TORONTO, CANADA – Ivanhoe Mines (TSX: IVN) today announced its financial results for the three and nine months ended September 30, 2013. All figures are in US dollars unless otherwise stated.

HIGHLIGHTS

- On August 28, the company changed its name from Ivanplats to Ivanhoe Mines to reflect its commitment to development as a leading international multi-commodity mining company. The trading symbol on the Toronto Stock Exchange was changed to IVN.

- In a major advance, Ivanhoe Mines announced on September 9 that it had received approval from the South African government’s Department of Mineral Resources (DMR) to proceed with the sinking of an 800-metre deep bulk-sample shaft to access the underground Flatreef platinum, palladium, nickel, copper, gold and rhodium discovery at its Platreef Project in South Africa’s Bushveld Complex. Contractor mobilization and site preparation for the 7.25-metre-diameter bulk-sample shaft is expected to start in December 2013.

- On October 4, the company closed a C$108 million non-brokered financing through the issuance of 54 million new Class A common shares at C$2.00 per share. Robert Friedland, Ivanhoe Mines’ Executive Chairman, subscribed for C$25 million of the offering, effectively proportionate to his holding in the company.

- On October 16, Ivanhoe Mines reported an unprecedented 90-metre intersection of 4.51 grams of platinum, palladium, rhodium and gold per tonne, plus 0.37% nickel and 0.20% copper, at its Flatreef underground discovery at the Platreef Project. The drill intercept included a 41-metre section grading 6.88 grams of platinum, palladium, rhodium and gold per tonne, plus 0.51% nickel and 0.21% copper.

- At the Kamoa copper discovery in the Democratic Republic of Congo (DRC), independent engineers are finalizing a revised Preliminary Economic Assessment (PEA) to deliver the best balance of a lower initial capital cost and shortest time to first production, while maintaining the company’s commitment and momentum toward a major mine, mill and smelting operation.

- Elsewhere in the DRC, dewatering of the existing mine workings is continuing to progress at the Kipushi zinc-copper project. The current water level is 1,113 metres below surface, a reduction of 127 metres since the end of June. Ivanhoe Mines’ initial goal is to successfully remove water down to the mine’s 1,150-metre level by the end of December 2013. Ivanhoe Mines then will be in a position to begin an aggressive underground diamond-drilling program designed to confirm and expand the mine’s high-grade resources.

Principal Projects and Review of Activities

Ivanhoe Mines with offices in Canada, the United Kingdom and South Africa, is advancing and developing its three principal projects:

- The Kamoa copper discovery in a previously unknown extension of the Central African Copperbelt in the DRC’s Province of Katanga.

- The Platreef Discovery of platinum, palladium, nickel, copper, gold and rhodium on the Northern Limb of the Bushveld Complex in South Africa.

- The historic, high-grade Kipushi zinc-copper mine, also on the Copperbelt in the DRC and now being dewatered and upgraded to support a future return to production of zinc, copper and other metals following a care-and-maintenance program conducted between 1993 and 2011.

Ivanhoe Mines also is evaluating other opportunities as part of its objective to become a broadly based international mining company.

Kamoa Copper Project (95%-owned by Ivanhoe Mines)

Copper discovery and mine development planning

Democratic Republic of Congo (DRC)

The Kamoa Project is a newly discovered, very large, stratiform copper deposit with adjacent prospective exploration areas within the Central African Copperbelt, approximately 25 kilometres west of the town of Kolwezi and about 270 kilometres west of the Katangan provincial capital of Lubumbashi. Ivanhoe Mines holds its 95% interest in the Kamoa Project through a subsidiary company, African Minerals Barbados Limited SPRL (AMBL). A 5%, non-dilutable interest in AMBL was transferred to the DRC government on September 11, 2012, for no consideration, pursuant to the DRC Mining Code. Ivanhoe Mines also has offered to sell an additional 15% interest to the DRC government on commercial terms to be negotiated.

