Kipushi’s Big Zinc Deposit has an estimated 10.2 million tonnes

of Measured and Indicated Mineral Resources grading 34.9% zinc

Successful return to steady-state production will make Kipushi

the world’s highest-grade major zinc mine

Pre-feasibility study scheduled for release later this year;

excellent progress being made on mine rehabilitation work

Drilling program underway to expand and upgrade Kipushi’s Inferred Resources

KIPUSHI, DEMOCRATIC REPUBLIC OF CONGO — Robert Friedland, Executive Chairman of Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF), and Lars-Eric Johansson, Chief Executive Officer, announced today that negotiations are underway with government agencies – Gécamines, the state-owned miner and Ivanhoe’s partner at Kipushi, and Société Nationale des Chemins de Fer du Congo (SNCC), the DRC’s national railway company – and potential project financiers to advance agreements to launch a new era of commercial production at the upgraded Kipushi zinc-copper-silver-germanium mine in the Democratic Republic of Congo (DRC).

The Kipushi Mine is owned by Kipushi Corporation (KICO), a joint venture between Ivanhoe Mines (68%) and Gécamines (32%). Kipushi is on the Central African Copperbelt in the province of Haut-Katanga, approximately 30 kilometres southwest of the provincial capital of Lubumbashi and less than one kilometre from the international border with Zambia.

Kipushi’s rich future drawing on a history of distinction – and the waiting Big Zinc Deposit

Built and then operated by Union Minière for 42 years, Kipushi began mining a reported 18% copper from a surface open pit in 1924. It was the world’s richest copper mine at the time. Then it transitioned to become Africa’s richest underground copper, zinc and germanium mine. State-owned Gécamines gained control of Kipushi in 1967 and operated the mine until 1993.

Over a span of 69 years, Kipushi produced a total of 6.6 million tonnes of zinc and 4.0 million tonnes of copper from 60 million tonnes of ore grading 11% zinc and approximately 7% copper. It also produced 278 tonnes of germanium and 12,673 tonnes of lead between 1956 and 1978. There is no formal record of the production of precious metals as the concentrate was shipped to Belgium and the recovery of precious metals remained undisclosed during the colonial era; however, drilling by Ivanhoe Mines has encountered significant silver values within Kipushi’s current zinc- and copper-rich deposits.

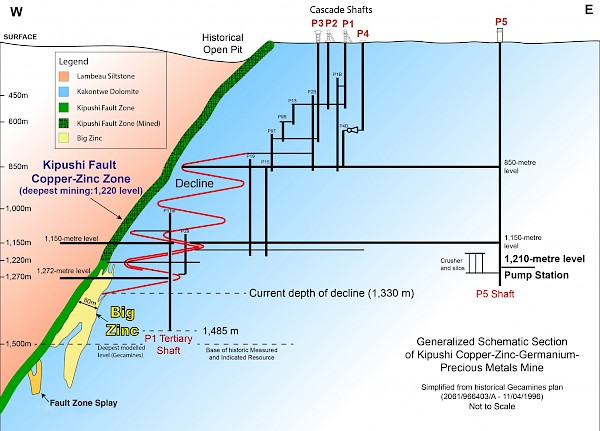

Most of Kipushi’s historical production was from the Fault Zone, a steeply-dipping ore body rich in copper and zinc that initially was mined as an open pit. The Fault Zone extends to a depth of at least 1,800 metres below surface, along the intersection of a fault in carbonaceous dolomites (see Figure 2).The founding era of mining at Kipushi ended in 1993, when it was placed on care and maintenance due to a combination of economic and political factors.

Before Kipushi was idled, Gécamines discovered the Big Zinc Deposit at a depth of approximately 1,250 metres below surface and adjacent to the producing Fault Zone (see Figure 2). The Big Zinc’s mineral resources have never been mined. Ivanhoe’s drilling has upgraded and expanded the Big Zinc Deposit’s Measured and Indicated Mineral Resources to an estimated 10.2 million tonnes grading 34.9% zinc, 0.65% copper, 19 grams/tonne (g/t) silver and 51 g/t germanium, at a 7% zinc cut-off, containing an estimated 7.8 billion pounds of zinc.

