Ivanhoe Mines records a profit of $85.4 million in Q3

Kamoa-Kakula Copper Mine achieved Phase 1 commercial production on July 1, 2021

More than 77,500 tonnes of copper produced year-to-date; copper production guidance for 2021 raised to 92,500 to 100,000 tonnes

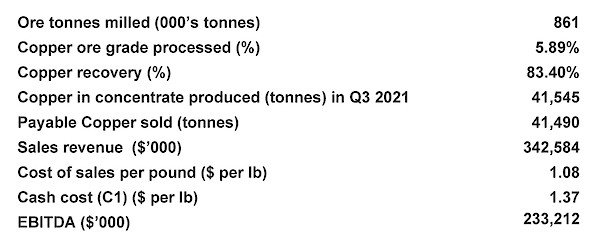

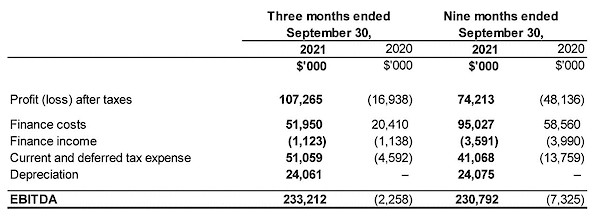

Kamoa-Kakula sold 41,490 tonnes of payable copper and recognized revenue of $342.6 million in Q3, with an inaugural operating profit of $209.7 million and EBITDA of $233.2 million

Kamoa-Kakula’s Phase 2 expansion to begin operations in Q2 2022, doubling the mine’s projected annual copper production to approximately 400,000 tonnes

Excellent progress on all-weather road and geophysical surveys on Ivanhoe’s Western Foreland exploration project

Extensive drilling program on Western Foreland to continue in 2022

Development of the world-scale Platreef palladium, rhodium, platinum, nickel, copper and gold project in South Africa making rapid progress; first production expected in 2024

TORONTO, CANADA ‒ Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF) today announced its financial results for the three and nine months ended September 30, 2021. This quarter marks the first quarter of commercial production at the company’s Kamoa-Kakula Copper joint-venture in the Democratic Republic of Congo (DRC).

Ivanhoe Mines also is advancing development of the Platreef palladium-rhodium-platinum-nickel-copper-gold discovery in South Africa, which is scheduled to begin production in 2024, and is upgrading the historic Kipushi zinc-copper-lead-germanium mine, also in the DRC, for a resumption of production. Ivanhoe also is exploring for new copper discoveries on its Western Foreland exploration licences in the DRC, near the Kamoa-Kakula Project. All figures are in U.S. dollars unless otherwise stated.

Watch a new video highlighting Kamoa-Kakula’s Q3 operational and financial achievements:https://vimeo.com/645848726/9d4de9d7d6

HIGHLIGHTS

- The Kamoa-Kakula Project began producing copper in May 2021 and achieved commercial production on July 1, 2021. Production for the third quarter was 41,545 tonnes of copper in concentrate, with year-to-date production of more than 77,500 tonnes as of November 15, 2021.

- The initial 2021 production guidance range for copper in concentrate of 80,000 to 95,000 tonnes was raised to 92,500 to 100,000 tonnes, reflecting the successful completion of ramp-up of the Kakula Phase 1 concentrator.

- During its first quarter of commercial production, the Kamoa-Kakula joint venture sold 41,490 tonnes of payable copper and recognized revenue of $342.6 million, with an operating profit of $209.7 million and an EBITDA of $233.2 million.

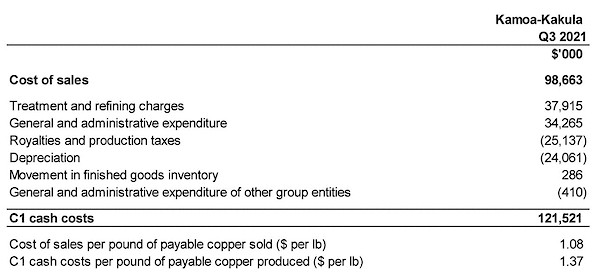

- Kamoa-Kakula’s cost of sales per pound (lb) of payable copper sold was $1.08/lb, while cash costs (C1) per pound of payable copper totaled $1.37/lb. Costs for the quarter reflect the measured ramp-up of production at Kamoa-Kakula to steady-state, and are expected to trend downward as the Phase 2 concentrator plant is commissioned and the mine’s fixed operating costs are spread over increased copper production.

- Kamoa-Kakula’s Phase 2 construction is progressing well toward a Q2 2022 start-up, which will see a doubling of the mine’s nameplate milling throughput to 7.6 million tonnes per annum (Mtpa). Phases 1 and 2 combined are forecast to produce approximately 400,000 tonnes of copper per year.

- Ivanhoe Mines recorded a profit of $85.4 million for Q3 2021, compared to a loss of $5.3 million for the same period in 2020. The company’s share of profit from the Kamoa-Kakula joint venture and the finance income therefrom were the principal contributors to the profit recorded in the current quarter.

- The company has a strong balance sheet with cash and cash equivalents of $579.7 million on hand as at September 30, 2021, and expects that the majority of Kamoa-Kakula’s expansion capital expenditures on Phase 2 and Phase 3 will be funded from copper sales and facilities in place at Kamoa. Based on current market conditions, it is anticipated that shareholder loan repayments from Kamoa-Kakula will commence in 2022.

- During Q3, Ivanhoe continued its 2021 copper exploration program on its Western Foreland licences that cover approximately 2,550 square kilometres in close proximity to Kamoa-Kakula. Work in Q3 primarily was focused on completing the project’s infrastructure program (all-weather road building and bridge construction) needed to allow Ivanhoe’s drilling crews to access the highly-prospective exploration licences located to the south and west of the Kamoa and Kakula orebodies. Geophysical surveys (airborne, electromagnetic (EM), and gravity) were advanced during the quarter and are either complete or are nearing completion. Drilling during the quarter was focused on extending the copper discoveries at Makoko and Kiala.

- Platreef’s updated feasibility study for the phased development plan is progressing well toward completion in early 2022. All design and engineering work has been completed with the cost estimates well advanced. The Shaft 1 changeover is progressing well in preparation for permanent rock hoisting in early 2022. Construction activities on the Shaft 2 headframe also are advancing.

- Financing arrangements for Platreef’s first phase of development are nearing completion, which include a $300-million gold, palladium and platinum streaming facility, and a senior project debt facility of up to $120 million.

- The review of Kipushi’s development and financing plan with joint-venture partner and state-owned mining company, Gécamines, is progressing well as Ivanhoe looks to resume development activities. Discussions with potential financing sources are in progress.

- At the end of Q3 2021, Kamoa-Kakula had reached 3.00 million work hours free of a lost-time injury, Kipushi had reached 3.66 million work hours free of a lost-time injury, and Platreef had reached 310,000 work hours free of a lost-time injury. In addition, the construction team at Kamoa-Kakula achieved 4.00 million hours worked without a lost-time injury in October 2021, a milestone that underscores the strict safety culture of the Kamoa Copper construction team.

- On November 12, 2021, Ivanhoe promoted David van Heerden to the role of Chief Financial Officer. David has been with Ivanhoe since 2011 in progressively senior finance roles, most recently Vice President, Finance, Treasury and Tax.

Robert Friedland, Ivanhoe Mines’ Founder and Executive Co-Chair, remarked: “Today, after a more than 25-year-long odyssey… and having overcome a myriad of challenges worthy of Homer… that the critics claimed were impossible to hurdle… we are very pleased to report our first full quarter of commercial production and our inaugural operating profit. This achievement was made possible through the tireless efforts of thousands of people over more than two decades. These include our dedicated employees, our patient and loyal shareholders, our joint-venture partners, the Government of the Democratic Republic of Congo, and of course, the people who live in the vicinity of, and work at, this magnificent copper complex.

“We are immensely proud to say that Kamoa-Kakula – comprising the first world-scale, greenfield copper discoveries in the Democratic Republic of Congo since the country gained independence in 1960… is well on its way to joining the ranks of the world’s largest and greenest copper producers, with the highest copper grades by a wide margin.

“There is profound potential to discover additional tier-one copper deposits in the Western Foreland basin, as our team of talented geologists and geoscientists search for the next high-grade discovery, armed with our proprietary exploration knowledge gained from 20 years of experience in the Western Foreland copper basin.

“Turning an operating profit in just the first quarter of commercial production at Kamoa-Kakula highlights the ability of the mine to deliver as promised, and to self-fund its expansion to produce up to 800,000 tonnes of copper yearly, as demonstrated in previous independent studies. Kamoa-Kakula will rapidly repay its construction costs and pay dividends to its shareholders, including our most important partner, the Government of the Democratic Republic of Congo.

“However, the biggest dividend from Kamoa-Kakula that will benefit everyone on Planet Earth is invisible to the naked eye… it is the global warming gas that will never make it into the atmosphere as the copper mined at Kamoa-Kakula makes its way into tomorrow’s electric vehicles, energy storage systems and batteries, and renewable power generation. That vision of a greener and more sustainable world is one we share with all our stakeholders.