Kamoa is the world’s largest undeveloped, high-grade copper deposit. On January 17, 2013, an updated mineral resource estimate was announced that increased Kamoa’s Indicated Mineral Resources to a total of 739 million tonnes grading 2.67% copper and containing 43.5 billion pounds of copper. This was an increase of 115% over the previous September 2011 estimate of 348 million tonnes grading 2.64% copper and containing 20.2 billion pounds of copper. Both estimates used a 1% copper cut-off grade and a minimum vertical mining thickness of three metres.

In addition to the Indicated Mineral Resources, the updated estimate included Inferred Mineral Resources of 227 million tonnes grading 1.96% copper and containing 9.8 billion pounds of copper, also at a 1% copper cut-off grade and a minimum vertical mining thickness of three metres.

The latest Kamoa resource estimate was prepared by AMEC, based on core from 555 holes drilled to December 10, 2012, in accordance with CIM Guidelines and directed by AMEC’s Technical Director Dr. Harry Parker.

At a higher, 2% copper cut-off grade, Kamoa’s Indicated Resources now total 550 million tonnes grading 3.04% copper and containing 36.9 billion pounds of copper. At the 2% cut-off, Kamoa also has 93 million tonnes of Inferred Resources grading 2.64% copper, which contain an estimated 5.4 billion pounds of copper.

Phased approach to the development of a large mine and smelter

The project team is finalizing an updated PEA that will reflect a two-phased development approach to the Kamoa Project. The first phase of mining would target high-grade copper mineralization from shallow, underground resources to yield a high-value concentrate. Initial mill feed would come from Kansoko Sud and lead into the Centrale area of Kamoa’s gently-dipping mineralized zones that collectively contain estimated Indicated Resources of 224 million tonnes grading 3.85% copper (at a 3.0% copper cutoff and a minimum three-metre vertical mining thickness), as detailed in the March 2013 Kamoa Technical Report. The second phase would entail a major expansion of the mine and mill and construction of a large smelter.

The PEA, expected to be completed later this year, will be followed by a comprehensive Development Study, projected to be completed in the second half of next year, which the company expects will declare an initial estimate of mineral reserves.

Building of underground mine-access decline at Kamoa planned to begin early next year

Preparations are underway to start the first mine-access decline at Kamoa. The decline would provide access to the high-grade, near-surface copper resources that would be targeted for the planned first phase of production using the room-and-pillar mining method.

Initial start-up could involve concentrate sales pending construction of smelter

The start-up scenario to be examined in the PEA and Development Study will consider the sale of copper concentrates as an interim measure pending Ivanhoe’s completion of its planned smelter in the vicinity of the Kamoa Project.

Additional power to develop optimum-sized smelter

In 2011, Ivanhoe and DRC’s state-owned power company, La Société Nationale d’Electricité (SNEL), agreed to upgrade two existing hydroelectric power plants, Mwadingusha and Koni, to feed up to 113 megawatts into the national power supply grid. SNEL would provide the Kamoa Project with 100 megawatts from the grid, which would be sufficient to operate the initial mine. In April 2013, SNEL signed a further memorandum of understanding with Ivanhoe to upgrade a third hydroelectric power plant – Nzilo 1 – that is projected to provide approximately an additional 100 megawatts to the grid upon its completion, entitling Kamoa to receive another 100 megawatts to be supplied from the grid. A combined total of 200 megawatts from the grid would provide sufficient power for Kamoa’s smelter and future mine expansions.

Additional studies are underway to advance the geotechnical, engineering and metallurgical understanding of Kamoa in support of the Development Study. Stantec Inc., of Arizona, USA, is preparing the mine plan based on the mineral resource estimate contained in the March 2013 Kamoa Technical Report. Further hydrological drilling and testing is scheduled for the first half of 2014 to improve Kamoa’s hydrological models.

