TORONTO, CANADA – Ivanhoe Mines (TSX: IVN) today announced its financial results for the first quarter ended March 31, 2015. All figures are in U.S. dollars unless otherwise stated.

HIGHLIGHTS

- On April 20, 2015, China-based Zijin Mining Group acquired a 9.9% stake in Ivanhoe Mines by investing approximately C$105 million (US$85 million) to help advance Ivanhoe’s three mine-development projects in Africa. Under terms of the agreement, Ivanhoe will issue 76,817,020 common shares to Zijin through a private placement at a price of C$1.36 per share. In addition, Ivanhoe and Zijin are in detailed, friendly discussions about the strategic co-development of Ivanhoe’s Kamoa copper discovery in the Democratic Republic of Congo (DRC).

- On March 3, 2015, members of the Ivanhoe Mines exploration team received the prestigious Thayer Lindsley Award from the Prospectors & Developers Association of Canada (PDAC) for the discovery of the Kamoa Copper Deposit in the DRC.

- In January 2015, Ivanhoe completed a pre-feasibility study for the Platreef Project in South Africa that covered the first phase of development of a large, mechanized, underground mine with an initial four-million-tonne-per-year concentrator and associated infrastructure to support initial concentrate production by 2019. The study estimates a planned initial, average annual production rate of 433,000 ounces of platinum, palladium, rhodium and gold (3PE+Au), plus 19 million pounds of nickel and 12 million pounds of copper per year, at an estimated $322 per ounce of 3PE+Au, net of by-products. The feasibility study for the first phase of development is expected to commence within the next six weeks.

- Ivanhoe Mines plans to develop the Platreef underground mine in three phases — an initial annual rate of four million tonnes per year (Mtpa) to establish an operating platform to support future expansions; followed by a doubling of production to eight Mtpa; and then a third expansion phase to a steady-state 12 Mtpa. At a projected production rate of 12 Mtpa, Platreef would be among the largest platinum-group metals mines in the world.

- On February 11, 2015, Ivanhoe announced that its South African subsidiary, Ivanplats, was the top-ranked platinum-sector mining company in compliance with the country’s black empowerment laws. Ivanplats achieved Level 3 status in its first verification assessment on the Broad-Based Black Economic Empowerment (BBBEE) scorecard. A total of 70% of the 700 permanent and contract workers currently employed by the company are from the local area.

- In major double achievements of on-the-job health and safety management, both the Kamoa Project in the DRC and the Platreef Project in South Africa now have surpassed the total of four million accumulated person hours of work without either project incurring a single injury that caused a loss of time worked. The Platreef Project topped the four-million-hour mark in April 2015. The Kamoa Project, which ended 2014 with a lost-time-injury-free (LTIF) total of 3.9 million hours, pushed its record to 4.04 million hours by the end of March this year.

- Construction work on a large concrete surface collar for the 7.25-metre-diameter Shaft 1 at Platreef is advancing well and the refurbished stage and hoist-winding equipment will be installed once the foundations are complete. Shaft 1, including some initial lateral, underground development work, is expected to be fully funded from dedicated funds remaining in Ivanhoe’s treasury from the $280 million received in 2011 from the sale of an 8% interest in the Platreef Project to the ITOCHU-led Japanese consortium.

- On February 17, 2015, Ivanhoe announced the intersection of a potential new zone of mineralization by Hole KPU072 at the Kipushi copper-zinc-germanium-lead and precious-metals mine in the DRC, 140 metres below the base of historical Indicated Resources within the Big Zinc zone. The observed intersection includes mixed massive sphalerite, chalcopyrite and minor pyrite from 417.32 metres to 420.55 metres, massive sphalerite from 420.55 metres to 468.09 metres, and massive pyrite with accessory chalcopyrite and sphalerite from 468.09 metres to 477.17 metres. The core intersection angles suggest that the zone may have a true width of approximately 30 metres.

Principal Projects and Review of Activities

Ivanhoe Mines is advancing and developing its three principal projects in Southern Africa:

- The Kamoa copper discovery in a previously unknown extension of the Central African Copperbelt in the DRC’s Province of Katanga.

- The Platreef Discovery of platinum, palladium, nickel, copper, gold and rhodium on the Northern Limb of the Bushveld Complex in South Africa.

- The historic, high-grade Kipushi zinc-copper mine, also on the Copperbelt in the DRC and now being drilled and upgraded following a care-and-maintenance program conducted between 1993 and 2011.

