US$575 million funding positions Ivanhoe and joint-venture partners to fast-track additional hydropower upgrades to provide sufficient clean and renewable electricity for Kamoa-Kakula expansions to 19 million tonnes of ore per annum and beyond, including a smelter

Funding also allows for expansion and acceleration of the Western Foreland exploration program, in pursuit of the next world-scale copper discovery

TORONTO, CANADA – Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF) Co-Chairs Robert Friedland and Yufeng “Miles” Sun are pleased to announce a number of opportunities to accelerate planned expansions at the company’s world-scale portfolio of mining and exploration assets, that may be funded in part with the proceeds from the recently completed US$575 million, 2.50% convertible senior notes offering.

The high-priority opportunities include accelerating the Phase 3 expansion at the Kamoa-Kakula copper mine (beyond Phases 1 and 2) in the Democratic Republic of Congo (DRC). Fast-tracking additional hydropower upgrades in the DRC also is a high-priority opportunity to ensure abundant clean and renewable electricity for all subsequent expansions at Kamoa-Kakula. The management team also is evaluating a potential, state-of-the-art, direct-to-blister smelter that could bring numerous economic benefits and further reduce the project’s Scope 3 emissions.

The funding also will provide opportunities to expand and accelerate the copper exploration program on the company’s Western Foreland exploration licences, located in close proximity to the Kamoa-Kakula mining licence.

Mr. Friedland commented: “The proceeds from the offering strengthen the position of Ivanhoe Mines. The company will now look to further increase production at our Kamoa-Kakula copper joint-venture, and to accelerate the Phase 3 concentrator expansion from 7.6 million tonnes per annum to 11.4 million tonnes per annum. Together with our partner Zijin Mining, we have already accelerated the Phase 2 expansion to begin production in Q3 2022 and bring copper production to approximately 400,000 tonnes, or approximately 880 million pounds, per year. Our improved capital position now opens the distinct possibility of earlier development of the Phase 3 expansion, which would bring copper production at Kamoa-Kakula, up to approximately 530,000 tonnes, or approximately 1.2 billion pounds, per year.

“The success of the offering and new funding also gives us additional capital to accelerate and expand our already extensive exploration program on the 2,550-square-kilometre Western Foreland Project.

“We are delighted to welcome many new institutional investors to Ivanhoe Mines. Our company is about to make the long-fought transition from an explorer and developer, to becoming a major diversified mining company. It has been a remarkable journey for Kamoa-Kakula and Platreef; to grow from grassroots discoveries to imminently joining the ranks of the world’s largest producers of copper, platinum-group metals and nickel.

“We firmly believe that Ivanhoe Mines is uniquely positioned as both a deep value and growth equity story, with industry-leading Environmental, Social and Governance attributes. We trust our new investors share our optimism for the disruptive potential to realize additional world-scale copper discoveries on our Western Foreland Exploration Project that hosts geology identical to Kamoa-Kakula.

“Given the compelling projected rates of returns generated by the phased expansions at Kamoa-Kakula, and outstanding project economics at a discount rate of 8%, the coupon rate of 2.50% is an extremely attractive form of financing.

“At last year’s Mining Indaba conference in Cape Town, South Africa, as well as several other speaking venues, we made the point that it was irrational that Chile should enjoy a significantly lower discount rate than the Democratic Republic of Congo. This 2.50% coupon convertible bond financing is a testament to the growing recognition that Lualaba Province, formerly part of Katanga Province, is the best place in the world to find and develop the highest-quality, lowest-carbon-footprint copper mines that the global energy transition so desperately needs.”

Kamoa-Kakula’s Phase 1, 3.8-Mtpa concentrator and foundations for the Phase 2 concentrator.

Another view of Kamoa-Kakula’s Phase 1, 3.8-Mtpa concentrator (in red circle) is nearing completion, with the civil works for the second 3.8-Mtpa concentrator (Phase 2) advancing rapidly. Roofing of the concentrate storage shed (foreground) is underway.

Second stage (C2) commissioning at Kamoa-Kakula’s Phase 1 ball mills (in yellow) and the concrete foundations for the second set of ball mills for the Phase 2 concentrator (foreground), are underway.

Ivanhoe plans to report Kamoa-Kakula’s regular progress update for the month of March on Tuesday, April 6, after the international Easter holidays, allowing time to double check the assays and tonnages produced in the March reporting period.