The Phase 5 metallurgical testwork campaign is underway at XPS in Sudbury, Canada, and Mintek in Johannesburg, South Africa. The results will be used to conduct flow-sheet optimization trade off studies prior to starting the Development Study process design. Drilling is underway in the Kansoko Sud and Kansoko Centrale areas to obtain samples for the next phase of testwork. The two areas constitute the bulk of the material to be mined during the first phase of development and are important for the phase-one concentrator design.

Drilling during the third quarter focused on requirements for resource evaluation and metallurgical studies; Ivanhoe presently has seven drill rigs on site. Drilling totalling 13,513 metres was completed for the quarter in 79 holes; 8,632 metres were drilled for resource evaluation on the Kansoko Sud and Kansoko Centrale areas, and 4,048 metres were drilled for metallurgical testing in the Kansoko Sud, Kamoa Sud and Kansoko Centrale areas. In addition, 357 metres of variability testing, 295 metres of hydrogeology drilling and 181 metres of geotechnical drilling also were completed.

Platreef Project (90%-owned by Ivanhoe Mines)

Platinum-group elements, nickel and copper discovery and mine development planning

South Africa

Development work focused on mineral resources contained in Flatreef underground discovery

The Platreef Project, in South Africa’s Limpopo province, is 90%-owned by Ivanhoe Mines and 10%-owned by a Japanese consortium of Itochu Corporation; Japan Oil, Gas and Metals National Corporation (JOGMEC) and JGC Corporation. The Japanese consortium’s 10% interest in the Platreef Project was acquired in two tranches for a total investment of $290 million.

The Platreef Project includes the underground Flatreef Deposit of thick, platinum-group elements, nickel and copper mineralization in the Northern Limb of the Bushveld Complex, approximately 280 kilometres northeast of Johannesburg.

In the Northern Limb, such mineralization primarily is hosted within the Platreef, a mineralized sequence that is traced more than 30 kilometres along strike. Ivanhoe’s Platreef Project, within the southern sector of the Platreef, is comprised of three contiguous properties: Turfspruit, Macalacaskop and Rietfontein. The northernmost property, Turfspruit, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of properties and mining operations.

Since 2007, Ivanhoe has focused its exploration activities on defining and advancing the down-dip extension of its original Platreef discovery, now known as the Flatreef Deposit, that potentially is amenable to highly mechanized underground mining methods. The Flatreef area lies entirely on the Turfspruit and Macalacaskop properties.

In June 2013, Ivanhoe filed a Mining Right Application (MRA) for the Platreef Project with the DMR. A Mining Right allows a company to mine and process minerals optimally from the mining area for a period of 30 years, which may be extended upon application.

The Flatreef Mineral Resource, with a strike length of six kilometres, predominantly lies within a flat to gently dipping portion of the Platreef mineralized belt at relatively shallow depths of approximately 700 to 1,100 metres below surface.

The Flatreef Deposit is characterized by its very large vertical thicknesses of high-grade mineralization and a platinum-to-palladium ratio of approximately 1:1, which is significantly higher than other recent PGM discoveries on the Bushveld’s Northern Limb. The grade shells used to constrain mineralization in the Flatreef Indicated Resource area have average true thicknesses of approximately 24 metres at a 2.0-gram-per-tonne (g/t) 3PE (platinum-palladium-gold) cut-off grade, with an equivalent average resource grade of 4.1 g/t 4PE (platinum-palladium-gold-rhodium), 0.34% nickel and 0.17% copper. Flatreef’s Indicated Mineral Resources of 214 million tonnes contain an estimated 28.5 million ounces of platinum, palladium, gold and rhodium, 1.6 billion pounds of nickel and 0.8 billion pounds of copper.

