In addition, Ivanhoe sold a 1% share interest in Kamoa Holding to privately-owned Crystal River for $8.32 million – which Crystal River will pay through a non-interest-bearing, 10-year promissory note. Since the conclusion of the Zijin transaction in December 2015, each shareholder has been required to fund expenditures at the Kamoa-Kakula Project in an amount equivalent to its proportionate shareholding interest in Kamoa Holding.

A 5%, non-dilutable interest in the Kamoa-Kakula Project was transferred to the DRC government on September 11, 2012, for no consideration, pursuant to the 2002 DRC mining code. Following the signing of an agreement with the DRC government in November 2016, in which an additional 15% interest in the Kamoa-Kakula Project was transferred to the DRC government, Ivanhoe and Zijin Mining now each hold an indirect 39.6% interest in the Kamoa-Kakula Project, Crystal River holds an indirect 0.8% interest and the DRC government holds a direct 20% interest. Kamoa Holding holds an 80% interest in the project.

Kamoa-Kakula surpassed eight million hours worked without a lost-time injury in 2017

Health and safety remain key priorities for all people working at the Kamoa-Kakula Project, which had achieved 8,686,769 lost-time, injury-free hours worked to the end of 2017. This outstanding achievement reflects the dedication and safety-focused culture of the entire Kamoa-Kakula exploration and development teams.

New Mineral Resource estimate announced in February 2018 establishes Kamoa-Kakula as world’s fourth-largest copper deposit

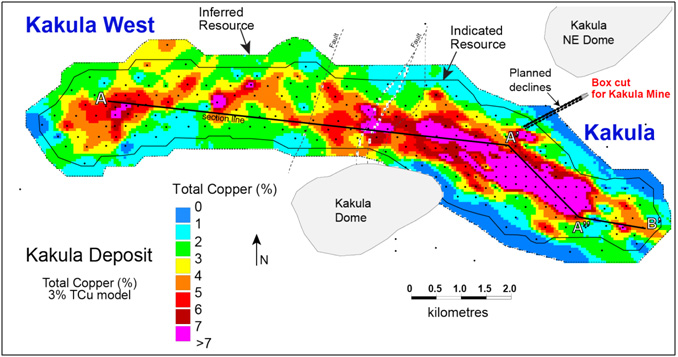

On February 26, 2018, Ivanhoe announced a new Mineral Resource estimate for the Kakula Discovery on the Kamoa-Kakula Project.

Kakula’s Indicated Mineral Resources now total 585 million tonnes at a grade of 2.92% copper, containing 37.7 billion pounds of copper at a 1% copper cut-off. At a 2% copper cut-off, Indicated Mineral Resources total 330 million tonnes at a 4.07% copper grade, containing 29.6 billion pounds of copper. At a 3% copper cut-off, Indicated Mineral Resources total 174 million tonnes at a grade of 5.62% copper, containing 21.5 billion pounds of copper.

Inferred Mineral Resources total 113 million tonnes at a grade of 1.90% copper, containing 4.7 billion pounds of copper at a 1% copper cut-off. At a 2% copper cut-off, Inferred Mineral Resources total 44 million tonnes at a 2.59% copper grade, containing 2.5 billion pounds of copper. At a 3% copper cut-off, Inferred Mineral Resources total nine million tonnes at a grade of 3.66% copper, containing 0.7 billion pounds of copper.

The average true thickness of the selective mineralized zone (SMZ) at a 1% copper cut-off is 10.1 metres in the Indicated Mineral Resources area and 6.7 metres in the Inferred Mineral Resources area. At a higher 3% copper cut-off, the average true thickness of the SMZ is 4.7 metres in the Indicated Mineral Resources area and 3.3 metres in the Inferred Mineral Resources area.

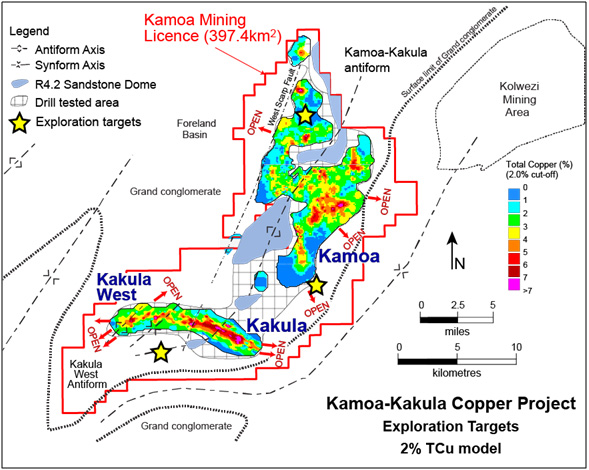

Kamoa-Kakula mining licence, showing the Kamoa, Kakula and Kakula West Mineral Resource areas.