Now, the planned restoration of production at Kipushi is based on initial mining that will be focused on the Big Zinc Deposit.

Key steps toward the start of a new era of mining at Kipushi

Excellent progress has been made by KICO in modernizing the Kipushi Mine’s underground infrastructure as part of preparations for the mine to resume commercial production. With the underground upgrading program nearing completion, KICO’s focus now will shift to modernizing and upgrading Kipushi’s surface infrastructure to handle and process Kipushi’s high-grade zinc and copper resources.

The current mine redevelopment plan, as outlined in the May 2016 independent, preliminary economic assessment (PEA), has a two-year construction period with quick ramp-up to a projected, steady-state, annual production of 530,000 tonnes of zinc concentrate.

A pre-feasibility study (PFS) is underway to refine the findings of the PEA, and to optimize the mine’s redevelopment schedule, life-of-mine operating costs and initial capital costs required to return the mine to production, taking into consideration the significant capital already invested to date on critical rehabilitation work. Ivanhoe expects to complete the PFS before the end of this year.

“The KICO team, which includes more than 390 Congolese nationals, has done a fantastic job in safely upgrading the mine’s underground infrastructure in anticipation of restarting production,” said Mr. Friedland.

“Given the extremely high zinc grades at Kipushi, the mine has the potential to become one of the world’s largest and lowest-cost zinc producers, while also producing significant quantities of copper, silver and germanium. With the current, long-term, bullish market sentiment for zinc, we look forward to working with our partner, Gécamines, prospective project financiers and our team at Kipushi to fast-track completion of the remaining development at the mine.

“Since the PEA was issued in May 2016, we have made major strides towards completing the underground infrastructure upgrading program and we are much closer to achieving our vision of building a world-class zinc operation at Kipushi,” Mr. Friedland added.

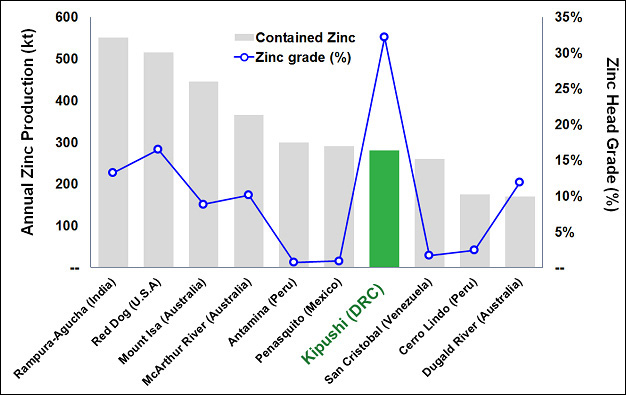

Restoration of production will make Kipushi the world’s highest-grade major zinc mine

