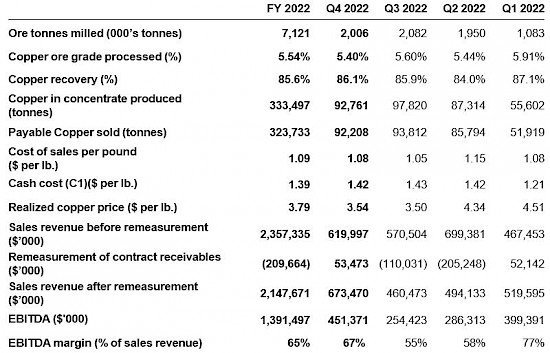

Kamoa-Kakula Copper Complex sold 323,733 tonnes of payable copper in 2022 and recognized record annual revenue of $2.15 billion and record EBITDA of $1.39 billion

■

Ivanhoe Mines recognized a record profit of $434 million in 2022, driven by record income from the Kamoa-Kakula joint venture of $405 million

■

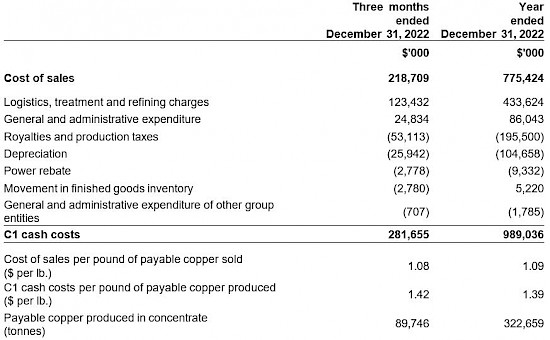

Kamoa-Kakula’s 2022 cost of sales total $1.09 per lb. of payable copper; C1 cash costs of $1.39 per lb. within guidance

■

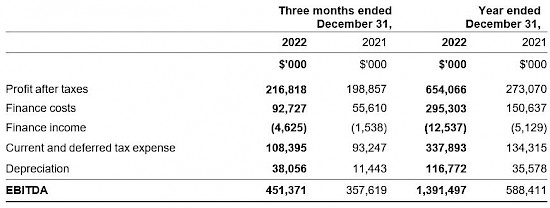

Kamoa-Kakula sold 92,208 tonnes of payable copper in Q4 2022 for record quarterly revenue of $673 million and record EBITDA of $451 million at a margin of 67%

■

Kamoa-Kakula’s Phase 3 expansion on target for Q4 2024 completion; increasing copper production to a ten-year average of 620,000 tonnes per annum, at C1 cash cost of $1.22/lb.

■

Ivanhoe Mines commences optimization work to accelerate Phase 2 expansion of the Tier-One Platreef palladium, nickel, platinum, rhodium, copper and gold mine in South Africa; Phase 1 on target for first production in Q3 2024

■

Construction ongoing at ultra-high-grade Kipushi zinc-copper-germanium-silver mine; on track for Q3 2024 production

JOHANNESBURG, SOUTH AFRICA ‒ Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF) today announced its financial results for the year ended December 31, 2022. Ivanhoe Mines is a leading Canadian mining company that is advancing its four principal mining and exploration projects in Southern Africa: the Phase 3 expansion of the Kamoa-Kakula Copper Complex in the Democratic Republic of Congo (DRC) that commenced commercial operations in July 2021; the construction of the Platreef palladium, nickel, platinum, rhodium, copper and gold project in South Africa, scheduled for first production in the third quarter of 2024; the restart of the historic Kipushi zinc-copper-lead-germanium mine in the DRC, also scheduled for first production in the third quarter of 2024; and the exploration for new copper discoveries on Ivanhoe’s 2,407-square-kilometre Western Foreland exploration project, which is adjacent to Kamoa-Kakula. All figures are in U.S. dollars unless otherwise stated.

FINANCIAL HIGHLIGHTS

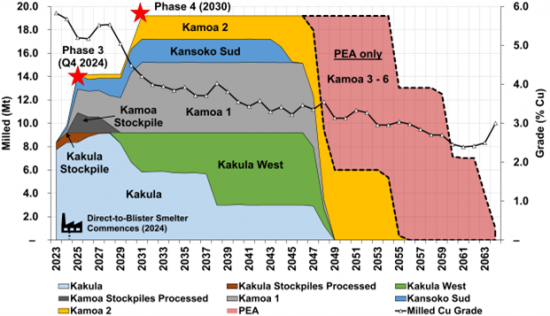

- Ivanhoe Mines reported a record profit of $434 million for 2022, compared with a profit of $45 million for 2021. Ivanhoe’s profit in Q4 2022 was $37 million compared to a profit of $24 million in Q3 2022.

- Kamoa-Kakula sold 323,733 tonnes of copper in 2022, and recognized record revenue of $2.15 billion, record operating profit of $1.27 billion and record EBITDA of $1.39 billion.

- During Q4 2022, Kamoa-Kakula sold 92,208 tonnes of payable copper and recognized record revenue of $673 million, record operating profit of $418 million and record EBITDA of $451 million.

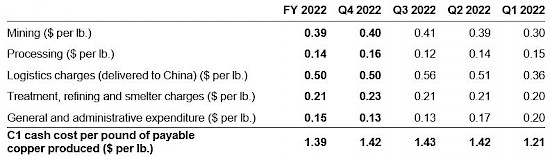

- Kamoa-Kakula’s cost of sales per pound (lb.) of payable copper sold was $1.08/lb. for Q4 2022 compared with $1.05/lb. in Q3 2022. Cash costs (C1) per pound of payable copper produced in Q4 2022 totalled $1.42/lb., compared to $1.43/lb. in Q3 2022.

- Ivanhoe Mines presents adjusted EBITDA for the group of $489 million for 2022, and $162 million for Q4 2022, which includes an attributable share of EBITDA from Kamoa-Kakula.

- Since entering Phase 1 commercial production on July 1, 2021, the Kamoa-Kakula joint venture has generated $1.22 billion of net cash from operating activities, which has funded both the Phase 2 and Phase 3 expansion activities to date.

- Ivanhoe Mines has a strong balance sheet with cash and cash equivalents of $597 million on hand as at December 31, 2022, and total debt of $739 million, the majority of which relates to the $575 million of unsecured 2.5% convertible notes that mature in April 2026, unless redeemed earlier.

OPERATIONAL HIGHLIGHTS

- Production at the Kamoa-Kakula Copper Complex for the fourth quarter of 2022 was 92,761 tonnes of copper in concentrate.

- The debottlenecking program of Kamoa-Kakula’s Phase 1 and Phase 2 concentrators was completed ahead of schedule, increasing nameplate processing capacity by 22% to a combined total of 9.2 million tonnes of ore per annum. The final installation and commissioning of a fourth Larox filter press are now also complete, increasing copper production capacity to 450,000 tonnes per annum.

- Kamoa-Kakula’s Phase 3 expansion, 500,000-tonne-per-annum on-site, direct-to-blister copper smelter and refurbishment of Turbine #5 at the Inga II hydroelectric facility are all advancing on schedule and are expected to be complete in late 2024. At current copper prices, it is expected that cashflow from Kamoa-Kakula’s Phase 1 and Phase 2 operations will be sufficient to fund the 2023 and 2024 expansion capital cost requirements of $2.53 billion.

- In January 2023, Ivanhoe Mines announced outstanding economic results of an updated, independent Integrated Development Plan (2023 IDP) for the world-leading Kamoa-Kakula Copper Complex. The Pre-Feasibility Study (PFS) for a phased expansion from 9.2 to 19.2 million tonnes per annum yields an after-tax NPV8% of approximately $19 billion, over a 33-year mine life. Kamoa-Kakula to rank as the fourth largest copper producer globally from 2025, with lowest-quartile C1 cash costs.

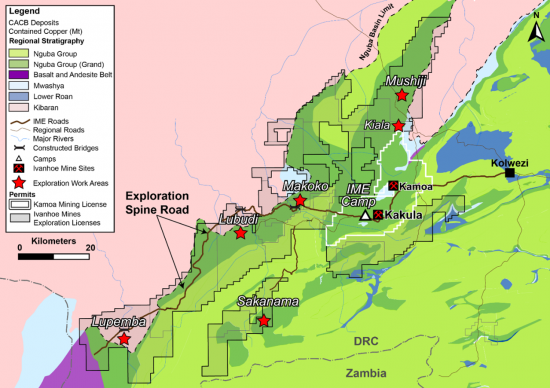

- Ivanhoe continues its expansive copper exploration program on its Western Foreland licences that cover approximately 2,407 square kilometres adjacent to Kamoa-Kakula. The 2023 exploration program is budgeted at approximately $19 million and includes up to 70,000 metres of total drilling.

- In mid-2023, Ivanhoe plans to release a maiden Mineral Resource estimate for its Makoko and Kiala high-grade copper discoveries in the Western Foreland, to be followed by a Preliminary Economic Assessment.

- Ivanhoe has commenced an optimization study at its Tier-One Platreef palladium, nickel, platinum, rhodium, copper and gold mine in South Africa to potentially accelerate production from the Phase 2 expansion. The study will consider the implications of converting the 5.1-metre-diameter ventilation shaft (Shaft 3), which is under construction, to a production shaft with the capability to hoist.

- Underground development work at Platreef continues to focus on establishing underground infrastructure on the 750-metre, 850-metre and 950-metre levels around Shaft 1, as well as developing towards the first reef and stoping areas on all three levels. Mine development across all three levels has progressed well, with more than 750 metres of lateral development completed to date. The first concentrate is scheduled for Q3 2024.

