Major progress made at three key development projects

in 2013 and the first quarter of 2014

TORONTO, CANADA – Ivanhoe Mines (TSX: IVN) today announced its financial results for the year ended December 31, 2013. All figures are in US dollars unless otherwise stated.

HIGHLIGHTS

- On August 28, 2013, the company changed its name from Ivanplats to Ivanhoe Mines to reflect its commitment to development as a leading international, multi-commodity mining company. The trading symbol on the Toronto Stock Exchange was changed to IVN.

- On October 4, 2013, Ivanhoe Mines closed a C$108 million financing through the issuance of 54 million new Class A common shares at C$2.00 per share. Robert Friedland, Ivanhoe Mines’ Executive Chairman, subscribed for C$25 million of the offering, effectively proportionate to his holding in the company.

- On September 9, 2013, Ivanhoe Mines received approval from the South African government’s Department of Mineral Resources to proceed with the sinking of an 800-metre-deep bulk-sample shaft to access the underground Flatreef platinum, palladium, nickel, copper, gold and rhodium discovery at its Platreef Project on the Bushveld Complex’s Northern Limb. Surface construction work for the 7.25-metre-diameter shaft now is underway.

- On March 26, 2014, Ivanhoe welcomed the positive findings of an independent, preliminary economic assessment (PEA) of the Platreef Project. The PEA estimates that at the planned, base-case mining rate of eight million tonnes per year the mine would become Africa’s lowest-cost producer of platinum-group metals, with annual production of 785,000 ounces of platinum, palladium, rhodium and gold.

- A Mining Right Application for the Platreef Project was filed with the Department of Mineral Resources in June 2013, which would permit the company to mine and process minerals from the mining area for a period of 30 years, and which may be extended upon application.

- On October 16, 2013, Ivanhoe Mines reported an unprecedented 90-metre intersection of 4.51 grams per tonne (g/t) of platinum, palladium, rhodium and gold (3PE+Au), plus 0.37% nickel and 0.20% copper, at its Flatreef Discovery at the Platreef Project. The drill intercept included a 41-metre section grading 6.88 grams of platinum, palladium, rhodium and gold per tonne, plus 0.51% nickel and 0.21% copper, at a 1.0 g/t 3PE+Au cut-off.

- In March 2014, an exploration drill hole in the Ga-Madiba extension zone on the eastern flank of the Flatreef extension intersected an estimated true thickness of 34.4 metres that contains 4.63 g/t of platinum, palladium and gold (2PE+Au), plus 0.30% nickel and 0.13% copper, at a 1.0 g/t 2PE+Au cut-off. The Ga-Madiba zone, covering approximately three square kilometres, adjoins and stretches to the south from the established area of Inferred Resources, which in turn surrounds the area of Indicated Resources that is at the heart of the Flatreef Discovery – where Ivanhoe is planning to develop an underground mine.

- In March 2014, the Platreef Project achieved a significant operational safety milestone when it recorded the completion of three million person hours of work without incurring a lost-time injury. The project presently has 112 permanent employees, plus an additional 389 contract and sub-contract workers, 64% of whom are from the local area.

- On November 18, 2013, Ivanhoe announced the findings of an updated independent preliminary economic assessment of its Kamoa copper discovery in the Democratic Republic of Congo (DRC). The Kamoa PEA estimated that the planned mine is projected to have the highest grade among the world’s largest copper mines and also to be one of the world’s lowest-cost copper producers. The PEA also estimated a pre-tax net present value of $4.3 billion and an 18.5% internal rate of return.

- Also in the DRC, underground drilling began in March 2014 at the Kipushi copper-zinc-germanium-lead and precious-metals mine, which is southeast of Kamoa on the Central African Copperbelt in southern Katanga Province, less than one kilometre from the Zambian border. The drilling is designed to confirm and update Kipushi’s estimated historical resources and to further expand the resources on strike and at depth. Access to the mine’s principal working level at 1,150 metres below the surface was restored in December 2013 following an intensive dewatering operation.

- In March 2014, Ivanhoe Mines signed a financing agreement with DRC’s La Société Nationale d’Electricité (SNEL), allowing the rehabilitation of three existing hydroelectric power plants. A combined total of 200 megawatts from the grid would provide sufficient power for Kamoa’s planned 300,000-tonne-per-year smelter and the associated future mine expansions.

Principal Projects and Review of Activities

Ivanhoe Mines, with offices in Canada, the United Kingdom and South Africa, is advancing and developing its three principal projects:

- The Kamoa copper discovery in a previously unknown extension of the Central African Copperbelt in the DRC’s Province of Katanga.