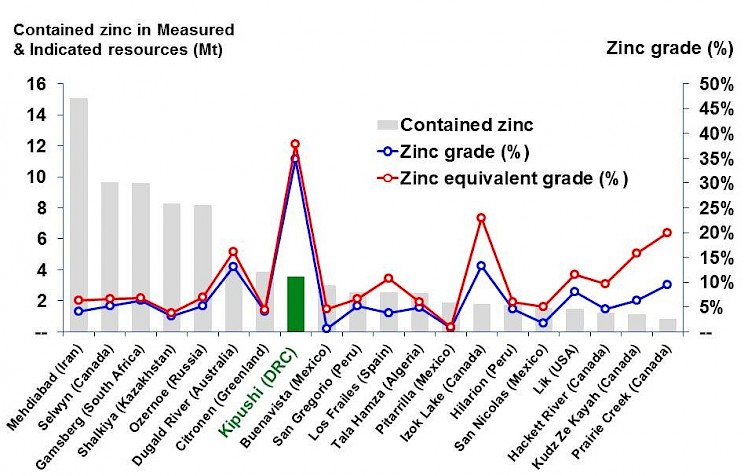

The PFS will focus on the mining of Kipushi’s Big Zinc Deposit, which has an estimated 10.2 million tonnes of Measured and Indicated Mineral Resources grading 34.9% zinc. This exceptional grade is more than twice as high as the Measured and Indicated Mineral Resources of the world’s next-highest-grade, major zinc project, according to Wood Mackenzie, a leading, international industry research and consulting group.

In addition to the Big Zinc Deposit, Kipushi has several copper-rich zones that also contain silver, germanium and zinc. Measured and Indicated Mineral Resources contained in the copper-rich Série Récurrente Zone, Fault Zone, and Fault Zone Splay total 1.63 million tonnes at grades of 4.01% copper, 2.87% zinc and 22 g/t silver, at a 1.5% copper cut-off, containing 144 million pounds of copper. Inferred Mineral Resources in these zones total an additional 1.64 million tonnes at grades of 3.30% copper, 6.97% zinc and 19 g/t silver.

Figure 1. |

World’s 10 largest zinc mines, ranked by forecasted production by 2019. |

Source: Wood Mackenzie. Note: Independent research by Wood Mackenzie concludes that at the forecast production and head grade, the Kipushi Project, once in production, will rank among the world’s major zinc mines. Wood Mackenzie compared the Kipushi Project’s life-of-mine average annual zinc production and zinc head grade of 281,000 tonnes and 32%, respectively, against production and zinc head grade forecasts for 2019.

Excellent progress made on mine rehabilitation work

The main production shaft for the Kipushi Mine, Shaft 5, has been upgraded and re-commissioned. The main personnel and material winder has been upgraded and modernized to meet global industry standards and safety criteria. The Shaft 5 rock-hoisting winder, which had an annual hoisting capacity of 1.8 million tonnes, is being upgraded and is expected to be fully operational early next year.

Underground upgrading work is continuing on the crusher and the rock load-out facilities at the bottom of Shaft 5 and the main haulage way on the 1,150-metre level between the Big Zinc access decline and Shaft 5. This work is expected to be completed before the end of the first quarter of 2018.

The planned primary mining method for the Big Zinc Deposit in the PEA and PFS is sublevel long hole, open stoping, with cemented backfill. The crown pillars are expected to be mined once adjacent stopes are backfilled using a pillar-retreat mining method. The Big Zinc Deposit is expected to be accessed via the existing decline and without any significant new development. The main levels are planned to be at 60-metre vertical intervals, with sublevels at 30-metre intervals.

Figure 2. |

Schematic section of Kipushi Mine. |

Optimized zinc processing methodology for the PFS

Based on recent, additional metallurgical test work and trade-off studies, Ivanhoe has revised the planned process-plant design for the PFS. The optimized plant utilizes dense media separation (DMS), followed by milling and a flotation recovery plant. The addition of milling and a flotation recovery plant improved the combination of concentrate grades and recoveries from what the recent metallurgical test work determined was achievable from a DMS plant only. DMS is a simple density-concentration technique that preliminary test work has shown yields positive results for the Kipushi material, which has a sufficient density differential between the waste rock (predominantly dolomite) and mineralization (sphalerite). Furthermore, the addition of a milling and flotation circuit to DMS is expected to improve the project economics as a result of higher concentrate grades.

Given the significant, very-high-grade zinc resource at Kipushi, which is rich in potential by-product credits including copper, silver and germanium, Ivanhoe and the Gécamines technical team are continuing to investigate additional downstream processing options.