- The pilot drilling required for the raise-boring of Platreef’s Shaft 2 commenced in February 2023. Headgear construction began in November 2022 with more than 70 metres of the 104-metres completed to date. In addition, raise boring of Shaft 3 also commenced in February 2023.

- Surface earthworks and civil works for the Kipushi concentrator continue on schedule, with over 1,700 cubic metres of foundation concrete poured to date. First concentrate is on track for Q3 2024.

- Underground mine development around Kipushi’s Big Zinc orebody is advancing ahead of schedule. Development waste, as well as low-grade mineralized rock from the advancement of the perimeter and access drives surrounding the Big Zinc orebody, is being hoisted to the surface and stockpiled.

- At the end of December 2022, Kamoa-Kakula achieved 1.53 million work hours free of a lost-time injury. Zero lost time injuries have been recorded on the construction projects of the Phase 3 expansion, smelter construction and Inga II Turbine #5 refurbishment. In addition, the Platreef Project reached 408,360 hours worked free of a lost-time injury, and the Kipushi Project reached 658,142 hours worked free of a lost-time injury.

- According to estimates by the United States Geological Survey, the Democratic Republic of the Congo is now the World’s second-largest copper-producing country, tied with Peru, having produced 2.2 million tonnes in 2022. This achievement would not be possible without Kamoa-Kakula, the fastest-growing major copper mine on the planet.

Watch an updated, detailed timeline on the history of the Kamoa-Kakula Copper Complex: https://vimeo.com/806783775/fa83ffbb7c

Read Ivanhoe’s Fourth Quarter 2022 Sustainability Update: https://bit.ly/3l95VGI

Conference call for investors on Monday, March 13

Ivanhoe Mines will hold an investor conference call to discuss its 2022 fourth quarter and annual financial results at 10:30 a.m. Eastern time / 7:30 a.m. Pacific time on Monday, March 13. The conference call will conclude with a question-and-answer (Q&A) session. Media are invited to attend on a listen-only basis.

To view the webcast please use the following link: https://edge.media-server.com/mmc/p/vcbrd72a

Analysts are invited to join by phone for the Q&A using the following link: https://register.vevent.com/register/BI2a229263d9634c82ab5ad144f57d6398

An audio webcast recording of the conference call, together with supporting presentation slides, will be available on Ivanhoe Mines’ website at www.ivanhoemines.com.

After issuance, the Financial Statements and Management’s Discussion and Analysis will be available at www.ivanhoemines.com and www.sedar.com.

Principal projects and review of activities

1. Kamoa-Kakula Copper Complex

39.6%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kamoa-Kakula Copper Complex operated as the Kamoa Holding joint venture between Ivanhoe Mines and Zijin Mining, has been independently ranked as the world’s fourth-largest copper deposit by international mining consultant Wood Mackenzie from 2025. The project is approximately 25 kilometres southwest of the town of Kolwezi and about 270 kilometres west of Lubumbashi. Kamoa-Kakula Copper Complex’s Phase 1 concentrator began producing copper in May 2021 and achieved commercial production on July 1, 2021. The Phase 2 concentrator, which doubled nameplate production capacity, was commissioned in April 2022.

Ivanhoe sold a 49.5% share interest in Kamoa Holding Limited (Kamoa Holding) to Zijin Mining and a 1% share interest in Kamoa Holding to privately-owned Crystal River in December 2015. Kamoa Holding holds an 80% interest in the project. Since the conclusion of the Zijin transaction, each shareholder has been required to fund expenditures at Kamoa-Kakula in an amount equivalent to its proportionate shareholding interest. Ivanhoe and Zijin Mining each hold an indirect 39.6% interest in Kamoa-Kakula, Crystal River holds an indirect 0.8% interest, and the DRC government holds a direct 20% interest.

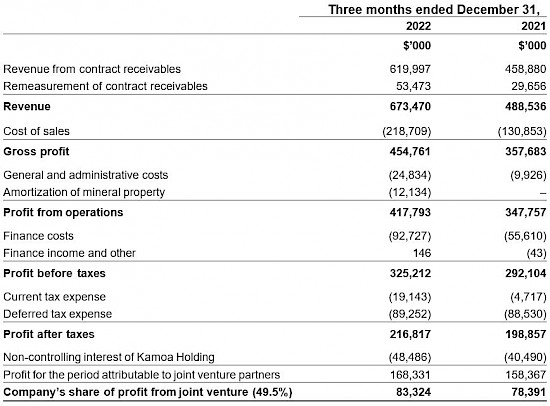

Kamoa-Kakula summary of operating and financial data

All figures in the above tables are on a 100%-project basis. Metal reported in concentrate is before refining losses or deductions associated with smelter terms. This release includes “EBITDA”, “Adjusted EBITDA”, “EBITDA margin” and “Cash costs (C1)” which are non-GAAP financial performance measures. For a detailed description of each of the non-GAAP financial performance measures used herein and a detailed reconciliation to the most directly comparable measure under IFRS, please refer to the non- GAAP Financial Performance Measures section of the company’s MD&A for the year ended December 31, 2022.

C1 cash cost per pound of payable copper produced can be further broken down as follows:

C1 cash costs are prepared on a basis consistent with the industry standard definitions by Wood Mackenzie cost guidelines but are not measures recognized under IFRS. In calculating the C1 cash cost, the costs are measured on the same basis as the company’s share of profit from the Kamoa Holding joint venture that is contained in the financial statements. C1 cash costs are used by management to evaluate operating performance and include all direct mining, processing, and general and administrative costs. Smelter charges and freight deductions on sales to the final port of destination, which are recognized as a component of sales revenues, are added to C1 cash cost to arrive at an approximate cost of delivered, finished metal. C1 cash costs exclude royalties and production taxes and non-routine charges as they are not direct production costs.

Kamoa-Kakula produced 333,497 tonnes of copper in 2022, an increase of 215% compared with 2021

Kamoa-Kakula’s Phase 1 and 2 concentrator plants milled approximately 2.0 million tonnes of ore during the fourth quarter at an average feed grade of 5.4% copper, for a total of 7.1 million tonnes at an average grade of 5.5% copper for the year ended December 31, 2022. This included high-grade, run-of-mine ore from the Kakula Mine, supplemented with ore from the surface stockpiles to meet the throughput over design capacity. In line with design parameters, copper recoveries averaged approximately 86% for the year.

The Kamoa-Kakula Copper Complex produced 92,761 tonnes of copper in concentrate in the fourth quarter of 2022, for a total of 333,497 tonnes of copper in concentrate for the year. This represents an increase of 215% compared with 2021 due to the successful commissioning of the Phase 2 concentrator in April 2022 and achieved the upper end of 2022 guidance.

All figures are on a 100% project basis and metal reported in concentrate is before refining losses or deductions associated with smelter terms.

Phase 1 and Phase 2 debottlenecking program to boost throughput to 9.2 million tonnes of ore per year is complete

In late February 2023, the debottlenecking of Kamoa-Kakula’s Phase 1 and 2 concentrators was completed ahead of schedule. The program increases the combined design processing capacity of the Phase 1 and 2 concentrator plants by 22%, from 7.6 to 9.2 million tonnes per annum (Mtpa).

Commissioning of the fourth filter press took place on March 4, 2023. The debottlenecking program boosts Kamoa-Kakula’s annual production capacity to approximately 450,000 tonnes of copper in concentrate.

Since the completion of the debottlenecking, the concentrator has achieved record daily throughput of 27,796 tonnes and a record daily copper production of 1,505 tonnes.

However, since December and persisting during the first quarter of 2023, Kamoa-Kakula has experienced intermittent grid stability issues in the DRC, impacting the ability to run the Phase 1 and 2 concentrators continuously. The issues have been prevalent across the southern grid power system in the DRC Copper Belt.

Kamoa Copper is liaising with the DRC’s state-owned power company La Société Nationale d’Electricité (SNEL), to identify the issues and assist with potential solutions, as well as evaluate options to insulate Kamoa-Kakula from future disruptions.

Representatives from DRA Global and Outotec standing in front of the first batch of concentrate produced from the newly installed fourth Larox filter press. The commissioning of the filter press ahead of schedule marks the completion of the debottlenecking program.

Outstanding economic results of updated, independent Integrated Development Plan (2023 IDP) for world-leading Kamoa-Kakula Copper Complex

After the end of the quarter on January 30, 2023, Ivanhoe Mines announced the results of an updated independent Integrated Development Plan (2023 IDP) for the Kamoa-Kakula Copper Complex. The 2023 IDP consists of a Pre-Feasibility Study (Kamoa-Kakula 2023 PFS) for the Phase 3 and Phase 4 expansions of the Kamoa-Kakula Copper Complex over a 33-year mine life, as well as an updated Preliminary Economic Assessment (Kamoa-Kakula 2023 PEA) that includes a life-of-mine extension case to 42 years overall.