- The Platreef Discovery of platinum, palladium, nickel, copper, gold and rhodium on the Northern Limb of the Bushveld Complex in South Africa.

- The historic, high-grade Kipushi zinc-copper mine, also on the Copperbelt in the DRC and now being drilled and upgraded, following a care-and-maintenance program conducted between 1993 and 2011.

Ivanhoe is evaluating other opportunities as part of its objective to become a broadly based, international mining company.

1. Kamoa Project

95%-owned by Ivanhoe Mines

Democratic Republic of Congo (DRC)

Kamoa is world’s largest undeveloped high-grade copper discovery

The Kamoa Project is a newly discovered, very large, stratiform copper deposit with adjacent prospective exploration areas within the Central African Copperbelt, approximately 25 kilometres west of the town of Kolwezi and about 270 kilometres west of the Katangan provincial capital of Lubumbashi.

Ivanhoe holds its 95% interest in the Kamoa Project through a subsidiary company, Kamoa Copper SPRL. A 5%, non-dilutable interest in Kamoa Copper SPRL was transferred to the DRC government on September 11, 2012, for no consideration, pursuant to the DRC Mining Code. Ivanhoe also has offered to sell an additional 15% interest to the DRC government on commercial terms to be negotiated.

Kamoa is the world’s largest undeveloped, high-grade copper deposit. On January 17, 2013, an updated mineral resource estimate was announced that increased Kamoa’s Indicated Mineral Resources to a total of 739 million tonnes grading 2.67% copper and containing 43.5 billion pounds of copper. This was an increase of 115% over the previous estimate in September 2011 of 348 million tonnes grading 2.64% copper and containing 20.2 billion pounds of copper. Both estimates used a 1.0% copper cut-off grade and a minimum vertical mining thickness of three metres.

In addition to the Indicated Mineral Resources, the updated estimate included Inferred Mineral Resources of 227 million tonnes grading 1.96% copper and containing 9.8 billion pounds of copper, also at a 1.0% copper cut-off grade and a minimum vertical mining thickness of three metres.

The latest Kamoa resource estimate was prepared by AMEC, based on core from 555 holes drilled to December 10, 2012, in accordance with CIM Guidelines and directed by AMEC’s Technical Director Dr. Harry Parker.

At a higher, 2.0% copper cut-off grade, Kamoa’s Indicated Resources now total 550 million tonnes grading 3.04% copper and containing 36.9 billion pounds of copper. At the 2.0% cut-off, Kamoa also has 93 million tonnes of Inferred Resources grading 2.64% copper, which contain an estimated 5.4 billion pounds of copper.

Phased approach to the development of a large mine and smelter

An updated preliminary economic assessment (PEA) was published in November 2013 that reflects a phased approach to development of the Kamoa Project. The first phase of mining would target high-grade copper mineralization from shallow, underground resources to yield a high-value concentrate. The second phase would entail a major expansion of the mine and mill and construction of a smelter to produce blister copper.

Highlights of the Kamoa PEA:

- A large mine and smelter would be developed using a two-phased approach.

- A smaller-scale start-up would establish an operating platform to support expansion.

- Early cash flows would be generated from the sale of high-grade copper concentrate.

- Low pre-production capital requirement of approximately $1.4 billion.

- Steady-state production target of 300,000 tonnes per year of blister copper, which would establish Kamoa as one of the world’s largest copper mines, with the highest grade.

- Cash costs of $1.19 per pound of copper would rank Kamoa near the bottom of the global cash-cost curve.

- Pre-tax Net Present Value, at an 8% discount rate, of $4.3 billion.

- After-tax Net Present Value, at an 8% discount rate, of $2.6 billion.

- Pre-tax internal rate of return of 18.4%; after-tax IRR of 15.3%.

The initial mining rate and concentrate feed capacity of three million tonnes per year would be followed in Year 5 by an additional expansion of eight million tonnes per year in concentrator capacity and the construction of an on-site smelter with a capacity to produce 300,000 tonnes per year of blister copper. In addition, an estimated 1,600 tonnes of sulphuric acid per day would be produced as a by-product in the copper smelting process. The PEA contemplates that the sulphuric acid produced at Kamoa would be sold to copper-oxide mining operations on the Central African Copperbelt that currently purchase acid from Zambia or from overseas.

