The initial Kakula Mineral Resource estimate vaults the Kamoa-Kakula

Project into the ranks of the world’s 10 largest copper deposits.

Its copper grades are the highest of the top 10, by a wide margin.

Kakula Discovery remains open for significant expansion.

TORONTO, CANADA ‒ Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF) today announced its financial results for the third quarter ended September 30, 2016. All figures are in US dollars unless otherwise stated.

HIGHLIGHTS

- On October 12, 2016, Ivanhoe released an independently verified, initial Mineral Resource estimate for the extremely-high-grade Kakula Discovery on the Kamoa-Kakula Copper Project, in the Democratic Republic of Congo (DRC). Kakula’s Indicated Resources presently total 192 million tonnes at a grade of 3.45% copper, containing 14.6 billion pounds of copper. Inferred Resources total 101 million tonnes at a grade of 2.74% copper, containing 6.1 billion pounds of copper. Both estimates are at a 1.0% copper cut-off.

- The combined Kamoa-Kakula Indicated Mineral Resources now total 944 million tonnes grading 2.83% copper, containing 58.9 billion pounds of copper at a 1.0% copper cut-off grade and a minimum thickness of three metres. Kamoa-Kakula also has Inferred Mineral Resources of 286 million tonnes grading 2.31% copper and containing 14.6 billion pounds of copper, also at a 1.0% copper cut-off grade and a minimum thickness of three metres.

- With the addition of Kakula’s Mineral Resources, Wood Mackenzie – a prominent, international industry research and consulting group – has independently demonstrated that the Kamoa-Kakula Project is the largest copper discovery in Zambia and the DRC, making it the largest copper discovery ever made on the African continent. In addition, Wood Mackenzie’s research also shows that Kamoa-Kakula already ranks among the 10 largest copper deposits in the world.

- The Kakula Discovery remains open along trend to the northwest and the southeast, while the remainder of the Kakula Exploration Area remains untested. Ivanhoe expects that an updated Mineral Resource estimate for the Kakula Discovery will be issued in Q1 2017.

- With the initial Kakula estimate completed, Kamoa Copper has retained OreWin Pty. Ltd., of Australia, to prepare a preliminary economic assessment (PEA) for the development of the Kakula Deposit. The PEA, which is expected to be completed before the end of 2016, will concentrate on establishing the economic parameters of a potential four-million-tonne-per-year mining operation at Kakula.

- Recent bench-scale metallurgical flotation test work at XPS Consulting and Testwork Services laboratories in Falconbridge, Canada, achieved copper recoveries of 87.8% and produced a concentrate with an extremely high grade of 56% copper using the flowsheet developed during the Kamoa pre-feasibility study (PFS). The material tested was a composite of chalcocite-rich Kakula drill core, assaying 8.1% copper.

- Underground mine development at Kamoa’s planned initial mining area at Kansoko Sud is progressing ahead of plan and within budgeted costs. The twin declines, incorporating both a service and a conveyor tunnel, each have advanced more than 365 metres since the first excavation blast was conducted in May of this year. Development of the underground mine is designed to reach the high-grade copper mineralization at the Kansoko Sud deposit during the first quarter of 2017.

- On October 25, 2016, Ivanhoe received the third of five scheduled $41.2 million installment payments from a Zijin Mining Group Co., Ltd. subsidiary as part of a strategic co-development agreement under which Zijin acquired 49.5% of Ivanhoe’s majority stake in the Kamoa-Kakula copper discovery. Zijin agreed to pay $412 million for a 49.5% interest in Ivanhoe subsidiary Kamoa Holding Limited that presently owns 95% of the Kamoa-Kakula Project. The remaining $82.4 million is required to be paid in two further equal installments, every 3.5 months; the next installment is due February 8, 2017.

- Cordial negotiations are continuing between Ivanhoe, its Kamoa-Kakula joint-venture partner Zijin Mining and senior DRC government officials to complete the transfer to the DRC government of an additional 15% interest in the Kamoa-Kakula Project, on terms to be negotiated. Ivanhoe expects a mutually beneficial agreement to be achieved in the near future that will provide long-lasting, positive benefits to the DRC government and the Congolese people.

- On September 13, 2016, Ivanhoe announced that ongoing upgrading work financed by the company at the Mwadingusha hydropower plant has begun supplying an initial 11 megawatts (MW) of power to the DRC’snational grid. The Kamoa-Kakula Project began drawing power from the national grid on October 30, 2016.

- Also in the DRC, Ivanhoe is making good progress on a pre-feasibility study for the redevelopment of the Kipushi zinc-copper-germanium-lead-silver mine. The comprehensive study is being prepared by OreWin Pty. Ltd., of Australia, and will refine the company’s May 2016 preliminary economic assessment of Kipushi’s proposed redevelopment. The upgraded mine is expected to produce an annual average of 530,000 tonnes of zinc concentrate over a 10-year mine life at a total cash cost, including copper by-product credits, of approximately $0.54 per pound of zinc.

- At the Platreef platinum-palladium-gold-nickel-copper project in South Africa, sinking of Shaft 1 has reached a depth of more than 120 metres below surface. Shaft 1, which is expected to reach the Flatreef Deposit in late 2017, will provide development access into the deposit and will be utilized to fast-track production during the project’s first phase.

- The design has been completed for Platreef’s Shaft 2, which will have a total hoisting capacity of six million tonnes per annum and an internal diameter of 10 metres; construction is expected to begin in 2017. When completed, Shaft 2 is expected to be the main production shaft at the Platreef Mine.