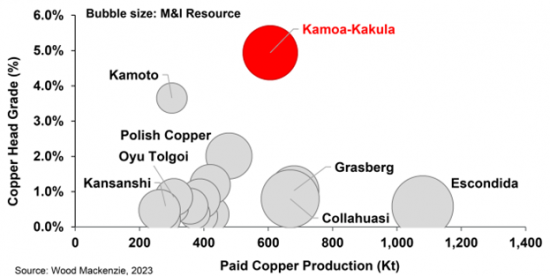

The Kamoa-Kakula 2023 PFS (Phase 3 and 4 expansion) plans for a staged increase in nameplate processing capacity from the current combined capacity of 9.2 Mtpa, up to a total of 19.2 Mtpa. The Phase 1 and 2 concentrators will continue to process ore from the Kakula Mine, as well as the new adjacent Kakula West mine from 2029. The Phase 3, 5.0 Mtpa concentrator, which is under construction and on target for the first concentrate in Q4 2024, will be fed with ore from the existing Kansoko Sud Mine (formerly Kansoko Mine), as well as new mines currently under development in the Kamoa area, known as Kamoa 1 and 2. The Phase 4 expansion consists of an additional 5.0 Mtpa concentrator that will take the total processing capacity of the Kamoa-Kakula Copper Complex up to 19.2 Mtpa. The Phase 4 concentrator will be fed by new mines in the Kamoa area.

The completion of the Phase 3 expansion in Q4 2024 is planned to coincide with the commissioning of an on-site, direct-to-blister flash copper smelter capable of producing 500,000 tonnes per annum of copper anode.

Highlights of the Kamoa-Kakula 2023 PFS (Phase 3 and 4 expansion) include:

- Phase 1 and 2 at steady-state production (9.2 Mtpa) for the first two years, following the completion of the debottlenecking program by Q2 2023, generating cash flow to fund the ongoing capital expenditures.

- Phase 3 expansion to 14.2 Mtpa processing capacity from late 2024 drives a significant increase in copper production, which is forecast to average 620,000 tonnes during the first ten years.

- Commissioning of the 500,000 tonne-per-annum smelter in conjunction with Phase 3 results in a significant improvement in operating cost.

- A significant period of cash flow generation in the first five years following Phase 3 (2025 to 2029) with copper production averaging approximately 650,000 tonnes at a cash cost (C1) of $1.15/lb.

- Phase 4 expansion, ramping up 19.2 Mtpa production capacity after 2030, will allow sustained copper production of over 500,000 tonnes per year through 2047.

The remaining Phase 3 capital cost, including contingency, is $3.04 billion, excluding $255 million already spent through December 2022. Of the $3.04 billion, $2.53 billion is spent during 2023 and 2024 up to the commissioning of the Phase 3 concentrator, with the remaining capital cost for the continuing ramp-up of the mining operations thereafter.

After-tax NPV, at an 8% discount rate, of $19.1 billion and a mine life of 33 years at a long-term copper price of $3.70/lb.

The Kamoa-Kakula 2023 PEA (Life-of-mine extension case) projects a nine-year mine life extension of the Kamoa-Kakula Copper Complex, in addition to the Kamoa-Kakula 2023 PFS. This case includes the addition of four new underground mines in the Kamoa area (called Kamoa 3, 4, 5 and 6) to maintain the overall production rate of up to 19.2 Mtpa.

Highlights of the Kamoa-Kakula 2023 PEA (Life-of-mine extension case) include:

- Life-of-mine extension case shows the potential to maintain the production rate at up to 19.2 Mtpa for an additional 9 years beyond the 33 years in the Kamoa-Kakula 2023 PFS.

- The sequential ramp-up of four new underground mines in the Kamoa area (called Kamoa 3, 4, 5 and 6) providing an additional 181.2 Mt of feed to the Kamoa and Kakula concentrators at an average grade of 3.1% copper, producing an additional 4.8 Mt of contained copper in concentrate.

- After-tax NPV, at an 8% discount rate, of $20.2 billion and mine life of 42 years.

The Kamoa-Kakula 2023 PEA is preliminary and includes an economic analysis that is based, in part, on Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically for the application of economic considerations that would allow them to be categorized as Mineral Reserves – and there is no certainty that the results will be realized. Mineral Resources do not have demonstrated economic viability and are not Mineral Reserves.

The Kamoa-Kakula 2023 PFS and Kamoa-Kakula 2023 PEA were independently prepared by OreWin Pty Ltd. Of Adelaide, Australia; China Nerin Engineering Co., Ltd., of Jiangxi, China; DRA Global of Johannesburg, South Africa; Epoch Resources of Johannesburg, South Africa; Golder Associates Africa of Midrand, South Africa; Metso-Outotec Oyj of Helsinki, Finland; Paterson and Cooke of Cape Town, South Africa; SRK Consulting Inc. of Johannesburg, South Africa; and MSA Group of Johannesburg, South Africa.

A National Instrument 43-101 technical report will be filed on SEDAR at www.sedar.com and the Ivanhoe Mines website at www.ivanhoemines.com on March 16, 2023.

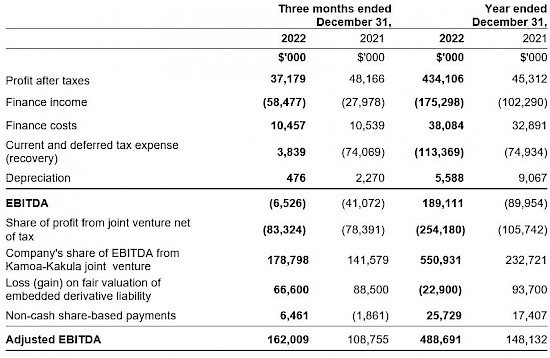

Figure 1: World’s projected top 20 copper mines in 2025, by key metrics.

Notes: Kamoa-Kakula production and grade are based on average paid copper production and average copper feed grade during the first 10 years as detailed in the Kamoa-Kakula 2023 PFS. Kamoa-Kakula resource is based on the contained copper in the Measured & Indicated category in the Kamoa-Kakula 2023 PFS. The ‘Copper Head Grade’ reflects the average reserve grade. 2025 Measured & Indicated resources take into account 2023-2024 production figures (which have been subtracted from the starting 2023 M&I resources balance). Measured & Indicated resources are inclusive of reserves and are on a 100% basis.

Source: Wood Mackenzie (based on public disclosure, the Kamoa-Kakula 2023 PFS has not been reviewed by Wood Mackenzie).

Figure 2: Kamoa-Kakula 2023 IDP life-of-mine development plan by deposit

Figure by OreWin, 2023.

Surface earthworks for the Phase 3 concentrator plant and associated infrastructure are well advanced with civil works advancing on schedule

The Phase 3 expansion includes a new 5.0 Mtpa concentrator at Kamoa, which is located approximately 10 kilometres north of the Phase 1 and 2 concentrators.

The process design of the Phase 3 concentrator is very similar to that of the Phase 1 and 2 concentrators, only larger. The front end of the concentrator (stockpile, crushing and screening) will be built to a capacity of 10 Mtpa, double the required capacity for Phase 3, in anticipation of the future Phase 4 expansion. This follows the same construction philosophy as that of Phase 1 and Phase 2. The bulk of the equipment is the same or similar to that installed in the Phase 1 and 2 concentrators, resulting in a commonality of spare parts, while leveraging prior operational and maintenance experience.

Detailed design and procurement activities are on schedule with all major equipment ordered and the first steel erection expected around June 2023. Earthworks are essentially complete and civil construction is well-advanced.

Following the commissioning of Phase 3, expected by the end of 2024, Kamoa-Kakula will have a total processing capacity of over 14 million tonnes per annum. The completion of Phase 3 is expected to increase annualized copper production to an average of approximately 620,000 tonnes per year over the next ten years, which will position Kamoa Copper as the world’s fourth-largest copper mining complex, and the largest copper mine on the African continent.

Construction of the concentrate foundations for the flotation cells on the Phase 3 concentrator.

Kamoa-Kakula’s Phase 3 expansion also includes the replacement of Turbine #5 at the Inga II hydroelectric power station. The turbine replacement will supply an additional 178 megawatts (MW) of clean hydroelectric power to the national grid and provide power for Phase 3.

Kamoa-Kakula’s Phase 3 expansion includes a direct-to-blister flash copper smelter that will incorporate leading-edge technology supplied by Metso Outotec of Espoo, Finland. It is projected to be one of the largest, single-line copper flash smelters in the world, and the largest in Africa, with a production capacity of 500,000 tonnes per annum of blister copper anodes. The 100-hectare smelter complex is being constructed adjacent to the Phase 1 and Phase 2 concentrator plants and is designed to meet the International Finance Corporation’s (IFC) emissions standards.

The smelter will have a processing capacity of approximately 1.2 Mtpa of dry concentrate feed and is designed to run on a blend of concentrate produced from the Kakula (Phase 1 and 2) and Kamoa (Phase 3 and future Phase 4) concentrators. Under the Kamoa-Kakula 2023 PFS, the smelter is projected to accommodate approximately 80% of Kamoa-Kakula’s total concentrate production, including that from Phase 3 and the future Phase 4 expansion. Kamoa-Kakula will continue to toll-treat concentrates under the 10-year agreement with the Lualaba Copper Smelter, located near the town of Kolwezi approximately 50 kilometres from Kamoa-Kakula, which is expected to account for approximately 150,000 tonnes of copper concentrate annually. The balance of copper production will be exported as concentrate.

As a by-product, the smelter will also produce between 650,000 and 800,000 tonnes per annum of high-strength sulphuric acid that is expected to be sold in the domestic DRC market.

3D rendered image of the on-site, 500,000 tonnes per annum direct-to-blister flash copper smelter. It is projected to be one of the largest, single-line copper flash smelters in the world, and the largest in Africa.

The bulk of the terracing earthworks for the smelter complex were completed in 2022 and the civil construction is now well advanced with all piling complete and foundations for the direct-to-blister flash smelting furnace and downstream electric slag cleaning furnace nearing completion. The erection of structural steel and the furnace is due to start in March 2023. The first batch of furnace steel arrived on site in January 2023. All major equipment has been ordered and is now being manufactured, while construction is on schedule to commission the smelter by the end of 2024.