“The bright lights of Kamoa-Kakula have blinded the investment world to our Platreef Project, which is among this planet’s largest precious and electric metals deposits with enormous quantities of palladium, rhodium, platinum, nickel and copper; and more ounces of gold than many leading gold mines. For a long time, the development of Platreef has been a destiny waiting to be fulfilled. However, Platreef’s time to shine now is upon us.

“The initial scope of the phased development plan is to fast-track Platreef into production in 2024, starting with an initial 700,000-tonne-per-annum underground mine. The plan is designed to establish an operating platform to support potential future expansions up to 12 million tonnes of ore per year. This would position Platreef among the largest nickel and platinum-group-metals producing mines in the world, producing in excess of 24,000 tonnes of nickel and 1.1 million ounces of palladium, rhodium, platinum, and gold per year, and help feed the demand for these critical minerals that the world needs as it transitions to a low carbon economy.”

Principal projects and review of activities

1. Kamoa-Kakula Project

39.6%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kamoa-Kakula Project, a joint venture between Ivanhoe Mines and Zijin Mining, has been independently ranked as the world’s fourth-largest copper deposit by international mining consultant Wood Mackenzie. The project is approximately 25 kilometres west of the town of Kolwezi and about 270 kilometres west of Lubumbashi. The Kamoa-Kakula Project began producing copper in May 2021 and achieved commercial production on July 1, 2021.

Ivanhoe sold a 49.5% share interest in Kamoa Holding Limited (Kamoa Holding) to Zijin Mining and a 1% share interest in Kamoa Holding to privately-owned Crystal River in December 2015. Kamoa Holding holds an 80% interest in the project. Since the conclusion of the Zijin transaction, each shareholder has been required to fund expenditures at the Kamoa-Kakula Project in an amount equivalent to its proportionate shareholding interest in Kamoa Holding.

Ivanhoe and Zijin Mining each hold an indirect 39.6% interest in the Kamoa-Kakula Project, Crystal River holds an indirect 0.8% interest and the DRC government holds a direct 20% interest.

Kamoa-Kakula Q3 2021 summary of operating and financial data

9,858 tonnes of copper in concentrate were produced in Q2 2021, bringing the year-to-date total tonnes produced as of September 30, 2021 to 51,403.

C1 cash costs are prepared on a basis consistent with the industry standard definitions by Wood Mackenzie cost guidelines, but are not measures recognized under IFRS. In calculating the C1 cash cost, the costs are measured on the same basis as the company’s share of profit from the Kamoa Holding joint venture that is contained in the financial statements. C1 cash costs are used by management to evaluate operating performance and include all direct mining, processing, and general and administrative costs. Smelter charges and freight deductions on sales to final port of destination, which are recognized as a component of sales revenues, are added to C1 cash cost to arrive at an approximate cost of delivered finished metal. C1 cash costs exclude royalties and production taxes and non-routine charges as they are not direct production costs.

C1 cash cost per pound of payable copper produced can be further broken down as follows:

All figures in the above tables are on a 100%-project basis. Metal reported in concentrate is prior to refining losses or deductions associated with smelter terms. This news release includes earnings before interest, tax, depreciation and amortization (EBITDA), and “Cash costs (C1) per pound” which are non-GAAP financial performance measures. For a detailed description of each of the non-GAAP financial performance measures used in this news release, and a detailed reconciliation to the most directly comparable measure under IFRS, please refer to the Non-GAAP Financial Performance Measures section of this news release.

Kamoa-Kakula’s Phase 1 (left) and Phase 2 concentrator plants. The Phase 1 plant began operations in May 2021 and the Phase 2 plant is on track to begin operations in Q2 2022.

Nathalie Mulel, Kamoa Copper’s Senior Officer, Customs, with Kamoa Copper blister copper ingots, containing approximately 99% copper, produced at the Lualaba Copper Smelter near Kolwezi, DRC.

Health and safety at Kamoa-Kakula

At the end of September 2021, the Kamoa-Kakula Project reached 3,002,776 work hours free of a lost-time injury. Three lost-time injuries occurred early in Q3 2021. The project continues to strive toward its workplace objective of zero harm to all employees and contractors.

Kamoa-Kakula has successfully focused on prevention, preparation, and mitigation in managing the risks associated with COVID-19. Large-scale testing, combined with focused preventative measures, ensured that positive cases were quickly identified, isolated, and treated, with cross contamination kept to a minimum. Maintaining this high standard of risk management remains a daily focus, to prevent future cases. During the first nine months of 2021, the Kamoa-Kakula Project conducted 6,083 COVID-19 tests, with 477 patients testing positive for COVID-19.

With the support of the Democratic Republic of Congo government, UNICEF and other stakeholders, Kamoa Copper SA completed its first round of COVID-19 vaccinations in June 2021. In conjunction with the DRC government’s extended program of vaccinations, the second round of COVID-19 vaccinations at Kamoa-Kakula commenced in mid-August.

The Kamoa COVID-19 hospital continues to treat patients when required, as construction progresses well for the expansion and upgrade of the primary healthcare wing. Kamoa-Kakula’s highly experienced doctors and nurses apply the latest medical treatments, supported by a world-leading emergency response and paramedic team.

As the pandemic evolves, the medical team at the Kamoa hospital continues to review and update risk-mitigation protocols, while ensuring that new medical advances are investigated and applied to protect the health and safety of employees and community members.

Copper concentrate production from the initial 3.8-Mtpa Kakula concentrator plant commenced in May 2021; commercial production achieved on July 1, 2021

First ore was introduced into the ball mills on May 20, 2021, and the first saleable concentrate was filtered on May 25, 2021, marking the start of concentrate production of the project’s first phase, 3.8-Mtpa concentrator plant and associated facilities.

The Kamoa-Kakula Project was deemed to have reached commercial production on July 1, 2021, after achieving a milling rate exceeding 80% of design capacity and recoveries close to 70% for a continuous, seven-day period. Revenue recognition, as well as depreciation of Kamoa-Kakula’s first phase, 3.8-Mtpa concentrator plant and milling operation, commenced on this date.

Copper recoveries progressively increased from an average of approximately 81% in July 2021 to approximately 85% in September 2021. The Phase 1, steady-state-design copper recovery is approximately 86%, depending on ore feed grade.

41,545 tonnes of copper in concentrate were produced in Q3 2021 for a total of 51,403 tonnes year-to-date as of September 30, 2021, for delivery to either the Lualaba Copper Smelter near Kolwezi, or to international markets. This is an additional 4,653 tonnes to the 46,750 tonnes reported for the year-to-date to September 20, 2021, in Ivanhoe’s September 30, 2021 news release.

Loading high-grade copper concentrate at the Kamoa-Kakula concentrate storage warehouse for transport to the nearby Lualaba Copper Smelter for processing into blister copper ingots, containing approximately 99% copper.

Producing Kamoa Copper blister copper ingots at the Lualaba Copper Smelter near Kolwezi, DRC.

Copper production guidance for 2021

Overall construction of the Kamoa-Kakula Project’s first phase, 3.8-Mtpa concentrator plant and associated facilities is complete. First ore was introduced into the ball mills on May 20, 2021, and first saleable concentrate was filtered on May 25, 2021, marking the start of concentrate production.

As at November 15, 2021, contained copper in concentrate produced by the Kamoa-Kakula Project amounted to more than 77,500 tonnes. Ivanhoe’s production guidance for contained copper in concentrate at Kamoa-Kakula in 2021 has been raised to 92,500 to 100,000 tonnes. The figures are on a 100%-project basis and metal reported in concentrate is prior to refining losses or deductions associated with smelter terms.

Cost of sales per pound of payable copper sold and C1 cash costs per pound of payable copper produced for Q4 2021 are not expected to be materially different to actual expenditure for Q3 2021.

Copper production, cost of sales and cash cost guidance for 2022, including the start of Phase 2 operations, will be provided in January 2022.

Commissioning of the initial 3.8-Mtpa Kakula concentrator plant and C5 performance tests complete

Commissioning of the first phase, 3.8-Mtpa concentrator now has been completed, with the final commissioning performance tests which consisted of a 72- hour continuous run successfully carried out in early September. The plant now has been handed over to operations. During commissioning, the concentrate filter was identified as a potential bottleneck, and a second filter recently has been installed and commissioned. The second filter will allow Kamoa-Kakula to take advantage of ultra-high-grade copper ore and milling throughputs in excess of design. A third filter will be installed as part of the Phase 2 expansion.

Hot commissioning of the backfill plant is nearing completion with one underground stope already filled with paste backfill. All areas of the backfill plant now are C4 (hot commissioning) complete with just the C5 (performance tests) outstanding.

The backfill plant is being used to mix tailings from the processing plant with cement to produce paste backfill. The backfill is being pumped back into the mine and used to help support mined-out areas. Approximately one-half of the mine’s tailings will be sent back underground as paste backfill, significantly reducing the surface tailings storage.

Construction of Kamoa-Kakula’s Phase 2 expansion now more than 60% complete; Phase 3 studies are progressing

Construction of the second 3.8-Mtpa concentrator plant is progressing well toward a Q2 2022 start-up with the current focus on the erection and installation of structural steel, platework and piping. A number of items of mechanical equipment are being installed including the crusher, ball mills, flotation cells and the tailings thickener.