1. Kamoa Project

95%-owned by Ivanhoe Mines

Democratic Republic of Congo (DRC)

The Kamoa Project is a very large, stratiform copper deposit with adjacent prospective exploration areas within the Central African Copperbelt, approximately 25 kilometres west of the town of Kolwezi and about 270 kilometres west of the Katangan provincial capital of Lubumbashi. Ivanhoe holds its 95% interest in the Kamoa Project through a subsidiary company, Kamoa Copper SA (formerly African Minerals Barbados Limited SPRL). A 5%, non-dilutable interest in Kamoa Copper SA was transferred to the DRC government on September 11, 2012, for no consideration, pursuant to the DRC Mining Code. Ivanhoe also has offered to sell an additional 15% interest to the DRC government on commercial terms to be negotiated.

Kamoa is the world’s largest undeveloped, high-grade copper deposit. On January 17, 2013, an updated mineral resource estimate was announced that increased Kamoa’s Indicated Mineral Resources to a total of 739 million tonnes grading 2.67% copper and containing 43.5 billion pounds of copper. This was an increase of 115% over the previous estimate prepared in September 2011 of 348 million tonnes grading 2.64% copper and containing 20.2 billion pounds of copper. Both estimates used a 1.0% copper cut-off grade and a minimum vertical mining thickness of three metres.

In addition to the Indicated Resources, the updated estimate included Inferred Mineral Resources of 227 million tonnes grading 1.96% copper and containing 9.8 billion pounds of copper, also at a 1.0% copper cut-off grade and a minimum vertical mining thickness of three metres.

At a higher, 2.0% copper cut-off grade, Kamoa’s Indicated Resources total an estimated 550 million tonnes grading 3.04% copper and containing 36.9 billion pounds of copper. At the 2.0% cut-off, Kamoa also has 93 million tonnes of Inferred Resources grading 2.64% copper, which contain an estimated 5.4 billion pounds of copper.

Diamond drilling

Limited drilling occurred in Q1 2015, with only 100 metres completed in three shallow holes drilled by company-owned rigs in the Kansoko Nord area.

Ivanhoe plans to continue drilling in 2015 with two company-owned rigs and a recently purchased new rig that is capable of drilling to a depth of 1,000 metres. The 2015 exploration program will focus on the southern portion of the project area where the successful 2014 program highlighted a promising target — the Kakula discovery, which is similar in style and stratigraphic position to the high-grade Kansoko trend. Exploration also will continue to look for shallow, high-grade zones in the Kamoa North area.

Preparation for construction of first declines

The construction of the box cut for the first access declines to the initial, planned underground mine was completed at the end of 2014. This will enable the construction of the twin declines that have been designed to intersect the high-grade copper mineralization in the Kansoko Sud area, approximately 150 metres below the surface.

Ivanhoe’s drilling program in this area has defined a thick, near-surface zone of high-grade copper mineralization, where a recent drill hole intercepted 15.7 metres (true width) of 7.04% copper, at a 1.5% total copper cut-off.

Figure 1: Completed box cut with access roadway under construction.

A tender for construction of the twin declines to the first mining area and a raise-bore ventilation shaft was issued at the end of November. The company anticipates awarding the contract in Q2 2015 and commencing construction in Q3 2015. The tendered work also will include bolting, meshing and shotcreting required to permanently support the walls of the box cut. The construction of a concrete roadway, drains and de-watering sumps in the box cut began at the end of 2014 and is due to be completed in Q3 2015.

Pre-feasibility study

In line with the phased approach to project development outlined in the 2013 Kamoa preliminary economic assessment, the Kamoa pre-feasibility study (PFS) is progressing based on the planned first phase of the project, which will be the construction of an underground operation producing three million tonnes a year and feeding an adjacent concentrator.

Given the relatively undeformed, continuous mineralization of the Kamoa resource, it is considered amenable to large-scale, mechanized stepped-room-and-pillar mining, transitioning to drift-and-fill mining in the deeper sections of the mine.

A consortium of MDM and AMEC Foster Wheeler has been appointed to complete the PFS for the processing plant and infrastructure.

The concentrator plant consists of three stages of crushing followed by ball milling to a grind of 80% passing 53µm (micrometres). The flotation circuit consists of a fast-floating rougher and cleaner section followed by a slower-floating rougher and cleaner section, including a concentrate regrind. Concentrate from the two sections is combined, dewatered and bagged for sale. Testwork consistently has resulted in copper recoveries in excess of 85% at concentrate grades approaching 40% copper, depending on copper-feed mineralogy. The scope of work for the infrastructure includes the access road, rail siding, raw-water supply from a borefield and power supply for the mine.

Work on the mining portion of the PFS is progressing well, with the majority of the underground design and mine scheduling completed. Additional design and testwork is continuing for the paste backfill system that is planned to be used in drift-and-fill mining.