Papi Seokolo, Technician, installing fiber optic cables in the Phase 1 concentrator plant.

Ivanhoe looking to fast-track additional hydropower upgrades in the DRC

The upgrading work at the Mwadingusha hydropower plant in the DRC is nearing completion with the synchronization of the first turbine achieved in December 2020. Commissioning and synchronization of the second and third turbines are underway. Electricity from all of Mwadingusha’s six turbines, with an upgraded output of 78 megawatts, is expected to be integrated into the national power grid in the second quarter of 2021.

The work is being conducted by engineering firm Stucky of Lausanne, Switzerland, under the direction of Ivanhoe Mines and Zijin Mining, in private-public partnership with the DRC’s state-owned power company, La Société Nationale d’Electricité (SNEL). Kamoa-Kakula’s agreement with SNEL with respect to the upgrading of the Mwadingusha plant provides Kamoa-Kakula with up to 100 megawatts (MW) from the national grid. Phases 1 and 2 at Kamoa-Kakula have an estimated, combined power consumption of between 85 MW and 100 MW.

Mr. Friedland commented: “The Democratic Republic of Congo is blessed with some of the world’s greatest hydropower potential. Hydro-generated electricity, potentially supplemented by solar power, with their virtues of being clean and renewable, are the best energy solutions to support our development priorities as we continue to look for ways to reduce our impact on the environment and produce the “green” copper the world energy transition requires. A 2020 independent audit of Kamoa-Kakula’s greenhouse gas intensity metrics performed by Hatch Ltd. of Canada, confirmed that the project will be among the world’s very lowest greenhouse gas emitters per unit of copper produced.

“The new funding will enable the expedited rehabilitation of additional sources of hydropower in the Democratic Republic of Congo to provide additional clean, reliable and renewable electricity for future phases of expansion at Kamoa-Kakula.”

Engineers completing the alternator assembly for Mwadingusha’s sixth generator unit.

Electricians from CEGELEC, a French engineering company, putting the finishing touches to Kakula’s 220-kilovolt main substation.

Kakula’s 220-kilovolt main substation and power line connecting to the grid.

Kamoa-Kakula joint venture is refining its longer-term downstream strategy

Kamoa Copper is considering the potential construction of a smelting complex for the production of blister and anode copper. A downstream processing facility has a compelling rationale, significantly reducing the overall volumes of copper concentrate shipped from the mine and the cost of transportation and logistics, export taxes and concentrate treatment charges, as well as producing sulphuric acid as a by-product. There is a strong demand and market for sulphuric acid in the DRC to recover oxide copper ores. DRC copper mines currently import significant volumes of sulphur and sulphuric acid for the treatment of oxide copper ores.

The Kamoa-Kakula 2020 preliminary economic assessment (PEA) included the construction of a smelter complex, based on Finland-based Outotec’s direct-to-blister furnace technology that is suitable for treating Kakula-type concentrates with relatively high copper/sulphur ratio, and low iron. China Nerin Engineering acted as the main engineering consultant with Outotec, providing design and costing for propriety equipment, including the direct blister furnace, waste heat boiler, and the slag cleaning electric furnace. The smelter design capacity is between 750,000 and 1 million tonnes per annum of concentrate feed, producing in excess of 400 ktpa copper in the form of blister and anode, with a capital cost in the region of US$600 million (100%-basis) to be jointly financed with Ivanhoe’s equal partner Zijin Mining, which is expected to be funded through a combination of internal cash flows and project-level debt.

The power requirement for the direct-to-blister smelter is approximately 35 megawatts, which may be supplied by additional hydropower investments in the DRC. This also would enable the Kamoa-Kakula Project to further reduce its Scope 3 carbon-equivalent emissions.

Further engineering studies underway at Kansoko, Kamoa North and Kakula West as potential sources of ore to accelerate Kamoa-Kakula’s future development phases

In September 2020, Ivanhoe announced the findings of an independent Integrated Development Plan (IDP) for the tier one Kamoa-Kakula Copper Project. The IDP included a PEA that evaluated an integrated, multi-staged development to achieve a production rate of 19 Mtpa, yielding a potential after-tax NPV8% of US$11.1 billion, IRR of 56% over a plus 40-year mine life, and payback of 3.6 years using a base case, long-term copper price of US$3.10.