Engineering and procurement activities essentially are complete, with fabrication and delivery to site well advanced and more than 92% complete. The only outstanding items being fabricated are electrical equipment. Fabrication of all structural steel, platework and piping from China has been completed, with the bulk of the material delivered to site. The bulk of the mechanical equipment also has been delivered to site.

Newly-installed Phase 2 flotation cells, with the Phase 1 flotation cells in the background.

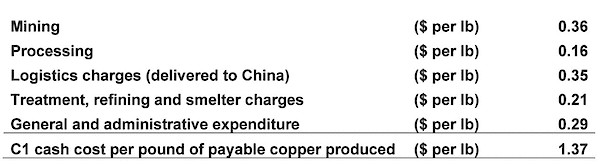

Boilermaker Zetty Musangu Sampind assembling racks to hold electrical cables in the Phase 2 concentrator plant.

Construction is nearing completion on the Phase 2 high pressure grinding rolls (HPGR) tower and the feed and product conveyors (on the left), adjacent to the Phase 1 HPGR tower and conveyors.

Construction of the Phase 2 concentrate storage building is advancing rapidly.

Ivanhoe and its partner Zijin are exploring the acceleration of the Kamoa-Kakula Phase 3 concentrator expansion, with initial project scoping nearing completion and study work advancing.

The scope of Kamoa-Kakula’s Phase 3 expansion includes a third concentrator plant to be located adjacent to the Kansoko Mine (at the Kansoko Sud orebody), approximately 10 kilometres north of the Kakula Mine. The Phase 3 concentrator is being designed to have a larger nameplate milling capacity than the 3.8-Mtpa nameplate milling capacity of the Phase 1 and 2 concentrators.

The planned Phase 3 concentrator is expected to be fed from a combination of the established mine at Kansoko Sud, together with the opening of the Kansoko Central orebody and the first of the Kamoa North mining areas.

In addition, the studies will take into consideration the plans to upgrade turbine 5 at the Inga II hydropower complex to provide 162 megawatts of renewable hydropower, as well as the construction of a direct-to-blister smelter.

Study work on all aspects of the Phase 3 expansion is underway, with expected completion during 2022, after which Kamoa Copper will advance into a more detailed phase of design and engineering work. In parallel, a location for a new box cut, which will provide access to the Kansoko Central orebody and the first of the Kamoa North mining areas, has been identified and geotechnical drilling is underway to confirm the suitability of the location. Kamoa Copper is expected to break ground on the box cut early in 2022.

Geotechnical drilling to confirm the suitability of the planned location for a new box cut that will provide initial access to the Kansoko Central orebody and the first of the Kamoa North mining areas.

New ore haul trucks, each with a 63-tonne payload, and scooptrams supplied by Sandvik of Stockholm, Sweden. The new fleet of mining equipment will be used to ramp up mining operations in advance of the start of the Phase 2 concentrator plant.

One of the new Sandvik ore haul trucks heading down the northern decline at the Kakula Mine.

Kamoa smelter basic engineering to commence shortly

Kamoa Copper is planning to construct a direct-to-blister flash smelter adjacent to the Phase 1 and Phase 2 concentrator plants. The smelter is designed to use technology supplied by Outotec Oyj of Helsinki, Finland, and has been sized to process the bulk of the copper concentrate forecast to be produced by the Phase 1, Phase 2 and Phase 3 concentrator plants, with a production capacity of 500,000 tonnes per annum of blister copper.

A request for tender for the smelter engineering, procurement and construction manager (EPCM) services and basic engineering services has been issued to the market and bids from prospective engineering companies have been received. Kamoa Copper is in the final stages of adjudication and an award is expected shortly.

The next stages in the project development will be the completion of basic engineering and the ordering of the long-lead items of equipment.

Ore stockpiles now hold approximately 3.73 million tonnes grading 4.72% copper, containing more than 175,000 tonnes of copper

Kamoa-Kakula’s total high- and medium-grade ore surface stockpiles totalled approximately 3.66 million tonnes at an estimated grade of 4.73% copper as of the end of September 2021.

395,000 tonnes of ore grading 5.73% copper were mined in October 2021 and comprised 360,000 tonnes grading 5.91% copper from the Kakula Mine, including 174,000 tonnes grading 6.91% copper from the mine’s high-grade centre, and 35,000 tonnes grading 3.84% copper from the Kansoko Mine. The project’s total high- and medium-grade ore surface stockpiles now contain approximately 3.73 million tonnes at an estimated grade of 4.72% copper as of the end of October 2021.

During October, a north-south, water-bearing structure was intersected at the Kakula Mine’s northern perimeter drift. This new structure produced considerable water inflow that caused some localized flooding in the nearby surrounding workings in early October. Since then, the water inflow has decreased by more than 50% and has been controlled by the mining team, with the flooded areas largely dewatered and no impact on overall production from underground. Hydrological studies are ongoing with industry experts, which will be used for planning in advance of mining operations. Kakula has significant excess installed pumping capacity, with further expansions planned in 2022.

Electrician Junior Mwepu entering the Kakula North lamp room via a fingerprint scanner. As part of the mine’s ongoing safety initiatives, new card readers and fingerprint scanners have been installed at entry points to the mine.

Huang Ya Wen (left) and Estime Kasongo installing rollers for the Phase 2 high-pressure-grinding-rolls (HPGR) stockpile conveyor system.

Kamoa-Kakula delivering Phase 1 blister copper and copper concentrate under off-take agreements

Kamoa Copper’s off-take agreements are with CITIC Metal (HK) Limited (CITIC Metal) and Gold Mountains (H.K.) International Mining Company Limited, a subsidiary of Zijin, for 50% each of the copper products from Kamoa-Kakula’s Phase 1 production. The off-take agreements are evergreen for the production volumes from Phase 1, including copper concentrate and blister copper resulting from processing of copper concentrates at the nearby Lualaba Copper Smelter.

CITIC Metal and Zijin are purchasing the copper concentrate at the Kakula Mine and the blister copper at the Lualaba Copper Smelter on a free-carrier basis, meaning the buyers are responsible for arranging freight and shipment to the final destination, initially via the port of Durban, South Africa.

Kamoa Copper delivered its first bulk copper concentrates to the Lualaba Copper Smelter on June 1, 2021. The smelter is expected to treat up to 150,000 wet metric tonnes of copper concentrates from Kamoa-Kakula annually. Kamoa-Kakula began exporting its copper concentrate internationally in July 2021. The first truckloads of copper concentrate destined for smelters outside of the DRC departed from the mine site on July 17, 2021.

Kamoa Copper’s concentrate transportation logistics team inside the concentrate storage warehouse.

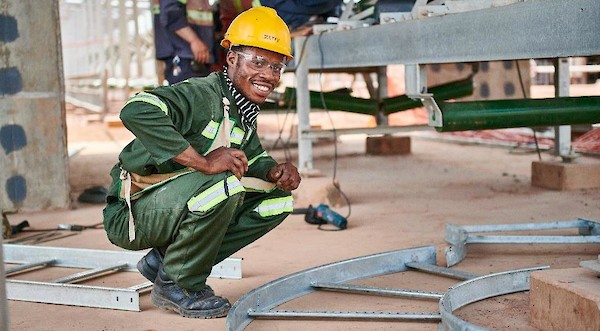

Mwadingusha hydropower plant fully operational and providing 78 megawatts of clean electricity for Kamoa-Kakula’s phases 1 and 2; focus now shifted to upgrading turbine 5 at the Inga II hydropower plant to provide power for Kamoa-Kakula expansions

All six new turbines at the Mwadingusha hydropower plant were synchronized to the national electrical grid in August 2021, with each generating unit producing approximately 13 megawatts (MW) of power, for a combined output of approximately 78 MW.

In August 2021, Kamoa-Kakula’s energy company signed an extension of the existing financing agreement with La Société Nationale d’Electricité (SNEL) to upgrade turbine 5 at the Inga II hydropower complex. Since June 2021, rehabilitation scoping works and technical visits have been conducted by Stucky Ltd. of Renens, Switzerland, and Voith Hydro of Heidenheim, Germany, a leading engineering group. Voith Hydro, the contractor for the turbine 5 upgrade, has successfully rehabilitated two turbine generators at the adjoining Inga I hydropower plant, a project that was financed by the World Bank.

Early works related to the removal of sand in the draft tube of turbine 5 is in progress. Completion of this work will allow the engineering teams from Voith Hydro, Stucky and SNEL to complete the scoping work.

Turbine 5 is expected to produce 162 MW of renewable hydropower, providing the Kamoa-Kakula Copper Complex and the planned, associated smelter with abundant, sustainable electricity for future expansions.

The Inga II hydropower facility on the Congo River. The penstock for turbine 5 is circled in red.

Engineers from Kamoa Copper, SNEL, Stucky and Voith Hydro at turbine 5.

Kamoa-Kakula aiming to be first net-zero carbon emitter among top-tier copper mines by electrifying mining fleet with state-of-the-art equipment powered by electric batteries or hydrogen fuel cells

On May 5, 2021, Ivanhoe Mines announced its pledge to achieve net-zero operational greenhouse gas emissions (Scope 1 and 2) at the industry-leading Kamoa-Kakula Copper Mine.

In support of the Paris Agreement on climate change, and in the spirit of the commitments at the April 2021 Leaders Summit on Climate by the Chinese and American governments to sharply cut emissions, Ivanhoe Mines has committed to working with its joint-venture partners and leading underground mining equipment manufacturers to ensure that Kamoa-Kakula becomes the first net-zero operational carbon emitter among the world’s top-tier copper producers.