At the same cut-off of 2.0 g/t 4PE, the latest Flatreef estimate includes Inferred Mineral Resources of 415 million tonnes grading 3.5 g/t 4PE, 0.33% nickel and 0.16% copper, containing an estimated additional 47.2 million ounces of platinum, palladium, gold and rhodium, 3.0 billion pounds of nickel and 1.5 billion pounds of copper. Inferred mineral resource estimates, under the CIM guidelines, do not have demonstrated economic viability and may never achieve the confidence to be mineral reserve estimates or to be mined.

Unprecedented 90-metre intersection of high-grade PGMs, plus nickel and copper

Ivanhoe intersected mineralization containing 4.51 grams per tonne of platinum, palladium, rhodium and gold (4PGE) over 90.64 metres at a 1.0 g/t 3PE cut-off in a recently drilled hole at the underground Flatreef Deposit. The same hole also included a 40.79-metre section grading 6.88 grams per tonne 4PGE at a 3g/t 3PE cut-off and additional nickel and copper mineralization grading 0.37% nickel and 0.20% copper, plus a platinum-to-palladium ratio of approximately 1:1, over the entire 90-metre intersection.

The gentle dips in the Flatreef Discovery area mean that the drilled thickness approximates true thickness.

The recent Hole TMT006 was collared approximately 360 metres south of the location of the bulk-sample shaft. The high-grade mineralization started at a depth of 803 metres below surface and continued to a depth of 894 metres. The two mineralized reefs that comprise the uppermost mineralized portion of the Flatreef Discovery – T1M and T2 – are adjacent to each other in this area, which is a contributing factor to the size of the intersection.

Previous drilling by Ivanhoe at the Flatreef Discovery produced combined intercepts of the T1M and T2 zones that averaged 24 metres in thickness. This is exceptional for the Bushveld Complex, where many underground platinum mines have averaged thicknesses of 0.4 to 1.5 metres.

Within the project area, the separation between the T1M and T2 reefs varies considerably, with a general thinning from east to west. The separation between the T1M and the T2 reefs is controlled by the thickness of the T1 feldspathic pyroxenite that can vary from a few metres to more than 100 metres and appears to be controlled by syn-intrusive structures. Drill holes adjacent to TMT006 also show unusually thick mineralized intersections varying from 21.0 metres to 48.8 metres. What makes TMT006 exceptional is the extent and continuity of the mineralization that extends into the footwall of the T2 reef.

Hole TMT006 is one of seven metallurgical and geotechnical holes drilled since June 2013 and for which Ivanhoe has received assay results. Assays from the initial seven holes are listed in a table in Ivanhoe’s October 16, 2013 news release available on www.ivanhoemines.com and www.sedar.com.

Bulk-Sample Right received and 3-D seismic survey completed

After filing the Platreef MRA in June 2013, the company began the Environmental and Social Impact Assessment (ESIA) process. The ESIA scoping report was publicly issued for review and comment in July 2013. Various questions and comments were received from interested and affected parties. The final ESIA and Environmental Management Plan (EMP) must be filed with the DMR before February 2014. The approval of the EMP is a prerequisite to MRA approval.

The bulk-sample application was approved during September 2013 and the company undertook a 3-D seismic survey in October that provided Ivanhoe’s engineers with high-resolution imaging of the Flatreef mineralized zones ahead of the planned mining development.

Terrace and collar designs for the 7.25-metre-diameter bulk-sample shaft (Shaft #1) have commenced and contractor mobilization and site preparation is expected to start in December. Approximately 250 contract employees will be working on the shaft once the sinking work begins. The vertical shaft will extend to a depth below surface of 800 metres and facilitate the collection of a mineralized bulk sample in the second half of 2015 to complete the company’s development assessment of the Flatreef.

Shaft #1, including some initial lateral underground development work, is expected to cost US$80 million (ZAR818 million), which is fully funded from the approximately US$180 million in dedicated funds remaining in Ivanhoe’s treasury from the US$280 million received in 2011 for the sale of an 8% interest in the Platreef Project to the Japanese consortium of Itochu Corporation, JOGMEC and JGC Corporation.