Aerial view of the smelter construction site. Civil works and foundation construction are well underway. There will be approximately four times more steel used in the construction of the smelter compared with the Phase 1 concentrator.

Civil construction for Kamoa-Kakula’s Phase 3 direct-to-blister flash smelter is advancing well, including the foundation for the direct-to-blister furnace pictured below.

Decline development for the Kamoa 1 and 2 mines progressing well

Construction of the twin declines to the Kamoa 1 and Kamoa 2 underground mines and excavation to access the Phase 3 mining areas is advancing well. The Kamoa 1 and Kamoa 2 mines share a single box cut with twin declines (service and conveyor). Construction of the declines is well advanced, with over 1,300 metres of development completed to date. Underground mining activities are expected to commence at Kamoa 1 in 2023 and Kamoa 2 in 2025, which will both involve the same mechanized drift-and-fill mining methods employed at the Kakula mine.

Kamoa-Kakula’s Inbound Logistics Team receiving the new 450-tonne crane in their yard. (L-R) Ruddy Mutombo, Marc Muteba, Marc Kafwata, David Kara, Richard Yatha, and Salis Kayumba.

Draw-down of surface ore stockpiles continues as required; stockpiles hold approximately 4.1 million tonnes grading 4.05% copper, containing more than 165,000 tonnes of copper

Kamoa-Kakula’s high- and medium-grade ore surface stockpiles totaled approximately 4.1 million tonnes at an estimated grade of 4.05% copper as of the end of December 2022. The operation mined 1.89 million tonnes of ore grading 5.39% copper in Q4 2022, which was comprised of 1.80 million tonnes grading 5.51% copper from the Kakula mine, including 0.71 million tonnes grading 6.80% copper from the mine’s high-grade centre.

While the ongoing expansion of underground infrastructure at the Kakula Mine takes place, ore will be drawn as required from the stockpile to maximize copper production.

Ongoing rehabilitation of Turbine #5 at Inga II hydropower will provide clean, green hydropower for Phase 3

Like the existing Phase 1 and Phase 2 operations, future expansions of the Kamoa-Kakula Copper Complex will be powered by clean, renewable hydro-generated electricity which is developed in partnership with the DRC’s state-owned power company La Société Nationale d’Electricité (SNEL).

Rehabilitation work is ongoing at turbine #5 of the existing Inga II hydropower facility on the Congo River, to generate an additional 178 megawatts (MW) of renewable hydropower, which underpins the Phase 3 power requirement, including the smelter. The refurbishment is scheduled for completion in Q4 2024, to align with the commissioning of the Phase 3 concentrator and smelter.

Rehabilitation works at the Inga II facility are advancing well, with the team from lead-contractor Voith Hydro mobilized to the Inga II site in Q4 2022. Dismantling works on the existing alternator are ongoing, as well as the fabrication of a new runner. Study work is also progressing well to upgrade the transmission capacity of the existing grid infrastructure between the Inga II hydropower facility and the Kamoa site.

In response to recent grid stability issues, Kamoa-Kakula is actively evaluating options to insulate operations from grid instability. The current installed backup generation capacity on-site is approximately 32 MW for emergency power. Over time there is a plan to increase this to 132 MW in a phased roll-out, with an additional 11 MW expected in Q2 2023 and a further 73 MW to be installed towards the end of 2023. Ultimately this will be sufficient for emergency power for Phases 1, 2 and 3, as well as enough to run one of the concentrators at Kakula.

Discussions have also commenced to secure additional power via the Zambian interconnector. Study work is underway on further options for additional on-site backup power capacity, including additional generators, as well as renewable options, such as solar and hydro, together with battery storage.

Kakula substation and backup generator farm, adjacent to the Phase 1 and 2 Concentrators. On the right-hand side are 16 generators of backup power capacity totaling 22 MW. On the left side are 8 new generators being installed with a capacity of 11 MW, to be commissioned in Q2 2023.

(L-R) Chris Tshibanda, Control Room Supervisor; Rachelle Museka, Mill Operator; Linda Malumda, Senior Operator Larox, at the Kamoa-Kakula Phase 1 and Phase 2 concentrator plants, which recently reached a throughput rate of 9.2 Mtpa.

COPPER PRODUCTION AND CASH COST GUIDANCE FOR 2023

The figures are on a 100%-project basis and metal reported in concentrate is before refining losses or deductions associated with smelter terms. Kamoa-Kakula’s 2023 guidance is based on several assumptions and estimates and involves estimates of known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially.

Production guidance is based on assumptions about the timing for the completion of the debottlenecking program, among other things.

Cash costs (C1) per pound of payable copper amounted to $1.42 for the fourth quarter of 2022 and $1.39 for the year ended December 31, 2022.

Cash cost (C1) guidance factors in an increase in the grid power tariff supplied by DRC state-owned utility, Société Nationale d’Electricité (SNEL), which was increased from approximately $0.06 per kilowatt-hour (kWh) to $0.10 per kWh in December 2022. This marks the first increase by the predominantly hydro-powered grid in over 10 years. Kamoa-Kakula, via its energy subsidiary, continues to receive a 40% rebate on the power invoices payable, which repays the loan made to SNEL to rehabilitate state-owned hydroelectric power generation capacity and associated electrical infrastructure. The loan balance as at end of February 2023 was $255 million. Based on the Kamoa-Kakula 2023 PFS, the loan is anticipated to be amortized over approximately nine years.

Cash cost (C1) guidance is based on assumptions including, among other things, prevailing logistics costs based on estimated regional trucking capacity, particularly as regional idled operations are expected to come online, as well as increased benchmark treatment and refining charges, and inflation in consumables and other inputs.

C1 cash cost is a non-GAAP measure used by management to evaluate operating performance and includes all direct mining, processing, stockpile rehandling charges, and general and administrative costs. Smelter charges and freight deductions on sales to the final port of destination (typically China), which are recognized as a component of sales revenues, are added to C1 cash cost to arrive at an approximate cost of delivered finished metal.

For historical comparatives, see the non-GAAP Financial Performance Measures section of the company’s MD&A for the year ended December 31, 2022.

2. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project is owned by Ivanplats (Pty) Ltd (Ivanplats), which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically disadvantaged, broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with approximately 150,000 people, project employees and local entrepreneurs. A Japanese consortium of ITOCHU Corporation, Japan Oil, Gas and Metals National Corporation, and Japan Gas Corporation, owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper, and gold mineralization on the Northern Limb of the Bushveld Igneous Complex in Limpopo Province – approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane.

On the Northern Limb, platinum-group metals mineralization is primarily hosted within the Platreef, a mineralized sequence traced for more than 30 kilometres along the strike. Ivanhoe’s Platreef Project, within the Platreef’s southern sector, is comprised of two contiguous properties: Turfspruit and Macalacaskop. Turfspruit, the northernmost property, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of mining operations and properties.

Since 2007, Ivanhoe has focused its exploration and development activities on defining and advancing the down-dip extension of its original discovery at Platreef, now known as the Flatreef Deposit, which is amenable to highly mechanized, underground mining methods. With Shaft 1, the initial access to the deposit, now in operation and hoisting development rock from underground, Ivanhoe is focusing on construction activities to bring Phase 1 of Platreef into production by Q3 2024.

Platreef development is currently funded by $300-million stream financing, with efforts to finalize additional senior debt facility targeted for completion in the first half of 2023.

Surface construction activities are underway, while lateral underground mine development is progressing well

Underground development work has been focused on the vertical development of waste passes between the 750-metre, 850-metre and 950-metre levels, and lateral development towards the orebody, as well as lateral development required for underground infrastructure on each level including access to the bottom of Shaft 3 on the 950-metre level. Shaft 3 is currently being reamed and is planned to be complete in Q4 2023. More than 750 metres of lateral development has been completed across all three levels, as well as over 200 metres of vertical development between the three levels.

Construction for Platreef’s Phase 1 concentrator has commenced, with the first production on schedule for Q3 2024. Earthworks construction is now underway, with mill foundation civil activities advancing well. Long-lead equipment orders were placed with the majority of items to be delivered during the third quarter of 2023. The structural steel, piping and plate work (SMPP) contractor has been appointed and mobilization to the site is expected in mid-March 2023. Over 650 tonnes of structural steel are in fabrication, with over 150 tonnes ready for delivery.

Concrete pouring for Platreef’s Phase 1 concentrator is underway, showing foundations for the concentrate thickener and tailings thickener in the foreground and flotation cells in the background.

Construction of Platreef’s first solar-power plant commenced in Q3 2022 with commissioning expected in 2023. The solar-generated power from the plant will be used for mine development and construction activities.

The 10-metre diameter Shaft 2, which is required for the Phase 2 expansion, will be among the largest hoisting shafts on the African continent and is currently under construction. Construction during the quarter included the 104-metre-tall headframe, which commenced in December 2022 on schedule. Shaft 2’s headframe will be equipped with up to 8 Mtpa of hoisting capacity. The headgear concrete slide construction commenced in November 2022 with more than 70 metres of the 104 metres in total completed to date.

Shaft 2 headgear slide under construction (on the right), next to Shaft 1 headgear (on the left), which has been used for hoisting since February 2022. More than 70 metres of the 104-metre Shaft 2 headgear have been completed to date.

Ivanhoe Mines executive team members, together with investors, on the 950-metre-level standing in front of the 5.1-metre reamer head that recently commenced the raise boring of Shaft 3.

Underground mining crew working on lateral development on the 950-metre level.