Drilling program underway to expand and upgrade Inferred Resources

A 41-hole, 6,500-metre underground drilling program at Kipushi is nearing completion. The program includes six metallurgical holes and 35 resource drill holes in the Fault Zone, the Nord Riche and Southern Zinc zones to expand and upgrade Inferred Resources to Indicated Resources. Ivanhoe expects to issue an updated Mineral Resource estimate for Kipushi later this year once all the assays have been received from the drilling program.

Exploration drilling conducted by Ivanhoe in 2015 sucessfully confirmed that both the Big Zinc Deposit and Fault Zones remain open at depth and to the south. Additional high-grade copper-zinc-silver-germanium mineralization also was discovered in the Fault Zone and in the Fault Zone Splay in the immediate footwall of the Fault Zone.

Germanium is a strategic metal that is a key component of fibre-optic systems, infrared optics, high-efficiency solar cell applications, and light-emitting diodes. The current spot price of germanium is approximately US$1,650 a kilogram.

Initiation of cooperation agreement with the Congolese national railway

Ivanhoe has initiated a new cooperation agreement with SNCC to rehabilitate the inactive spur line that connects the Kipushi Mine to the Congolese national railway and to the overall north-south rail corridor that links the DRC Copperbelt to the seaport at Durban, South Africa.

“Ivanhoe and SNCC are negotiating details of an infrastructure financing agreement for the railway rehabilitation works and the terms of operation for the spur line,” said Mr.Johansson.

“This cooperation on public infrastructure projects mirrors Ivanhoe Mines’ successful, ongoing partnership with the DRC’s state-owned power company, La Société Nationale d’Electricité, for the rehabilitation of three hydropower plants.”

Figure 3. |

Zinc prices are trading above $1.40 a pound and are at 10-year highs. |

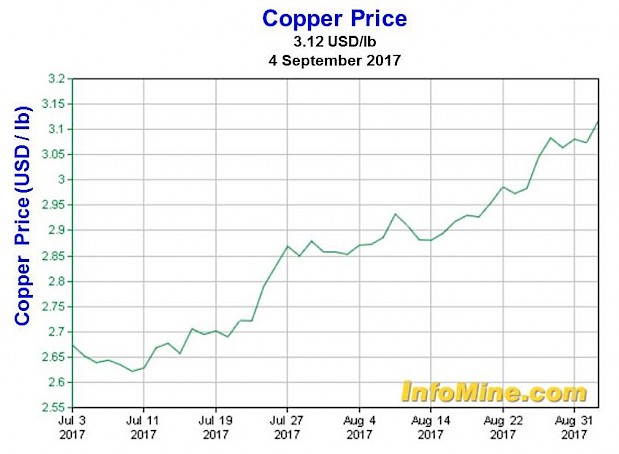

Figure 4. |

Copper prices now are trading above $3.00 a pound. |

May 2016 PEA findings support Kipushi’s highly attractive economics,

particularly in the context of current zinc prices

(All monetary figures in this news release are US dollars (US$), unless otherwise stated.)

The independent PEA for the planned redevelopment of the Kipushi Mine was published in May 2016 and assumed a base case, long-term zinc price of $2,227 per tonne ($1.01 per pound). The report described the redevelopment of Kipushi as an underground mine producing an average of 530,000 tonnes of zinc concentrate annually over a 10-year mine life at a total cash cost, including copper by-product credits, of approximately $0.54 per pound of zinc.

PEA highlights included:

- At a long-term zinc price of $2,227 per tonne ($1.01 per pound), after-tax net present value (NPV) at an 8% real discount rate is $533 million.

- At a long-term zinc price of $2,227 per tonne, after-tax real internal rate of return (IRR) is 30.9%.

- At a long-term zinc price of $2,227 per tonne, after-tax project payback period is 2.2 years.

- Leveraging existing surface and underground infrastructure significantly lowers the redevelopment capital compared to a greenfield development project, as well as the time required to reinstate production.

- Life-of-mine average cash cost of $0.54 per pound of zinc is expected to rank Kipushi, once in production, in the lower quartile of the cash-cost curve for zinc producers globally.