Among the world’s largest copper deposits by contained copper, Kamoa-Kakula has the highest copper grades by a wide margin.

Source: Wood Mackenzie

*Note: Selected based on contained copper (Measured & Indicated Mineral Resources, inclusive of Mineral Reserves, and Inferred Mineral Resources), ranked on contained copper in Measured & Indicated Mineral Resources.

Kakula and Kakula West discovery areas showing grades of Indicated and Inferred Mineral Resource blocks at a 3% copper cut-off.

The Kakula Discovery remains open for significant expansion in multiple directions, while the remainder of the southern parts of the Kamoa-Kakula mining-licence area is virtually untested.

The combined Kamoa-Kakula Indicated Mineral Resources now total 1.34 billion tonnes grading 2.72% copper, containing 80.7 billion pounds of copper at a 1.0% copper cut-off grade and an approximate minimum thickness of 3.0 metres. At a higher 1.5% copper cut-off grade and a minimum thickness of 3.0 metres, the combined Kamoa-Kakula Indicated Mineral Resources now total 1.03 billion tonnes grading 3.17% copper, containing 71.7 billion pounds of copper.

Kamoa-Kakula also has Inferred Mineral Resources of 315 million tonnes grading 1.87% copper, containing 13.0 billion pounds of copper at a 1.0% copper cut-off grade and an approximate minimum thickness of 3.0 metres. At a 1.5% copper cut-off grade and a minimum thickness of 3.0 metres, Kamoa-Kakula’s Inferred Mineral Resources now total 183 million tonnes grading 2.31% copper, containing 9.3 billion pounds of copper.

Exploration drilling by one of 13 rigs at the Kakula West Discovery.

Kamoa-Kakula 2017 PEA and PFS present three initial development scenarios

On November 28, 2017, Ivanhoe Mines announced positive findings of an expanded, independent PEA for the development of the Kakula Discovery at the Kamoa-Kakula Project.

Highlights of the three development scenarios examined include:

- Initial mine development scenario of a six-Mtpa underground mine and surface processing complex at Kakula:

- For this option, the PEA envisaged an average annual production rate of 246,000 tonnes of copper at a mine-site cash cost of $0.45 per pound of copper and total cash cost of $1.08 per pound of copper for the first five years of operations, and copper annual production of up to 385,000 tonnes by year four.

- An initial capital cost of $1.2 billion for this option would result in an after-tax net present value at an 8% discount rate (NPV8%) of $4.2 billion. The internal rate of return of 36.2% and project payback period of 3.1 years confirm the compelling economics for Kamoa-Kakula’s initial phase of production.

- Kakula would benefit from an ultra-high, average feed grade of 6.4% copper during the first 10 years of operations, and 5.5% copper on average during a 24-year mine life.

- A six-Mtpa Kakula PFS is underway, with completion targeted for the second half of 2018. Kakula’s surface box cut was completed in October 2017. Development of twin underground declines, similar to those at the nearby Kansoko Mine, has begun and is expected to take about a year to complete. The first blast for the declines was completed in November 2017.

Underground development at Kakula has advanced each of the service

and conveyor declines more than 316 metres toward the mineralized zone.

- Expanded, two-mine scenario for an integrated, 12 Mtpa, two-stage development, beginning with initial production from Kakula, to be followed by a subsequent, separate underground mining operation at nearby Kansoko, along with the construction of a smelter:

- Under this option, initial production would occur at a rate of six Mtpa from the Kakula Mine, before increasing to 12 Mtpa with ore from the Kansoko Mine. As resources at Kakula and Kansoko are mined, the PEA envisages that production would begin at Kamoa North to maintain 12 Mtpa throughput during a 44-year mine life.

- For the two-phase, sequential operation, the PEA envisaged $1.2 billion in initial capital costs. Future expansion at the Kansoko Mine and subsequent extensions could be funded by cash flows from the Kakula Mine, resulting in an after-tax, net present value at an 8% discount rate (NPV8%) of $7.2 billion and an internal rate of return of 33%.

- Under this approach, the PEA also included the construction of a direct-to-blister, flash-copper smelter with a capacity of 690,000 tonnes of copper concentrate per annum to be funded from internal cash flows. This would be completed in year five of operations, achieving significant savings in treatment charges and transportation costs.

- The 12-Mtpa scenario would deliver average annual production of 370,000 tonnes of copper at a total cash cost of $1.02 per pound of copper during the first 10 years of operations and production of 542,000 tonnes by year nine. At this future production rate, Kamoa-Kakula would rank among the world’s five largest copper mines.