The phased expansion scenario to 19 Mtpa, in five incremental phases of 3.8 Mtpa each, would position Kamoa-Kakula as the world’s second largest copper mining complex, with peak annual copper production of more than 800,000 tonnes. Phase 1, which has an estimated US$336 million (100%-basis, as at January 1, 2021) of capital costs to first production expected in July 2021, is nearing completion and Phase 2 is under development, with expected start-up in Q3 2022, and estimated direct capital costs of approximately US$600 million. Phases 1 and 2 combined are forecast to produce up to approximately 400,000 tonnes of copper metal per year (the current copper price is approximately US$9,000 a tonne).

Kamoa-Kakula is on track to have more than three million tonnes of high-grade and medium-grade ore stockpiled on surface, holding more than 125,000 tonnes of contained copper, prior to the planned start of processing in July 2021.

Given the current copper price environment, Ivanhoe, together with its partner Zijin, is exploring the acceleration of the Kamoa-Kakula Phase 3 concentrator expansion from 7.6 Mtpa to 11.4 Mtpa, which may be fed from expanded mining operations at Kansoko or new mining areas at Kamoa North (including the Bonanza Zone) and Kakula West.

Kamoa-Kakula has a massive resource base. At a 1% cut-off, the current, combined Indicated Mineral Resources for the Kamoa-Kakula Project total 1.387 billion tonnes grading 2.74% copper. At a 3% cut-off, the Indicated Mineral Resources total 423 million tonnes grading 4.68% copper.

Kamoa-Kakula’s Indicated Mineral Resource in different areas of the project, at a 3% cut-off:

- Kakula and Kakula West: 167 million tonnes at 5.50% copper.

- Kamoa: 256 million tonnes at 4.15% copper.

- Included within the Kamoa total:

- Kamoa North (including the Bonanza Zone): 12 million tonnes at 4.65% copper.

- Kamoa Far North: 5 million tonnes at 4.49% copper.

- Included within the Kamoa total:

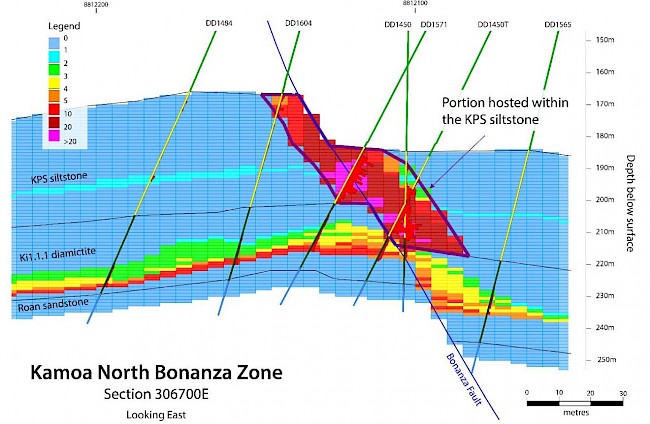

The Kamoa North Bonanza Zone was discovered in 2019 and represents the highest copper grades encountered to date on the Kamoa-Kakula mining licence. The ultra-high copper grades intercepted to date in the Kamoa North Bonanza Zone are believed to be the result of an east-west growth fault focusing copper-rich fluids to interface with both the typical mineralized horizon at Kamoa-Kakula and the overlying, highly-sulphidic and reduced Kamoa Pyritic Siltstone (KPS).

The Kamoa North Bonanza Zone contains an initial Indicated Mineral Resource estimate of 1.5 million tonnes grading 10.7%copper (162,000 tonnes of contained copper), at a 5% cut-off.

Other high-grade resources at Kamoa-Kakula are located at Kakula West, Kamoa North and Kamoa Far North. The recent Kiala Discovery, which is an extension of the Kamoa Far North copper zone on Ivanhoe’s 100%-owned Western Foreland licences to the north of the Kamoa-Kakula mining licence, also has the potential to host high-grade copper zones.

Chalcocite-rich core sample from a drill hole completed in 2020 at the Kamoa North Bonanza Zone. This sample graded 53% copper.

Section showing the ultra-high copper grades in the Kamoa North Bonanza Zone.