Marna Cloete, President of Ivanhoe Mines, joined by executive management and investors, starting the pilot drill hole for the raise boring of Shaft 2 (in the background). Shaft 2 will have a hoisting capacity of up to 8 Mtpa.

The drilling of the pilot drill in Shaft 2 down to the mine’s workings commenced in the first quarter of 2023 and is on schedule to finish during the second quarter, whereafter reaming of a 3.1-metre diameter hole is planned. Raise-boring of the 5.1-metre-diameter ventilation shaft (Shaft 3) also commenced in the first quarter of 2023. Reaming is expected to be completed in Q4 2023.

Construction of the Masodi Wastewater Treatment Plant is on schedule for completion in Q3 2023. Treated water from the facility available for offtake will be sufficient for Platreef’s Phase 1 and Phase 2 water requirements.

Ivanhoe Mines commences optimization work to potentially accelerate Platreef’s Phase 2 expansion

Ivanhoe has initiated optimization work to identify value-accretive options for installing hoisting capacity in Shaft 3. Shaft 3, which is currently under construction and was originally planned as a ventilation-only shaft, with a diameter of 5.1 metres, is now planned to be equipped for hoisting which provides an alternative option to remove ore and waste from the underground mine. This has the benefit of de-risking the development and ramp-up of the Phase 1 mine and may be used to accelerate the ramp-up of underground mining activities for Phase 2, in advance of the completion of Shaft 2, which is expected in 2027.

3. Kipushi Project

68%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kipushi zinc-copper-germanium-silver-lead mine in the DRC is adjacent to the town of Kipushi, approximately 30 kilometres southwest of Lubumbashi on the Central African Copper Belt. Kipushi is approximately 250 kilometres southeast of the Kamoa-Kakula Copper Complex and less than one kilometre from the Zambian border. Ivanhoe acquired its 68% interest in the Kipushi Project in November 2011, through Kipushi Holding which is 100%-owned by Ivanhoe Mines. The balance of 32% in the Kipushi Project is held by the state-owned mining company, Gécamines.

In Q1 2022, Kipushi Holding and Gécamines signed a new agreement to return the ultra-high-grade Kipushi Mine to commercial production. The new agreement sets out the commercial terms that will form the basis of a new Kipushi joint-venture agreement establishing a robust framework for the mutually beneficial operation of Kipushi for years to come and is subject to execution of definitive documentation. Once the agreement is concluded, it is anticipated that Ivanhoe Mines’ ownership in the Kipushi Project will reduce to 62%, with Gécamines holding the balance of 38%.

Kipushi will be the world’s highest-grade major zinc mine, with an average head grade of 36.4% zinc over the first five years of production.

Surface construction activities are advancing on schedule to return Kipushi to production in Q3 2024

Detailed design for the Kipushi concentrator and associated surface infrastructure is effectively complete, with procurement activities well advanced. Orders for all twelve long lead items of equipment have been placed, as well as the contract for the supply and installation of structural steel, piping and plate work (SMPP). Long lead order equipment packages are expected to commence delivery to the site in late summer. This includes the ball mill, currently being fabricated by CITIC in China. Construction work on site is advancing on schedule, with earthworks effectively complete and civil work advancing well. First concentrate is on schedule to occur during Q3 2024.

Civil work on the foundations for Kipushi’s processing plant is progressing on schedule. Shaft 5, its head frame in the background, will haul ore to the surface and an overland conveyor will stockpile it on a new run-of-mine (ROM) pad (left of picture).

Underground development work at Kipushi advancing ahead of schedule, access drive development focused around the top of the Big Zinc orebody

Underground mine development around Kipushi’s Big Zinc orebody is advancing ahead of schedule. Stope perimeter drives are being developed on the 1,245m, 1,260m, 1,290m and 1,320m levels, with stope access development at the 1,335-metre level advancing well. Waste rock and low-grade mineralized rock from the advancement of the perimeter and access drives are being hoisted to the surface through Shaft 5 and stockpiled.

Shaft 5 is planned to be the main production shaft once operations commence, with a maximum hoisting capacity of up to 1.8 Mtpa. The bottom of Shaft 5 provides primary access to the lower levels of the mine, including the Big Zinc orebody, along the 1,150-metre haulage level.

Mining will be conducted using highly productive, mechanized methods. Cemented rock fill will be utilized to backfill open stopes, with tailings from the surface, to reduce surface tailings and maximize ore extraction. Ore is crushed underground, and conveyed to the base of the P5 shaft, where it will be hoisted to the surface and conveyed to the nearby run-of-mine stockpile, adjacent to the 800,000-tonne-per-annum concentrator.

Stoping of the Big Zinc orebody is expected to commence no later than early 2024, to build a high-grade ore stockpile ahead of processing plant commissioning in Q3 2024.

Bernice Monga Mutombo, Drill Operator, operating a drilling rig at the 1,220-metre level.

New commercial border crossing to provide a significant advantage to the Kipushi Mine and the local region

Ivanhoe signed a memorandum of understanding (MOU) with the provincial government of Haut-Katanga to study options for upgrading the DRC-Zambia border crossing in the town of Kipushi for commercial imports and exports. As part of the MOU, Ivanhoe agreed to complete a scoping study investigating various border options. The study has been completed and issued to the provincial government for consideration .

Results of the scoping study were presented and adopted by Ivanhoe Mines and Haut-Katanga, identifying a preferred option for the construction of a new border crossing and the rehabilitation of the existing border crossing. Further studies are underway on the Zambian road network to identify the preferred route to link Kipushi and facilitate efficient export to international ports.

A new commercial border crossing will provide a significant advantage to the Kipushi Mine as a direct means of importing materials and consumables, clearing customs, and will provide socio-economic benefits to the town and Province of Haut-Katanga. The border crossing will also benefit logistics for Kamoa-Kakula’s operations.

Work continues to improve processes for clearing copper and zinc products for export and to open alternative export border crossings between the DRC and Zambia, to alleviate congestion at the existing border crossings at Kasumbalesa and Sakania in Haut-Katanga Province.

4. Western Foreland Exploration Project

90%- to 100%-owned by Ivanhoe Mines

Democratic Republic of Congo

Ivanhoe’s DRC exploration group is targeting Kamoa-Kakula-style copper mineralization on its Western Foreland exploration licences. The 17 licences in the Western Foreland cover a combined area of approximately 2,407 square kilometres to the north, south and west of the Kamoa-Kakula Copper Complex. The exploration group is using models that successfully led to the discoveries of Kakula, Kakula West, and the Kamoa North Bonanza Zone on the Kamoa-Kakula mining licence. The group is composed of a mixture of the same exploration geologists responsible for these previous discoveries as well as others with experience exploring the greater Central African Copper Belt.

At the Lupemba target area in the far southwest of Western Foreland, ground gravity and a large 800-metre-spaced air core grid continued in the fourth quarter. 69 holes were completed in the fourth quarter, for a total of 150 air-core holes completed in 2022. The air core drilling programs collect samples below the exotic Kalahari sands for geochemistry and lithology identification. Kalahari sands have been moved from great distances and overlay the rocks of interest by as much as 40 metres, thereby acting as a barrier to traditional surface exploration methods such as soil sampling. Air core samples are analyzed in the same way as soil samples are collected from residual environments, indicating geochemical anomalies for follow-up.

In the Makoko area, exploration focused on testing the six-kilometre western extension of the growth fault corridor that was previously identified by wide-spaced drill sections in 2021. The 2022 drill program consisted of step-out and in-fill drilling, totalling 8,000 metres across 41 holes. Continuity of mineralization was proven with a current strike length identified to be approximately 11 kilometres. These results will be incorporated into the Mineral Resource estimate for Makoko, planned for mid-year.

Ground gravity geophysical surveys have started on regional, basin-wide traverses, aimed at strengthening the existing airborne gravity data used to identify basin architecture. Previous seismic survey data has recently been re-processed and preliminary results were reviewed in the fourth quarter.

Diamond drilling in the fourth quarter continued with three contractor diamond drill rigs and an Ivanhoe Land Cruiser-mounted diamond drill rig. East of Makoko, a deep drill hole was started on the Kakula-Monwezi trend and will continue drilling in 2023. The hole, located between the Kakula and Makoko deposits, is targeting the host stratigraphy at depth for the continuity of the mineralization system. At Kakula East, another deep hole was drilled orientated back towards the Kakula deposit from southeast of the Western Forelands decollement. The hole was drilled to understand the geology across the decollement and for targeting any easterly extension of the Kakula deposit’s mineralization across the major tectonic divide. In the Mushiji area, three kilometres north of the Kamoa-Kakula licence, a deep hole was drilled to define the northern extent of the Roan stratigraphy, the hole confirmed the northern limit of the Roan basin but failed to intersect any significant mineralization.

After quarter end, the company announced in February that an independent Mineral Resource estimate for Western Foreland’s Makoko and Kiala high-grade copper discoveries is targeted for mid-2023, followed by a Preliminary Economic Assessment. Concurrently, Western Foreland’s 2023 exploration program is budgeted at approximately $19 million, including up to 70,000 metres of drilling.

Figure 3. Map highlighting Ivanhoe Mines’ current exploration target areas across the Western Foreland licences.