The production scenario schedules 326 million tonnes to be mined and milled at an average copper grade of 3.0% copper over a 30-year mine life, producing 7.8 million tonnes of payable blister copper (plus 0.5 million tonnes of payable copper in concentrate in the initial concentrate phase) over the life of the project.

Steady-state production from Year 6 onward of 306,000 tonnes per year of blister copper would establish Kamoa as one of the world’s largest copper mines. Kamoa also would have the highest average grade among the 20 largest copper mines currently in production or expected to be in production, according to data from Wood Mackenzie, an international industry research and consulting group. Average cash costs of $1.19 per pound of copper (after sulphuric acid credit) over the life of the mine rank Kamoa near the bottom of the 2013 cash-cost curve for copper mines globally.

Work on underground mine-access decline at Kamoa planned to begin in 2014

Preparations are underway to start the first mine-access decline at Kamoa. The decline would provide access to the high-grade, near-surface copper resources that would be targeted for the planned first phase of production using the room-and-pillar mining method.

A development study is underway to advance the geotechnical, engineering and metallurgical understanding of Kamoa. Phase 6 of the metallurgical testwork program is underway at the XPS laboratories in Sudbury, Canada, and the Mintek laboratories in Johannesburg, South Africa. Phase 6A testwork considers the first four years of mining during which time flotation concentrate will be sold. Phase 6B considers the next 15 years of mining; from year five onward, during which blister copper would be produced. The mining areas for phases 6A and 6B are different and representative samples from these areas were collected during Q4 2013.

Drilling during the fourth quarter of 2013 was focused on resource infill and metallurgical studies. In total, 8,450 metres in 56 holes were completed for the quarter. A combined 6,483 metres were drilled for resource evaluation – 5,555 metres on the Kansoko Sud area and 928 metres on the Kansoko Centrale area; 1,619 metres were drilled for metallurgical testing in the Kamoa Sud, Kansoko Central, Kansoko sud and Makalu areas. In addition, 348 metres of hydrogeology drilling was completed in the Kansoko East, Kansoko Nord and Kansoko Sud areas. Total drilling costs during the fourth quarter were $4.7 million.

Agreement signed to upgrade existing hydroelectric power plants

In March 2014, a financing agreement was signed between Ivanhoe and the DRC’s La Société Nationale d’Electricité (SNEL). Ivanhoe is working with SNEL to upgrade two existing hydroelectric power plants at a first stage, Mwadingusha and Koni, to feed up to 113 megawatts into the national power supply grid. SNEL will provide the Kamoa Project with up to 100 megawatts from the grid, which would be sufficient to operate the initial Kamoa mine.

A third hydroelectric power plant – Nzilo 1 – would follow under the same financing agreement. Nzilo 1 will have a capacity of about 108 megawatts upon its completion, entitling Kamoa to receive another 100 megawatts from the grid. The upgrading of technology which will be applied on these power plants will allow up to 10% more to the initial capacity of these power plants.

A combined total of 200 megawatts from the grid would provide sufficient power for Kamoa’s planned 300,000-tonne-per-year smelter and the associated future mine expansions.

2. Platreef Project

90%-owned by Ivanhoe Mines

South Africa

The Platreef Project, in South Africa’s Limpopo province, is 90%-owned by Ivanhoe and 10%-owned by a Japanese consortium of Itochu Corporation; ITC Platinum, an Itochu affiliate; Japan Oil, Gas and Metals National Corporation; and Japan Gas Corporation. The Japanese consortium’s 10% interest in the Platreef Project was acquired in two tranches for a total investment of $290 million.

The Platreef Project includes the underground Flatreef Deposit of thick, platinum-group elements, nickel, copper and gold mineralization in the Northern Limb of the Bushveld Complex, approximately 280 kilometres northeast of Johannesburg.

In the Northern Limb, such mineralization primarily is hosted within the Platreef, a mineralized sequence that is traced more than 30 kilometres along strike. Ivanhoe’s Platreef Project, within the southern sector of the Platreef, is comprised of three contiguous properties: Turfspruit, Macalacaskop and Rietfontein. The northernmost property, Turfspruit, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of properties and mining operations.

Since 2007, Ivanhoe has focused its exploration activities on defining and advancing the down-dip extension of its original Platreef discovery, now known as the Flatreef Deposit, which potentially is amenable to highly mechanized, underground mining methods. The Flatreef area lies entirely on the Turfspruit and Macalacaskop properties.

Platreef also is planning a phased approach to a large, mechanized mine

An independent preliminary economic assessment was released in March 2014 that reflects a phased approach to development of the Platreef Project. Initiating production with a four-million-tonne-per-year first phase would establish an operating platform to support future expansions. Subsequent phases would see production expanded to eight million tonnes and 12 million tonnes per year.