If the PEA assumed a long-term zinc price of $3,000 per tonne (or $1.36 per pound, which approximates the current spot price of zinc), the after-tax NPV8%would be $1.27 billion.

- Similarly, based on the information in the PEA and assuming a long-term zinc price of $3,000 per tonne, after-tax IRR would be 53.3% and after-tax project payback period would be 1.1 years.

- In addition, the PEA used a base-case zinc treatment charge of $200 per tonne, which is substantially higher than rates observed in the current zinc concentrate market.

Table 1: After-tax NPV8% sensitivity to zinc prices and discount rates ($ millions).

|

Discount rate |

Zinc price ($/tonne) |

||||

| $2,000 | $2,227 | $2,500 | $2,750 | $3,000 | |

| Undiscounted | $719 | $1,076 | $1,507 | $1,901 | $2,295 |

| 5% | $436 | $696 | $1,008 | $1,293 | $1,577 |

| 8% | $315 | $533 | $794 | $1,032 | $1,269 |

| 10% | $249 | $444 | $677 | $889 | $1,101 |

| 12% | $193 | $368 | $577 | $767 | $957 |

The PEA for Kipushi’s redevelopment was prepared by OreWin Pty. Ltd., of Adelaide, Australia, and the MSA Group (Pty.) Ltd., of Johannesburg, South Africa, in compliance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101).

KICO team members at the new conveyor belt installed at Kipushi’s 1,150-metre level

|

A scooptram loader and haul truck, part of the fleet of new underground mining equipment

|

Welding on the underground rock crusher at the bottom of Shaft 5 that is being

|

Kipushi’s upgraded water pumping station at the 1,210-metre level. |

Members of the Titan underground drilling team. The 6,500-metre drilling program

|

KICO team members at Kipushi’s Shaft 5 hoist winder. |

Precision machining is among KICO’s skilled services advancing Kipushi’s upgrading

|

New high-volume ventilation fan installed at Kipushi’s Shaft 4. |

Kipushi’s core shed, with Shaft 5 headframe at left in background. |

Pre-shift safety meeting (right) beside Kipushi’s Shaft 5 headframe. |

Table 2. Kipushi zinc-rich Mineral Resources at 7% zinc cut-off grade, January 23, 2016.

| Zone | Category | Tonnes (millions) |

Zn % |

Cu % |

Pb % |

Ag g/t |

Co ppm |

Ge g/t |

|||||

|

Big Zinc |

Measured | 3.59 | 38.39 | 0.67 | 0.36 | 18 | 17 | 54 | |||||

| Indicated | 6.60 | 32.99 | 0.63 | 1.29 | 20 | 14 | 50 | ||||||

| Inferred | 0.98 | 36.96 | 0.79 | 0.14 | 7 | 16 | 62 | ||||||

|

Southern Zinc |

Indicated | 0.00 | – | – | – | – | – | – | |||||

| Inferred | 0.89 | 18.70 | 1.61 | 1.70 | 13 | 15 | 43 | ||||||

| Total | Measured | 3.59 | 38.39 | 0.67 | 0.36 | 18 | 17 | 54 | |||||

| Indicated | 6.60 | 32.99 | 0.63 | 1.29 | 20 | 14 | 50 | ||||||

| Measured & Indicated | 10.18 | 34.89 | 0.65 | 0.96 | 19 | 15 | 51 | ||||||

| Inferred | 1.87 | 28.24 | 1.18 | 0.88 | 10 | 15 | 53 | ||||||

| Contained metal quantities | |||||||||||||

| Zone | Category | Tonnes (millions) |

Zn (million lbs) |

Cu (million lbs) |

Pb (million lbs) |

Ag (million oz) |

Co (million lbs) |

Ge (million ;oz) |

|||||

| Big Zinc | Measured | 3.59 | 3,035.8 | 53.1 | 28.7 | 2.08 | 0.13 | 6.18 | |||||