Since the Kamoa-Kakula mines and concentrator plants already are powered by clean, renewable hydro-generated electricity, the focus of the company’s net-zero commitment will be on electrifying the project’s mining fleet with new, state-of-the-art equipment powered by electric batteries or hydrogen fuel cells.

Kamoa-Kakula is working closely with its mining equipment suppliers to decrease the use of fossil fuels in its mining fleet, and evaluate the viability, safety and performance of new electric, hydrogen and hybrid technologies. The mine plans to introduce them into its mining fleet as soon as they become commercially available.

Enriching communities through sustainable development

Ivanhoe Mines founded the Sustainable Livelihoods Program in 2010 to strengthen food security and farming capacity in the host communities near Kamoa-Kakula by establishing an agricultural training garden and support for farmers at the community level. Today, approximately 900 community farmers are benefiting from the Sustainable Livelihoods Program, producing high-quality food for their families and selling the surplus for additional income. The Sustainable Livelihoods Program, which commenced with maize and vegetable production, now includes fruit, aquaculture, poultry and honey.

The construction of 100 new fishponds is complete, bringing the total number of fishponds to 138. The project will significantly contribute toward local entrepreneurship and enhanced regional food security. A group of community participants took part in, and graduated as facilitators for, an adult literacy training program.

Additional non-farming-related activities continued during Q3 2021 and include education programs, enterprise and supplier development programs, and the supply of fresh water to a number of local communities using solar-powered boreholes. 27 of a planned 35 boreholes were drilled so far in communities using local contractors, providing approximately ten thousand community members with easy access to clean water. Construction, landscaping and equipping of the Kaponda Primary School is progressing well. Local community enterprise programs continued including brick-making, sewing, landscaping and gardening.

Construction of resettlement houses for the relocation program is continuing as planned. To date, 129 homes have been relocated, with five households remaining. The remaining families are scheduled for relocation upon completion of the construction of their new homes. Construction of the community church at Kaponda is 95% complete. The livelihood restoration program focused on the distribution of 758 chickens for all project-affected-people, with special consideration for vulnerable households.

Jean Munika, a Sustainable Livelihoods worker, with a few of the 3,200 orange tree seedlings for planting at homes in local communities and at a new, community-owned six-hectare orange orchard.

Paul Kabengele, Superintendent Community Projects (left), and Fabrice Mazeze, Sustainable Livelihoods Agronomist, inspecting a new crop of oranges at Kamoa Copper’s demonstration garden.

2. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project is owned by Ivanplats (Pty) Ltd (Ivanplats), which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically-disadvantaged, broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with approximately 150,000 people, project employees and local entrepreneurs. Ivanplats reached Level 4 contributor status in its most recent verification assessment on the B-BBEE scorecard. A Japanese consortium of ITOCHU Corporation, Japan Oil, Gas and Metals National Corporation, and Japan Gas Corporation, owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper and gold mineralization on the Northern Limb of the Bushveld Igneous Complex in Limpopo Province – approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane.

On the Northern Limb, platinum-group metals mineralization is primarily hosted within the Platreef, a mineralized sequence that is traced more than 30 kilometres along strike. Ivanhoe’s Platreef Project, within the Platreef’s southern sector, is comprised of two contiguous properties: Turfspruit and Macalacaskop. Turfspruit, the northernmost property, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of mining operations and properties.

Since 2007, Ivanhoe has focused its exploration and development activities on defining and advancing the down-dip extension of its original discovery at Platreef, now known as the Flatreef Deposit, which is amenable to highly-mechanized, underground mining methods. The Flatreef area lies entirely on the Turfspruit and Macalacaskop properties that form part of the company’s mining right.

Health and safety at Platreef

At the end of September 2021, the Platreef Project reached a total of 310,440 lost-time, injury-free hours worked.

COVID-19 protocols are continuously reviewed and optimized; as a result, the company implemented several measures to prevent and mitigate the escalation of infections. Those measures included the mass testing of employees and visitors, provision of transport to employees and a vaccination rollout. By the end of September 2021, a total of 4,649 COVID-19 tests had been conducted. In support of the National Department of Health’s national vaccine rollout strategy, Ivanplats launched an on-site COVID-19 vaccination campaign that has administered 396 vaccine doses to date. Approximately 75% of the Platreef Project’s employees and contractors working on site have at minimum received their first dose of the vaccine.

Phased development plan and feasibility study nearing completion

Platreef’s updated feasibility study for the phased development plan is progressing well toward completion in early 2022. All design and engineering work has been completed with cost estimates well advanced.

The initial scope of the phased development plan is to fast-track Platreef into production in 2024, starting with an initial 700,000-tonne-per-annum (700-ktpa) underground mine using the existing Shaft 1 and a new on-site concentrator with a capacity of up to 770 ktpa. This phased development plan will be targeting high-grade mining areas near the shaft, requiring significantly lower initial capital costs.

While development and initial production is achieved using Shaft 1, the sinking of Shaft 2 continues in parallel, and once the shaft is available the processing capacity is expected to be expanded with the construction of two additional 2.2-Mtpa concentrator modules. At this point, total mine production would be increased to the envisaged steady-state production of 5.2 Mtpa.

Project-level financing arrangements of up to $420 million to advance Platreef’s development nearing completion

In February 2021, Ivanplats signed a non-binding term sheet with Orion Mine Finance, a leading international provider of production-linked stream financing to base and precious metals mining companies, for a $300 million gold, palladium and platinum streaming facility. The stream financing is nearing completion and remains subject to execution of definitive documentation. The streaming facility is planned to be drawn down in two separate tranches, as needed for the development of the initial 700-ktpa underground mine and required infrastructure.

Ivanplats also appointed two prominent, international commercial banks – Societe Generale and Nedbank – as mandated lead arrangers for a senior project debt facility of up to $120 million. The senior project debt facility is scheduled to be utilized only after the streaming facility is fully drawn. Definitive terms and conditions of the debt facility are subject to the completion of the feasibility study for Platreef’s phased development plan, completion of due diligence and structuring, as well as negotiation and execution of definitive documentation. Terms and conditions of the debt facility will be made available when finalized.

Shaft 1 changeover to a production shaft progressing well

The construction of the 996-metre-level station at the bottom of Shaft 1 was completed in July 2020. Shaft 1 initially will be used to access the orebody and is approximately 350 metres away from a high-grade area of Flatreef that is planned for bulk, mechanized mining. The three development stations that will provide initial, underground access to the high-grade orebody also have been completed on the 750-, 850-, and 950-metre levels.

Construction of the auxiliary winder foundations has been completed, and the auxiliary winder installed and commissioned. The headgear, both winders, equipping stage, conveyances and control systems comply with the highest current industry safety standards, with proven and tested safety and redundancy systems in place.

The changeover construction at Shaft 1 is progressing to plan and is on schedule for commencement of rock hoisting early in 2022. All equipment for the shaft changeover has been procured and is on site. The changeover work within the shaft is being done by Platreef’s experienced owners’ team.

The winder that was used to successfully sink Shaft 1 has been converted to function as the main equipping conveyance during the shaft changeover, and will serve as the permanent rock, personnel and material winder following the shaft-equipping phase. The shaft will be equipped with two 12.5-tonne skips (with hoisting capacity of 825,000 tonnes per year) and an interchangeable personnel and materials conveyance to accommodate the movement of personnel and materials during the initial phase of mining.

Rope guides will be used for the main rock, personnel and materials conveyances, while steel sets and guides will be used for the auxiliary winder conveyance. The stage and winder ropes used during the sinking phase have been removed, and the new equipping stage, permanent guide-ropes and permanent hoisting ropes have been installed. The auxiliary winder has been installed and commissioned to assist during the shaft and station equipping phase, and to function as a personnel winder during the main rock hoisting cycle. Shaft equipping is progressing well with the permanent service pipes, guides, electrical cables and other control cables successfully installed down to the 950-metre-level.

Newly designed rock chutes will connect the conveyors feeding the concentrator plant and the waste rock area; from there the waste rock will be crushed and used as cemented backfill underground, as well as for protection berms to contain storm water and reduce noise emissions.

Shaft equipping commenced in May 2021 and remains on track to be completed in early 2022. Following the completion of the changeover work in the shaft, underground stations, and establishment of the ore and waste passes, lateral underground mine development will commence toward high-grade ore zones.

Key underground development orders placed

The waste conveyor, which will feed from Shaft 1, is progressing to plan with all mechanical and electrical orders well advanced. Delivery of the radial stacker is planned for February 2022 and the complete waste conveyor load-out system is expected to be fully operational by early 2022. Additionally, Ivanplats placed an initial order with Epiroc of Stockholm, Sweden, for its primary mining fleet consisting of emissions-free, battery electric jumbo face drill rigs and load haul dump (LHD) vehicles, due for delivery in early 2022.

Manufacturing and assembly of a battery-electric, mechanized mining drill rig at the Epiroc facilities in Örebro, Sweden (a Boomer M2C drill rig) that will be used for Phase 1 underground development at the Platreef Mine. Delivery to site is expected early in 2022.