- The feasibility study for the first phase of mine development at Platreef, which is being managed by DRA Global, is expected to be completed in March 2017.

- On August 29, 2016, Ivanhoe announced that its board of directors had authorized the company to seek strategic advice at the project and corporate levels to help address unsolicited interest that the company and its projects have received.

- On September 12, 2016, Standard and Poor’s (S&P) added Ivanhoe Mines to the S&P/TSX Composite Index, which is widely considered to be the leading indicator of broad market activity in Canadian equity markets.

- Ivanhoe Mines’ three projects achieved a combined 10.4 million work hours free of lost-time injuries (LTIF) by the end of the third quarter of 2016. Ivanhoe had recorded 178,500 LTIF hours at Platreef, 4.67 million hours at Kipushi and 5.59 million hours at Kamoa-Kakula to the end of Q3 2016.

Principal projects and review of activities

1. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project is owned by Ivanplats (Pty) Ltd, which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically-disadvantaged broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with a total of approximately 150,000 people, project employees and local entrepreneurs.Ivanplats reconfirmed its Level 3 status in its second verification assessment on a B-BBEE scorecard. A Japanese consortium of ITOCHU Corporation and its affiliate, ITC Platinum, plus Japan Oil, Gas and Metals National Corporation and JGC Corporation, owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper and gold mineralization in the Northern Limb of the Bushveld Igneous Complex, approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane in Limpopo Province. Since 2007, Ivanhoe has focused its exploration activities on defining and advancing the down-dip extension of its original discovery at Platreef, now known as the Flatreef Deposit, which is amenable to highly mechanized, underground mining methods. The Flatreef area lies entirely on the Turfspruit and Macalacaskop properties, which form part of the company’s mining right.

Health and safety at Platreef

The Platreef Project reached a total of 6,331,141 million hours in terms of the Mines Health and Safety Act and the Occupational Health and Safety Act (OHSA) by the end of September 2016. The project recorded 178,552 work hours free of lost-time injuries (LTIF) up until the end of Q3 2016.

Unfortunately, the project suffered a lost-time injury during the quarter. A rock-drill operator was injured, booked off and returned to work seven days after the incident. The Platreef Project continues to strive toward its workplace objective of an environment that causes zero harm to any employees, contractors, sub-contractors or consultants.

Shaft 1 construction

Shaft 1, with an internal diameter of 7.25 metres, will provide initial access to the ore body and enable the initial underground capital development to take place during the development of Shaft 2, the main production shaft.

Following the successful commissioning and licencing of the stage and kibble winders and ancillary equipment, the permanent sinking phase started in July 2016. The initial sinking phase was completed to 107 metres below surface and the main sinking phase has been initiated.

A sinking rate of 45 metres per month is expected during the main phase, which includes a 300-millimetre concrete shaft lining and inserts. The current level is approximately 130 metres below surface; stations will be developed at the 450-, 750-, 850- and 950-metre levels. The main sinking phase is expected to reach its projected, final depth of 980 metres below surface in 2018.

Figure 1. Shaft 1 headgear and other related surface infrastructure.

Project infrastructure

Work is complete on the internal substation, which has a capacity of five million volt-amperes (MVA). Construction is underway on the power transmission lines from Eskom, South Africa’s public electricity utility, which are expected to supply the electricity for shaft sinking. Back-up generators have been installed to ensure continued sinking operations during any interruptions in Eskom’s supply of electricity. The new transmission lines also are expected to provide power to an adjacent community near the Platreef Project, which will be a major, added community benefit.

Figure 2. Eskom’s 5MVA line to Platreef Project.

Other on-site work completed includes the storm-water pond management system, concrete batch plant, workshops, stores and an explosives magazine.

Construction of the intersection on the National Road (N11) highway for improved access to the Platreef mine site was completed in August 2016. The work included adding extra lanes to the existing roadway, exit and entry ramps, storm-water management and resurfacing of the intersection.

Platreef implementing a phased approach to a large, underground, mechanized mine

Ivanhoe plans to develop the Platreef Mine in phases. The initial annual rate of four million tonnes per annum (Mtpa) is designed to establish an operating platform to support future expansions. This is expected to be followed by a potential doubling of production to 8 Mtpa; and then a third expansion phase to a steady-state 12 Mtpa, which would establish Platreef among the largest platinum-group-metals mines in the world.

Ivanhoe has made good progress on advancing the feasibility study of the first phase, which began in August 2015. The study is being managed by DRA Global – with specialized sub-consultants including Stantec Consulting, Murray & Roberts Cementation, SRK, Golder Associates and Digby Wells Environmental – and is expected to be completed in the first half of 2017. There are expected to be opportunities to refine and modify the timing and capacities of subsequent phases of production to suit market conditions during the development and commissioning of the first phase.

Planned mining methods to incorporate highly productive, mechanized methods

The selected mining areas in the current mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below the surface. The main access to the Flatreef Deposit and ventilation system is expected to be through four vertical shafts. Shaft 2 will host the main personnel transport cage, material and ore-handling systems; Shafts 1, 3 and 4 will provide ventilation to the underground workings. Shaft 1, now under development, also will be used for initial access to the deposit and early underground development.