| Indicated | 6.60 | 4,797.4 | 91.9 | 187.7 | 4.15 | 0.20 | 10.54 | ||||||

| Inferred | 0.98 | 797.2 | 17.1 | 3.0 | 0.23 | 0.03 | 1.96 | ||||||

| Southern Zinc | Indicated | 0.00 | 0.0 | 0.0 | 0.0 | 0.00 | 0.00 | 0.00 | |||||

| Inferred | 0.89 | 368.6 | 31.8 | 33.5 | 0.38 | 0.03 | 1.23 | ||||||

| Total | Measured | 3.59 | 3,035.8 | 53.1 | 28.7 | 2.08 | 0.13 | 6.18 | |||||

| Indicated | 6.60 | 4,797.4 | 91.9 | 187.7 | 4.15 | 0.20 | 10.54 | ||||||

| Measured & Indicated | 10.18 | 7,833.3 | 144.9 | 216.4 | 6.22 | 0.33 | 16.71 | ||||||

| Inferred | 1.87 | 1,168.7 | 49.6 | 36.8 | 0.61 | 0.06 | 3.21 | ||||||

Notes:

- All tabulated data has been rounded and, as a result, minor computational errors may occur.

- Mineral Resources that are not Mineral Reserves have no demonstrated economic viability.

- The Mineral Resource is reported as the total in-situ Mineral Resource.

- Metal quantities are reported in multiples of Troy Ounces or Avoirdupois Pounds.

- The cut-off grade calculation was based on the following assumptions: zinc price of $1.02/pound, mining cost of $50/tonne, processing cost of $10/tonne, G&A and holding cost of $10/tonne, transport of 55% zinc concentrate at $375/tonne, 90% zinc recovery and 85% payable zinc.

Figure 5. World’s top 20 zinc projects by contained zinc. |

Source: Wood Mackenzie. Note: All tonnes and metal grades of individual metals used in the equivalency calculation of the above-mentioned projects (except for Kipushi) are based on public disclosure and have been compiled by Wood Mackenzie. All metal grades have been converted by Wood Mackenzie to a zinc equivalent grade at Wood Mackenzie’s respective long-term price assumptions.

About the Kipushi Mine

Kipushi is a historic, high-grade, copper-zinc-sliver-germanium mine that operated from 1924 to 1993 in the DRC’s Central African Copperbelt, adjacent to the town of Kipushi.

After being placed on care and maintenance in 1993, the lower levels of the mine flooded in early 2011 due to a lack of pumping maintenance over an extended period. Ivanhoe Mines acquired a 68% interest in Kipushi in November 2011 and assumed responsibility for ongoing redevelopment, dewatering and drilling. In December 2015, Ivanhoe achieved a major milestone in its upgrading of Kipushi’s underground infrastructure when the water level in Shaft 5 was pumped below the mine’s main pumping station 1,210 metres underground. The water level now is maintained below the 1,210-metre leveland the mine has clear and safe access to all of the main underground workings, including the Big Zinc Deposit.

Qualified Person, Quality Control and Assurance

The scientific and technical information in this news release has been reviewed and approved by Stephen Torr, P.Geo., Ivanhoe Mines’ Vice President, Project Geology and Evaluation, a Qualified Person under the terms of National Instrument 43-101. Mr. Torr is not independent of Ivanhoe Mines. Mr. Torr has verified the technical data disclosed in this news release.

Ivanhoe has prepared and filed a current independent, NI 43-101-compliant technical report for the Kipushi Project, titled “Kipushi Zn-Cu Project, Kipushi 2016 Preliminary Economic Assessment,” dated May 2016, which is available under the company’s SEDAR profile at www.sedar.com and on the company’s website at www.ivanhoemines.com. The technical report includes relevant information regarding the effective dates and the assumptions, parameters and methods of the mineral resource estimates on the Kipushi Project cited in this release, as well as information regarding data verification, exploration procedures, sample preparation, analysis and security, and other matters relevant to the scientific and technical disclosure contained in this release in respect of the Kipushi Project.