Continued focus on sustainability

There remains a key focus on safety, health, environmental management and community relations at the Kamoa site. By the end of Q1 2015, 4,047,743 lost-time-injury-free (LTIF) hours had been worked. Ivanhoe is continuing to maintain health programs relating to malaria and HIV monitoring, prevention and treatment in the workplace and in the communities.

Baseline data collection for Environmental, Social and Health Impact Assessment (ESHIA) purposes was completed in 2014 and the team continues to monitor surface and ground-water conditions, dust fallout and noise levels for regulatory purposes. A reforestation program involving more the 3,000 square metres and 800 seedlings has been developed.

A total of 165 stakeholder meetings were conducted in Q1 2015 involving 2,052 participants ranging from community members and traditional leaders to governmental officials. The construction of the Kaponda School was completed and a handover ceremony was attended by the community members, authorities, partners and Kamoa representatives. Livelihood initiatives during Q1 2015 included the monitoring of the 343 hectares of maize, honey and vegetable production and marketing and the training of women on poultry production.

Figure 2: Chief Musokantanda cutting the ribbon during the Kaponda School handover ceremony.

A social and environmental management system has been developed that monitors and records environmental and community statistics. Resettlement planning and updating of the environmental and social impact assessment await the finalization of the project schedule.

2. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project in South Africa’s Limpopo province is 64%-owned by Ivanhoe through its subsidiary, Ivanplats (Pty) Ltd. (Ivanplats) and 10%-owned by a Japanese consortium of ITOCHU Corporation; ITC Platinum, an ITOCHU affiliate; Japan Oil, Gas and Metals National Corporation; and Japan Gas Corporation. The Japanese consortium’s 10% interest in the Platreef Project was acquired in two tranches for a total investment of $290 million. The remaining 26% interest is held by Ivanhoe’s broad-based, black economic empowerment (BBBEE) partners, which include communities, employees and entrepreneurs. Ivanplats achieved Level 3 status in its first verification assessment on a BBBEE scorecard, the highest-ranking platinum-sector mining company in compliance with South Africa’s black empowerment laws.

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper and gold mineralization in the Northern Limb of the Bushveld Igneous Complex, approximately 280 kilometres northeast of Johannesburg.

On the Northern Limb, such mineralization primarily is hosted within the Platreef, a mineralized sequence that is traced more than 30 kilometres along strike. Ivanhoe’s Platreef Project, within the southern sector of the Platreef, is comprised of three contiguous properties: Turfspruit, Macalacaskop and Rietfontein. The northernmost property, Turfspruit, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of properties and mining operations.

Since 2007, Ivanhoe has focused its exploration activities on defining and advancing the down-dip extension of its original Platreef discovery, now known as the Flatreef Deposit, which is viewed as being amenable to highly mechanized, underground mining methods. The Flatreef area lies entirely on the Turfspruit and Macalacaskop properties.

Figure 3: Aerial view of Platreef Project, March 25, 2015.

Mining right activated

The Ivanplats mining right was officially executed by the national government’s Department of Mineral Resources on November 4, 2014. The mining right authorizes the company to exclusively mine and process platinum-group metals, nickel, copper, gold, silver, cobalt, iron, vanadium and chrome from the mining area for an initial period of 30 years, and may be renewed for an unlimited number of consecutive periods each of up to 30 years, in accordance with section 24 of the Mineral and Petroleum Resources Development Act.

Mining operations must be conducted in accordance with the Mining Work Program (MWP) and any amendment to such MWP, and with an approved Environmental Management Plan (EMP). The company commenced the roll-out of its Social and Labour Plan (SLP), which includes the planning, implementation and execution of local economic development projects, human resource development and enterprise/supplier development.

Shaft 1 construction

The excavation of the box cut is complete and the construction of the large concrete shaft collar is underway. Construction also is underway of the foundations for the large winding equipment required for shaft sinking. The winding equipment has been refurbished and is being stored off-site.

Figure 4: Construction of Shaft 1 collar, April 22, 2015.

Figure 5: Construction of Shaft 1 collar, May 8, 2015.

Other work on site includes the construction of the primary terraces for Shaft 1 and the 5MVA temporary power supply. The construction of the pollution control dam is ongoing. A total of 83% of the 638 permanent and contract workers currently employed by the company are from the local area.

Figure 6: Construction of Shaft 1 kibble winder foundation.

Platreef planning a phased approach to a large, underground, mechanized mine

The company completed a pre-feasibility study (PFS) in January 2015 that covered the first phase of development that is expected to include construction of an underground mine, concentrator and other associated infrastructure to support initial concentrate production by 2019. As the first phase is being developed and commissioned, there will be opportunities to refine the timing and scope of subsequent phases of production.