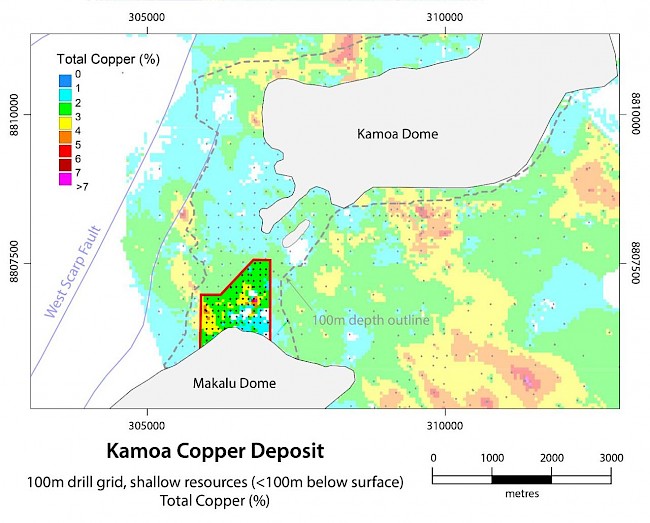

Based on the project’s current Indicated Mineral Resource, shallow resources less than 100 metres below surface within a 100-metre drill grid located between the Kamoa and Makalu domes, contain 13.5 million tonnes grading 2.58% copper (348,000 tonnes of contained copper), at a 1% cut-off.

These shallow resources have not been included in the mine planning for the Kamoa 2020 pre-feasibility study because higher-grade ore from the underground production schedule meets the current plant capacity requirements of Phases 1 and 2. The shallow resource represents an additional opportunity as a readily available alternative source of plant feed for Phase 3.

Shallow resources outlined in red drilled at a 100-metre grid spacing, north of the Kansoko Mine, between the Kamoa and Makalu domes.

Table 1. Indicated Mineral Resource (at 1% total copper cut-off grade) for the selected tightly-drilled, shallow zone.

| Classification | Tonnes (millions) |

Area (Sq. km) |

Copper Grade (%) |

Vertical Thickness (m) |

Contained Copper (kt) |

Contained Copper (billion lbs) |

|---|---|---|---|---|---|---|

| Indicated | 13.5 | 1.3 | 2.58 | 3.9 | 348 | 0.8 |

Notes to accompany the selected Indicated Mineral Resource table:

The tabulated Mineral Resource is a subset of the overall Kamoa Mineral Resource. Ivanhoe’s Vice President Resource, George Gilchrist, Professional Natural Scientist (Pr. Sci. Nat) with the South African Council for Natural Scientific Professions (SACNASP), estimated the Mineral Resources under the supervision of Gordon Seibel, a Registered Member (RM) of the Society for Mining, Metallurgy and Exploration (SME), who is the Qualified Person for the Mineral Resource estimate. The effective date of the estimate for Kamoa is 30 January 2020, and the cut-off date for drill data is 20 January 2020. The Mineral Resources at Kakula were estimated as of 10 November 2018 and the cut-off date for the drill data is 1 November 2018. On 10 February 2020, the inputs used in assessing reasonable prospects of eventual extraction and the drill data inputs were reviewed to ensure the estimate remained current. There are no changes to the estimate as a result of the review, and the estimate has an effective date of 10 February 2020. Mineral Resources are reported using the CIM 2014 Definition Standards for Mineral Resources and Mineral Reserves. Mineral Resources are reported on a 100% basis. Ivanhoe holds an indirect 39.6% interest in the Project. Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Mineral Resources at Kamoa are reported using a total copper (TCu) cut-off grade of 1% TCu and a minimum vertical thickness of 3 m. There are reasonable prospects for eventual economic extraction under assumptions of a copper price of US$3.00/lb.; employment of underground mechanized room-and-pillar and drift-and-fill mining methods; and that copper concentrates will be produced and sold to a smelter. Mining costs are assumed to be US$27/t, and concentrator, tailings treatment, and general and administrative costs (G&A) are assumed to be US$17/t. Metallurgical recovery for Kamoa is estimated to average 84% (86% for hypogene and 81% for supergene). At a 1% TCu cut-off grade, assumed net smelter returns for 100% of Mineral Resource blocks will cover concentrator, tailings treatment, and G&A costs.

Mineral Resources at Kakula are reported using a TCu cut-off grade of 1% TCu and a minimum vertical thickness of 3 m. There are reasonable prospects for eventual economic extraction under assumptions of a copper price of US$3.10/lb., employment of underground, mechanized, room-and-pillar and drift-and-fill mining methods, and that copper concentrates will be produced and sold to a smelter. Mining costs are assumed to be US$34/t, and concentrator, tailings treatment, and G&A costs are assumed to be US$20/t. Metallurgical recovery is assumed to average 83% at the average grade of the Mineral Resource. Ivanhoe is studying reducing mining costs using a controlled convergence room-and-pillar method. At a 1% TCu cut-off grade, assumed net smelter returns for 100% of Mineral Resource blocks will cover concentrator, tailings treatment and G&A costs.