Shaft 2 headgear construction from hitch to collar well underway

Early-works surface construction for Shaft 2 began in 2017, including the excavation of a surface box-cut to a depth of approximately 29 metres below surface and construction of the concrete hitch for the 103-metre-tall concrete headgear (headframe), which will house the shaft’s permanent hoisting facilities and support the shaft collar. The Shaft 2 headframe construction, from the hitch to the collar level, is progressing well with the third and fourth headgear lifts well advanced. 10 civil lifts are to be constructed, including a ventilation plenum and personnel access tunnel, with targeted completion in May 2022.

Platreef’s Shaft 2 construction, raising the headframe from the hitch to the collar (at surface).The headframe for Shaft 1 is in the background.

Platreef’s Shaft 2 will have a finished and concrete-lined internal diameter of 10 metres and be sunk to a planned, final depth of 1,104 metres below surface.

Long-term supply of bulk water for the Platreef Mine

In May 2018, Ivanhoe announced the signing of an agreement to receive local, treated water to supply most of the bulk water needed for the first phase of production at Platreef. The Mogalakwena Local Municipality agreed to supply a minimum of five million litres of treated water a day for 32 years from the town of Mokopane’s new Masodi Treatment Works. Ivanplats has agreed to work with the municipality to complete the treatment facility in time to be used in Platreef’s ongoing underground mine development and surface infrastructure construction.

Under the terms of the agreement, which is subject to certain suspensive conditions, Ivanplats will provide financial assistance to the municipality for certified costs of up to a maximum of R248 million (approximately $17 million) to complete the Masodi treatment plant. Ivanplats will purchase the treated wastewater at a reduced rate of R5 per thousand litres for the first 10 million litres per day to offset a portion of the initial capital contributed.

During June 2021, and in addition to the Masodi treatment plant, Ivanplats also signed an undertaking to participate with the Lebalelo Water User Association for an additional 10 million litres per day from the Olifants River Water Resources Development Project. The initial agreement is to participate in a feasibility study for this venture with the prospect of securing an additional long-term water supply for the Platreef Project.

Development of human resources and job skills

The Platreef Project’s second Social and Labour Plan (SLP) now has been approved. Through the implementation of this second SLP, Ivanplats plans to build on the first SLP and continue with its training and development suite, which includes 15 new mentors, internal skills training for 78 staff members, a legends program to prepare retiring employees with new/other skills, community adult education training for host community members, core technical skills training for at least 100 community members, portable skills training, and more. The Platreef Project continues to support several educational programs and the provision of free Wi-Fi in host communities.

Equipping of the mine’s permanent training academy currently is underway, with the official launch being planned for 2022. Classrooms and offices at the training academy have been installed and the training and e-learning program has been instituted. A cadetship program, providing learnership opportunities to 49 local students was launched, offering a national certificate in health and safety, as well as mining competencies, such as utility vehicle operations, from the Murray & Roberts Training Academy. The cadetship program seeks to enhance gender diversity, with 54% of the students being female.

Local economic development projects will contribute to community water-source development through the Mogalakwena Municipality boreholes program. Other projects, which will be conducted in partnership with other parties, include the refurbishment and equipping of a health clinic in Tshamahansi Village.

The enterprise and supplier development commitments comprise of expanding the existing kiosk and laundry facilities and adding expanded change house facilities to be managed by a community partner in the future. A five-year integrated business accelerator and funding project assists community members to obtain help with development and supplier readiness.

Female cadets from local communities selected by Platreef for a six-month training program at the Murray & Roberts Training Academy in Carletonville, South Africa, to learn the skills to operate mechanized, underground mining equipment. The unique characteristics of the Platreef orebody offer a new generation of skilled South African workers the opportunity to work in a highly-mechanized and safe environment.

3. Kipushi Project

68%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kipushi copper-zinc-germanium-silver-lead mine in the DRC is adjacent to the town of Kipushi and approximately 30 kilometres southwest of Lubumbashi. It is located on the Central African Copperbelt, approximately 250 kilometres southeast of the Kamoa-Kakula Project and less than one kilometre from the Zambian border. Ivanhoe acquired its 68% interest in the Kipushi Project in November 2011; the balance of 32% is held by the state-owned mining company, Gécamines.

Health and safety at Kipushi

At the end of September 2021, the Kipushi Project reached a total of 3,663,876 work hours free of lost-time injuries. It has been more than two and a half years since the last lost-time injury occurred at the project.

Since temporarily suspending mine development operations due to the COVID-19 pandemic, the project maintained a reduced workforce to safely and cost-effectively maintain infrastructure and pumping systems and to execute planned projects.

The Kipushi Project has built a new potable water station to provide a free daily supply of water to the municipality of Kipushi. This daily supply to the Kipushi municipality community members includes power supply, disinfectant chemicals, routine maintenance, security and emergency repair of leaks to the primary reticulation to the benefit of an estimated 100,000 people, excluding those from rural areas. Approximately 1,000 cubic metres of potable water is pumped hourly and continuously to consumers on a daily basis.

50 boreholes of potable water are planned to be drilled around the Kipushi district over five years to reach areas not served by the current distribution reticulation. To date, 12 solar-powered potable water wells have been drilled and currently are operating throughout the district.

The Kipushi Project continues to support educational initiatives through renovations at the Mungoti School, and the granting of bursaries and scholarships to students from Kipushi. Over the past year, approximately 100 students have been supported through the bursary program. The sewing training centre project established by the Kipushi Project continued producing cloth face masks, donating approximately 2,000 masks a month to host communities. The Kipushi Project also is broadcasting daily COVID-19 awareness messages on a local community radio station, as well as through a motorized caravan.

The Sustainable Livelihoods Program, which commenced in 2020 with a poultry farming initiative established for the benefit of a consortium of local women, is progressing well with more than 500 chickens having been brought to market. This program is planned for expansion around the Kipushi district.

Kipushi’s definitive feasibility study in final stages of completion

A definitive feasibility study (DFS) for the Kipushi Project is substantially complete, which builds on the results of the pre-feasibility study (PFS) announced by Ivanhoe Mines in 2017. The development of Kipushi is based on a two-year construction timeline, which utilizes the significant existing surface and underground infrastructure already in place to allow for significantly lower capital costs than comparable greenfield development projects.

The feasibility study envisages the recommencement of underground mining operations, together with the construction of a concentrator facility on surface with annual processing capacity of 800,000 tonnes.

The draft DFS, together with the development and financing plan for Kipushi, are being reviewed by Ivanhoe Mines and its partner Gécamines. It is anticipated that these discussions will be concluded with the finalization of the feasibility study and the agreement on the development and financing plan in the near future.

Project development and infrastructure

Although development and rehabilitation activities in 2021 to date, as well as for 2020, were limited, significant progress has been made in recent years to modernize the Kipushi Mine’s underground infrastructure as part of preparations for the mine to resume commercial production, including upgrading a series of vertical mine shafts to various depths, with associated headframes, as well as underground mine excavations and infrastructure. A series of crosscuts and ventilation infrastructure still is in working condition and have been cleared of old materials and equipment to facilitate modern, mechanized mining. The underground infrastructure also includes a series of high-capacity pumps to manage the mine’s water levels, which now are easily maintained at the bottom of the mine.

Shaft 5 is eight metres in diameter and 1,240 metres deep and has been upgraded and re-commissioned. The main personnel and material winder has been upgraded and modernized to meet international industry standards and safety criteria. The Shaft 5 rock-hoisting winder also is fully operational with new rock skips, new head- and tail-ropes, and attachments installed. The two newly manufactured rock conveyances (skips) and the supporting frames (bridles) have been installed in the shaft to facilitate the hoisting of rock from the main ore and waste storage silos feeding rock on the 1,200-metre level.

Since temporarily suspending mine development operations, priority engineering tasks still continue, including new winder installations as a second means of egress on the cascade side, and repairs, as well as replacement of main critical pump columns in Shaft 5 to ensure reliable and continued pumping of water from the mine.

Kipushi’s newly-installed Shaft 15 winder. With the price of zinc recently surging to its highest price since 2007, recently hitting 14-year highs, Ivanhoe is working hard with its partner, Gécamines, to finalize the project’s feasibility study and advance a new era of production at Kipushi.

Electrician Olivier inspecting a new control panel for Kipushi’s Shaft 15 winder.

4. Western Foreland Exploration Project

100%-owned and 90%-owned by Ivanhoe Mines

Democratic Republic of Congo

Ivanhoe’s DRC exploration group is targeting Kamoa-Kakula-style copper mineralization through a regional exploration and drilling program on its Western Foreland exploration licences, located to the north, south and west of the Kamoa-Kakula Project. Ivanhoe’s Western Foreland Exploration Project consists of 17 licences that cover a combined area of approximately 2,550 square kilometres.

Exploration models that successfully led to the discoveries of Kakula, Kakula West, and the Kamoa North Bonanza Zone on the Kamoa-Kakula joint-venture mining licence are being applied to the extensive Western Foreland land package by the same team of exploration geologists responsible for the previous discoveries.

Exploration activities at the Western Foreland area continued during Q3 2021, with diamond drilling to the east and west of the Makoko area as well as in the Kiala and Lufupa areas, north of the Kamoa mining licences. 35 diamond holes were completed totalling 9,699 metres.