PFS highlights

- Development of a large, mechanized, underground mine with an initial four-million-tonne-per-year concentrator and associated infrastructure.

- Planned initial average annual production rate of 433,000 ounces (oz) of platinum, palladium, rhodium and gold (3PE+Au), plus 19 million pounds of nickel and 12 million pounds of copper.

- Estimated pre-production capital requirement of approximately $1.2 billion, including $114 million in contingencies, at a ZAR:USD exchange rate of 11 to 1.

- Platreef would rank at the bottom of the cash-cost curve, at an estimated $322 per ounce of 3PE+Au, net of by-products.

- The planned Platreef mine is projected to require a workforce of approximately 2,200 within four years of the start of production.

- After-tax Net Present Value (NPV) of $972 million, at an 8% discount rate.

- After-tax Internal Rate of Return (IRR) of 13%.

The scenarios describe a staged approach, where there would be opportunities to expand the operation depending on demand, smelting and refining capacity and capital availability. As the Phase 1 production scenario is developed and placed into production, there is expected to be an opportunity to modify and optimize the subsequent phases, allowing for changes to the timing of capacity expansions to suit market conditions.

Ivanhoe also has retained Whittle Consulting of Melbourne, Australia, to conduct an optimization study based on the Platreef PFS. This work is complete and certain recommendations from the study will be carried forward into the feasibility study during 2015.

Mineral resources in the Flatreef underground discovery

The Flatreef Mineral Resource, with a strike length of 6.5 kilometres, lies predominantly within a flat to gently dipping portion of the Platreef mineralized belt at relatively shallow depths of approximately 700 to 1,100 metres below the surface.

The Flatreef Deposit is characterized by its very large vertical thicknesses of high-grade mineralization and a platinum-to-palladium ratio of approximately 1:1, which is significantly higher than other recent PGM discoveries on the Bushveld’s Northern Limb. The grade shells used to constrain mineralization in the Flatreef Indicated Mineral Resource area have average true thicknesses of approximately 24 metres at a cut-off grade of 2.0 grams per tonne (g/t) of platinum, palladium and gold (2PE+Au). The Indicated Mineral Resource grade at an equivalent 2.0-gram-per-tonne 3PE+Au cut-off is 4.1 g/t 3PE+Au, 0.34% nickel and 0.17% copper. Flatreef’s Indicated Mineral Resources of 214 million tonnes contain an estimated 28.5 million ounces of platinum, palladium, gold and rhodium, 1.6 billion pounds of nickel and 0.8 billion pounds of copper. The company has declared an initial Probable Mineral Reserve of 15.5 million ounces of platinum, palladium, rhodium and gold, using a declining Net Smelter Return (NSR) cut-off of $100/t-$80/t.

Mining methods

Mining zones in the current Platreef mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below the surface. Four vertical shafts will provide access to the mine. Shaft 2 will host the main personnel transport cage, material and ore handling systems, while Shafts 1, 3 and 4 will provide ventilation for the underground workings. Shaft 1, now under development, will be used for initial access to the ore body and early underground development.

Mining will be performed using highly productive, mechanized methods, including long-hole stoping and drift-and-fill mining. The mined drift-and-fill and long-hole stopes will be backfilled with a paste mixture that utilizes tailings from the process plant and cement. The ore will be hauled from the stopes to the bottom of Shaft 2, where it will be crushed and hoisted to surface.

Metallurgical and processing

Metallurgical test work has focused on maximizing the recovery of platinum-group elements (PGE) and base metals, while producing an acceptably high-grade concentrate suitable for further processing and/or sale to a third party. The three main geo-metallurgical units and composites have produced smelter-grade final concentrates of approximately 85 g/t PGE + Au at acceptable PGE recoveries. Testwork also has shown that the material is amenable to treatment by conventional flotation without the need for re-grinding. Batch open-circuit and locked-cycle flotation testwork has been performed.

Comminution and flotation testwork has indicated that the optimum grind size is 80% passing 75 µm (micrometres), which is consistent with sizes commonly reported by platinum mines in South Africa. The circuit developed during 2014 includes the use of industry-standard reagents and has replaced the previous circuit that used niche flotation reagents. Current flotation test work is focused on improving the concentrate specification to facilitate discussions around future off-take agreements.

Platreef ore is classified as ranging from hard to very hard, and thus not suitable for semi-autogenous grinding. A multi-stage crushing and ball-milling circuit is the preferred option.