Ivanhoe is working with the Japanese consortium on an integrated Flatreef development plan based on an exclusively underground mining operation of up to 12 million tonnes per year utilizing multiple shafts. The study is expected to be completed early next year.

Drilling during the third quarter totalled 16,464 metres. Ongoing diamond drilling at the Platreef Project is being conducted by 14 rigs, nine of which are drilling comminution, metallurgical and geotechnical holes and five are drilling exploration holes targeting a potential contiguous, high-grade mineralized zone to the southeast of Flatreef’s Zone 1. The exploration drilling program is focused on delineating an initial Inferred Resource on the target – Ga-Madiba – that is believed to represent the southern continuation of the shallow Flatreef underground deposit.

Since drilling resumed at the Platreef Project in June 2013, a total of 24,759 metres have been drilled in 22 holes and 11 deflections, representing approximately 70% of the planned 2013 development drilling program. Ivanhoe expects to complete the 2013 drilling program in mid-December.

Kipushi Project (68%-owned by Ivanhoe Mines)

Upgrading of historic zinc-copper mine

Democratic Republic of Congo (DRC)

The Kipushi Project, also located in the DRC’s Katanga province, southeast of the company’s Kamoa Project, is adjacent to the town of Kipushi and approximately 30 kilometres southwest of the provincial capital of Lubumbashi. Ivanhoe acquired its 68% interest in the Kipushi Project in November 2011; the balance of 32% is held by La Générale des Carrières et des Mines (Gécamines), the DRC’s state-owned mining company.

Dewatering work succeeding in exposing existing mine workings for upgrading

Dewatering of the existing mine workings is continuing. The water level was pumped down to 1,073 metres at the end of Q3 2013, was 1,100 metres as of November 1, 2013, and currently has been reduced to 1,113 metres below surface – leaving only a further 37 metres to be cleared before the main working level at 1,150 metres can be accessed and upgraded.

Ivanhoe’s initial goal is to successfully remove water down to the mine’s 1,150-metre level by the end of December 2013. Ivanhoe then will be in a position to begin an aggressive underground diamond-drilling program designed to confirm the mine’s estimated remaining, high-grade resources, which were included in the September 2012 Kipushi Technical Report prepared by IMC Group Consulting Ltd. and to seek to further expand the resources on strike and at depth.

In addition, Ivanhoe also expects to achieve its objective of dewatering to the bottom of the ramp decline, at 1,270 metres below surface, during the first quarter of 2014.

The reliability of electric power delivered to Kipushi from the state-owned power grid has been more consistent since May, greatly assisting in sustaining the dewatering effort.

Steelwork and equipment are being progressively replaced and upgraded as the water level continues to drop. New, large-capacity, high-pressure Ritz and Vogel pumps installed in April 2013 have raised the pumping rate to 64,800 cubic metres per day. Additional capacity is being installed to further increase the pumping rate to a planned 81,600 cubic metres per day.

Drilling to begin in early 2014 to confirm and expand Kipushi’s high-grade resources

The historically-mined deposit at Kipushi is comprised of high-grade copper-zinc-lead mineralization within the Kipushi Fault Zone, which has a strike length of 600 metres and previously was mined to a depth of 1,207 metres below surface. Based on drilling reports by Gécamines, the Fault Zone is known to extend to at least 1,800 metres below surface.

From its start-up in 1924 as the Prince Léopold Mine, Kipushi produced a total of 6.6 million tonnes of zinc and 4.0 million tonnes of copper – from 60.0 million tonnes of ore grading 11% zinc and approximately 7% copper – until operations were halted in 1993 due to political instability. The mine also produced 278 tonnes of germanium between 1956 and 1978.