2,836 metres of diamond drilling were completed over the Kiala and Lufupa areas. Drilling at Makoko focused on Makoko East, and 19 holes totalling 4,502 metres were completed.

A new Land Cruiser-mounted aircore drill rig was commissioned during the quarter and commenced a drilling program at Kakula and over the Bonanza Zone, two areas of known high-grade copper mineralization. The aim was to test for any geochemical dispersion patterns in the saprolite above known mineralization at depth. Aircore drilling is a key part of the Western Foreland exploration strategy for areas of significant sand cover, to obtain a deep saprolite sample. These fences form part of the orientation program for this exploration method. 24 holes of aircore drilling totalling 734 metres were completed.

Surface soil and stream-sediment sampling focused on some permits. In total, 73 streams, two pits and 719 soil samples were collected in the quarter, along with termite samples. Given the large volume of soil, stream-sediment and drill-core samples submitted for assaying, results are pending.

Construction of the 60-kilometre access spine road across the western permits is nearing completion of clearing and laterite compaction, with 58 kilometres having been cleared to date, of which 46 kilometres have been covered with laterite. An additional 9.4 kilometres of spine road have been added to the program to provide access to the full extent of the southwest foreland.

Geophysical airborne surveys such as magnetics, gravity and electromagnetics recommenced in Q3 2021. This new geophysical data will enhance the target delineation program for drill testing and soil sampling, as well as provide a better understanding of the structural domains of the area. The geophysical surveys are planned to be completed by the end of the year with additional aircraft being added to speed up the surveys.

Ongoing construction of the Western Foreland’s 69.4-kilometre access spine road across the western permits is nearing completion.

Drill crews testing for high-grade copper mineralization along trend to the west of the Makoko discovery area.

David van Heerden promoted to Chief Financial Officer

On November 12, 2021, Ivanhoe promoted David van Heerden to the role of Chief Financial Officer (CFO). Mr. van Heerden has been with Ivanhoe since 2011 in progressively senior finance roles, most recently Vice President, Finance, Treasury and Tax. Prior to joining Ivanhoe Mines, he was in the assurance division of Ernst & Young Inc. in Johannesburg, South Africa, with a focus on mining and construction clients. David is a registered Chartered Accountant.

Mr. van Heerden’s appointment allows Marna Cloete to focus solely on her role as Ivanhoe’s President. Ms. Cloete held the dual roles of President and CFO since her appointment as company president in March 2020.

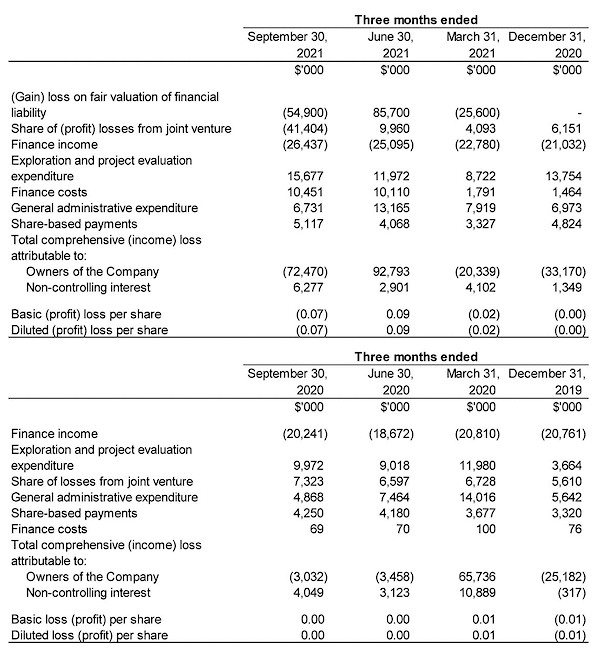

SELECTED QUARTERLY FINANCIAL INFORMATION

The following table summarizes selected financial information for the prior eight quarters. Ivanhoe had no operating revenue in any financial reporting period. All revenue from commercial production at the Kamoa-Kakula Project is recognized within the Kamoa Holding joint venture. Ivanhoe did not declare or pay any dividend or distribution in any financial reporting period.

DISCUSSION OF RESULTS OF OPERATIONS

Review of the three months ended September 30, 2021 vs. September 30, 2020

The company recorded total comprehensive income of $66.2 million for Q3 2021 compared to a loss of $1.0 million for the same period in 2020.

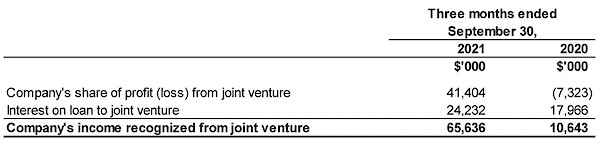

The Kamoa-Kakula Project commenced commercial production on July 1, 2021, and sold 41,490 tonnes of payable copper in Q3 2021 realizing revenue of $342.6 million for the Kamoa Holding joint venture. The company recognized income in aggregate of $65.6 million from the joint venture in Q3 2021, which can be summarized as follows:

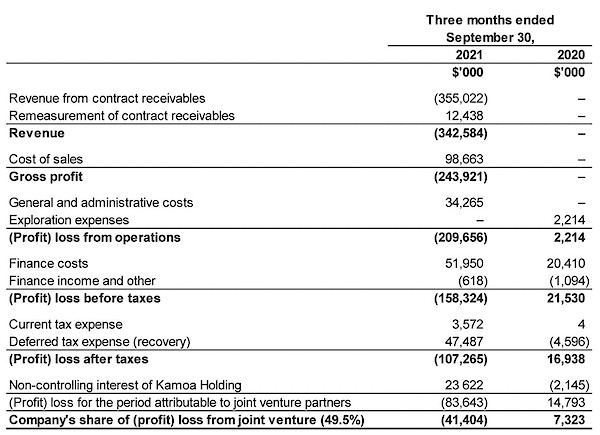

The company’s share of profit from the Kamoa Holding joint venture was $41.4 million in Q3 2021 compared to a loss of $7.3 million in Q3 2020. The following table summarizes the company’s share of (profit) loss of the joint venture for the three months ended September 30, 2021, and for the same period in 2020:

Of the $52.0 million finance costs recognized in the Kamoa Holding joint venture for Q3 2021, $45.0 million (Q3 2020: $20.4 million) relates to shareholder loans where each shareholder is required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest. Of the remaining finance costs, $5.5 million relates to the $300 million advance payment facility and provisional payment facility available under Kamoa’s offtake agreements and $1.5 million relates to the equipment financing facilities.

As explained in the accounting for the convertible notes section below, the company recognized a gain on fair valuation of the embedded derivative financial liability of $54.9 million for Q3 2021. Finance cost increased from $0.1 million for Q3 2020 to $10.5 million for the same period in 2021, $10.2 million of which related to the interest on the convertible notes at the effective interest rate.

Finance income for Q3 2021 amounted to $26.4 million and was $6.2 million more than for the same period in 2020 ($20.2 million). Included in finance income is the interest earned on loans to the Kamoa Holding joint venture to fund operations that amounted to $24.2 million for Q3 2021, and $18.0 million for the same period in 2020, and increased as the accumulated loan balance increased.

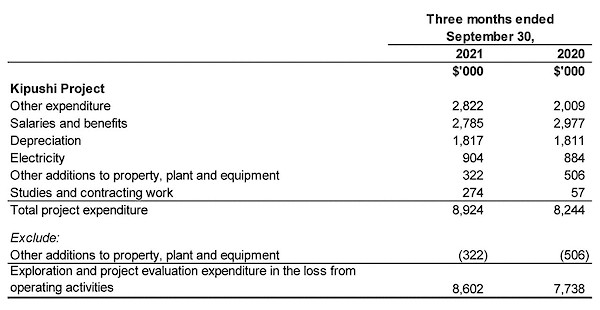

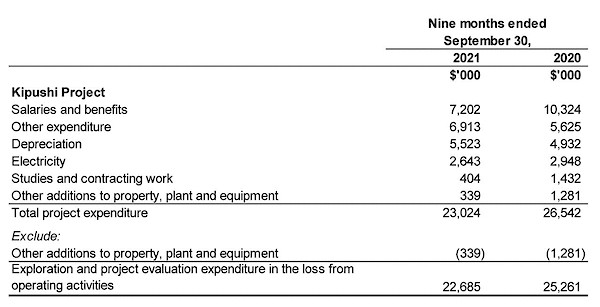

Exploration and project evaluation expenditure amounted to $15.7 million in Q3 2021 and $10.0 million for the same period in 2020. Exploration and project evaluation expenditure related to exploration at Ivanhoe’s Western Foreland exploration licences and amounts spent at the Kipushi Project which was on reduced activities and incurred limited cost of a capital nature during these periods. The main classes of expenditure at the Kipushi Project in Q3 2021 and Q3 2020 are set out in the following table:

Review of the nine months ended September 30, 2021 vs. September 30, 2020

The company recorded a total comprehensive loss of $13.3 million for the nine months ended September 30, 2021, compared to a loss of $77.3 million for the same period in 2020.

The comprehensive loss for the nine months ended September 30, 2020, included an exchange loss on translation of foreign operations of $49.6 million, resulting from the weakening of the South African Rand by 22% from December 31, 2019, to September 30, 2020, compared to an exchange loss on translation of foreign operations recognized for the same period in 2021 of $10.4 million.