Highlights of the Platreef PEA:

- A large, mechanized, underground mine is planned to be developed through a phased approach.

- Three run-of-mine production scenarios were examined – 4 million tonnes per year (Mtpa); a base case of 8 Mtpa; and 12 Mtpa.

- An initial 4 Mtpa scenario would establish an operating platform.

- Expansions, to the base-case 8 Mtpa scenario and also to the 12 Mtpa scenario, can be accelerated as the market dictates.

- Opportunities exist for additional phases of development beyond 12 Mtpa, subject to further study.

Key features of the 8 million tonnes/year base-case scenario include:

- Annual production target of 785,000 ounces of platinum, palladium, rhodium and gold. (At an expanded operating scenario of 12 million tonnes per year, the annual production target would be 1.1 million ounces of platinum, palladium, rhodium and gold [3PE+Au]).

- Platreef, with the highest concentration of base metals among Africa’s producers of platinum-group metals, would rank at the bottom of the cash-cost curve at an estimated $341 per ounce of 3PE+Au, net of by-products.

- Estimated pre-production capital requirement of approximately $1.7 billion, including $381 million in contingencies.

- An after-tax Net Present Value of $1.6 billion, at an 8% discount rate.

- An after-tax internal rate of return of 14.3%.

The base case for the Platreef PEA analysis is the 8 Mtpa production scenario. The scenarios describe a staged approach, where there is opportunity to expand the operation depending on demand, smelting and refining capacity and capital availability. As Phase 1 is developed and placed into production, there is opportunity to modify and optimize the subsequent phases, allowing for changes to the timing or expansion capacity to suit the conditions at the time. Opportunities for additional expansion beyond Phase 3 may be available, but require additional investigation.

Phase 1 would include the construction of a concentrator and other associated infrastructure to establish an operating platform to support the start of production at a nominal plant capacity of 4 Mtpa by 2020. Phase 2 includes a ramp-up to a plant capacity of 8 Mtpa by 2024; Phase 3 envisages a further ramp-up to a steady-state plant capacity of 12 Mtpa by 2028.

The Platreef preliminary economic assessment technical report has been filed on SEDAR at www.sedar.com and on the Ivanhoe Mines website at www.ivanhoemines.com.

Mining Right approval pending

A Mining Right Application (MRA) for the Platreef Project was filed with the Department of Mineral Resources (DMR) in June 2013 to permit the company to mine and process minerals from the mining area for a period of 30 years, and which may be extended upon application.

The application review process involves a thorough assessment of Ivanhoe’s Environmental Management Program (EMP), Social and Labour Plan, Mining Works Program and Broad-Based Black Economic Empowerment structure. The Environmental and Social Impact Assessment will engage with all interested stakeholders, including local communities and governments. A complete EMP must be filed with the DMR within 180 days of its acceptance of the MRA. The entire application process is being administered by the DMR. Ivanhoe has received feedback from the DMR on all of these items and now expects to receive approval of its Mining Right in May 2014.

Based on legal consultation, it has been established that if Ivanhoe does not receive the Mining Right by May 31, 2014, the company will be required to suspend all operational work on the Platreef Project until the Mining Right is granted by the DMR.

Development work focused on resources in Flatreef underground discovery

The Flatreef Mineral Resource, with a strike length now extended to 6.5 kilometres, predominantly lies within a flat to gently dipping portion of the Platreef mineralized belt at relatively shallow depths of approximately 700 to 1,100 metres below surface.

The Flatreef Deposit is characterized by its very large vertical thicknesses of high-grade mineralization and a platinum-to-palladium ratio of approximately 1:1, which is significantly higher than other recent PGM discoveries on the Bushveld’s Northern Limb. The grade shells used to constrain mineralization in the Flatreef Indicated Mineral Resource area have average true thicknesses of approximately 24 metres at a cut-off grade of 2.0 grams per tonne (g/t) of 2PE+Au (platinum-palladium-gold) while the indicated Mineral Resource grade at equivalent 2.0 gram-per-tonne 3PE cut off is 4.1 g/t 3PE+Au (platinum-palladium -rhodium-gold), 0.34% nickel and 0.17% copper. Flatreef’s Indicated Mineral Resources of 214 million tonnes contain an estimated 28.5 million ounces of platinum, palladium, gold and rhodium, 1.6 billion pounds of nickel and 0.8 billion pounds of copper.