5. The Mokopane Feeder Exploration Project

100%-owned by Ivanhoe Mines

South Africa

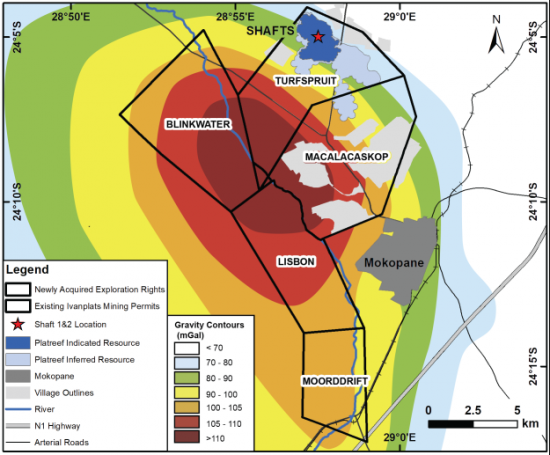

Three new 100%-owned exploration rights were granted on the Northern Limb of the Bushveld complex in South Africa during Q4 2022. The three new exploration rights (Blinkwater 244KR, Moordrift 289KR and Lisbon 288KR) cover 80 square kilometres, forming a continuous block situated on the southwest border of the existing Platreef Project’s mining rights.

The three new exploration rights, together with Ivanhoe’s existing properties, cover a large geophysical gravity anomaly that was previously identified from a widely spaced regional ground gravity survey. Academic studies based on historical data hypothesize that the anomaly represents a primary feeder zone to the Rustenburg Layered Suite of the Northern Limb of the Bushveld Complex. Significant thickening of the Rustenburg Layered Suite, particularly of the more-dense Lower Zone units, is necessary to explain the large gravity anomaly. The proximity of the proposed feeder to the regional-scale crustal faults (the Ysterberg-Planknek and the Zebediela faults), as well as the anomalously thick zones of platinum-group metals mineralization at the Platreef Deposit, lead Ivanhoe to believe there is significant potential for mineralization to be associated with this gravity feature.

To better understand the conceptual target, a detailed high-resolution airborne-magnetic and gradiometer-gravity geophysical survey commenced over the project area in Q1 2023, with the view to conducting diamond drilling later in the year.

Figure 4. Image of the Platreef and Mokopane Feeder licences overlaid on the gravity geophysics anomaly.

Safety and sustainability

At the end of December 2022, Kamoa-Kakula had reached 1.53 million work hours free of a lost-time injury with a Total Recordable Injury Frequency Rate (TRIFR) (total injuries recorded per 1,000,000 hours worked) of 1.54 for the year ended December 31, 2022. Zero lost time injuries have been recorded on the construction of the Phase 3 expansion, smelter construction and Inga II Turbine #5 refurbishment. The Platreef Project reached 408,360 hours worked free of a lost-time injury with a TRIFR of 4.23 for the year ended December 31, 2022, and the Kipushi Project reached 658,142 hours worked free of a lost-time injury with a TRIFR of 1.8 for the year ended December 31, 2022.

Ivanhoe mines has published its Fourth Quarter 2022 Sustainability Update on the Company’s website. This can be viewed here: https://bit.ly/3l95VGI

Ivanhoe Mines will issue its sixth annual Sustainability Report in March 2023, highlighting the company’s commitment to ESG and illustrating how it mines with a greater purpose. The report will detail Ivanhoe Mines’ sustainability programs and initiatives in 2022, including significant accomplishments achieved at its three principal development projects, and outline targets and benchmarks for current and future activities.

SELECTED ANNUAL FINANCIAL INFORMATION

This selected financial information is per IFRS as presented in the annual consolidated financial statements. Ivanhoe had no operating revenue in any financial reporting period. All operating revenue from commercial production at Kamoa-Kakula is recognized within the Kamoa Holding joint venture. Ivanhoe did not declare or pay any dividend or distribution in any financial reporting period.

DISCUSSION OF RESULTS OF OPERATIONS

Review of the year ended December 31, 2022, vs. December 31, 2021

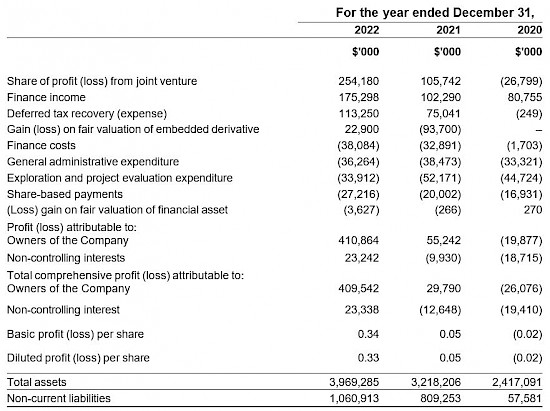

The company recorded a profit for the year of $434 million and total comprehensive income of $433 million for the year ended December 31, 2022, compared to a profit of $45 million and total comprehensive income of $17 million for the year ended December 31, 2021. The main contributor to the profit for 2022 was the company’s share of the profit from the Kamoa Holding joint venture.

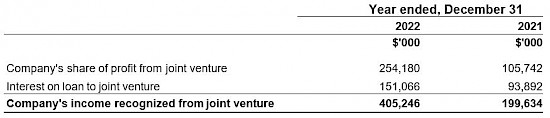

The company recognized income in aggregate of $405 million from the joint venture in 2022, which can be summarized as follows:

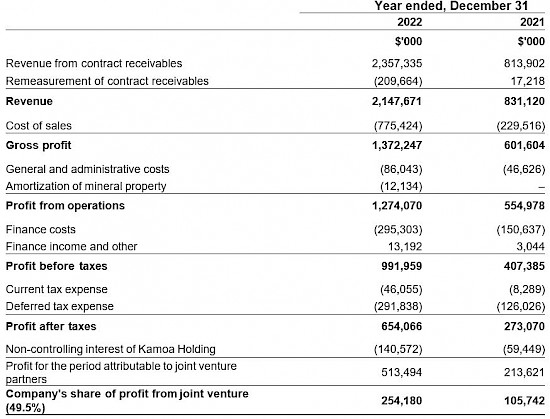

The company’s share of profit from the Kamoa Holding joint venture was $254 million for the year ended December 31, 2022, compared to a profit of $106 million for the same period in 2021, the breakdown of which is summarized in the following table:

Of the $295 million (2021: $151 million) finance costs recognized in the Kamoa Holding joint venture for 2022, $254 million (2021: $134 million) relates to shareholder loans where each shareholder funded Kamoa Holding in an amount equivalent to its proportionate shareholding interest before generating sufficient operational cashflow. Of the remaining finance costs, $34 million (2021: $14 million) relates to the provisional payment facility available under Kamoa-Kakula’s offtake agreements, while $7 million (2021: $3 million) relates to the equipment financing facilities.

Exploration and project evaluation expenditure amounted to $34 million for the year ended December 31, 2022, and was $18 million less than for the same period in 2021 ($52 million). Exploration and project evaluation expenditure related to exploration at Ivanhoe’s Western Foreland exploration licences and amounts spent at the Kipushi Project until June 30, 2022, when project development recommenced.

Finance income amounted to $175 million for the year ended December 31, 2022, and $102 million for the same period in 2021. Included in finance income is the interest earned on loans to the Kamoa Holding joint venture to fund operations that amounted to $151 million for 2022, and $94 million for 2021. No additional loans were advanced in 2022 with joint venture cashflow funding its operations and expansions. Interest increased due to higher LIBOR rates and due to the higher accumulated loan balance.

As explained in the accounting for the convertible notes section in the MD&A, the company recognized a gain on fair valuation of the embedded derivative financial liability of $23 million for 2022 (2021: loss of $94 million).

Deferred tax recovery (income) amounted to $113 million for the year ended December 31, 2022, and $75 million for the same period in 2021. The deferred tax recovery in 2022 is related mainly to the Kipushi Project, while the deferred tax recovery in 2021 is related to the Platreef Project.

With the agreement of the development plan by the shareholders of Kipushi and the approval of the development budget consistent with the Kipushi 2022 Feasibility Study in June 2022, it was deemed probable that future taxable profit will be available from the Kipushi Project, against which the unused tax losses and unused tax credits can be utilized. As a result, the company recognized the previously unrecognized deferred tax asset in June 2022, resulting in a deferred tax recovery (income) of $113 million in 2022.

With the completion of the stream financing facilities in December 2021, which will fund a large portion of the Platreef Project’s Phase 1 capital costs, and supported by the excellent results of the Platreef 2022 FS, it was deemed probable that future taxable profit will be available from the Platreef Project, against which the unused tax losses and unused tax credits can be utilized. As a result, the company recognized the previously unrecognized deferred tax asset in December 2021, resulting in a deferred tax recovery (income) of $75 million in 2021.

The total comprehensive income for 2022, included an exchange loss on translation of foreign operations of $1.2 million, compared to an exchange loss on translation of foreign operations recognized for the same period in 2021 of $28 million resulting mainly from the weakening of the South African Rand by 7% from December 31, 2021, to December 31, 2022.

Financial position as at December 31, 2022, vs. December 31, 2021

The company’s total assets increased by $751 million, from $3,218 million as at December 31, 2021, to $3,969 million as at December 31, 2022. The main reason for the increase in total assets was attributable to the increase in the company’s investment in the Kamoa Holding joint venture by $405 million, the increase in property, plant and equipment of $162 million as project development continued at the Platreef and Kipushi projects, as well as the increase in deferred tax assets by $135 million.