Kipushi also contains the Big Zinc, a very high-grade zinc deposit discovered by state-owned miner Gécamines at approximately 1,200 metres below surface in the early 1990s, shortly before the mine’s closure. The Big Zinc, which remains unmined and open at depth, is accessible from existing underground workings. Based on drilling reports by Gécamines, multiple steeply dipping exploratory holes have intersected exceptionally high-grade zinc mineralization, grading 42% to 45% zinc, between the 1,375-metre and 1,600-metre levels elevations, with more than 60 metres to 100 metres apparent thickness.

Prior to the 1993 halt of production at Kipushi, Gécamines discovered and drill-delineated the Big Zinc Deposit, an extremely high-grade, zinc-rich body. The top of the Big Zinc occurs at approximately the 1,200-metre level and Gécamines’ drilling confirmed that it continues down to at least the 1,640-metre level. The Big Zinc has a strike length of at least 100 metres, is 40 to 80 metres in width and is open at depth.

Ivanhoe’s planned 2014 drilling program is scheduled to complete approximately 100 holes totalling more than 20,000 metres. The program’s primary goals are to:

- Conduct confirmatory drilling to validate the historical resources within the Big Zinc and Fault zones to bring the historical resources to current resources under CIM standards.

- Conduct extension drilling to test and upgrade the deeper portions, below the 1,500-metre level, of the Big Zinc and Fault zones that previously were classified as Inferred Resources.

- Conduct exploration drilling to test areas that were not evaluated historically, such as the deeper portions of the Fault Zone and extensions to the high-grade copper mineralization of the mine’s Northern Deposit.

- Obtain large-diameter drill core from the Big Zinc for confirmatory metallurgy test work.

New underground drill holes also may provide a platform for geophysical exploration of Kipushi’s deep mineral potential, leveraging Ivanhoe’s in-house expertise. The Kipushi Deposit has never been evaluated using modern geophysical techniques.

Most of the underground infrastructure already is in place to support the drilling program. The majority of the drilling will be conducted from sites on the 1,270-metre-level hanging-wall development drift, with metallurgical samples of the Big Zinc taken as soon as the water reaches the 1,227-metre-level. A 280-metre, step-back extension of the drift also will be driven to allow the drill crews to test the down-dip extensions of the Big Zinc and Fault zones.

Independent consultant MSA Group of South Africa has been appointed to prepare a current estimate of Big Zinc resources to CIM standards following completion of the confirmation drilling program.

Mintek, South Africa’s national mineral research organization, recently completed a preliminary metallurgical testwork campaign on existing drill core from the Big Zinc. Comminution testwork indicated that the material is soft and therefore easy to crush and mill. Flotation testwork indicated that the material was easily upgradable to a very high-grade concentrate composition at high zinc recoveries.

MDM Engineering Group Limited, of South Africa, has been retained to complete processing options studies based upon the Mintek metallurgical testwork.

Ivanhoe Mines conducting strategic process for early lock-up release transaction

Ivanhoe Mines has obtained regulatory approval for a transaction structure that the company contemplates would simultaneously provide locked up shareholders with a right to release and sale of locked up shares; would provide additional funding for the company’s ongoing project development and would secure a strategic investor that would help to advance the overall development of the company’s key projects. The company is in the process of discussion and negotiation with potential third-party participants in the transaction, with any such transaction subject to, among other things, finalization of definitive commercial terms with one or more of those third parties.

Company name changed to Ivanhoe Mines

On August 28, the company announced that it had changed its name from Ivanplats to Ivanhoe Mines Ltd. The trading symbol for the common shares of the renamed Ivanhoe Mines is IVN on the Toronto Stock Exchange.

“As our company continues to advance our diverse, principal projects, we believe this is the right time to make the transition to a corporate identity that more broadly reflects the fact that Ivanplats has grown and evolved in recent years to become much more than a singularly focused platinum-group metals company,” said Executive Chairman Robert Friedland.