A two-phased development approach was used for PFS flow-sheet design. The selected flow sheet is comprised of a four-million-tonne-per-year, three-stage crushing circuit that will feed crushed material to two parallel milling-flotation modules, each with a capacity of two million tonnes per year. Flotation is followed by a four-million-tonne-per-year tailings handling and concentrate thickening, filtration and storage circuit.

Shafts 1 and 2

Shaft 1 will have an internal diameter of 7.25 metres, with an annual planned hoisting capacity of 2.5 million tonnes. It is projected to reach a total depth of 975 metres in 2018. South Africa-based Aveng Mining, the shaft-sinking contractor, is responsible for the excavation of the box-cut access for the shaft collar and vent plenum and will be the sinking contractor for Shaft 1. The fabrication of the temporary, sinking head-frame and centre tower has begun.

Shaft 1, including some initial lateral, underground development work, is expected to be fully funded from dedicated funds remaining in Ivanhoe’s treasury from the $280 million received in 2011 for the sale of an 8% interest in the Platreef Project to the ITOCHU-led Japanese consortium.

Ivanhoe awarded the contract for the design and engineering of Shaft 2, the 10-metre-diameter main production shaft that will be capable of hoisting six million tonnes a year, to South Africa-based Murray & Roberts Cementation in June 2014. This will enable Ivanhoe to start Shaft 2 development works this year, subject to necessary approvals and funding. The box-cut designs are complete and the contract for the early engineering works for the winding equipment has been awarded to South Africa-based FLSmidth.

Bulk water and electricity supply

The Olifants River Water Resource Development Project (ORWRDP) is designed to deliver water to the Eastern and Northern limbs of South Africa’s Bushveld Igneous Complex. The project consists of the new De Hoop Dam, the raised wall of the Flag Boshielo Dam and related pipeline infrastructure that ultimately will deliver water to Pruissen, southeast of the Northern Limb. The Pruissen Pipeline Project will be developed to deliver water onward from Pruissen to the municipalities, communities and mining projects on the Northern Limb. Ivanhoe is a member of the ORWRDP’s Joint Water Forum. The Minister of Water & Sanitation issued a directive that the Trans Caledonian Tunnel Authority was appointed as the implementing agent for the outstanding phases of the ORWRDP’s scheme, which include the Phase 2B pipeline from Flag Boshielo Dam to Mokopane.

Participants in the water development scheme are required to indicate their water requirements so that the total water demand may be calculated relative to the scheme’s capacity. The Platreef Project’s water requirement for the first phase of development is projected to peak at approximately 10 million litres per day. Ivanhoe is continuing to investigate various alternative bulk-water sources.

The Platreef Project’s power requirement for a four-million-tonne per year underground mine, concentrator and associated infrastructure has been estimated at approximately 100MVA. As power is required for the initial mine development (shaft sinking), prior to the main power supply being available, an agreement with Eskom has been reached for the supply of 5MVA of temporary construction power. Ivanhoe is awaiting the budget quote from Eskom on the permanent supply.

Exploration and resource expansion drilling

A total of 5,349 metres in 10 holes of Zone 1 resource-expansion drilling was completed on February 11, 2015. There are no current plans to continue with exploration drilling in 2015 as the focus of activities shifts to shaft development and the feasibility study. Despite the pause in exploration activity, the Platreef Project remains highly prospective, with the mineralised horizon open to the south and west. Additional resources potentially could be defined or the confidence in existing resources improved through exploration drilling as and when required.

There have been significant advances in the understanding of the structural framework of the Platreef Project since the completion of the 2012 resource model. Ongoing modelling and the collection of significant additional structural data have culminated in a fully revised structural model for inclusion in a new resource estimate to be completed in 2015. Since 2013, additional diamond drilling, a three-dimensional seismic survey, comprehensive photography of all Main Zone intersections and a systematic, section-by-section re-logging of all UMT drill holes has provided significant additional information.

Through the collection of this data and a very systematic approach to identifying, validating and re-modelling observed features, a revised structural model was completed at the end of Q1 2015.

Job-skills training and environmental management commitments

As required under South African legislation, and in conjunction with the approval of the mining right, an integrated water-use licence application was submitted to the Department of Water and Sanitation (DWS); a waste-management licence application was submitted to the National Department of Environmental Affairs; and an application for environmental authorization was submitted to the Limpopo Department of Economic Development, Environment and Tourism (LEDET). Extensive environmental, social and engineering baseline studies were conducted in 2013 in support of these applications.

The Platreef Project received environmental authorization in June 2014 from LEDET. Ivanhoe is working closely with this department to ensure continual compliance during the implementation of the approved environmental management plan and the conditions stipulated in the environmental authorization. Authorization also was received from the DWS for the extraction of specified quantities of water from groundwater resources.