Planned mining of the Flatreef Deposit is expected to use highly productive, mechanized methods, including long-hole stoping and drift-and-fill mining. Mined-out areas will be backfilled with a paste mixture that utilizes tailings from the process plant and cement. The ore will be hauled from the stopes to a series of ore passes that will connect to a main haulage level at Shaft 2, from where it will be hoisted to surface for processing.

Bulk water and electricity supply

The Olifants River Water Resource Development Project (ORWRDP) is designed to deliver water to the Eastern and Northern limbs of South Africa’s Bushveld Complex. The project consists of the new De Hoop Dam, the raised wall of the Flag Boshielo Dam and related pipeline infrastructure that ultimately is expected to deliver water to Pruissen, southeast of the Northern Limb. The Pruissen Pipeline Project is expected to be developed to deliver water onward from Pruissen to the municipalities, communities and mining projects on the Northern Limb. Ivanhoe is a member of the ORWRDP’s Joint Water Forum. The Minister of Water & Sanitation has directed that the Trans-Caledon Tunnel Authority serve as the implementing agent for the outstanding phases of the ORWRDP scheme, which include the Phase 2B pipeline from Flag Boshielo Dam to Mokopane.

The Platreef Project’s water requirement for the first phase of development is projected to peak at approximately 10 million litres per day, which is expected to be serviced by the scheme. Ivanhoe also is investigating various alternative sources of bulk water, including an allocation of bulk grey-water from the local municipality.

The Platreef Project’s electricity requirement for a four-million-tonne-per-year underground mine, concentrator and associated infrastructure has been estimated at approximately 100 million volt-amperes. An agreement has been reached with Eskom for the supply of phase-one power. Ivanhoe chose a self-build option for permanent power that will enable the company to manage the construction of the distribution lines from Eskom’s Burutho sub-station to the Platreef Mine. The formulation of the self-build and electrical supply agreements are in progress.

Development of human resources and job skills

Work is progressing well on the further implementation of Ivanhoe’s Social and Labour Plan (SLP), to which the company has pledged a total of R160 million ($11 million) during the first five years, until November 2019. The approved plan includes R67 million ($4 million) for the development of job skills among local residents and R88 million ($6 million) for local economic development projects. Additional internal training is ongoing to provide members of the current workforce with opportunities to expand their skills.

Ivanplats recently concluded a one-year deal with the National Union of Mineworkers (NUM) for annual wage increases without any labour disruption or work stoppage during negotiations.

2. Kipushi Project

68%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kipushi copper-zinc-germanium-lead mine, in the Democratic Republic of Congo, is adjacent to the town of Kipushi and approximately 30 kilometres southwest of Lubumbashi. It is located on the Central African Copperbelt, approximately 250 kilometres southeast of the Kamoa-Kakula Project and less than one kilometre from the Zambian border. Ivanhoe acquired its 68% interest in the Kipushi Project in November 2011; the balance of 32% is held by the state-owned mining company, La Générale des Carrières et des Mines (Gécamines).

Health, safety and community development at Kipushi

The Kipushi Project achieved a total of 4,674,445 work hours free of lost-time injuries, equivalent to 1,512 days, to the end of Q3 2016. Malaria remains the most frequently occurring health concern at Kipushi; in Q3 2016, there was an average of 15 cases each month among employees, which is above the dry-season norm.

In an effort to reduce the incidence of malaria in the Kipushi community, a Water Sanitation and Health (WASH) program has been initiated in cooperation with the Territorial Administrator and the local community. The main emphasis of the program’s first phase is cleaning storm drains in the municipality to prevent the accumulation of ponded water, where malarial mosquitos breed.

The Fionet program to combat malaria has distributed 150 Deki electronic readers in addition to the original 37 readers provided to medical-service providers in Lualaba and Haut-Katanga provinces. The Deki technology provides automated reading of Rapid Diagnostic Tests to remove the human-error factor and prescription of unnecessary medication and uploads data to a cloud server for analysis by the Ministry of Health in planning malaria-control measures. Data gathered up until September 30, 2016, indicate that 18,818 patients have been tested using the Deki reader, with more than half those testing negative for malaria.

Project development and infrastructure

The Kipushi Mine, which had been placed on care and maintenance in 1993, flooded in early 2011 due to a lack of pump maintenance over an extended period. At its peak, water reached 851 metres below the surface. A major milestone was reached in December 2013 when Ivanhoe restored access to the mine’s principal haulage level at 1,150 metres below the surface. Since then, crews have been upgrading underground infrastructure to permanently stabilize the water levels.

Since completion of the drilling program, water levels have been lowered to approximately the 1,245-metre-level in Shaft 5. Engineering work has focused on upgrading of Shaft 5 conveyances and infrastructure, cleaning the shaft bottom to facilitate the installation of new hoist ropes, repairs and upgrades to the hoisting infrastructure and cleaning and stripping of the main pump station at the 1,200-metre-level.

Figure 3. Connecting discharge pipes to one of five pumps on the 1,200-metre-level.

Pre-feasibility study underway at Kipushi

A pre-feasibility study (PFS) now underway will further refine the optimal development scenario for the existing underground mine at Kipushi. Orewin Pty. Ltd., of Australia, has been appointed the main contractor and Golder Associates, MDM, SRK, DRA and Grindrod have been engaged to complete various aspects of the PFS.