At the same cut-off of 2.0 g/t 3PE+Au, the latest Flatreef estimate includes Inferred Mineral Resources of 415 million tonnes grading 3.5 g/t 3PE+Au, 0.33% nickel and 0.16% copper, containing an estimated additional 47.2 million ounces of platinum, palladium, gold and rhodium, 3.0 billion pounds of nickel and 1.5 billion pounds of copper. Inferred Mineral Resource estimates, under CIM guidelines, do not have demonstrated economic viability and may never achieve the confidence to be Mineral Reserve estimates or to be mined.

Development of bulk-sample shaft proceeding

Surface construction work is underway for Shaft #1, the 7.25-metre-diameter bulk-sample shaft. The vertical shaft is planned to be sunk to a depth below surface of 800 metres and enable the collection of a mineralized bulk sample, expected in the first half of 2016, to complete the company’s development assessment of the Flatreef. South Africa-based Aveng Mining, the sinking contractor for Shaft #1, is continuing surface preparation work at the site, where excavation of the box-cut access has begun. Upgrading of hoisting equipment to be installed in the shaft headframe, is underway; excavations for concrete foundations of the shaft collar and ventilation casing recently began.

Shaft #1, including some initial lateral, underground development work, is expected to be fully funded from dedicated funds remaining in Ivanhoe’s treasury from the US$280 million received in 2011 for the sale of an 8% interest in the Platreef Project to the Itochu-led Japanese consortium.

Ivanhoe will begin the design and engineering of Shaft #2, the main production shaft, in Q2 2014. This will enable the company to start Shaft #2 development works in Q1 2015, subject to necessary approvals and funding.

A pre-feasibility study (PFS) also is underway and completion is targeted for the second half of 2014. The PFS currently focuses on the Phase 1, 4 Mtpa production case, based on selling or tolling concentrate at local smelters. Studies will continue on the Phase 2, 8 Mtpa base case and Phase 3, 12 Mtpa production scenarios, with the intention of presenting an integrated development plan for the project incorporating the Phase 1 PFS.

Exploration and development drilling

Diamond drilling of 53 holes totalling 23,054 metres was completed during Q4 2013, including 18 deflections. Geotechnical and metallurgical development drilling totalled 8,020 metres in 35 holes, while exploration drilling totalled 15,033 metres in 18 holes. Exploration drilling focused on expanding the Indicated Mineral Resources around the planned initial mining area (Mine 1 area) and on defining the 400-metre Inferred Mineral Resources grid at the Ga-Madiba extension zone. Drilling costs for Q4 2013 amounted to $3.4 million.

A total of 40,336 metres of diamond drilling was completed during all of 2013. The initial focus was completion of the development-drilling program to support the ongoing pre-feasibility study; a total of 24,625 metres of development drilling was completed in 88 holes, including deflections. Exploration drilling for the year was split between the Ga-Madiba prospect and the expansion of Indicated Resources to the north, west and south of the initial Mine 1 area. A total of 11,938 metres of exploration drilling was completed in 14 holes, including deflections on Ga-Madiba. Ten holes remain outstanding on the Inferred grid. Exploration drilling is focused on expanding the Indicated Resource to allow for the phase 2 pre-feasibility study of eight-million-tonne per year mining scenario.

2014 exploration program

Ivanhoe is planning more than 90,000 metres of diamond drilling in 2014 at a budgeted cost of $16.2 million. The 2014 exploration and expansion program will focus on four areas: Northern Zone 1, Zone 3, Zone 2 and the Ga-Madiba 400-metre grid. The goal is to delineate additional Indicated Resources in the immediate vicinity of Zone 1 that would support an eight-million-tonne per year (phase 2) pre-feasibility study and allow for the potential declaration of an initial Inferred Resource estimate on the Ga-Madiba extension zone.

3. Kipushi Project

68%-owned by Ivanhoe Mines

Democratic Republic of Congo (DRC)

The Kipushi copper-zinc-germanium-lead mine, in southern Katanga province, is adjacent to the town of Kipushi and approximately 30 kilometres southwest of the provincial capital of Lubumbashi. It also is on the Central African Copperbelt, southeast of the company’s Kamoa Project, and less than one kilometre from the Zambian border. Ivanhoe acquired its 68% interest in the Kipushi Project in November 2011; the balance of 32% is held by La Générale des Carrières et des Mines (Gécamines), the DRC’s state-owned mining company.