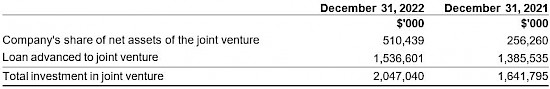

The company’s investment in the Kamoa Holding joint venture increased by $405 million from $1,642 million as at December 31, 2021, to $2,047 million as at December 31, 2022. The company’s share of profit from the Kamoa Holding joint venture for 2022, amounted to $254 million, while the interest on the loan to the joint venture amounted to $151 million. The company’s investment in the Kamoa Holding joint venture can be broken down as follows:

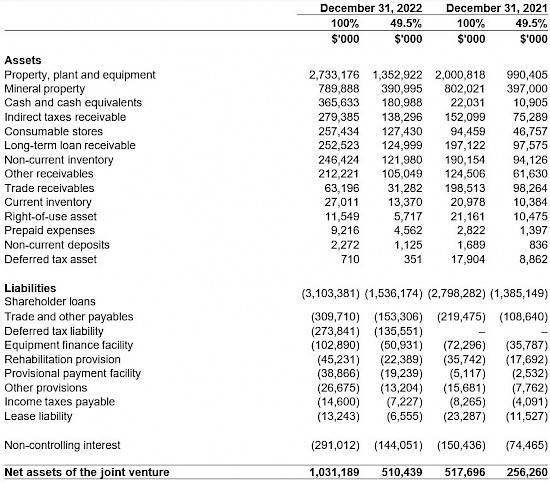

The company’s share of net assets in the Kamoa Holding joint venture can be broken down as follows:

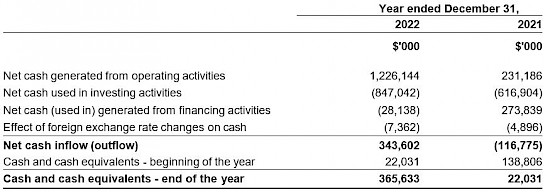

Before commencing commercial production in July 2021, the Kamoa Holding joint venture principally used loans advanced to it by its shareholders to advance the Kamoa-Kakula Copper Complex through investing in development costs and other property, plant and equipment. No additional shareholder loans were advanced in 2022 with joint venture cashflow funding its operations and expansions. The joint venture had a healthy cash position at the end of December 2022 with cash and cash equivalents of $366 million in hand.

The Kamoa-Kakula’s Phase 1 and 2 operations are anticipated to generate significant operating cash flow to fund Phase 3 capital cost requirements at current copper prices and the joint venture is arranging short-term financing facilities should a shortfall occur due to a significant decrease in copper prices.

The cash flows of the Kamoa Holding joint venture can be summarized as follows:

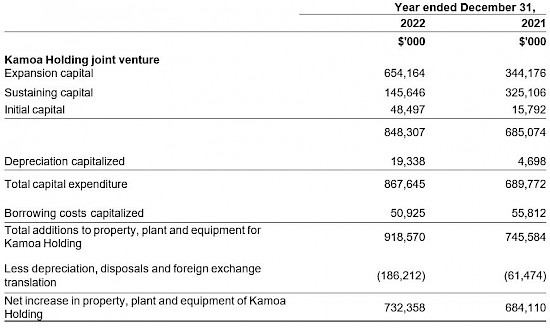

The Kamoa Holding joint venture’s net increase in property, plant and equipment from December 31, 2021, to December 31, 2022, amounted to $732 million and can be further broken down as follows:

Ivanhoe’s cash and cash equivalents decreased by $11 million, from $608 million as at December 31, 2021, to $597 million as at December 31, 2022. The company spent $159 million on project development and acquiring other property, plant and equipment and generated $177 million from operating activities, which includes the receipt of the second and final prepayment of $225 million under the Ivanplats stream financing agreements.

The net increase in property, plant and equipment amounted to $162 million, with additions of $175 million to project development and other property, plant and equipment. Of this total, $126 million pertained to development costs and other acquisitions of property, plant and equipment at the Platreef Project, while $48 million pertained to development costs and other acquisitions of property, plant and equipment at the Kipushi Project as set out in the MD&A.

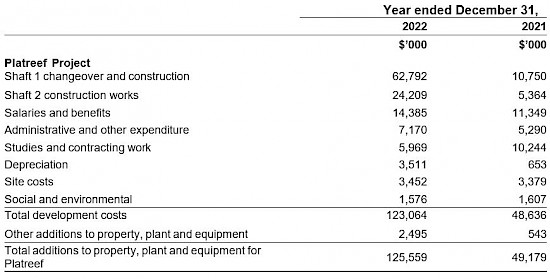

The main components of the additions to property, plant and equipment – including capitalized development costs – at the Platreef Project for the year ended December 31, 2022, and for the same period in 2021, are set out in the following table:

Costs incurred at the Platreef Project are deemed necessary to bring the project to commercial production and are therefore capitalized as property, plant and equipment.

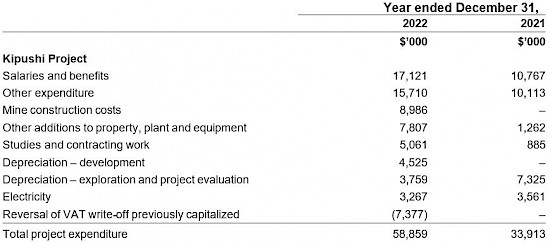

The main components of expenditure at the Kipushi Project for the year ended December 31, 2022, and for the same period in 2021 are set out in the following table:

The increase in the Company’s deferred tax asset is related mainly to the recognition of the previously unrecognized deferred tax asset of the Kipushi Project in June 2022, due to the agreement of the development plan by the shareholders of Kipushi, making it probable that future taxable profit will be available from the Kipushi Project, against which the unused tax losses and unused tax credits can be utilized.

The Company’s total liabilities increased by $287 million to $1,128 million as at December 31, 2022, from $841 million as at December 31, 2021, with the increase mainly due to the additional deferred revenue recognized on the streaming facility of $241 million including a notional finance charge and after transaction costs. The deferred revenue represents the prepayment for the future sale of refined gold and palladium and platinum to be delivered by the Platreef Project in the future and will be amortized as ounces are delivered to the Stream Purchasers.

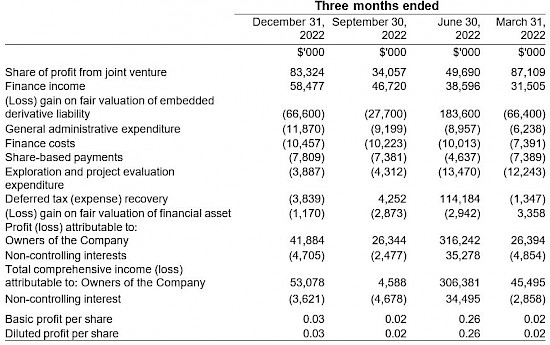

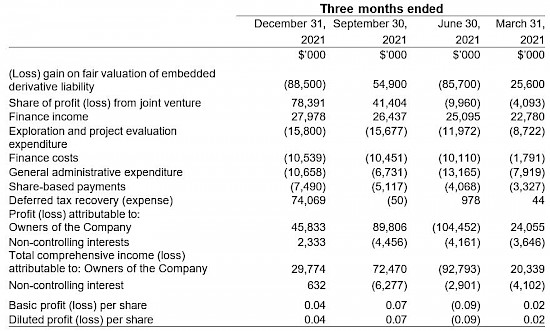

SELECTED QUARTERLY FINANCIAL INFORMATION

The following table summarizes selected financial information for the prior eight quarters. Ivanhoe had no operating revenue in any financial reporting period. All revenue from commercial production at Kamoa-Kakula is recognized within the Kamoa Holding joint venture. Ivanhoe did not declare or pay any dividend or distribution in any financial reporting period.

Review of the three months ended December 31, 2022, vs. December 31, 2021

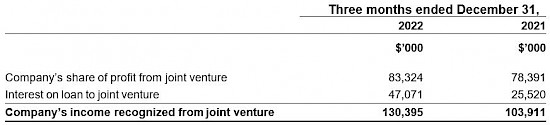

The company recorded a profit for Q4 2022 of $37 million compared to a profit of $48 million for the same period in 2021, with the company’s share of the profit from the Kamoa Holding joint venture being a key contributor to the Q4 2022 profit. The total comprehensive income for Q4 2022 was $49 million compared to $30 million for Q4 2021.

The Kamoa-Kakula Copper Complex sold 92,208 tonnes of payable copper in Q4 2022 realizing revenue of $673 million for the Kamoa Holding joint venture, compared to 53,165 tonnes of payable copper sold for revenue of $489 million for the same period in 2021. The company recognized income in aggregate of $130 million from the joint venture in Q4 2022, which can be summarized as follows:

The company’s share of profit from the Kamoa Holding joint venture was $5 million more in Q4 2022 compared to the same period in 2021 and is broken down in the following table:

Kamoa-Kakula’s other operating data is summarized under the review of operations section of the MD&A.

Finance income for Q4 2022 amounted to $58 million and was $30 million more than for the same period in 2021 ($28 million). Included in finance income is the interest earned on loans to the Kamoa Holding joint venture to fund past development which amounted to $47 million for Q4 2022, and $26 million for the same period in 2021, and increased due to the higher LIBOR rates and accumulated loan balance.

The company recognized a loss on the fair valuation of the embedded derivative financial liability of $67 million for Q4 2022, compared to a loss on the fair valuation of the embedded derivative financial liability of $89 million for Q4 2021, which is further explained in the accounting for the convertible notes section of the MD&A.

Exploration and project evaluation expenditure amounted to $4 million in Q4 2022 and $16 million for the same period in 2021. Exploration and project evaluation expenditure for Q4 2022 related to exploration at Ivanhoe’s Western Foreland exploration licences, while Q4 2021 also included amounts spent at the Kipushi Project, for which expenditure was capitalized in Q4 2022 due to the recommencement of the development of the project.