The PFS will refine the positive preliminary economic assessment (PEA) for the redevelopment of the Kipushi Project that was announced on May 2, 2016. The PEA was prepared in compliance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Highlights of the PEA, prepared by OreWin and the MSA Group (Pty) Ltd, of Johannesburg, South Africa, include:

- After-tax net present value at an 8% real discount rate is $533 million.

- After-tax real internal rate of return is 30.9%.

- After-tax project payback period is 2.2 years.

- Leveraging existing surface and underground infrastructure significantly lowers the redevelopment capital compared to a greenfield development project, as well as the time required to reinstate production.

- Life-of-mine average planned zinc concentrate production of 530,000 dry tonnes per annum – with a concentrate grade of 53% zinc – is expected to rank Kipushi, once in production, among the world’s major zinc mines.

- Life-of-mine average cash cost of $0.54/lb. of zinc is expected to rank Kipushi, once in production, in the bottom quartile of the cash-cost curve for zinc producers globally.

3. Kamoa-Kakula Project

47%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kamoa-Kakula Copper Project, a joint venture between Ivanhoe Mines and Zijin Mining, is the largest copper discovery ever made on the African continent, with adjacent prospective exploration areas within the Central African Copperbelt in the Democratic Republic of Congo, approximately 25 kilometres west of the town of Kolwezi and about 270 kilometres west of Lubumbashi. Ivanhoe sold a 49.5% share interest in Kamoa Holding Limited, the company that presently owns 95% of Kamoa Copper SA, the owner of the Kamoa-Kakula Project, to Zijin Mining in December 2015 for an aggregate consideration of $412 million. In addition, Ivanhoe sold a 1% share interest in Kamoa Holding to privately-owned Crystal River Global Limited for $8.32 million – which Crystal River will pay through a non-interest-bearing, 10-year promissory note.

A 5%, non-dilutable interest in the Kamoa-Kakula Project was transferred to the DRC government on September 11, 2012, for no consideration, pursuant to the DRC Mining Code. Ivanhoe also has offered to transfer an additional 15% interest to the DRC government on terms to be negotiated. Constructive and cordial negotiations over the offer are continuing between Ivanhoe Mines, Zijin and senior DRC government officials. Ivanhoe expects a mutually beneficial agreement to be achieved in the near future that will provide long-lasting, positive benefits to the DRC government and the Congolese people.

Subsequent to the sales to Zijin and Crystal River, Ivanhoe owns an effective 47% of the Kamoa-Kakula Project, which will decrease to an effective 40% should the additional 15% interest be transferred to the DRC government.

Kamoa-Kakula already ranks among the 10 largest copper deposits in the world. On October 12, 2016, an initial Mineral Resource estimate for the extremely-high-grade Kakula Discovery was issued with an effective date of October 9, 2016. The combined Kamoa-Kakula Indicated Mineral Resources now total 944 million tonnes grading 2.83% copper, containing 58.9 billion pounds of copper at a 1.0% copper cut-off grade and a minimum thickness of three metres. Kamoa-Kakula now also has Inferred Mineral Resources of 286 million tonnes grading 2.31% copper and containing 14.6 billion pounds of copper, also at a 1.0% copper cut-off grade and a minimum thickness of three metres.

Kamoa-Kakula studies

The mining portion of the feasibility study for a four-million-tonne-per-annum (4 Mtpa) mine at Kansoko Sud is progressing well; the work is being carried out by a number of specialist consultants, including Stantec for the mine, DRA for the underground engineering, KGHM Cuprum for geotechnical and mining method, SRK for the mine geotechnical and Golder for geohydrology.

With the initial Kakula Mineral Resource estimate completed, Kamoa Copper has retained OreWin, of Adelaide, Australia, to prepare a preliminary economic assessment (PEA) for the development of the Kakula Deposit. The PEA, which is expected to be completed before the end of 2016, will concentrate on establishing the economic parameters of potential mining operations at Kakula, including capital and operating costs for an underground mine.

The PEA will draw on recommendations from the Kamoa 2016 pre-feasibility study, including the potential to increase production to up to four million tonnes per year from the proposed initial mining area.

Recent bench-scale metallurgical flotation test work carried out at XPS Consulting and Testwork Services laboratories in Falconbridge, Canada, achieved copper recoveries of 87.8% and produced a concentrate with an extremely high grade of 56% copper using the flowsheet developed during the Kamoa pre-feasibility study. The material tested was a composite of recent, chalcocite-rich Kakula drill core, assaying 8.1% copper.

Kakula mineralization is characteristically bottom loaded. The Resource estimate demonstrates that opportunities exist to mine Kakula at much higher lateral and vertical cut-offs than at Kamoa’s Kansoko Sud. The clear zonation and grades in the central high-grade core should provide sequencing opportunities to mine at significantly elevated grades.

Health and safety at Kamoa-Kakula

Health and safety remain key priorities for all people working at the Kamoa-Kakula Project, where an excellent safety record has been achieved. As of September 30, 2016, a total of 5,590,040 hours had been worked without a lost-time injury.

Exploration activities lead to a substantial expansion of the Kakula Discovery

On October 12, 2016 the company released the initial Resource estimate for its Kakula Discovery at the Kamoa-Kakula Project. Highlights of the initial Kakula Mineral Resource estimate, prepared by Ivanhoe Mines under the direction of Amec Foster Wheeler E&C Services Inc., of Reno, USA, in accordance with the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves are:

- Indicated Resources total 192 million tonnes at a grade of 3.45% copper, containing 14.6 billion pounds of copper at a 1% copper cut-off. At a 2% copper cut-off, Indicated Resources total 115 million tonnes at a 4.80% copper grade, containing 12.1 billion pounds of copper. At a higher cut-off of 3% copper, Indicated Resources total 66 million tonnes at a grade of 6.59% copper, containing 9.6 billion pounds of copper.