“We have been expanding our Platreef Project in South Africa’s Bushveld platinum belt for more than a decade. Encouraged by our progress, we began using the distinguishing Ivanplats name several years ago – before the fortuitous pace of events enabled us to announce our Kamoa copper discovery in the Democratic Republic of Congo’s Katanga Province in 2009 and before our acquisition of a majority interest in Katanga’s Kipushi zinc-copper-germanium-precious metals mine in 2011.”

The Ivanplats name is being retained for use in the ongoing development of the company’s Platreef Discovery of platinum-group elements, nickel, copper, gold and rhodium in South Africa.

The wellspring for the naming of the original Ivanhoe Mines entity in 1999 was Ivanhoe Capital Corporation, the private venture capital and project finance firm founded by Mr. Friedland in 1987. Ivanhoe Capital retained the right to the Ivanhoe name through a subsequent 2010 agreement with Ivanhoe Mines and Rio Tinto. This agreement required the relinquishment of the Ivanhoe name after Rio Tinto acquired control of Ivanhoe Mines in January 2012. Ivanhoe Mines shareholders voted in June 2012 to approve the change to the new name of Turquoise Hill Resources (TSX, NYSE & NASDAQ: TRQ), which took effect in August 2012, directly aligning the company’s name with its flagship Oyu Tolgoi Project in Mongolia.

Ivanhoe Mines completes C$108 million non-brokered private placement

On October 4, the company announced that it had closed a previously announced non-brokered private-placement financing.

The company raised C$108 million through the issuance of 54 million new Class A common shares at C$2.00 per share. Mr. Friedland subscribed for C$25 million of the offering, effectively proportionate to his holding in the company.

The proceeds of the offering will advance the development of the company’s Kamoa and Kipushi projects, and also will be used for general corporate purposes.

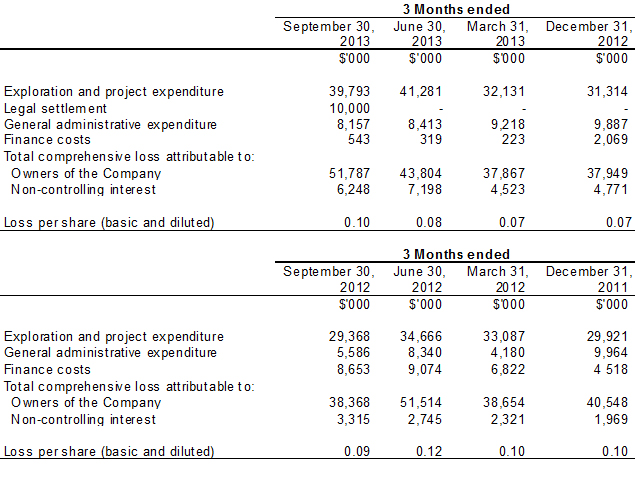

Selected Quarterly Information

The following table summarizes selected financial information for the prior eight quarters. Other than its share of revenue from the RK1 Consortium, Ivanhoe Mines had no operating revenue in any financial reporting period and did not declare or pay any dividend or distribution in any financial reporting period.

Review of the Three Months Ended September 30, 2013 vs. 2012

The company’s total comprehensive loss for Q3 2013 was $16.4 million higher than for the same period in 2012. The increase mainly was due to a $10.4 million increase in exploration and project expenditure, as well as the legal settlement expense of $10.0 million recognized in Q3 2013.

The decrease in finance costs was attributable to the conversion of the convertible bonds issued by the company in late 2011 and early 2012 (Pre-IPO Bonds) into Common Shares on October 23, 2012, as a result, and upon completion, of the initial public offering (IPO).

The increase in exploration and project expenditures by $10.4 million was due to an increase in expenditure of $4.7 million at the Kipushi Project, following its acquisition in 2011, as well as increased expenditure at the Kamoa and Platreef projects by $1.3 million and $2.1 million respectively. There also was an increase in expenditure on regional exploration in Q3 2013 compared to the same period in 2012.