Ivanhoe has engaged with the South African Heritage Resources Agency (SAHRA) to obtain input and guidance on the management of archaeological and heritage resources in the area.

The Platreef Project recently achieved more than four million person hours worked without a lost-time injury. Through teamwork, and in partnership with employees, consultants and contractors, Ivanhoe is working to establish a sustainable culture of harm prevention to benefit workers, communities, other stakeholders and the environment through an effective health, safety and environmental management system that recognizes and utilizes best industry practices.

Following the activation of the Platreef mining right in November 2014, Ivanhoe began investing in its Social and Labour Plan, to which the company has pledged a total of R160 million ($14 million) during the next five years. The approved plan includes R67.2 million ($6 million) for the development of job skills among local residents and R87.7 million ($8 million) for local economic development projects. This allocation includes R26 million ($2 million) to build a community skills development and a training facility in the Mokopane area as part of Ivanhoe’s objective of helping to establish a roster of qualified, local candidates for jobs at the mine and its associated minerals processing plant. The facility will be accredited by the Mining Qualifications Authority (MQA).

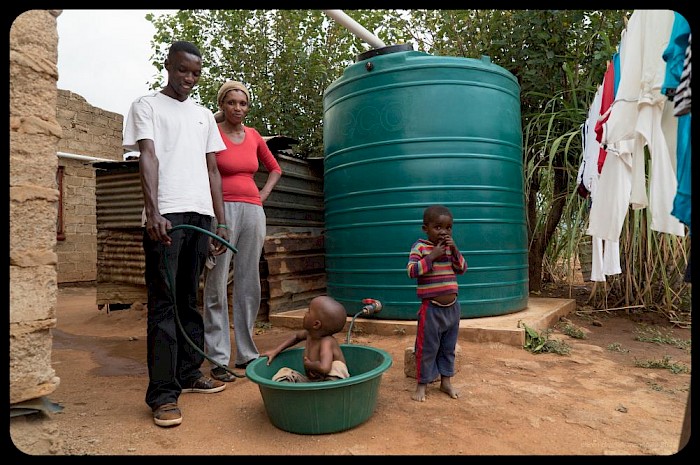

Figure 7: Non-core technical training with Maphelong Training Centre.

A total of 21 employees will participate in a planned internal training to provide members of the current workforce with opportunities to expand their skills, predominantly focused on exploration activities.

A total of 13 employees who do not meet the minimum Grade 12 employment requirement are enrolled in Adult Basic Education and Training (ABET). Internships for two employees in the Safety Department also are continuing.

Under a community training initiative launched in 2015, in partnership with the Department of Education, ABET began in four centres in communities directly affected by the planned development of the Platreef mine. Non-core technical training began in February 2015 at the Ergo Maphelong Training Centre in Masodi, where 78 local students are being trained in various non-core activities for employment during the mine’s construction phase.

Ivanhoe has initiated a R24 million ($2 million) partnership between South Africa’s University of Limpopo and Laurentian University in Canada to develop and equip Limpopo’s geology department to improve its curriculum choices for students, conduct research on the Platreef Project and offer post-graduate studies in geology. Ivanhoe will allocate approximately R12 million ($1 million) to the University of Limpopo and R12 million ($1 million) to Laurentian University over the next five years, and has committed to renewing the partnership for a further five-year period.

In addition to its SLP and BBBEE commitments, Ivanhoe has begun an R11 million ($1 million) water harvesting and community sanitation facility renovation project in its host communities. The Platreef Project will provide internships to help university students complete practical components of their studies and, in the process, provide the mine with potential candidates for permanent employment.

Figure 8: Recipients of the water harvesting community project at Platreef.

3. Kipushi Project

68%-owned by Ivanhoe Mines

Democratic Republic of Congo (DRC)

The Kipushi copper-zinc-germanium-lead mine, in the Democratic Republic of Congo’s southern Katanga province, is adjacent to the town of Kipushi and approximately 30 kilometres southwest of the provincial capital of Lubumbashi. It also is located on the Central African Copperbelt, southeast of Ivanhoe’s Kamoa Project, and less than one kilometre from the Zambian border. Ivanhoe acquired its 68% interest in the Kipushi Project in November 2011; the balance of 32% is held by the state-owned mining company, La Générale des Carrières et des Mines (Gécamines).

Project development and infrastructure

Work began in early March 2014 on the planned underground diamond-drilling program at the Kipushi Project, a major advance made possible by the ongoing dewatering program directed by Ivanhoe during the past three years following its acquisition of the historic mine in November 2011.