- Inferred Resources total 101 million tonnes at a grade of 2.74% copper, containing 6.1 billion pounds of copper at a 1% copper cut-off. At a 2% copper cut-off, Inferred Resources total 51 million tonnes at a 3.92% copper grade, containing 4.4 billion pounds of copper. At a higher cut-off of 3% copper, Inferred Resources total 27 million tonnes at a grade of 5.26% copper, containing 3.2 billion pounds of copper.

- The average true thickness of the selective mineralized zone (SMZ) at a 1% cut-off is 14.27 metres in the Indicated Resources area and 10.33 metres in the Inferred Resources area. At a higher 3% cut-off, the average true thickness of the SMZ is 5.91 metres in the Indicated Resources area and 5.15 metres in the Inferred Resources area.

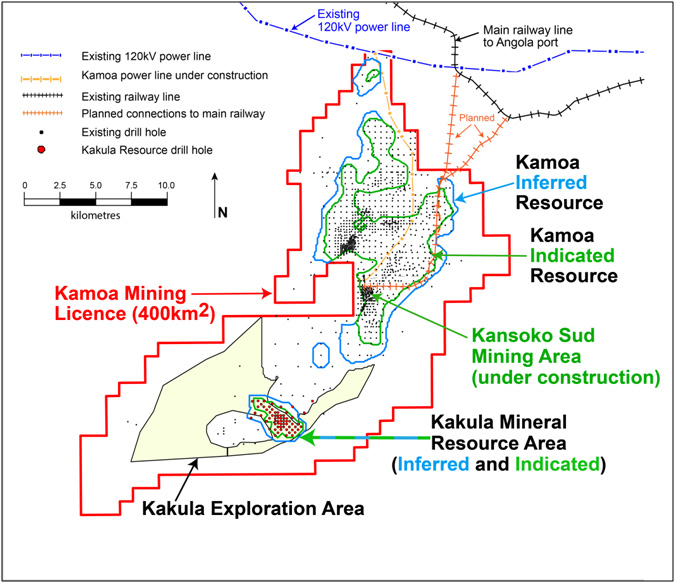

The Kakula Mineral Resource has been defined by drilling covering a total area of 8.7 square kilometres within the larger 60-square-kilometre Kakula Exploration Area, as shown in Figure 4. The total areal extent of Indicated Resource is 4.6 square kilometres at a 1% cut-off and the areal extent of the Inferred Resource is 3.3 square kilometres at a 1% cut-off. The average dip of the mineralized zone in the Indicated Resource area is 13 degrees, while the average dip is 16 degrees in the Inferred Resource area.

The high-grade copper mineralization remains open for significant expansion along trend to the northwest. The remainder of the Kakula Exploration Area remains untested (see Figure 4). The Mineral Resource estimate is based on the results from approximately 24,000 metres of drilling in 65 holes. An additional 13 holes totalling more than 7,000 metres have been completed and assay results are pending.

Indicated Resources are defined when the drill-hole spacing approximates a 400-metre grid, while Inferred Resources are defined when the drill-hole spacing approximates an 800-metre grid.

Figure 4. Kamoa-Kakula Project map showing location of Kakula exploration and initial Kakula Resource outline.

Updated Kamoa-Kakula Resource

Kakula’s estimated Resources are in addition to the Mineral Resources delineated elsewhere on the Kamoa mining licence that were disclosed by Ivanhoe Mines in a news release on February 23, 2016.

The combined Kamoa-Kakula Indicated Mineral Resources now total 944 million tonnes grading 2.83% copper, containing 58.9 billion pounds of copper at a 1.0% copper cut-off grade and a minimum true thickness of three metres.

Kamoa-Kakula now also has Inferred Mineral Resources of 286 million tonnes grading 2.31% copper and containing 14.6 billion pounds of copper, also at a 1.0% copper cut-off grade and a minimum true thickness of three metres.

Exploration activities lead to significant expansion of the Kakula Discovery and a substantial increase in the planned scope of exploration activities for 2016 and 2017

During Q3 2016, a total of 19,418 metres of exploration drilling was completed at the new Kakula Discovery. A total of 17,702 metres was completed by the drilling contractor, Titan Drilling SARL, utilizing up to six drill rigs; an additional 1,716 metres was completed using company-owned drill rigs. Included in the drilling program were holes drilled for geotechnical studies as well as PQ drill holes for comminution test work.

In addition to the exploration program, 185 metres were completed for dewatering of the Kansoko Sud declines. A total of 220 metres was completed by Titan Drilling for cover drilling within the declines ahead of the mine development. This program is planned to continue for the duration of the decline development. Drilling for 2016 now totals 33,443 metres.

As a result of the ongoing success of the Kakula drilling program and the extension along trend of the central, high-grade, chalcocite-rich core to the northwest and southeast at relatively shallow depths, the Kakula drilling program was expanded in Q2 by an additional 9,000 metres, to a total of 34,000 metres.