- Kamoa 2017 pre-feasibility study (PFS) development scenario of building the Kansoko Mine as a stand-alone six-Mtpa underground mine and surface processing complex:

- Under this scenario, the PFS envisages an average annual production rate of 178,000 tonnes of copper for the first 10 years of operations, and annual copper production of 245,000 tonnes by year seven.

- The initial capital cost of $1.0 billion to develop this mine would result in an after-tax, net present value of $2.1 billion at an 8% discount rate (NPV8%) – an increase of 109% compared to the net present value projected in the March 2016 Kamoa PFS. The internal rate of return is expected to be 24%, with a five-year project payback period.

Kamoa-Kakula electricians testing a new electrical panel installed in one of Kakula’s twin declines where development work is well underway to provide access to what will be a highly mechanized, underground copper mine.

Potential phased mine developments to 18 Mtpa and above are under evaluation for Kamoa-Kakula. In light of the successful, step-out drilling at Kakula West, as well as the potential to find additional resources in high-priority targets located in the untested parts of the Kamoa-Kakula Project, development plans will be reassessed and amended as the project moves forward.

The Kakula six-Mtpa PFS has begun. The work will be based on an updated Kakula 3-D resource model. The target date for completion is at the end of Q3 2018.

Underground development at the Kakula Deposit advancing ahead of plan

Construction of the 18-metre-deep Kakula box cut was successfully completed in October 2017, allowing access for the start of development of the twin declines in November.

The Kakula decline development contract was awarded to JMMC, the DRC subsidiary of JCHX Mining Management. The first blast for the twin declines at Kakula was carried out in November 2017; approximately 150 metres of development were completed by the end of 2017. As of March 15, each of the declines had been advanced more than 316 metres.

The 3,535-metre decline development contract is scheduled to be completed by the end of 2018.

Underground development at the Kansoko Deposit reached the high-grade mineralization in mid-2017; awaiting finalization of Kamoa-Kakula development plans

Underground development at Kamoa-Kakula’s Kansoko Mine, consisting of service and conveyor declines, was completed by Byrnecut Underground Congo SARL in September 2017. The high-grade Kansoko Sud copper mineralization was reached and approximately 13,500 tonnes of development ore was stockpiled at surface. Various development options for Kansoko are being assessed in conjunction with the ongoing mine development activities at Kakula.

Exploration activities focused on expanding Kakula Discovery

Exploration activity in Q4 2017 focused on infill drilling at Kakula West and the saddle area between Kakula and Kakula West. Drilling for the resource estimate was extended to the end of Q4 2017 to ensure that almost the entire, 13.3-kilometre strike length of Kakula was converted directly to Indicated Mineral Resources. A total of 31,433 metres of exploration drilling was completed in 60 holes. In addition to exploration drilling, 1,754 metres of hydro-geology drilling was completed in 10 holes and 400 metres of underground cover drilling also was completed.

Exploration drilling completed in 2017 at the Kamoa-Kakula Project totalled 121,899 metres in 239 holes. This total included 26 wedges for geotechnical and metallurgy test work. In addition, 3,420 metres of hydro-geology drilling and 664 metres of cover drilling were completed.

Regional geophysical surveys underway at Kamoa-Kakula and Western Forelands

An airborne gravity survey at Kamoa-Kakula and the Western Forelands area was completed in January 2018. The data are being processed, will be integrated with other geophysical and geological data and used for target development during Q1 2018.

Initial seismic line surveying and access development were undertaken in Q4 2017 in advance of running seismic traverses. The seismic work is being conducted by Hi-Seis, a leading international services company based in Australia. A seismic vibrator rig was mobilized to site in early January and high-definition seismic surveys are underway.

The geophysical seismic survey program is designed to assist in mine planning through gaining a better understanding of the relationship between geologic faults and the high-grade copper mineralization, and with targeting exploration-drilling.

The seismic vibrator rig being used in a geophysical survey of the Kamoa-Kakula licence area. The vibrator stops every 10 metres and sends controlled, seismic pulses into the ground to detect key geological markers.

Kamoa and Kakula mine sites now connected to the national hydroelectric grid

The construction of a 120-kilovolt (kV) power line to the Kansoko Mine was completed and a 120kV mobile substation installed, commissioned and energized in Q4 2016. An eight-kilometre, 11kV overhead power line, with mini-substations, was constructed from the Kansoko Mine to the Kamoa camp and is supplying hydropower to the Kamoa camp. A 12-kilometre, 120kV, dual-circuit power line between Kansoko and Kakula was completed in December 2017 and the Kakula Mine was energized with grid-power fed from Kamoa’s substation at the Kansoko Mine.