Reported Mineral Resources contain no allowances for hanging wall or footwall contact boundary loss and dilution. No mining recovery has been applied.

Tonnage and contained-copper tonnes are reported in metric units, contained-copper pounds are reported in imperial units, and grades are reported as percentages.

Approximate drillhole spacings are 800 m for Inferred Mineral Resources and 400 m for Indicated Mineral Resources.

Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade and contained metal content.

Negotiations for the marketing of Kakula’s copper concentrates expected to be concluded in April

Kamoa-Kakula is nearing completion of agreements with respect to the sale of its copper concentrates during Phase 1 operations. Kakula is expected to produce an extremely high-grade, clean copper concentrate (containing over 55% copper) that will be highly coveted by smelters around the world. Metallurgical test work indicates that the Kakula concentrates contain extremely low arsenic levels by world standards – approximately 0.01%.

Ivanhoe reviewing options to accelerate exploration program on its Western Foreland licences adjacent to Kamoa-Kakula Copper Mine

In February 2021, Ivanhoe announced plans to soon commence an expansive 2021 exploration program on its Western Foreland exploration licences, which include approximately 2,550 square kilometres in close proximity to the Kamoa-Kakula Copper Project. Ivanhoe’s DRC exploration group is targeting high-grade Kamoa-Kakula-style copper mineralization through a regional exploration and drilling program on the Western Foreland exploration ground, which shares the same geological setting as Kamoa-Kakula. Ivanhoe Mines’ exploration licences cover the ground that Ivanhoe’s geological team considers to be the most prospective in the Western Foreland region.

The initial 2021 exploration program includes 40,000 metres of combined aircore and diamond drilling, airborne and ground-based geophysics, soil sampling and road construction. Field work will commence at the start of the 2021 dry season, which typically begins in April.

The initial 2021 budget is US$16 million, which may be expanded based on program results. Much of this year’s exploration will focus on more than 1,700 square kilometres of new, 100%-owned permits that were acquired in 2019 and received environmental certification in 2020. Ivanhoe’s exploration team now is working on a comprehensive, fast-tracked exploration program for the coming years.

“Given the identical geology between Kamoa-Kakula and our adjoining exploration ground, which is more than six times larger in area than the Kamoa-Kakula mining licence, the Western Foreland Exploration Project is unquestionably one of the most compelling copper exploration districts anywhere on this planet,” said Marna Cloete, Ivanhoe Mines’ President and CFO.

“We are in the privileged position of owning a massive land package with outstanding geological potential next door to our Kamoa and Kakula discoveries. We are highly confident that we have the secret sauce for additional exploration successes in our backyard. Our unique intellectual property reflects the accumulation of in-depth, proprietary geological insights gained by Ivanhoe’s world-renowned exploration team during 25 years of exploration in the region.”

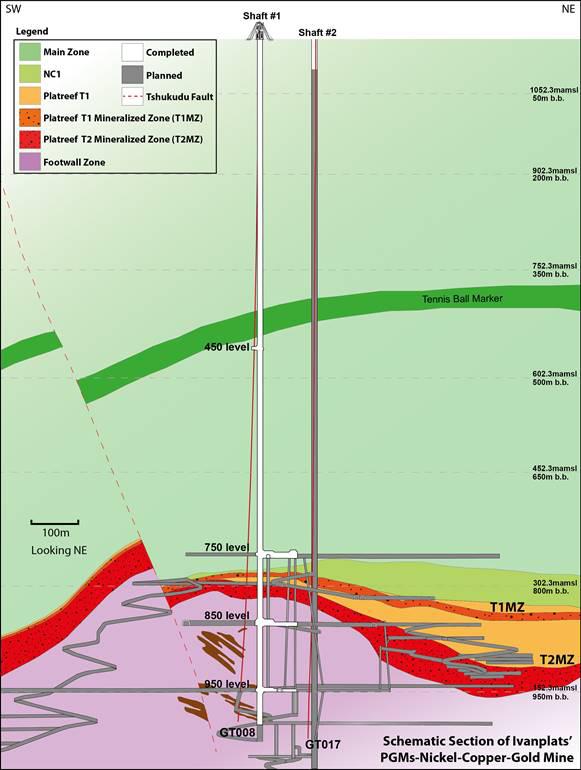

Accelerating sinking of Shaft 2 under consideration at the Platreef Mine in South Africa