With the completion of the initial Mineral Resource estimate and the significance of the discovery now firmly established, the Kakula exploration program has been significantly expanded by a further 60,000 metres. The expanded program is planned to run through to the end of Q2 2017 and will consist of infill drilling, resource expansion and exploration of the Kakula Discovery area. The expanded drill program will be completed by a combination of contractor drilling and company-owned rigs.

Mine development

Byrnecut Underground Congo SARL progressed well with the decline development at Kansoko during Q3 2016 and is advancing ahead of schedule. The twin declines, incorporating both a service and a conveyor tunnel, each have advanced more than 365 metres.

Figure 5. Kansoko box-cut sump being cleaned and equipped.

Development of the underground mine is designed to reach the high-grade copper mineralization at the Kansoko Sud deposit during the first quarter of 2017. The development is ahead of schedule and within budgeted costs.

During the quarter, the settling and clean-water dams were constructed and equipped, and the first cross-cut between the declines was blasted. The box-cut sump also was cleaned and equipped with permanent pumps and a pump column.

Figure 6. Underground loading operation.

In parallel with the Kamoa 2016 PFS, an alternative mining method – controlled-convergence room-and-pillar mining, developed by Poland-based KGHM – was investigated for potential use on the Kansoko deposits. Given the thick, mineralized widths encountered to date in the Kakula drilling program, controlled-convergence room-and-pillar mining also will be investigated for potential use at Kakula.

To help advance the ongoing exploration and development of the Kakula Deposit, the Kamoa engineering team has identified a possible location for a box cut at Kakula. The design of the box cut is underway and the preparation of tender documents for the excavation, support and civil works is underway.

A 10-kilometre road from the Kamoa mine site to Kakula is under construction to facilitate access for drill rigs and construction equipment during the rainy season.

Figure 7. The new Kakula access road under construction.

Hydroelectric power plant upgrading project

The Mwadingusha Unit 1 repair work was completed in August 2016 and the official inauguration ceremony took place on September 7, 2016, at the Mwadingusha power station. The Mwadingusha G1 unit, supplying 11MW, was synchronized to the national interconnected grid on September 6, 2016.

Selected quarterly financial information

The following table summarizes selected financial information for the prior eight quarters. Ivanhoe had no operating revenue in any financial reporting period and did not declare or pay any dividend or distribution in any financial reporting period.

| 3 Months ended | ||||

| September 30, 2016 | June 30, 2016 | March 31, 2016 | December 31, 2015 | |

| $’000 | $’000 | $’000 | $’000 | |

| Exploration and project expenditure * | 7,769 | 8,233 | 6,917 | 10,271 |

| General administrative expenditure * | 4,213 | 3,657 | 3,693 | 5,833 |

| Share-based payments | 1,750 | 1,312 | 1,473 | 2,345 |

| Gain on partial sale of subsidiary | – | – | – | (357,671) |

| Re-measurement to fair value of the interest retained in joint venture | – | – | – | (376,148) |

| Finance income | (7,239) | (7,367) | (8,469) | (1,191) |

| Finance costs | 454 | 445 | 428 | 1,556 |

| Mark-to-market gain on revaluation of warrants | – | – | – | (429) |

| Loss (gain) from subsidiary held for partial sale | – | – | – | 755 |

| Total comprehensive loss (gain) attributable to: | ||||

| Owners of the Company | (1,860) | 6,568 | 4,203 | (717,213) |

| Non-controlling interest | 2,445 | 3,483 | 2,897 | 2,468 |

| Loss (profit) per share (basic and diluted) | 0.00 | 0.01 | 0.01 | (0.92) |

| 3 Months ended | ||||

| September 30, 2015 | June 30, 2015 | March 31, 2015 | December 31, 2014 | |

| $’000 | $’000 | $’000 | $’000 | |

| Exploration and project expenditure * | 8,553 | 9,009 | 12,918 | 21,178 |

| General administrative expenditure * | 4,430 | 1,323 | 5,859 | 8,987 |

| Share-based payments | 1,655 | 1,736 | 1,986 | 2,245 |

| Finance income | (273) | (445) | (295) | (288) |

| Finance costs | 36 | 48 | 34 | 382 |

| Mark-to-market gain on revaluation of warrants | (970) | (1,334) | (4,212) | (2,316) |

| Loss from subsidiary held for partial sale | (7,958) | 2,675 | 209 | 4,813 |

| Total comprehensive loss attributable to: | ||||

| Owners of the Company | 9,420 | 11,008 | 15,511 | 31,649 |

| Non-controlling interest | 3,439 | 3,564 | 3,498 | 5,434 |

| Loss per share (basic and diluted) | 0.01 | 0.01 | 0.02 | 0.05 |

Discussion of results of operations

Review of the three months ended September 30, 2016 vs. September 30, 2015

The company’s total comprehensive loss for Q3 2016 of $0.6 million was $12.3 million lower than for the same period in 2015 ($12.9 million). The decrease mainly was due to exchange gains on translation of foreign operations recognized in Q3 2016 of $10.8 million resulting from the strengthening of the South African Rand by 10% from June 30, 2016, to September 30, 2016.

Finance income increased by $7.0 million in Q3 2016 when compared to the same period in 2015 and mainly included interest earned on loans to the Kamoa joint venture that amounted to $4.2 million and deemed income on the purchase price receivable from the partial sale of the Kamoa-Kakula Project that amounted to $2.3 million.

Exploration and project expenditures for the three months ending September 30, 2016, amounted to $7.8 million and were $0.8 million less than for the same period in 2015 ($8.6 million).