The Kansoko Mine, Kakula Mine and Kamoa camp now all are connected to the national, hydroelectric power grid.

Ongoing upgrading work enables Mwadingusha power station to supply 32 megawatts of clean electricity to national grid

In January of this year, Ivanhoe announced that ongoing upgrading work at the Mwadingusha hydropower plant in the DRC had almost tripled the plant’s interim power output from 11 to 32 megawatts (MW). This represents 45% of the plant’s designed capacity. Three of Mwadingusha’s six generators now have been modernized; the remaining three generators are due to be upgraded and fully operational by the end of 2019 – restoring the plant to its installed output capacity of approximately 71 MW of power.

The work at Mwadingusha, part of a program to eventually overhaul and boost output from three hydropower plants, is being conducted by engineering firm Stucky, of Lausanne, Switzerland, under the direction of Ivanhoe Mines and its joint-venture partner, Zijin Mining Group, in conjunction with the DRC’s state-owned power company, La Société Nationale d’Electricité (SNEL). Once fully reconditioned, the three plants will have installed capacity of approximately 200 MW of electricity for the national grid, which is expected to be more than sufficient for the Kamoa-Kakula Copper Project.

120kV power line at the Kamoa-Kakula Project.

Continued focus on community and sustainability

The number of job opportunities from the Kamoa-Kakula Project and contractors has risen during the fourth quarter of 2017 due to the increase in activity around the camp and mine area. Preference is being given to local job-seekers and numerous positions have been filled.

The Sustainable Livelihoods project is largely aimed at economically empowering communities in the vicinity of the planned mine. The project, which has been in place for the past five years, has continued to successfully manage the following programs during 2017:

- a maize (corn) production program yielded maize from local communities and the mine’s farm, which now includes a recently acquired sheller, cleaning machine, dehuller and grinding mill to produce maize meal;

- a vegetable program supplying produce to the Kamoa-Kakula Project camp kitchen;

- a poultry project that supplies chickens and eggs to the Kamoa-Kakula Project camp kitchen;

- a beekeeping program managing more than 50 honey-producing hives; and

- a fish-farming program, consisting of three fully-stocked dams.

A crop and household relocation survey has been conducted for the entire 15-square-kilometre Kakula mining area. Compensation to farmers has been paid; alternative land has been allocated and is in the process of being ploughed. A total of 45 relocation houses are being built near the village of Muvundaquali for households to be relocated from the mining area.

In 2017, the Kamoa-Kakula Project constructed, equipped and handed over a primary school at the Muvunda village and a secondary school at the Kaponda village. In addition, three communities now are being supplied with fresh, clean water from boreholes drilled by the project’s personnel and equipment.

Pineapples being harvested from the livelihoods garden as part of the program supplying produce to the Kamoa-Kakula Project.

Upgraded buildings at the Kaponda Primary School – one of the schools constructed and furnished by Ivanhoe Mines.

The poultry project that supplies chickens and eggs to the Kamoa-Kakula Project – one of the initiatives of the Kamoa-Kakula Sustainable Livelihoods Project working to build a sustainable, independent economy in nearby communities.

Ongoing detailed discussions to resolve issues arising from DRC’s 2018 mining code

On March 9, 2018, DRC President Joseph Kabila Kabange signed a new mining code into effect that revises and updates the country’s 2002 mining code.

International mining companies that have operations in the DRC, including Glencore, Randgold, China Molybdenum, MMG, Ivanhoe Mines and Zijin Mining, are collectively negotiating with the government to resolve their concerns about the impacts on their DRC operations that would result from the new mining code. The companies have confirmed their willingness to negotiate royalties and changes to other taxes as part of this process, but they expect that the negotiations will give priority to the recognition of the stability clauses contained in Article 276 of the 2002 mining code and certain mining conventions. Most notably, Article 276 provides that existing mining projects will continue to benefit from the terms of the 2002 code for 10 years after the implementation of a new code. The stability afforded under Article 276 influenced the decisions by many of the companies to invest in the DRC, resulting in more than $10 billion in direct investments and the creation more than 20,000 full-time mining jobs in the country.

The detailed, DRC mining-code negotiations are scheduled to begin March 26, following an initial, high-level meeting in Kinshasa on March 7 during which President Kabila gave an assurance that the companies’ concerns would be resolved through transitional arrangements, mining regulations and respect for existing agreements and guarantees.

DRC Western Foreland exploration project

Ivanhoe’s DRC exploration group is targeting Kamoa-Kakula-style copper mineralization through a regional drilling program on its 100%-owned Western Foreland exploration licences, located to the west of the Kakula-Kamoa Project.