The mine, which had been placed on care and maintenance in 1993, flooded in early 2011 due to a lack of pump maintenance over an extended period. Water reached 851 metres below surface at its peak. A major milestone was reached in December 2013 when Ivanhoe restored access to the mine’s principal haulage level at 1,150 metres below the surface.

Since then, crews have been upgrading underground infrastructure to permanently stabilize the water levels and support the drilling program. Recent improvements have included the establishment of pump stations at the 1,112-metre and 1,272-metre levels, refurbishment of a ventilation shaft fan, ventilation along the hanging-wall drift on the 1,272-metre level, continued removal of corroded ventilation column from Shaft 5 and inspections of all shaft conveyances, ropes and guides.

Water levels are stabilized below the 1,150-metre-level haul way and 1,272-metre-level hanging-wall drift, enabling access for drilling, with two rigs targeting the Série Récurrente and Big Zinc mineralization.

Figure 9: Commissioning of pump station at the 1,144-metre level.

Figure 10: Testing 54-kilowatt Flygt pump in test pit.

Figure 11: Ventilation shaft fan refurbishment.

Environmental studies

Golder Associates was engaged in early 2014 to conduct an IFC-compliant ESHIA baseline study to determine the impact of previous mining activities by Gécamines and provide a baseline for the future. A year-long environmental monitoring and sampling program was completed in Q1 2015, with a final report expected in Q2 2015.

Monitoring of surface and groundwater, air quality and climate is continuing to meet DRC regulatory reporting requirements.

Confirmatory and exploration drilling

Ivanhoe’s underground drilling program at Kipushi is designed to confirm and update the mine’s estimated historical resources and to further expand the resources along strike and at depth.

A total of 4,140 metres in 11 drill holes were completed in Q1 2015 in the Big Zinc and Nord Riche zones. A total of 17,413 metres of drilling had been completed in 81 holes by the end of Q1 2015.

SELECTED QUARTERLY FINANCIAL INFORMATION

The following table summarizes selected financial information for the prior eight quarters. Ivanhoe had no operating revenue in any financial reporting period and did not declare or pay any dividend or distribution in any financial reporting period.

Review of the three months ended March 31, 2015 vs. March 31, 2014

The company’s total comprehensive loss for Q1 2015 of $19.0 million was $29.8 million lower than for the same period in 2014 ($48.8 million). The decrease mainly was due to the capitalization of development costs in the current period on the Platreef and Kamoa projects of $12.3 million and $6.7 million respectively.

Exploration and project expenditures for the three months ending March 31, 2015, were $23.9 million less than for the same period in 2014. With the focus during 2015 at the Kamoa and Platreef projects on development, $8.2 million of the total $13.2 million exploration and project expenditure related to Kipushi, where the drilling program and upgrading of the underground and surface infrastructure continued. A total of $4.1 million related to retrenchment costs incurred in the closure of Ivanhoe’s regional exploration company in the DRC, while expenditure at the Kipushi Project decreased by $3.9 million compared to the same period in 2014.

Financial position as at March 31, 2015 vs. December 31, 2014

The company’s total assets decreased by $27.0 million, from $253.1 million as at December 31, 2014, to $226.1 million as at March 31, 2015. This mainly was due to a $41.9 million decrease in cash and cash equivalents that was partially offset by the increase in property, plant and equipment of $17.4 million.

The company utilized $20.4 million of its cash resources in its operations and earned interest income of $0.3 million on cash balances in Q1 2015. A total of $19.7 million was spent on project development and to acquire other property, plant and equipment. Development costs on the Platreef and Kamoa projects amounted to $12.5 million and $6.7 million respectively.

The company’s total liabilities decreased to $40.7 million as at March 31, 2015, from $50.7 million as at December 31, 2014. This was due to a decrease in trade and other payables of $5.8 million, as well as a $4.2 million decrease in the fair value of the share-purchase warrant financial liability that arose with the issuance of the purchase warrants in Q2 2014 and had a fair value of $2.7 million at March 31, 2015.

The company disposed of its Australian subsidiaries previously classified as assets and liabilities as held for sale on March 31, 2015. The company received $0.8 million worth of shares of Clean Teq Holdings Limited, which has been classified as financial assets at fair value through profit or loss, an A$3 million promissory note with a present value of $1.8 million on March 31, 2015, and a 2.5% NSR royalty over these assets.

Liquidity and capital resources

The company had $69.1 million in cash and cash equivalents and $55.2 million in short-term deposits as at March 31, 2015. Certain of the company’s cash and cash equivalents and short-term deposits, having an aggregate value of $94.6 million, are subject to contractual restrictions as to their use and are reserved for the Platreef Project.