Finance income for the nine months ended September 30, 2021, amounted to $74.3 million, and was $14.6 million more than for the same period in 2020 ($59.7 million). Included in finance income is the interest earned on loans to the Kamoa Holding joint venture to fund operations that amounted to $68.4 million for the nine months ended September 30, 2021, and $50.6 million for the same period in 2020, interest increased as the accumulated loan balance increased. Interest received on cash and cash equivalents decreased due to US interest rate cuts by the Federal Reserve.

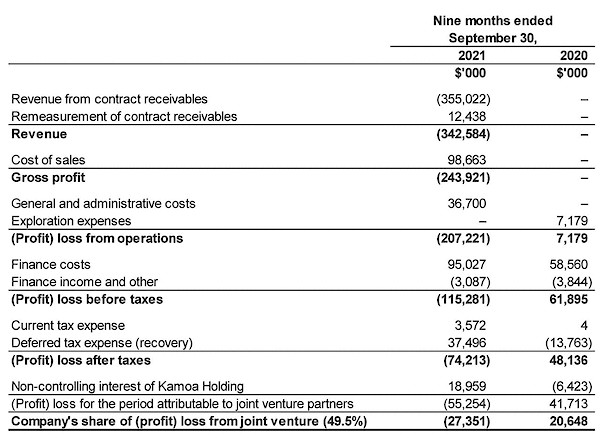

The company’s share of profit from the Kamoa Holding joint venture was $27.4 million for the nine months ended September 30, 2021, compared to a share of losses of $20.6 million for the same period in 2020. The following table summarizes the company’s share of the (profits) losses of Kamoa Holding for the nine months ended September 30, 2021, and for the same period in 2020:

Of the $95.0 million finance costs recognized in the Kamoa Holding joint venture for Q3 2021, $88.0 million (Q3 2020: $58.6 million) relates to shareholder loans where each shareholder is required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest. Of the remaining finance costs, $5.5 million relates to the $300 million advance payment facility and provisional payment facility available under Kamoa’s offtake agreements. $1.5 million relates to the equipment financing facilities.

Exploration and project evaluation expenditure amounted to $36.4 million for the nine months ended September 30, 2021, and $31.0 million for the same period in 2020. Exploration and project evaluation expenditure related to exploration at Ivanhoe’s Western Foreland exploration licences and amounts spent at the Kipushi Project which was on reduced activities and incurred limited cost of a capital nature in the periods.

The main classes of expenditure at the Kipushi Project for the nine months ended September 30, 2021 and for the same period in 2020 are set out in the following table:

As explained in the accounting for the convertible notes section below, the company recognized a loss on fair valuation of the embedded derivative financial liability of $5.2 million for the nine months ended September 30, 2021.

Financial positionas atSeptember 30, 2021 vs. December31, 2020

The company’s total assets increased by $591.9 million, from $2,417.1 million as at December 31, 2020, to $3,009.0 million as at September 30, 2021. The main reason for the increase in total assets was the receipt of the net proceeds from the convertible senior notes that closed on March 17, 2021. The net proceeds from the sale of the convertible notes, after deducting the expenses of the offering that related to the host liability of $10.5 million, was $564.5 million.

Cash and cash equivalents increased by $316.9 million, from $262.8 million as at December 31, 2020, to $579.7 million as at September 30, 2021 due to the receipt of the convertible note proceeds. The company utilized $59.7 million of its cash resources in its operations and advanced loans of $152.7 million to the Kamoa Holding joint venture during the nine months ended September 30, 2021.

The company’s total liabilities increased by $590.8 million to $671.4 million as at September 30, 2021, from $80.6 million as at December 31, 2020, with the increase mainly due to the private placement offering of $575.0 million of 2.50% convertible senior notes described below.

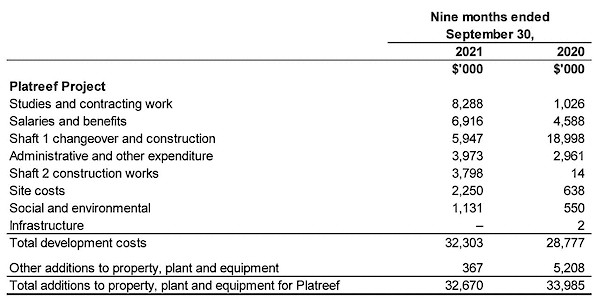

The net increase of property, plant and equipment amounted to $18.5 million, with additions of $34.0 million to project development and other property, plant and equipment. Of this total, $32.7 million pertained to development costs and other acquisitions of property, plant and equipment at the Platreef Project.

The main components of the additions to property, plant and equipment – including capitalized development costs – at the Platreef Project for the nine months ended September 30, 2021, and for the same period in 2020, are set out in the following table:

Costs incurred at the Platreef Project are deemed necessary to bring the project to commercial production and are therefore capitalized as property, plant and equipment.

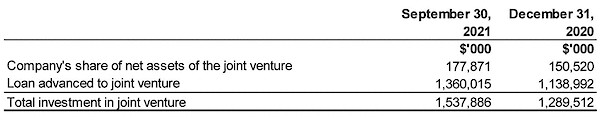

The company’s investment in the Kamoa Holding joint venture increased by $248.4 million from $1,289.5 million as at December 31, 2020, to $1,537.9 million as at September 30, 2021, with each of the current shareholders funding the project development equivalent to their proportionate shareholding interest. The company’s portion of the Kamoa Holding joint venture cash calls amounted to $152.7 million during the nine months ended September 30, 2021, while the company’s share of profit from the joint venture amounted to $27.4 million.

The company’s investment in the Kamoa Holding joint venture can be broken down as follows:

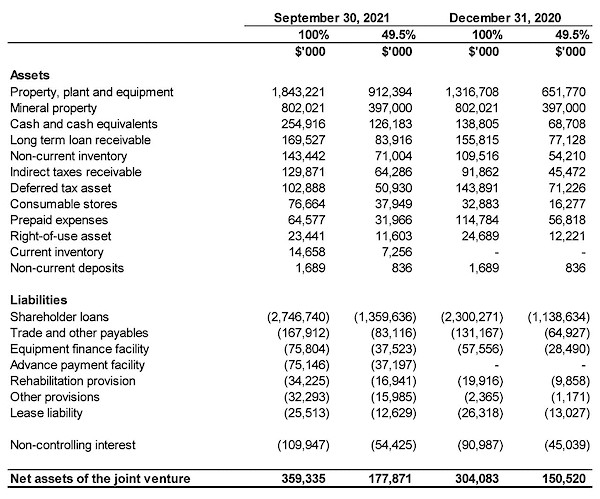

Prior to commencing commercial production in July 2021, the Kamoa Holding joint venture principally used loans advanced to it by its shareholders to advance the Kamoa-Kakula Project through investing in development costs and other property, plant and equipment. This can be evidenced by the movement in the company’s share of net assets in the Kamoa Holding joint venture which can be broken down as follows:

Going forward, all Phase 1 operating costs and the majority of Phase 2 and Phase 3 capital expenditures are expected to be funded from copper sales and facilities in place at Kamoa. Cash generated in excess of operational and expansion requirements is expected to be utilized to commence shareholder loan repayments. Based on current market conditions, it is anticipated that shareholder loan repayments from Kamoa-Kakula will commence in 2022.

The Kamoa Holding joint venture completed the draw-down of EUR 45 million (approximately $56 million) of the equipment financing and $9 million of the down-payment facilities in late December 2020 and EUR 61.7 million (approximately $75.2 million) of the equipment financing during the nine months ended September 30, 2021. The equipment finance is secured only by the equipment that is being financed and has an effective interest rate of 8.96%. The down-payment facility is unsecured and has an effective interest rate of 11.58%.

Furthermore, Kamoa Copper elected to draw the $300 million advance payment facility available under its offtake agreements in June 2021. The facility bears interest at a rate of 8% and is offset against provisional payments due to Kamoa Copper from product deliveries.

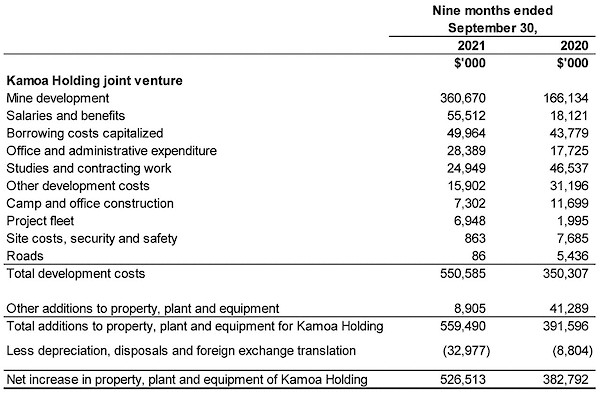

The Kamoa Holding joint venture’s net increase in property, plant and equipment from December 31, 2020, to September 30, 2021, amounted to $526.5 million and can be further broken down as follows:

Accounting for the convertible notes closed in March 2021

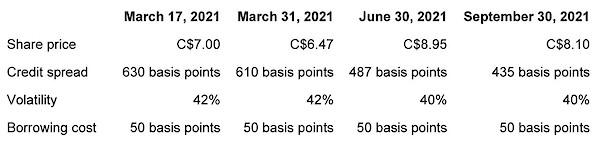

The company closed a private placement offering of $575.0 million of 2.50% convertible senior notes maturing in 2026 on March 17, 2021. Upon conversion, the convertible notes may be settled, at the company’s election, in cash, common shares or a combination thereof. Due to this election right, the convertible notes have an embedded derivative liability that is measured at fair value with changes in value being recorded in profit or loss, as well as the host loan that is accounted for at amortized cost.