Ivanhoe successfully continued its exploration drilling program through the rainy season during Q4 2017, based out of its new, stand-alone exploration camp. Drilling with two rigs is focused on one of the company’s promising targets, utilizing the new, all-weather road that connects the Kamoa-Kakula road network to the Western Foreland exploration licences. A recently-completed bridge across the Lufupa River will provide all-weather road access west of the river to previously inaccessible targets. One drill rig presently is drilling west of the river.

During Q4 2017, Ivanhoe’s exploration team completed 5,925 metres of drilling and finalized interpretation of the regional geology of the Western Foreland area. The company undertook a regional, airborne gravity survey across the area and the data are expected to be available soon for interpretation by geologists. Acquisition of 2-D seismic data is underway; approximately 11 kilometres of data will be recorded over the Western Foreland exploration licences.

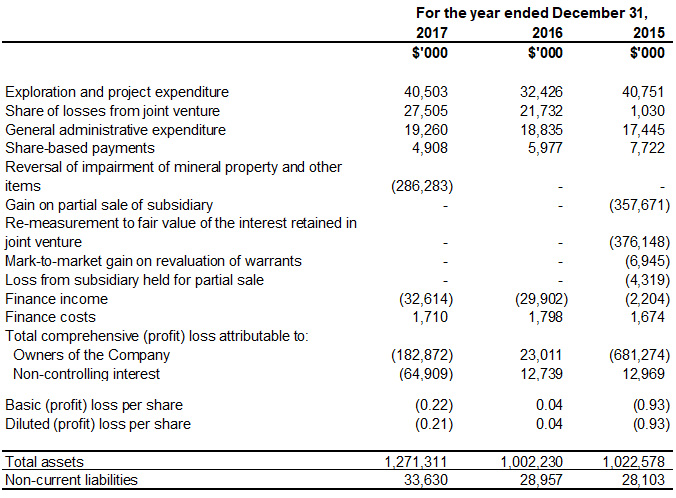

SELECTED ANNUAL FINANCIAL INFORMATION

This selected financial information is in accordance with IFRS as presented in the annual consolidated financial statements. Ivanhoe had no operating revenue in any financial reporting period and did not declare or pay any dividend or distribution in any financial reporting period.

DISCUSSION OF RESULTS OF OPERATIONS

Review of the year ended December 31, 2017, vs. December 31, 2016

The company recorded a total comprehensive profit of $247.8 million for the year ended December 31, 2017, compared to a total comprehensive loss of $35.8 million for the year ended December 31, 2016. The profit in 2017 was attributable mainly to the reversal of the impairment of mineral property and other items of the Kipushi Project of $286.3 million.

During 2017, the company recorded a reversal of the impairment of $286.3 million relating to the Kipushi Project. The circumstances leading to the reversal of the impairment charge included, but were not limited to, (i) an increase in the long-term zinc-price estimate; (ii) optimized zinc processing methodology; (iii) reduced capital expenditure estimates; and (iv) reduced realization cost estimates. All these estimates were supported by the pre-feasibility study for the Kipushi Project announced on December 13, 2017.

When excluding the 2017 reversal of impairment of $286.3 million, the company’s total comprehensive loss for the year ended December 31, 2017, amounted to $38.5 million. This is $2.7 million higher than the total comprehensive loss of $35.8 million for the same period in 2016. The increase mainly was due to an increase in exploration and project expenditure of $8.1 million and an increase in the company’s share of losses from the Kamoa Holding joint venture of $5.8 million, which was partially offset by an increase in exchange gains on translation of foreign operations, finance income and other income when compared to 2016.

Exploration and project expenditures for the year ended December 31, 2017, amounted to $40.5 million and were $8.1 million more than for the same period in 2016 ($32.4 million).

Of the total $40.5 million exploration and project expenditure, $36.7 million related to the Kipushi Project and $3.6 million was for exploration at Ivanhoe’s 100%-owned Western Foreland exploration licences. Exploration and project expenditures at the Kipushi Project increased by $5.0 million compared to the same period in 2016.

The costs associated with mine development are capitalized as development costs in Kamoa Holding, while the exploration expenditure is expensed. Capitalization of costs at Kakula commenced during Q2 2017, coinciding with the start of the Kakula box cut. Exploration drilling at Kakula West and in the saddle area between Kakula West and Kakula still is expensed.

The interest expense in the Kamoa Holding joint venture relates to shareholder loans where each shareholder is required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest. The company is advancing Crystal River’s portion on its behalf in return for an increase in the promissory note due to Ivanhoe.

Exchange gains on translation of foreign operations amounted to $13.8 million for the year ended December 31, 2017, compared to $10.2 million for the same period in 2016.