In November 2020, Ivanhoe announced the findings of the Platreef IDP that included the 2020 feasibility study (FS), which contains an updated production schedule based on the current project status, costs and economic assumptions. The schedule for the 2020 FS is driven by the sinking of the project’s second, larger shaft (Shaft 2), where early works have commenced. The 2020 FS envisions Shaft 2 equipped for hoisting in 2025, allowing for first concentrate production in the latter half of the year. The initial capital cost for the Platreef 2020 FS is estimated at US$1.4 billion.

The Platreef IDP20 also includes the Platreef 2020 PEA, which is an alternate, phased development plan that fast-tracks Platreef into production. The plan uses the project’s first shaft (Shaft 1) for initial hoisting and mine development, with 825,000 tonnes per annum (tpa) of total rock hoisting capacity, of which 125,000 tonnes is allocated for development rock. The alternate plan envisions building an initial concentrator with a capacity of 770,000 tpa and could produce first concentrate in mid-2024.

“We currently are proceeding with the changeover of Shaft 1 to become the project’s initial production shaft. This work is expected to be fully funded by the US$420 million financing package announced last month, which also is expected fund an initial 770,000-tpa concentrator plant. The 2020 feasibility study demonstrates the significant efficiency of scale that will be achieved at Platreef when Shaft 2, one of the largest shafts in Africa, is completed,” said Ms. Cloete.

“We can now assess options for advancing the sinking of Shaft 2, which could accelerate future Platreef expansions funded from the project’s internally generated cash flows. Once Shaft 2 is completed, the mine is forecast to produce over 600,000 ounces per year of palladium, platinum, rhodium and gold; plus, significant amounts of sulfide nickel and copper for the clean-energy transformation.”

Schematic section of the Platreef Mine, showing Flatreef’s T1 and T2 thick, high-grade mineralized zones (in red and dark orange), underground development work completed to date in shafts 1 and 2 (in white) and planned development work (in gray).

Kipushi Mine redevelopment project and financing plan under review by Ivanhoe Mines and Gécamines

At the Kipushi Mine redevelopment project in the DRC, the draft feasibility study, and development and financing plan are being reviewed by Ivanhoe Mines together with its joint-venture partner, state-owned mining company Gécamines. The project is maintaining a reduced workforce to conduct maintenance activities and pumping operations.

Ivanhoe has made excellent progress in upgrading Kipushi’s underground infrastructure to allow for mining to quickly begin at the ultra-high-grade Big Zinc orebody. Resumption of production at the mine now requires the construction of a surface processing plant and other related surface production facilities.

Discussions are continuing with Gécamines to advance a new era of production at Kipushi, and it is anticipated that these discussions will be concluded with the finalization of the feasibility study and the agreement on the development and financing plan by mid-2021.

Qualified Persons and NI 43-101 Technical Reports

Disclosures of a scientific or technical nature regarding development scenarios at the Kamoa-Kakula Project in this news release have been reviewed and approved by Steve Amos, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Amos is not considered independent under NI 43-101 as he is the Head of the Kamoa Project. Mr. Amos has verified the technical data disclosed in this news release.

Disclosures of a scientific or technical nature regarding the Kamoa-Kakula mineral resources in this news release have been reviewed and approved by George Gilchrist, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Gilchrist is not considered independent under NI 43-101 as he is the Vice President, Resources of Ivanhoe Mines. Mr. Gilchrist has verified the other technical data disclosed in this news release.

Scientific and technical information regarding the Western Foreland Project in this news release has been reviewed and approved by Stephen Torr, P.Geo., Ivanhoe Mines’ Vice President, Project Geology and Evaluation, a Qualified Person under the terms of National Instrument 43-101. Mr. Torr is not independent of Ivanhoe Mines. Mr. Torr has verified the technical data disclosed in this news release.