As at March 31, 2015, the company had consolidated working capital of approximately $123.0 million, compared to $162.1 million at December 31, 2014. The Platreef Project working capital is restricted and amounted to $92.1 million at March 31, 2015, and $104.3 million at December 31, 2014. Excluding the Platreef Project working capital, the resultant working capital was $30.9 million at March 31, 2015, and $57.8 million at December 31, 2014. The company believes it has sufficient resources to cover its short-term cash requirements. However, the company’s access to financing is always uncertain and there can be no assurance that additional funding will be available to the company in the near future.

On April 20, 2015, Zijin Mining Group Co., Ltd., acquired a minority interest in the company through a private placement. The company issued 76,817,020 common shares to a Zijin Mining Group Co., Ltd. subsidiary, through a private placement at a price of C$1.36 per share, yielding gross proceeds of approximately C$105 million (US$85 million). Zijin is one of the largest gold producers in China, the country’s second-largest primary copper producer and a major zinc producer. In addition to its portfolio of producing assets in China, Zijin also controls or has interests in existing mines in Australia, Russia, Tajikistan and Kyrgyzstan, and is participating in mine development projects in Canada, the Democratic Republic of Congo and Peru. Zijin’s shares trade on the Shanghai and Hong Kong stock exchanges.

The company’s main objectives for 2015 at the Kamoa Project are the finalization of the Phase 1 pre-feasibility study; commencement of the Phase 1 feasibility study; the continuation of drilling and starting construction of the twin declines at Kamoa, subject to funding. At Platreef, priorities are to commence the feasibility study and complete the Shaft 2 design at the Platreef Project. At the Kipushi Project, the principal objectives are completion the underground drilling program and preparation of a development plan.

This release should be read in conjunction with Ivanhoe Mines’ unaudited, condensed, consolidated interim financial statements for the three months ended March 31, 2015, and Management’s Discussion and Analysis report available at www.ivanhoemines.com and at www.sedar.com.

Qualified Person

Disclosures of a scientific or technical nature in this news release have been reviewed and approved by Stephen Torr, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of National Instrument 43-101. Ivanhoe Mines has prepared a NI 43-101-compliant technical report for each of the Kamoa Project, the Platreef Project and the Kipushi Project, which are available at www.sedar.com. These technical reports include relevant information regarding the effective date and the assumptions, parameters and methods of the mineral resource estimates on the Kamoa Project and Platreef Project cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the Kamoa Project, Platreef Project and Kipushi Project.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Bob Williamson +1.604.512.4856

South Africa: Jeremy Michaels +27.11.088.4300

Website www.ivanhoemines.com

Cautionary statement on forward-looking information

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws, including without limitation, the timing and results of: (i) a pre-feasibility study (PFS) at the Kamoa Project; (ii) statements regarding the expected date that the contract to develop the first set of Kamoa twin declines is awarded and statements regarding the date construction is expected to commence; (iii) statements regarding the declines having been designed to intersect the high-grade copper mineralization in the Kansoko Sud area; (iv) statements regarding the construction of a concrete roadway, drains and de-watering sumps in the Kamoa Project box cut; (v) statements regarding the projected depth of Shaft 1 at the Platreef Project in 2018 and the timing of the commencement of the start of Shaft 2 development; (vi) statements regarding the operational and technical capacity of Shaft 1; (vii) statements regarding peak water use of 10 million litres per day at the Platreef Project and development of the Pruissen Pipeline Project; (viii) statements regarding the completion of a new resource estimate at the Platreef Project in 2015; (ix) statements regarding underground mining to use mechanized room-and-pillar and drift-and-fill methods; (x) efforts to upgrade historical resource estimates at the Kipushi Project; (xi) the de-watering program at the Kipushi Project; (xii) statement regarding the completion of the Kipushi Project ESHIA baseline study and (xiii) statements regarding the timing, size and objectives for completion of drilling and other exploration programs for 2015 and future periods.

Such statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

This release also contains references to estimates of Mineral Resources. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production from the company’s projects, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that ultimately may prove to be inaccurate. Mineral Resource estimates may have to be re-estimated based on: (i) fluctuations in copper, nickel, platinum group elements (PGE), gold or other mineral prices; (ii) results of drilling; (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates; and (vi) the possible failure to receive required permits, approvals and licenses.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, the factors discussed below and under “Risk Factors” in the company’s MD&A, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this release. The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors set forth in the “Risk Factors” section in the company’s MD&A.

English

English Français

Français 日本語

日本語 中文

中文