Salaries and benefits for Q3 2013 increased by $1.4 million compared to Q2 2012 due to the increase in executive and administrative staff during the past year, which also resulted in an increase in office and administration expenditure.

Financial position as at September 30, 2013, vs. December 31, 2012

The company’s total assets decreased to $596.4 million as at September 30, 2013, from $726.7 million as at December 31, 2012. This mainly was due to a decrease in cash and cash equivalents of $152.2 million.

The company utilized $138.6 million of its cash resources in its operations and earned interest income of $0.9 million on cash balances. A total of $12.0 million was spent to acquire property, plant and equipment and other non-current assets.

Of the $12.0 million spent to acquire non-current assets, $2.6 million related to Ivanhoe’s share of the acquisition of an additional office building in London through Rhenfield Ltd., one of Ivanhoe’s joint operations. The remainder of the additions to property, plant and equipment mainly related to the procurement of assets required at the projects.

The company’s total liabilities increased from $113.1 million as at December 31, 2012, to $145.9 million as at September 30, 2013. This was due to an increase in non-current borrowings of $20.0 million as well as an increase in trade and other payables of $12.9 million.

The company had $107.7 million in cash and cash equivalents and $80.2 million in short-term deposits as at September 30, 2013. Certain of the company’s cash and cash equivalents and short-term deposits, having an aggregate value of $177.9 million, are subject to contractual restrictions as to their use. Based on current planned work programs, these restricted funds should be sufficient to advance the Platreef Project to 2014.

As at September 30, 2013, the company had consolidated working capital of approximately $172.3 million, compared to $324.3 million at December 31, 2012. The Platreef Project working capital is restricted and amounted to $178.6 million at September 30, 2013, and $204.2 million at December 31, 2012. Excluding the Platreef Project working capital, the resultant working capital was negative $6.3 million at September 30, 2013, and $120.1 million at December 31, 2012. As a result of the non-brokered private placement during October 2013, the company believes it has sufficient resources to cover its short-term cash requirements.

This release should be read in conjunction with Ivanhoe Mines’ unaudited Q3 2013 Financial Statements and Management’s Discussion and Analysis report available atwww.ivanhoemines.com and at www.sedar.com.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Stephen Torr, P.Geo., Ivanhoe Mines’ Vice President, Project Geology and Evaluation, a Qualified Person under the terms of National Instrument 43-101. Mr. Torr has verified the technical data disclosed in this release.

Ivanhoe Mines has prepared a NI 43-101-compliant technical report for each of the Kamoa Project, the Platreef Project and the Kipushi Project, which are available under the company’s SEDAR profile at www.sedar.com and at www.ivanhoemines.com. These technical reports include relevant information regarding the effective date and the assumptions, parameters and methods of the mineral resource estimates, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the Kamoa Project, Platreef Project and Kipushi Project.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Bob Williamson +1.604.512.4856

South Africa: Jeremy Michaels +27.11.088.4348

Website: www.ivanhoemines.com

Forward-looking statements

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws, including without limitation, the timing and results of: (i) an updated PEA at the Kamoa Project; (ii) the Development Study, which contemplates the declaration of a mineral reserve estimate at the Kamoa Project; (iii) grant of a mining right application at the Platreef Project; (iv) a PEA at the Platreef Project; (v) efforts to upgrade historical resource estimates at the Kipushi Project; and (vi) the de-watering program at the Kipushi Project. Such statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

This release also contains references to estimates of Mineral Resources. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production from the company’s projects, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource estimates may have to be re-estimated based on: (i) fluctuations in copper, nickel, PGE, gold, zinc or other mineral prices; (ii) results of drilling, (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates; and (vi) the possible failure to receive required permits, approvals and licenses.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, the factors discussed under “Risk Factors” in the company’s most recent MD&A, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this release.

The company’s actual results could differ materially from those anticipated in these forward-looking statements.

English

English Français

Français 日本語

日本語 中文

中文