With the focus at the Platreef Project on development, and the Kamoa-Kakula Project being accounted for as a joint venture, $7.5 million of the total $7.8 million exploration and project expenditure related to the Kipushi Project. Expenditure at the Kipushi Project decreased by $0.4 million compared to the same period in 2015.

Review of the nine months ended September 30, 2016 vs. September 30, 2015

The company’s total comprehensive loss of $17.7 million for the nine months ended September 30, 2016, was $28.7 million lower than for the same period in 2015 ($46.4 million). The decrease was due to exchange gains on translation of foreign operations of $10.4 million recognized in the first nine months of 2016 compared to an exchange loss on translation of foreign operations of $11.7 million for the same period in 2015.

The increase in finance income of $22.1 million, together with a $7.6 million decrease in exploration and project expenditure, also contributed to the decreased comprehensive loss for the period, but was partly offset by the company’s share of losses from its Kamoa joint venture that amounted to $15.8 million.

Finance income for the nine months ending September 30, 2016, amounted to $23.1 million, which was $22.1 million more than for the same period in 2015 ($1.0 million). The increase mainly was due to interest earned on loans to the Kamoa joint venture that amounted to $11.5 million for the nine months ending September 30, 2016, together with deemed finance income on the purchase price receivable from the partial sale of the Kamoa-Kakula Project, which amounted to $9.5 million.

Exploration and project expenditures for the nine months ending September 30, 2016, amounted to $22.9 million and were $7.6 million less than for the same period in 2015 ($30.5 million). The $4.1 million retrenchment costs incurred in 2015 relating to the closure of Ivanhoe’s regional exploration company in the DRC was the main reason for the decrease, together with reduced expenditure at the Kipushi Project.

With the focus at the Platreef Project on development and the Kamoa-Kakula Project being accounted for as a joint venture, $22.2 million of the total $22.9 million exploration and project expenditure related to the Kipushi Project. Expenditure at the Kipushi Project decreased by $2.8 million compared to the same period in 2015.

Financial positionas atSeptember 30, 2016 vs. December31, 2015

The company’s total assets decreased by $16.4 million, from $1,022.6 million as at December 31, 2015, to $1,006.2 million as at September 30, 2016. This resulted from the company utilizing its cash resources in its operations.

The remaining purchase price receivable due to the company as a result of the sale of 49.5% of Kamoa Holding decreased as the company received $93.1 million from Zijin during the nine months ending September 30, 2016. The present value of the remaining consideration receivable, net of transaction costs, was $113.4 million as at September 30, 2016. Ivanhoe received $41.2 million of the remaining consideration receivable subsequent to September 30, 2016, on October 25, 2016, and the next of the two remaining installments is due on February 8, 2017.

The company’s investment in the Kamoa Holding joint venture increased by $43.8 million from $412.0 as at December 31, 2015, to $455.8 million as at September 30, 2016, with the current shareholders funding the operations equivalent to their proportionate shareholding interest. At Kamoa-Kakula, the focus remained on development, together with an exploration program at the Kakula Discovery.

Property, plant and equipment increased by $37.7 million, with a total of $32.4 million being spent on project development and to acquire other property, plant and equipment, $29.7 million of which pertained to development costs of the Platreef Project.

The company utilized $24.8 million of its cash resources in its operations and earned interest income of $2.1 million on cash balances in the nine months ended September 30, 2016; the company’s portion of the Kamoa joint venture cash calls amounted to $47.1 million.

The company’s total liabilities decreased to $40.9 million as at September 30, 2016, from $43.8 million as at December 31, 2015. This mainly was due to the decrease in trade and other payables of $3.9 million.

Liquidity and capital resources

The company had $275.9 million in cash and cash equivalents as at September 30, 2016. Certain of the company’s cash and cash equivalents, having an aggregate value of $29.1 million, are subject to contractual restrictions as to their use and are reserved for the Platreef Project.

As at September 30, 2016, the company had consolidated working capital of approximately $401.9 million, compared to $424.6 million at December 31, 2015. The Platreef Project working capital is restricted and amounted to $28.8 million at September 30, 2016, and $53.2 million at December 31, 2015. Excluding the Platreef Project working capital, the resultant working capital was $373.1 million at September 30, 2016, and $371.4 million at December 31, 2015. The company believes it has sufficient resources to cover its short-term cash requirements. However, the company’s access to financing always is uncertain and there can be no assurance that additional funding will be available to the company in the near future.

On December 8, 2015, Zijin completed its investment in Ivanhoe’s Kamoa-Kakula Copper Project. Zijin, through a subsidiary company, has acquired a 49.5% interest in Kamoa Holding for a total of $412 million in a series of payments. Ivanhoe received an initial $206 million from Zijin on December 8, 2015 and a further $41.2 million on each of March 23, 2016, July 8, 2016, and October 25, 2016; the remaining $82.4 million is scheduled to be received in two equal installments, payable every 3.5 months from the previous installment. Upon closing of the transaction, each shareholder is required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest.

The company’s main objectives for 2016 at the Platreef Project remain the continuation of the phase one feasibility study and Shaft 1 construction. At Kipushi, the principal objective is the continued upgrading of mining infrastructure, now that the preliminary economic assessment has been successfully completed. At the Kamoa-Kakula Project, priorities are the continuation of drilling and the construction of the twin declines at Kamoa. The company expects to spend $14 million on further development at the Platreef Project; $8 million at the Kipushi Project; and $5 million on corporate overheads for the remainder of 2016. The company’s proportionate funding of the Kamoa-Kakula Project for Q4 2016 already has been advanced in September; however, funding for Q1 2017 is expected to be advanced in December 2016.