Ivanhoe has prepared a current, independent, NI 43-101-compliant technical report for each of the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project, which are available under the company’s SEDAR profile at www.sedar.com:

- The Kamoa-Kakula Integrated Development Plan 2020 dated October 13, 2020, prepared by OreWin Pty Ltd., China Nerin Engineering Co., Ltd., DRA Global, Epoch Resources, Golder Associates Africa, KGHM Cuprum R&D Centre Ltd., Outotec Oyj, Paterson and Cooke, Stantec Consulting International LLC, SRK Consulting Inc., and Wood plc., covering the company’s Kamoa-Kakula Project;

- The Platreef Integrated Development Plan 2020 dated December 6, 2020, prepared by OreWin Pty Ltd., Wood plc (formerly Amec Foster Wheeler), SRK Consulting Inc., Stantec Consulting International LLC, DRA Global, and Golder Associates Africa, covering the company’s Platreef Project; and

- The Kipushi 2019 Mineral Resource Update dated March 28, 2019, prepared by OreWin Pty Ltd., MSA Group (Pty) Ltd., SRK Consulting (South Africa) (Pty) Ltd, and MDM (Technical) Africa Pty Ltd. (a division of Wood PLC), covering the company’s Kipushi Project.

These technical reports include relevant information regarding the effective dates and the assumptions, parameters and methods of the mineral resource estimates on the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the Platreef Project, Kipushi Project and Kamoa-Kakula Project.

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on advancing its three principal joint-venture projects in Southern Africa: the development of major new, mechanized, underground mines at the Kamoa-Kakula copper discoveries in the DRC and at the Platreef palladium-platinum-nickel-copper-rhodium-gold discovery in South Africa; and the extensive redevelopment and upgrading of the historic Kipushi zinc-copper-germanium-silver mine, also in the DRC.

Kamoa-Kakula is expected to begin producing copper concentrate in July 2021 and, through phased expansions, is positioned to become one of the world’s largest copper producers. Kamoa-Kakula and Kipushi will be powered by clean, renewable hydro-generated electricity and Kamoa-Kakula will be among the world’s lowest greenhouse gas emitters per unit of metal produced. Ivanhoe also is exploring for new copper discoveries on its wholly-owned Western Foreland exploration licences in the DRC, near the Kamoa-Kakula Project.

Information contacts

Investors: Bill Trenaman +1.604.331.9834 / Media: Matthew Keevil +1.604.558.1034

Cautionary statement on forward-looking information

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

Such statements include without limitation, the timing and results of: (i) statements regarding the US$575 million funding positions Ivanhoe and its joint-venture partners to fast-track additional hydropower upgrades to provide clean and renewable electricity for Kamoa-Kakula expansions to 19 million tonnes of ore per annum and beyond, including a smelter; (ii) statements regarding the funding also allows for expansion and acceleration of the Western Foreland exploration program; (iii) statements regarding further engineering studies underway at Kansoko, Kamoa North and Kakula West as potential sources of ore to accelerate Kamoa-Kakula’s future development phases; (iv) statements regarding negotiations for the marketing of Kakula’s copper concentrates expected to be concluded in April; (v) statements regarding Kamoa-Kakula’s Phase 3 expansion would bring annualized copper production at Kamoa-Kakula to well over 500,000 tonnes, or approximately 1.2 billion pounds, of copper per year; (vi) statements regarding Kamoa-Kakula is on track to have more than three million tonnes of high-grade and medium-grade ore stockpiled on surface, holding more than 125,000 tonnes of contained copper, prior to the planned start of processing in July 2021; (vii) statements regarding Kamoa-Kakula’s Phase 2 has as expected start-up in Q3 2022 and estimated direct capital costs of approximately US$600 million; (viii) statements regarding the new funding allows Ivanhoe to assess options for advancing the sinking of Shaft 2, in order to maintain the optionality to expand Platreef production more quickly beyond the first phase; (ix) statements regarding the Platreef Mine will be positioned to produce over 600,000 ounces per year of palladium, platinum, rhodium and gold; plus, significant amounts of sulfide nickel and copper for the clean-energy transformation; and (x) discussions are continuing with Gécamines to advance a new era of production at Kipushi, and it is anticipated that these discussions will be concluded with the finalization of the feasibility study and the agreement on the development and financing plan by mid-2021.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to, risks related to the company’s ability to consummate the Offering; the fact that the company’s management will have broad discretion in the use of the proceeds from the Offering; unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this release are based upon what management of the company believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this release.

The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors set forth below in the “Risk Factors” section in the company’s 2020 Year End MD&A and its current annual information form.

English

English Français

Français 日本語

日本語 中文

中文