About Ivanhoe Mines

Ivanhoe Mines is advancing its three principal projects in Southern Africa: 1) Mine development at the Platreef platinum-palladium-gold-nickel-copper discovery on the Northern Limb of South Africa’s Bushveld Complex; 2) mine development and exploration at the tier one Kamoa-Kakula copper discovery on the Central African Copperbelt in the Democratic Republic of Congo; and 3) upgrading at the historic, high-grade Kipushi zinc-copper-silver-germanium mine, also on the DRC’s Copperbelt. For details, visit www.ivanhoemines.com.

Information contacts

| Investors Bill Trenaman +1.604.331.9834 |

Media North America: Bob Williamson +1.604.512.4856 South Africa: Jeremy Michaels +27.82.772.1122 |

Website www.ivanhoemines.com

Cautionary statement on forward-looking information

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements of the company, the Kipushi Project, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results, and speak only as of the date of this release.

The forward-looking statements and forward-looking information in this news release include without limitation, statements regarding (i) successful return to steady-state production will make Kipushi the world’s highest-grade major zinc mine; (ii) completion of a pre-feasibility study by the end of 2017; (iii) restarting commercial production at the Kipushi Project; (iv) upgrading and modernizing surface infrastructure; (v) upgrading shaft 5 rock-hoisting winder, the underground crusher at the bottom of Shaft 5, the Shaft 5 rock load-out facilities and the restoration of the main haulage way on the 1,150-metre level between the Big Zinc access decline and Shaft 5 before the end of the first quarter of 2018; (vi) completion of a 41-hole, 6,500-metre underground drilling program; (vii) rehabilitation of the rail spur that links the Kipushi Mine to the Congolese national railway line; (viii) statements regarding the rock hoisting winder is expected to be fully operational early in 2018; and (ix) statements regarding projected steady-state annual production of 530,000 tonnes of zinc concentrate. In addition, all of the results of the Kipushi 2016 PEA represent forward-looking information and statements.

The forward-looking information and statements also includes metal price assumptions, cash flow forecasts, projected capital and operating costs, metal recoveries, mine life and production rates, and other assumptions used in the Kipushi 2016 PEA. Readers are cautioned that actual results may vary from those presented.

All such forward-looking information and statements are based on certain assumptions and analyses made by Ivanhoe Mines’ management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believe are appropriate in the circumstances. These statements, however, are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information or statements including, but not limited to, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts to perform as agreed; social or labour unrest; changes in commodity prices; unexpected failure or inadequacy of infrastructure, or delays in the refurbishment or development of infrastructure, and the failure of exploration programs or other studies to deliver anticipated results or results that would justify and support continued studies, development or operations. Other important factors that could cause actual results to differ from these forward-looking statements also include those described under the heading “Risk Factors” in the company’s most recently filed MD&A as well as in the most recent Annual Information Form filed by Ivanhoe Mines. Certain of the risks that could cause the actual results to differ materially are also presented in the technical report for the Kipushi Project titled “Kipushi Zn-Cu Project, Kipushi 2016 Preliminary Economic Assessment” dated May 2016 and filed on May 27, 2016, available on SEDAR at www.sedar.com and on the Ivanhoe Mines website at www.ivanhoemines.com.

Readers are cautioned not to place undue reliance on forward-looking information or statements.

This news release also contains references to estimates of Mineral Resources. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource estimates may have to be re-estimated based on, among other things: (i) fluctuations in zinc, copper, or other mineral prices; (ii) results of drilling; (iii) results of metallurgical testing and other studies; (iv) changes to proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates; and (vi) the possible failure to receive required permits, approvals and licences.

Although the forward-looking statements contained in this release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this release.

English

English Français

Français 日本語

日本語 中文

中文