LIQUIDITY AND CAPITAL RESOURCES

The company had $597 million in cash and cash equivalents as at December 31, 2022. At this date, the company had consolidated working capital of approximately $611 million, compared to $595 million as at December 31, 2021.

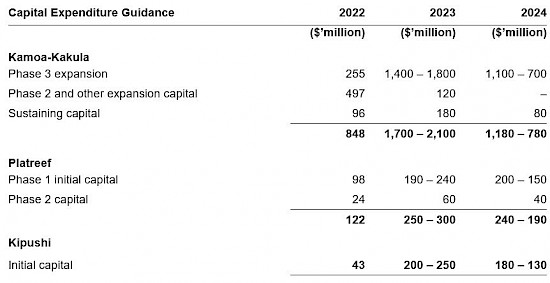

The company’s planned capital expenditure for 2023 and 2024 can be summarized as follows:

All capital expenditure figures are presented on a 100%-project basis. The 2022 capital expenditure figures above are preliminary and subject to final adjustment. The final capital expenditure figures will be confirmed in the company’s financial results for the fourth quarter and year ended December 31, 2022.

The ranges provided reflect uncertainty in the timing of Kamoa-Kakula Phase 3 expansion, Platreef Phase 2 capital and Kipushi cash flows between calendar years 2023 and 2024. The 2024 capital expenditure guidance for Platreef and Kipushi excludes sustaining capital required in 2024 post-initial production.

As documented in the Kamoa-Kakula 2023 Integrated Development Plan (IDP 2023) announced on January 30, 2023, the remaining capital cost for the total Phase 3 expansion is estimated at $3.0 billion, including the mine, concentrator, smelter, infrastructure and investment in off-site hydropower infrastructure. The Phase 1 and 2 operations are anticipated to generate significant operating cash flow in 2023 and 2024 and are expected to fund capital cost requirements at current copper prices. The joint venture had cash and cash equivalents of $366 million in hand at the end of December 2022.

Construction for Platreef’s Phase 1 Mine is underway, with the first production on track for Q3 2024. The planned Phase 2 capital expenditure at Platreef represents mainly the continuation of sinking Shaft 2 and the construction of the Shaft 2 headframe, allowing optionality for possible acceleration in Phase 2, which is currently under review.

Construction of the Kipushi Mine is also underway, with the processing plant scheduled for completion by Q3 2024. Long-lead equipment items have been ordered and manufacturing is underway, and earthworks and civil construction activities are taking place on the surface. Of the $380 million capital budget to completion, approximately $95 million has been committed to date. Offtake discussions, including a proposed $250 million pre-payment financing facility, have now advanced to final draft term sheets, which have been received from shortlisted parties and are currently under review by Kipushi’s shareholders. The agreements are intended to be completed, as well as a final, revised joint venture agreement between Kipushi Holding and Gécamines, during the first half of 2023.

Exploration activities at the Western Foreland exploration project in the DRC and other targets will continue in 2023 with an initial budget of $31 million.

NON-GAAP FINANCIAL PERFORMANCE MEASURES

Kamoa-Kakula’s C1 cash costs and C1 cash costs per pound

C1 cash costs and C1 cash costs per pound are non-GAAP financial measures. These are disclosed to enable investors to better understand the performance of Kamoa-Kakula in comparison to other copper producers who present results on a similar basis.

C1 cash costs are prepared on a basis consistent with the industry standard definitions by Wood Mackenzie cost guidelines but are not measures recognized under IFRS. In calculating the C1 cash cost, the costs are measured on the same basis as the Company’s share of profit from the Kamoa Holding joint venture that is contained in the financial statements. C1 cash costs are used by management to evaluate operating performance and include all direct mining, processing, and general and administrative costs. Smelter charges and freight deductions on sales to the final port of destination, which are recognized as a component of sales revenues, are added to C1 cash cost to arrive at an approximate cost of finished metal. C1 cash costs and C1 cash costs per pound exclude royalties and production taxes and non-routine charges as they are not direct production costs.

Reconciliation of Kamoa-Kakula’s cost of sales to C1 cash costs, including on a per pound basis:

Figures in the above table are for the Kamoa-Kakula joint venture on a 100% basis.

EBITDA, Adjusted EBITDA and EBITDA margin

EBITDA and Adjusted EBITDA are non-GAAP financial measures. Ivanhoe believes that Kamoa-Kakula’s EBITDA is a valuable indicator of the mine’s ability to generate liquidity by producing operating cash flow to fund its working capital needs, service debt obligations, fund capital expenditures and distribute cash to its shareholders. EBITDA and Adjusted EBITDA are also frequently used by investors and analysts for valuation purposes. Kamoa-Kakula’s EBITDA and the EBITDA and Adjusted EBITDA for the Company are intended to provide additional information to investors and analysts and do not have any standardized definition under IFRS and should not be considered in isolation or as a substitute for measures of performance prepared per IFRS. EBITDA and Adjusted EBITDA excludes the impact of cash costs of financing activities and taxes, and the effects of changes in operating working capital balances, and therefore are not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate EBITDA and Adjusted EBITDA differently.

The EBITDA margin is an indicator of Kamoa-Kakula’s overall health and denotes its profitability, which is calculated by dividing EBITDA by revenue. The EBITDA margin is intended to provide additional information to investors and analysts, does not have any standardized definition under IFRS, and should not be considered in isolation, or as a substitute, for measures of performance prepared per IFRS.

Reconciliation of profit after tax to Kamoa-Kakula’s EBITDA:

Figures in the above table are for the Kamoa-Kakula joint venture on a 100% basis.

Reconciliation of profit after tax to Ivanhoe’s EBITDA and adjusted EBITDA:

This news release should be read in conjunction with Ivanhoe Mines’ audited 2022 Financial Statements and Management’s Discussion and Analysis report available at www.ivanhoemines.com and at www.sedar.com.

Disclosure of technical information

Disclosures of a scientific or technical nature in this news release regarding the Kamoa-Kakula Copper Complex (other than stockpiles estimation), the Platreef Project and the Kipushi Project have been reviewed and approved by Steve Amos, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Amos is not considered independent under NI 43-101 as he is the Executive Vice President, Projects, at Ivanhoe Mines. Mr. Amos has verified the technical data related to the foregoing disclosed in this news release.

Disclosures of a scientific or technical nature regarding the Kamoa-Kakula stockpiles in this news release have been reviewed and approved by George Gilchrist, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Gilchrist is not considered independent under NI 43- 101 as he is the Vice President, Resources, at Ivanhoe Mines. Mr. Gilchrist has verified the technical data regarding the Kamoa-Kakula stockpiles disclosed in this news release.

Disclosures of a scientific or technical nature regarding the Western Foreland Project in this news release have been reviewed and approved by Stephen Torr, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Geosciences, at Ivanhoe Mines. Mr. Torr has verified the technical data regarding the Western Foreland Project disclosed in this news release.

Ivanhoe has prepared an independent, NI 43-101-compliant technical report for the Kamoa-Kakula Project, the Platreef Project and the Kipushi Project, each of which is available on the company’s website and under the company’s SEDAR profile at www.sedar.com:

Kamoa-Kakula Integrated Development Plan 2020 dated October 13, 2020, prepared by OreWin Pty Ltd., China Nerin Engineering Co., Ltd., DRA Global, Epoch Resources, Golder Associates Africa, KGHM Cuprum R&D Centre Ltd., Outotec Oyj, Paterson and Cooke, Stantec Consulting International LLC, SRK Consulting Inc., and Wood plc.

The Kipushi 2022 Feasibility Study dated February 14, 2022, prepared by OreWin Pty Ltd., MSA Group (Pty) Ltd., SRK Consulting (South Africa) (Pty) Ltd, and METC Engineering.

The Platreef 2022 Feasibility Study dated February 28, 2022, prepared by OreWin Pty Ltd., Mine Technical Services, SRK Consulting Inc., DRA Projects (Pty) Ltd and Golder Associates Africa.

These technical reports include relevant information regarding the effective dates and the assumptions, parameters and methods of the mineral resource estimates on the Platreef Project, the Kipushi Project and the Kamoa-Kakula Copper Complex cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the Platreef Project, Kipushi Project and Kamoa-Kakula Copper Complex.

The Kamoa-Kakula 2023 PFS and Kamoa-Kakula 2023 PEA were independently prepared by OreWin Pty Ltd. of Adelaide, Australia; China Nerin Engineering Co., Ltd., of Jiangxi, China; DRA Global of Johannesburg, South Africa; Epoch Resources of Johannesburg, South Africa; Golder Associates Africa of Midrand, South Africa; Metso-Outotec Oyj of Helsinki, Finland; Paterson and Cooke of Cape Town, South Africa; SRK Consulting Inc. of Johannesburg, South Africa; and MSA Group of Johannesburg, South Africa.

For the recently announced Kamoa-Kakula 2023 IDP (including the Kamoa-Kakula 2023 PFS and Kamoa-Kakula 2023 PEA), a new, independent NI 43-101 technical report will be filed on SEDAR at www.sedar.com and the Ivanhoe Mines website at www.ivanhoemines.com on March 16, 2023.

Information contact

Follow Robert Friedland (@robert_ivanhoe) and Ivanhoe Mines (@IvanhoeMines_) on Twitter.

Investors

Vancouver: Matthew Keevil +1.604.558.1034

London: Tommy Horton +44 7866 913 207

Media

Tanya Todd +1.604.331.9834

Website www.ivanhoemines.com

Forward-looking statements

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified using words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events, or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of this news release.