The convertible senior notes are senior unsecured obligations of the company which will accrue interest payable semi-annually in arrears at a rate of 2.50% per annum and will mature on April 15, 2026, unless earlier repurchased, redeemed or converted. The initial conversion rate of the notes is 134.5682 Class A common shares of the company per $1,000 principal amount of notes, or an initial conversion price of approximately $7.43 (equivalent to approximately C$9.31) per common share.

Holders of the notes may convert the notes, at their option, in integral multiples of $1,000 principal amount, or in excess thereof, at any time until the close of business on the business day immediately preceding October 15, 2025, but only under the following circumstances:

- during any calendar quarter commencing after the calendar quarter ending on June 30, 2021 (and only during such calendar quarter), if the last reported sale price of the company’s Class A common shares for at least 20 trading days (whether or not consecutive) during a period of 30 consecutive trading days ending on, and including, the last trading day of the immediately preceding calendar quarter is greater than or equal to 130% of the conversion price on each applicable trading day; or

- during the five consecutive business day period after any ten consecutive trading day period (the “measurement period”) in which the trading price per $1,000 principal amount of notes for each trading day of the measurement period was less than 98% of the product of the last reported sale price of the company’s Class A common shares and the conversion rate on each such trading day; or

- if the company calls any or all of the notes for redemption in certain circumstances or upon the occurrence of certain corporate events.

On or after October 15, 2025, until the close of business on the second scheduled trading day immediately preceding the maturity date, holders may convert all or any portion of their notes, in multiples of $1,000 principal amount, at the option of the holder regardless of the foregoing conditions.

The convertible notes will not be redeemable at the company’s option prior to April 22, 2024, except upon the occurrence of certain tax law changes. On or after April 22, 2024 and on or prior to the 41st scheduled trading day immediately preceding the maturity date, the notes will be redeemable at the company’s option if the last reported sale price of the company’s common shares has been at least 130% of the conversion price then in effect for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading day period (including the last trading day of such period) ending on, and including, the trading day immediately preceding the date on which the company provides notice of redemption at a redemption price equal to 100% of the principal amount of the convertible notes to be redeemed, plus accrued and unpaid interest to, but excluding, the redemption date.

Due to the fact that upon conversion, the notes may be settled, at the company’s election, in cash, common shares or a combination thereof, the conversion feature is a derivative financial liability. The effect of this is that the host liability will be accounted for at amortized cost, with an embedded derivative liability being measured at fair value with changes in value being recorded in profit or loss.

The effective interest rate of the host liability was deemed to be 9.39% and the interest recognized on the convertible notes amounted to $10.2 million in Q3 2021 and $21.5 million for the nine months ended September 30, 2021. The carrying value of the host liability was $435.5 million as at September 30, 2021.

The derivative liability had a fair value of $150.5 million on closure of the convertible notes offering, which decreased to $124.9 million as at March 31, 2021, increased to $210.6 million as at June 30, 2021, and decreased to $155.7 million as at September 30, 2021, resulting in a gain on fair valuation of financial liability of $25.6 million for Q1 2021, a loss on fair valuation of financial liability of $85.7 million for Q2 2021 and a gain on fair valuation of financial liability of $54.9 million for Q3 2021. The change in the fair value of the embedded derivative liability is largely due to the changes in the closing share price of the company’s common shares at the different reporting dates.

The following key inputs and assumptions were used in determining the fair value of the embedded derivative liability:

Transaction costs on the convertible notes offering relating to the derivative liability amounted to $3.7 million and was expensed and included in the profit and loss for Q1 2021.

LIQUIDITY AND CAPITAL RESOURCES

The company had $579.7 million in cash and cash equivalents as at September 30, 2021. At this date, the company had consolidated working capital of approximately $623.8 million, compared to $308.0 million as at December 31, 2020.

Since December 8, 2015, each shareholder in Kamoa Holding has been required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest. The company is advancing Crystal River’s portion on its behalf in return for an increase in the promissory note due to Ivanhoe.

The Platreef Project’s current expenditure is being funded solely by Ivanhoe, through an interest-bearing loan to Ivanplats, as the Japanese consortium has elected not to contribute to current expenditures.

The company’s main objectives for the remainder of 2021 at the Platreef Project is the detailed engineering and updated feasibility study for the phased development plan, progression of the Shaft 1 changeover and the construction of the Shaft 2 headframe to the collar. At Kipushi, cost-saving measures will continue until the finalization of the feasibility study and the development and financing plan are agreed. With first production achieved at the Kamoa-Kakula Project, construction of the Phase 2 concentrator expansion and associated infrastructure continues.

The company has forecast to spend $32.6 million on further development at the Platreef Project; $9 million at the Kipushi Project; $9 million on Western Foreland exploration projects; and $10 million on corporate overheads for the remainder of 2021.

The Kamoa Holding joint venture had cash and cash equivalents on hand of $254.9 million as at September 30, 2021. Going forward, all Phase 1 operating costs and the majority of Phase 2 and Phase 3 capital expenditures are expected to be funded from copper sales and facilities in place at Kamoa.

On March 17, 2021, the company closed a private placement offering of $575 million of 2.50% convertible senior notes maturing in 2026. The convertible senior notes are senior unsecured obligations of the company which will accrue interest payable semi-annually in arrears at a rate of 2.50% per annum and will mature on April 15, 2026, unless earlier repurchased, redeemed or converted. The notes will be convertible at the option of holders, prior to the close of business on the business day immediately preceding October 15, 2025, only under certain circumstances and during certain periods, and thereafter, at any time until the close of business on the second scheduled trading day immediately preceding the maturity date. Upon conversion, the notes may be settled, at the company’s election, in cash, common shares or a combination thereof. The carrying value of the host liability was $435.5 million and the fair value of the embedded derivative liability was $155.7 million as at September 30, 2021.

The company has a mortgage bond outstanding on its offices in London, United Kingdom, of £3.2 million ($4.4 million). The bond is fully repayable on August 28, 2025, secured by the property and incurs interest at a rate of GBP 1 month LIBOR plus 1.9% payable monthly in arrears. Only interest will be payable until maturity.

In 2013, the company became party to a loan payable to ITC Platinum Development Limited, which had a carrying value of $33.4 million as at September 30, 2021, and a contractual amount due of $35.0 million. The loan is repayable once the Platreef Project has residual cashflow, which is defined in the loan agreement as gross revenue generated by the Platreef Project, less all operating costs attributable thereto, including all mining development and operating costs. The loan attracts interest of USD 3 month LIBOR plus 2% calculated monthly in arrears. Interest is not compounded. The difference of $1.6 million between the contractual amount due and the carrying value of the loan is the benefit derived from the low-interest loan.

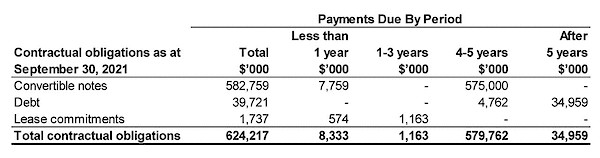

The company has an implied commitment in terms of spending on work programs submitted to regulatory bodies to maintain the good standing of exploration and exploitation permits at its mineral properties. The following table sets forth the company’s long-term obligations:

Debt in the above table represents the mortgage bond owing to Citibank and loan payable to ITC Platinum Development Limited, as described above.

The company is required to fund its Kamoa Holding joint venture in an amount equivalent to its proportionate shareholding interest.

This news release should be read in conjunction with Ivanhoe Mines’ Q3 2021 Financial Statements and Management’s Discussion and Analysis report available at www.ivanhoemines.com and at www.sedar.com.

Non-GAAP Financial Performance Measures

Kamoa-Kakula’s C1 cash costs and C1 cash costs per pound

C1 cash costs and C1 cash costs per pound are non-GAAP financial measures. These are disclosed to enable investors to better understand the performance of the Kamoa-Kakula Project in comparison to other copper producers who present results on a similar basis. C1 cash costs are prepared on a basis consistent with the industry standard definitions by Wood Mackenzie cost guidelines but are not measures recognized under IFRS. In calculating the C1 cash cost, the costs are measured on the same basis as the company’s share of profit from the Kamoa Holding joint venture that is contained in the financial statements. C1 cash costs are used by management to evaluate operating performance and include all direct mining, processing, and general and administrative costs. Smelter charges and freight deductions on sales to final port of destination, which are recognized as a component of sales revenues, are added to C1 cash cost to arrive at an approximate cost of finished metal. C1 cash costs and C1 cash costs per pound, exclude royalties and production taxes and non-routine charges as they are not direct production costs.

Reconciliation of Kamoa-Kakula’s cost of sales to C1 cash costs, including on a per pound basis:

All figures above are on a 100% basis.

EBITDA

EBITDA is a non-GAAP financial measure, which excludes income tax, finance costs, finance income and depreciation from net profit.