Finance income for the year ended December 31, 2017, amounted to $32.6 million, and was $2.7 million more than for the same period in 2016 ($29.9 million). The increase mainly was due to interest earned on loans to the Kamoa Holding joint venture to fund operations that amounted to $27.4 million in 2017 (2016: $16.2 million), as the accumulated loan balance increased.

Financial position as at December 31, 2017 vs. December 31, 2016

The company’s total assets increased by $269.1 million, from $1,002.2 million as at December 31, 2016, to $1,271.3 million as at December 31, 2017. This mainly was due to the $253.3 million increase in mineral properties and the $34.1 million increase in long-term loan receivable resulting from the reversal of the impairment relating to the Kipushi Project.

The company received a fourth installment of $41.2 million on February 8, 2017, a fifth and final installment on May 23, 2017, which represented the remaining purchase-price receivable due to the company as at December 31, 2016, as a result of the sale of 49.5% of Kamoa Holding.

The company’s investment in the Kamoa Holding joint venture increased by $78.7 million from $473.6 as at December 31, 2016, to $552.4 million as at December 31, 2017, with each of the current shareholders funding the operations equivalent to their proportionate shareholding interest. The company’s portion of the Kamoa Holding joint-venture cash calls amounted to $78.8 million during 2017, while the company’s share of comprehensive loss from the joint venture amounted to $27.5 million.

Property, plant and equipment increased by $72.8 million, with a total of $61.8 million being spent on project development and to acquire other property, plant and equipment; $47.2 million and $7.1 million pertained to development costs of the Platreef Project and Kipushi Project respectively. The total property, plant and equipment additions at the Kipushi Project for 2017 amounted to $11.6 million.

The company utilized $38.5 million of its cash resources in its operations and received interest of $3.7 million during 2017.

The company’s total liabilities increased by $13.9 million to $59.8 million as at December 31, 2017, from $46.0 million as at December 31, 2016

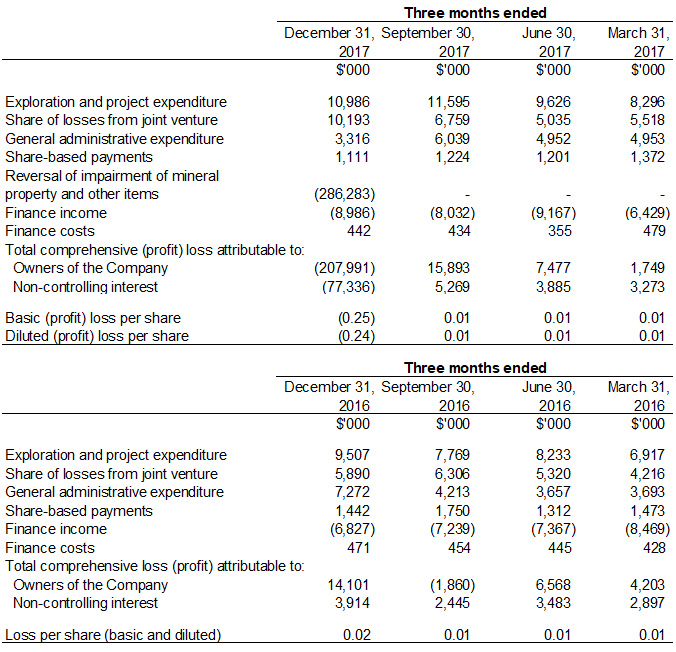

SELECTED QUARTERLY FINANCIAL INFORMATION

The following table summarizes selected financial information for the prior eight quarters. Ivanhoe had no operating revenue in any financial reporting period and did not declare or pay any dividend or distribution in any financial reporting period.

Review of the three months ended December 31, 2017, vs. 2016

The company recorded a total comprehensive profit of $285.3 million for Q4 2017 compared to a loss of $18.0 million for the same period in 2016. The profit in 2017 was attributable mainly to the reversal of the impairment of mineral property and other items of the Kipushi Project of $286.3 million, as described above.

When excluding the 2017 reversal of impairment, the total comprehensive loss for Q4 2017 amounts to $1.0 million, $17.0 million lower than in the same period in 2016. This largely was due to exchange gains on translation of foreign operations recognized in Q4 2017 of $12.4 million resulting from the strengthening of the South African Rand by more than 8% from September 30, 2017, to December 31, 2017, compared to an exchange loss on translation of foreign operations recognized in Q4 2016 of $0.1 million.