Successful dewatering program opens underground access for drill rigs

Work began in early March 2014 on the company’s planned 20,000-metre diamond-drilling program at the Kipushi Mine, a major advance made possible by the ongoing, successful dewatering program directed by Ivanhoe during the past two years after it acquired a 68% interest in Kipushi in November 2011.

The mine, which had been placed on care and maintenance in 1993, flooded in early 2011 due to a lack of pump maintenance over an extended period. Water reached 851 metres below surface at its peak. A major turning point was reached in December 2013 when access was restored to the mine’s principal working level at 1,150 metres below the surface.

The planned upgrading of the mine had succeeded in clearing water to the 1,267-metre level as of March 26, 2014.

100 holes planned in underground drilling program

Ivanhoe’s 2014 drilling program is scheduled to complete approximately 100 holes totalling more than 20,000 metres, which has been budgeted at $9.8 million. The drilling is designed to confirm and update Kipushi’s estimated historical resources and to further expand the resources on strike and at depth.

Specific objectives are to:

- Conduct confirmatory drilling to validate the historical resources within Kipushi’s Big Zinc zone and Fault Zone.

- Conduct extension drilling to test and upgrade the deeper portions of the Big Zinc and Fault zones, below the 1,500-metre level, which previously were classified as Inferred Resources.

- Conduct exploration drilling to test areas that have not been previously evaluated, such as the deeper portions of the Fault Zone and extensions to the high-grade copper mineralization of the mine’s Northern zone.

- Obtain large-diameter drill core from the Big Zinc zone for confirmatory metallurgy test work.

New, underground drill holes also may provide a platform for geophysical exploration of Kipushi’s deep mineral potential, leveraging the Ivanhoe group’s proprietary, in-house expertise. Kipushi has never been evaluated using modern geophysical techniques.

Most of the drilling will be conducted from sites on the hanging-wall development drift at the 1,270-metre level and from the footwall ramp below the 1,150-metre level.

The first hole was started on the 1,225-metre level at an inclination of -67 degrees and is designed to test the depth continuity of the Big Zinc zone and the down-dip extension of the adjacent, copper-rich Fault zone. The hole is expected to be drilled for approximately 600 metres to a depth of greater than 1,800 metres below surface. It also will provide sample material for ongoing metallurgical studies.

The second rig is underground at the 1,125-metre level staging area, awaiting preparation of the drill station, and is expected to start drilling from March 31, 2014. The third rig arrived at site on March 25 and is being tested on surface before being lowered to the staging area. A 280-metre step-back extension of the hanging-wall drift will be driven to enable the drill rigs to test deep extensions of the Big Zinc and Fault zones.

Independent consulting engineering firm MSA Group, of Gauteng, South Africa, has been appointed to prepare a current estimate of the Big Zinc resources to CIM standards following completion of the confirmation drilling program.

Previous drilling at Kipushi

Previous mining at Kipushi was conducted to a below-surface depth of 1,207 metres on the Kipushi Fault, a deposit of high-grade, copper-zinc-lead mineralization that has a strike length of 600 metres. The Fault Zone mineralization is known to extend to at least 1,800 metres below surface, based on previous drilling reports prepared by state-owned mining company Gécamines.

The Big Zinc zone, adjacent to the Fault Zone on the footwall side, was discovered shortly before the mine ceased production in 1993 and never has been mined. From its top at approximately the 1,200-metre level, the Big Zinc zone extends down dip to at least the 1,640-metre level, as indicated by Gécamines’ drilling reports.

Accessible from existing underground workings, the Big Zinc has a strike length of at least 100 metres, a true thickness calculated at 40 to 80 metres and is open to depth. Gécamines also reported that multiple, steeply-dipping, Big Zinc exploratory holes intersected exceptionally high-grade zinc mineralization, grading 42% to 45% zinc, between the 1,375-metre and 1,600-metre levels, with estimated, apparent thicknesses of between 60 and 100 metres.

Regional Exploration

Katanga Province, DRC

The 2013 field season wrapped up during the fourth quarter at the onset of the rainy season. During the year, the company drilled a total of 6,150 metres in 43 holes, using contractor and company-owned rigs. Contractor drilling at the Nzilo project, a Kamoa-style stratiform copper prospect, amounted to 3,654 metres in nine holes. The company’s in-house rigs completed 2,496 metres in 34 holes at the Lufupa project, west of Kamoa, and the Kale prospect, north of Tenke-Fungurume. Other 2013 activities included soil sampling, prospecting, mapping, ground magnetics and AMT surveys. Licence renewals filed in August 2013 were confirmed in Q4 2013.