This release should be read in conjunction with Ivanhoe Mines’ unaudited, condensed, consolidated interim financial statements for the three and nine months ended September 30, 2016, and Management’s Discussion and Analysis (MD&A) report available at www.ivanhoemines.com and at www.sedar.com.

Qualified Person

Disclosures of a scientific or technical nature in this news release have been reviewed and approved by Stephen Torr, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Project Geology and Evaluation. Mr. Torr has verified the technical data disclosed in this release.

Ivanhoe has prepared a current independent, NI 43-101-compliant technical report for each of the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project, which are available under the company’s SEDAR profile at www.sedar.com. These technical reports include relevant information regarding the effective dates and the assumptions, parameters and methods of the mineral resource estimates on the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project cited in this release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this release in respect of the Platreef Project, Kipushi Project and Kamoa-Kakula Project.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Bob Williamson +1.604.512.4856

South Africa: Jeremy Michaels +27.82.939.4812

Website www.ivanhoemines.com

Forward-looking statements

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws, including without limitation, the timing and results of: (i) statements regarding Shaft 1 providing initial access for early underground development at the Flatreef Deposit; (ii) statements regarding the station development of Shaft 1 at the 450, 750, 850 and 950 metre levels; (iii) statements regarding the sinking of Shaft 1, including that a sinking rate of 45 metres per month is expected; statements regarding Shaft 1 reaching the planned, final depth at 980 metres below surface in 2018; (iv) statements regarding the timing of the commencement of Shaft 2 development, including that construction is to commence in 2017; (v) statements regarding the operational and technical capacity of Shaft 1; (vi) statements regarding the internal diameter and hoisting capacity of Shaft 2; (vii) statements regarding the Company’s plans to develop the Platreef Mine in three phases: an initial annual rate of four million tonnes per annum (Mtpa) to establish an operating platform to support future expansions; followed by a doubling of production to eight Mtpa; and then a third expansion phase to a steady-state 12 Mtpa; (viii) statements regarding the planned underground mining methods of the Platreef Project; (ix) statements regarding peak water use of 10 million litres per day at the Platreef Project and development of the Pruissen Pipeline Project; (x) statements regarding the Platreef Project’s electricity requirement of 100 million volt-amperes; (xi) statements regarding the completion of a feasibility study at the Platreef Project in the first half of 2017; (xii) statements regarding the declines having been designed to intersect the high-grade copper mineralization in the Kansoko Sud area during the first quarter of 2017; (xiii) statements regarding the timing, size and objectives of drilling and other exploration programs for 2016 and future periods; (xiv) statements regarding the expectation to have a preliminary economic assessment (PEA) of the Kakula Discovery at the Kamoa-Kakula Project completed before the end of 2016; (xv) statements regarding the implementation of Social and Labour Plan at the Platreef Project; (xvi) statements that the expanded 60,000 metres of drilling at the Kakula Discovery will run through Q2 2017; and (xvii) statements regarding expected further expenditure in 2016 of $14 million on further development at the Platreef Project; $8 million at the Kipushi Project; and $5 million on corporate overheads – as well as its proportionate funding of the Kamoa-Kakula Project for Q1 2017 expected to be advanced in December 2016.

Such statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of this news release.

As well, the results of the pre-feasibility study of the Kamoa-Kakula Project, the pre-feasibility study of the Platreef Project and the preliminary economic assessment of the Kipushi Project constitute forward-looking information, and include future estimates of internal rates of return, net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs and the size and timing of phased development of the projects. Furthermore, with respect to this specific forward-looking information concerning the development of the Kamoa-Kakula, Platreef and Kipushi Projects, the company has based its assumptions and analysis on certain factors that are inherently uncertain. Uncertainties include: (i) the adequacy of infrastructure; (ii) geological characteristics; (iii) metallurgical characteristics of the mineralization; (iv) the ability to develop adequate processing capacity; (v) the price of copper, nickel, zinc, platinum, palladium, rhodium and gold; (vi) the availability of equipment and facilities necessary to complete development; (vii) the cost of consumables and mining and processing equipment; (viii) unforeseen technological and engineering problems; (ix) accidents or acts of sabotage or terrorism; (x) currency fluctuations; (xi) changes in regulations; (xii) the compliance by joint venture partners with terms of agreements, (xiii) the availability and productivity of skilled labour; (xiv) the regulation of the mining industry by various governmental agencies; and (xiv) political factors.

This news release also contains references to estimates of Mineral Resources and Mineral Reserves. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Estimates of Mineral Reserves provide more certainty but still involve similar subjective judgements. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production from the company’s projects, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that ultimately may prove to be inaccurate. Mineral Resource or Mineral Reserve estimates may have to be re-estimated based on: (i) fluctuations in copper, nickel, zinc, platinum group elements (PGE), gold or other mineral prices; (ii) results of drilling; (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates and/or changes in mine plans; (vi) the possible failure to receive required permits, approvals and licenses; and (vii) changes in law or regulation.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, the factors discussed below and under “Risk Factors”, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors set forth in the “Risk Factors” section and elsewhere in the company’s MD&A.

English

English Français

Français 日本語

日本語 中文

中文