Exploration and project expenditures for the three months ended December 31, 2017, amounted to $11.0 million and were $1.5 million more than for the same period in 2016 ($9.5 million). $8.3 million of the total $11.0 million exploration and project expenditure related to the Kipushi Project, with $2.6 million being spent on exploration at Ivanhoe’s 100%-owned Western Foreland exploration licences in Q4 2017. Expenditure at the Kipushi Project decreased by $1.1 million compared to the same period in 2016.

The company’s share of losses from the Kamoa Holding joint venture increased from $5.9 million in Q4 2016 to $10.2 million in Q4 2017.

LIQUIDITY AND CAPITAL RESOURCES

The company had $181.4 million in cash and cash equivalents as at December 31, 2017. At this date, the company had consolidated working capital of approximately $181.9 million, compared to $364.8 million at December 31, 2016. The Platreef Project’s restricted cash has been fully utilized and the project’s current expenditure is being funded solely by Ivanhoe as the Japanese consortium of ITOCHU Corporation; Japan Oil, Gas and Metals National Corporation and Japan Gas Corporation have elected not to contribute to current expenditures. Since the Platreef Project’s restricted cash was fully utilized, the Company has contributed a total of $6.7 million on behalf of the Japanese consortium.

Continuation of the company as a going concern is dependent upon establishing profitable operations, the confirmation of economically recoverable reserves, and the ability of the company to obtain further financing to develop its projects. Although the company has been successful in raising funds in the past, the company’s access to financing always is uncertain and there can be no assurance that additional funding will be available to the company in the near future.

On December 8, 2015, Zijin, through a subsidiary company, acquired a 49.5% interest in Kamoa Holding for a total of $412 million to be settled in a series of payments. Ivanhoe received an initial $206 million from Zijin on December 8, 2015, and a further $41.2 million on each of March 23, 2016, July 8, 2016, October 25, 2016, February 8, 2017, and May 23, 2017. Since December 8, 2015, each shareholder in Kamoa Holding has been required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest. The company is advancing Crystal River’s portion on its behalf in return for an increase in the promissory note due to Ivanhoe.

The company’s main objectives for 2018 at the Platreef Project are the continuation of Shaft 1 construction, securing a bulk-water supply and completion of early-works construction of Shaft 2. At Kipushi, the principal objective is the completion of the feasibility study and continued upgrading of mining infrastructure. At the Kamoa-Kakula Project, priorities are the continuation of decline construction at Kakula and the completion of a pre-feasibility study for Kakula. The company expects to spend $64 million on further development at the Platreef Project; $62 million at the Kipushi Project; $12 million on regional exploration in the DRC; and $18 million on corporate overheads in 2018 – as well as its proportionate funding of the Kamoa-Kakula Project, expected to be $76million for 2018.

Continuing strategic discussions concerning Ivanhoe Mines and its projects are ongoing with several significant mining companies and investors across Asia, Europe, Africa and elsewhere. Several investors that have expressed interest have no material limit on the provision of capital. There can be no assurance that the company will pursue any transaction or that a transaction, if pursued, will be completed.

This news release should be read in conjunction with Ivanhoe Mines’ audited 2017 Financial Statements and Management’s Discussion and Analysis report available at www.ivanhoemines.com and at www.sedar.com .

Qualified Person

Disclosures of a scientific or technical nature in this news release have been reviewed and approved by Stephen Torr, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Project Geology and Evaluation. Mr. Torr has verified the technical data disclosed in this news release.

Ivanhoe has prepared a current, independent, NI 43-101-compliant technical report for each of the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project, which are available under the company’s SEDAR profile at www.sedar.com :

- The Kamoa-Kakula 2017 Development Plan dated January 10, 2018, prepared by OreWin Pty Ltd; Amec Foster Wheeler E&C Services Inc. and Amec Foster Wheeler Australia Pty Ltd (collectively Amec Foster Wheeler); MDM (Technical) Africa Pty Ltd; Stantec Consulting International LLC and SRK Consulting (South Africa) Pty Ltd, covering the company’s Kamoa-Kakula Project;

- The Platreef 2017 Feasibility Study Technical Report dated September 4, 2017, prepared by DRA Global, OreWin Pty. Ltd., Amec Foster Wheeler, Stantec Consulting, Murray & Roberts Cementation, SRK Consulting, Golder Associates and Digby Wells Environmental, covering the company’s Platreef Project; and

- The Kipushi 2017 Prefeasibility Study Technical Report dated January 25, 2018, prepared by OreWin Pty Ltd, The MSA Group (Pty) Ltd, SRK Consulting (South Africa) (Pty) Ltd and MDM (Technical) Africa Pty Ltd, covering the company’s Kipushi Project.