Gabon

Ivanhoe holds two exploration licences in Gabon at Ndangui and Makokou, areas prospective for greenstone gold deposits. Eight diamond boreholes totalling 1,774 metres were completed at Ndangui in Q3 2013 and early Q4 2013. Gold and sulphide mineralization was encountered in most holes. Auger drilling at Makokou was completed to better define gold-in-soil anomalies. The Ndangui and Makokou licences were successfully renewed during Q4 2013, and are valid through 2016.

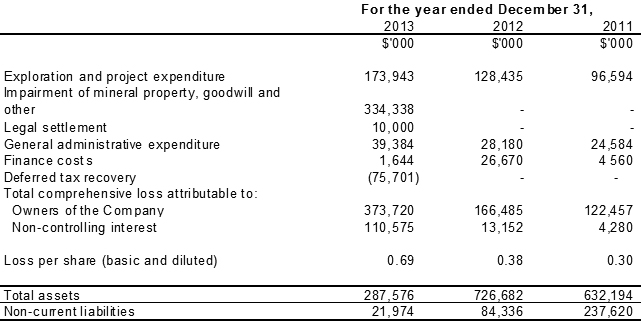

SELECTED ANNUAL FINANCIAL INFORMATION

This selected financial information is in accordance with IFRS as presented in the annual consolidated financial statements. Other than its share of revenue from the RK1 Consortium, Ivanhoe had no operating revenue in any financial reporting period and did not declare or pay any dividend or distribution in any financial reporting period.

Review of the year ended December 31, 2013 vs. December 31, 2012

The company’s total comprehensive loss for the year ending December 31, 2013, was $304.7 million higher than for the same period in 2012: $484.3 million in 2013 compared to $179.6 million in 2012. The increase was attributable mainly to the impairment of the Kipushi mineral property, goodwill and related loans and advances, which had a post-tax effect of $258.6 million. The remainder of the increase resulted from the $45.5 million year-on-year increase in the exploration and project expenditure, and the one-time legal-settlement expense recognized in Q3 2013 of $10.0 million. This was partially offset by the decrease in finance costs of $25.0 million.

As at December 31, 2013, the company recorded an impairment charge of $334.3 million upon completion of its annual assessment of the carrying value of goodwill, mineral properties and related loans and advances. The impairment charge, which was recorded within a separate line in the consolidated statement of comprehensive loss, included $252.3 million relating to Kipushi mineral properties; $67.4 million relating to goodwill recognized upon acquisition of Kipushi; $25.1 million relating to the long-term loan receivable from Gécamines; and $1.5 million relating to a common share investment funded on behalf of a non-controlling interest. The advances payable to Gécamines have been assessed as zero in the current year and resulted in a reduction of the impairment by $12.1 million. A tax recovery of $75.7 million was recorded as a result of the impairment charge on the Kipushi mineral property.

Significant judgments and assumptions were required in making estimates of the recoverable amount of cash generating units. This was particularly so in the assessment of long-life assets such as Kipushi. It should be noted that the valuations are subject to variability in key assumptions including, but not limited to, long-term commodity prices, capital expenditures, discount rates, transport costs, the cost of production and operating costs.

A change in one or more of the assumptions used to estimate the recoverable amount could result in a reduction or an increase in the recoverable amount.

All current exploration and refurbishment costs incurred on the Kipushi Project are expensed in accordance with Ivanhoe’s accounting policy.

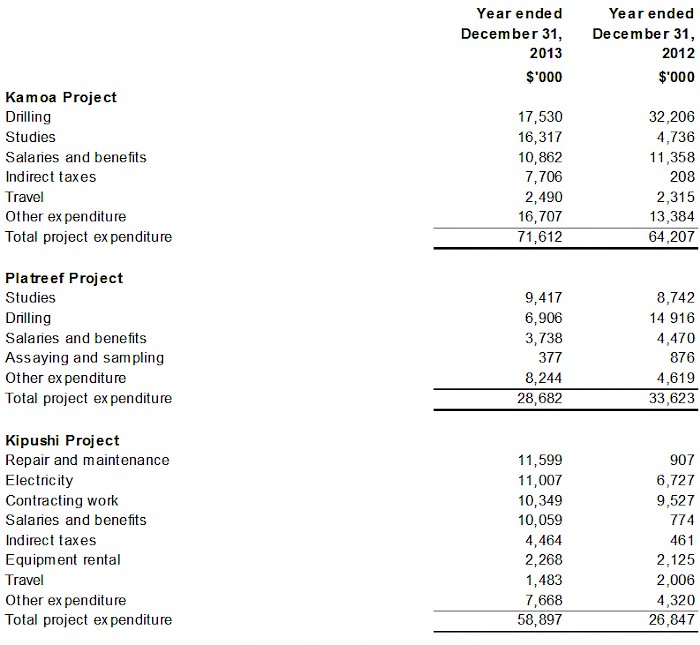

The increase in exploration and project expenditures resulted from increases in expenditure of $32.1 million at the Kipushi Project and $7.4 million at the Kamoa Project, which were partially offset by the decrease in expenditure at the Platreef Project by $4.9 million. There also was an increase in expenditure on regional exploration in the year ended December 31, 2013, compared to the same period in 2012. The main classes of expenditure on the company’s material projects in the two preceding financial years are set out in the following table:

Financial position as at December 31, 2013 vs. December 31, 2012

The company’s total assets decreased to $287.6 million as at December 31, 2013, from $726.7 million as at December 31, 2012. This mainly was due to the impairment of the Kipushi mineral property, goodwill and long term loan receivable of $252.3 million, $67.4 million and $25.1 million respectively, as well as a decrease in cash and cash equivalents of $116.0 million.

The company utilized $193.6 million of its cash resources in its operations and earned interest income of $1.3 million on cash balances. A total of $22.9 million was spent to acquire property, plant and equipment and other non-current assets.

Of the $22.9 million spent to acquire non-current assets, $2.6 million related to Ivanhoe’s share of the acquisition of an additional office building in London through Rhenfield Ltd., one of Ivanhoe’s joint operations. The remainder of the additions to property, plant and equipment mainly related to the procurement of assets required at the projects.

The company’s total liabilities decreased from $113.1 million as at December 31, 2012, to $60.3 million as at December 31, 2013. This was due to a decrease in deferred tax liability of $75.7 million and a decrease in advances payable to Gécamines of $11.2 million, offset by an increase in non-current borrowings of $19.9 million, as well as an increase in trade and other payables of $14.4 million.

The decrease in the deferred tax liability of $75.7 million was as a direct result of the tax recovery caused by the impairment of the Kipushi mineral property.

This release should be read in conjunction with Ivanhoe Mines’ audited 2013 Financial Statements and Management’s Discussion and Analysis report available at www.ivanhoemines.com and at www.sedar.com.

Qualified Person

Disclosures of a scientific or technical nature in this news release have been reviewed and approved by Stephen Torr, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of National Instrument 43-101. Ivanhoe Mines has prepared a NI 43-101-compliant technical report for each of the Kamoa Project, the Platreef Project and the Kipushi Project, which are available under the company’s SEDAR profile at www.sedar.com. These technical reports include relevant information regarding the effective date and the assumptions, parameters and methods of the mineral resource estimates on the Kamoa Project and Platreef Project cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the Kamoa Project, Platreef Project and Kipushi Project.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Bob Williamson +1.604.512.4856

South Africa: Jeremy Michaels +27.11.088.4300

Website www.ivanhoemines.com

Cautionary statement on forward-looking information

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws, including, without limitation, the timing and results of: (i) a development-study at the Kamoa Project that contemplates the declaration of a mineral reserve estimate (“Development Study”); (ii) grant of a mining right for the Platreef Project by May 2014; (iii) the creation of a Broad-Based Black Economic Empowerment structure for the Platreef Project; (iv) a pre-feasibility study (PFS) at the Platreef Project; (v) efforts to upgrade historical resource estimates at the Kipushi Project; (vi) the de-watering program at the Kipushi Project; and (vii) the commencement of the design and engineering of the main production shaft (Shaft #2) at the Platreef Project in Q2 2014. As well, the results of the preliminary economic analyses at the Platreef Project and the Kamoa Project also constitute forward-looking statements, including estimates of internal rates of return, net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, and estimates of capital and operating costs. Such statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

This release also contains references to estimates of Mineral Resources. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production from the company’s projects, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that ultimately may prove to be inaccurate. Mineral Resource estimates may have to be re-estimated based on: (i) fluctuations in copper, nickel, platinum-group elements (PGE), gold, zinc or other mineral prices; (ii) results of drilling, (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates; and (vi) the possible failure to receive required permits, approvals and licences.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, the factors discussed below and under “Risk Factors”, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this release.

The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors set forth in the “Risk Factors” section in the company’s MD&A.

English

English Français

Français 日本語

日本語 中文

中文