These technical reports include relevant information regarding the effective dates and the assumptions, parameters and methods of the mineral resource estimates on the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the Platreef Project, Kipushi Project and Kamoa-Kakula Project.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Bob Williamson +1.604.512.4856

South Africa: Jeremy Michaels +27.82.772.1122

Website www.ivanhoemines.com

Forward-looking statements

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of the company’s MD&A for the year ended December 31, 2017.

Such statements include without limitation, the timing and results of: (i) statements regarding Shaft 1 providing initial access for early underground development at the Flatreef Deposit; (ii) statements regarding the station development of Shaft 1 at the 750, 850 and 950 metre levels; (iii) statements regarding the sinking of Shaft 1, including that the average sinking rate is between 40 and 50 metres a month; (iv) statements regarding Shaft 1 reaching the planned, final depth at 980 metres below surface in 2019; (v) statements regarding the timing of Shaft 2 development, including that construction of the box cut will take approximately 12 months to complete and that Shaft 2 will be sunk to a final depth of more than 1,100 metres; (vi) statements regarding the operational and technical capacity of Shaft 1; (vii) statements regarding the internal diameter and hoisting capacity of Shaft 2; (viii) statements regarding the company’s plans to develop the Platreef Mine in three phases: an initial annual rate of four million tonnes per annum (Mtpa) to establish an operating platform to support future expansions; followed by a doubling of production to eight Mtpa; and then a third expansion phase to a steady-state 12 Mtpa; (ix) statements regarding the planned underground mining methods of the Platreef Project including long-hole stoping and drift-and-fill mining; (x) statements regarding peak water use of 7.5 million litres per day at the Platreef Project and development of the Pruissen Pipeline Project; (xi) statements regarding the Platreef Project’s estimated electricity requirement of 100 million volt-amperes; (xii) statements regarding the timing and completion of a pre-feasibility study for a six Mtpa mine at Kakula; (xiii) statements regarding the timing, size and objectives of drilling and other exploration programs for 2018 and future periods; (xiv) statements regarding exploration on the Western Foreland exploration licences; (xv) statements regarding completion of the twin declines at Kakula scheduled for completion of the contract by the end of 2018; (xvi) statements regarding the timing of an update to the Kipushi Mineral Resource estimate early in Q2 2018; (xvii) statements regarding the timing and completion of the feasibility study at the Kipushi Project; and (xviii) statements regarding expected expenditure for 2018 of $64 million on further development at the Platreef Project; $62 million at the Kipushi Project; $12 million on regional exploration in the DRC; and $18 million on corporate overheads in 2018 – as well as its proportionate funding of the Kamoa-Kakula Project, expected to be $76 million for 2018.

As well, all of the results of the pre-feasibility study of the Kamoa-Kakula Project and preliminary economic assessment of development options for the Kakula deposit, the feasibility study of the Platreef Project and the pre-feasibility study of the Kipushi Project, constitute forward-looking statements or information, and include future estimates of internal rates of return, net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs and the size and timing of phased development of the projects. Furthermore, with respect to this specific forward-looking information concerning the development of the Kamoa-Kakula, Platreef and Kipushi projects, the company has based its assumptions and analysis on certain factors that are inherently uncertain. Uncertainties include: (i) the adequacy of infrastructure; (ii) geological characteristics; (iii) metallurgical characteristics of the mineralization; (iv) the ability to develop adequate processing capacity; (v) the price of copper, nickel, zinc, platinum, palladium, rhodium and gold; (vi) the availability of equipment and facilities necessary to complete development; (vii) the cost of consumables and mining and processing equipment; (viii) unforeseen technological and engineering problems; (ix) accidents or acts of sabotage or terrorism; (x) currency fluctuations; (xi) changes in regulations; (xii) the compliance by joint venture partners with terms of agreements; (xiii) the availability and productivity of skilled labour; (xiv) the regulation of the mining industry by various governmental agencies; and (xiv) political factors.

This news release also contains references to estimates of Mineral Resources and Mineral Reserves. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Estimates of Mineral Reserves provide more certainty but still involve similar subjective judgments. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production from the company’s projects, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that ultimately may prove to be inaccurate. Mineral Resource or Mineral Reserve estimates may have to be re-estimated based on: (i) fluctuations in copper, nickel, zinc, platinum group elements (PGE), gold or other mineral prices; (ii) results of drilling; (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates and/or changes in mine plans; (vi) the possible failure to receive required permits, approvals and licences; and (vii) changes in law or regulation.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to, the factors discussed under “Risk Factors” and elsewhere in the company’s MD&A, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors set forth in the “Risk Factors” section and elsewhere in the company’s MD&A for the year ended December 31, 2017 and its Annual Information Form.

English

English Français

Français 日本語

日本語 中文

中文