Construction of 750-metre station to begin this month

to provide initial mine development access to the high-grade orebody

First two blasts successfully completed at surface box cut for Shaft 2

Project financing process progressing

MOKOPANE, SOUTH AFRICA – Ivanhoe Mines’ (TSX: IVN; OTCQX: IVPAF) Executive Chairman Robert Friedland, Chief Executive Officer Lars-Eric Johansson and Ivanplats’ Managing Director Dr. Patricia Makhesha announced today that Platreef’s Shaft 1 has reached a depth of 750 metres below surface and lateral development of the first mine access station now is underway.

The 750-metre station on Shaft 1 will provide initial, underground access to the high-grade orebody, enabling mine development to proceed during the construction of Shaft 2, which will become the mine’s main production shaft. The mining zones in the current Platreef Mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below surface. Shaft 1’s 750-metre station also will allow access for the first raise-bore shaft that will provide ventilation to the underground workings during the mine’s ramp-up phase.

The first of the mine’s planned fleet of mechanized, mobile, underground mining equipment – a small, 5.5-tonne load-haul-dump machine (LHD) – has arrived on site and will be used for off-shaft station development work on the 750-, 850- and 950-metre levels. People from Platreef’s surrounding host communities are being trained as operators of the LHD.

The LHD will be the first piece of mechanized, mobile equipment to be used underground on the northern limb of South Africa’s famous Bushveld Complex. The thick, flat-lying orebody at the Platreef Project is ideal for bulk-scale, mechanized mining. As underground development progresses, the mine plan calls for the addition of significantly larger mechanized mining equipment, such as 14- and 17-tonne LHDs and 50-tonne haul trucks.

Sinking of Shaft 1 will resume after the 750-metre station is completed. The shaft is expected to intersect the upper contact of the Flatreef Deposit (T1 mineralized zone) at an approximate shaft depth of 783 metres. As shaft sinking advances, two additional shaft stations will be developed at mine-working depths of 850 metres and 950 metres. Shaft 1 is expected to reach its projected, final depth of 980 metres below surface in 2019.

“Soon we will be able to show our stakeholders and investors Flatreef’s remarkably thick, high-grade mineralized zones that will allow us to be at the forefront of safe, underground bulk mining,” said Mr. Friedland.

“Our focus is to keep advancing the Platreef Project along its critical path. Our continued development of shafts 1 and 2 will provide access to the high-grade orebody and help to ensure that the project is able to meet the expected start-up of the first phase of the underground mine and concentrator.”

Mr. Friedland noted that the Platreef Project team and its South African sinking contractor, Aveng Mining, achieved a record monthly shaft-sinking rate of 54 metres in March. The project also has attained 160 days without a lost-time injury, a notable achievement given the safety challenges that shaft-sinking operations encounter. Ivanhoe remains committed to its workplace objective of an environment that causes zero harm to employees, contractors, sub-contractors and consultants.

“We believe that the unique characteristics of our Flatreef Discovery offer us the opportunity for a highly-mechanized and safe working environment for a new generation of skilled and trained South African workers.”

Approximately 40% of Platreef’s shaft-sinking team now is comprised of employees from local communities who had no previous mining experience. New employees receive intensive, on-site training for underground mining and complete a workplace-safety induction program.

Platreef: a significant new source of nickel, copperand platinum-group-metals for the world’s electric-vehicle revolution

In July 2017, Ivanhoe issued an independent, definitive feasibility study (DFS) for Platreef that covers the first phase of production at an initial mining rate of four million tonnes per annum (Mtpa). The DFS estimated that Platreef’s initial, average annual production rate will be 476,000 ounces of platinum, palladium, rhodium and gold, plus 21 million pounds of nickel and 13 million pounds of copper.

“Many investors don’t realize that, in addition to Platreef being projected to become one of Africa’s largest producers of platinum-group metals, the mine also is expected to be a significant producer of nickel and copper — two metals that are fundamental components for the electric-vehicle revolution,” said Mr. Friedland.

“Nickel is trading at three-year highs, due in part to the increased demand for metals needed for electric-vehicle batteries. There is a growing market realization that the new era of electric vehicles will be a disruptive, long-term force that will have a material impact on certain key metals — such as nickel, copper and cobalt — as early as 2020.”

Ivanhoe is working with potential concentrate-processing partners to study ways to incorporate an upgrading step to produce battery-grade nickel sulphate.

Platreef’s Shaft 1 sinking headgear and related surface infrastructure.

Construction of Shaft 2 surface box cut underway

The first two surface blasts for Shaft 2’s box cut were successfully completed earlier this month; four additional blasts are planned. The blasting will enable the excavation of the box cut to a depth of approximately 29 metres below surface and the construction of the concrete hitch (foundation) for the 103-metre-tall concrete headgear (headframe) that will house the shaft’s permanent hoisting facilities and support the shaft collar. Excavation of the box cut is expected to be completed by the end of the year.

Shaft 2, to be located approximately 100 metres northeast of Shaft 1, will have an internal diameter of 10 metres,will be lined with concrete and sunk to a planned, final depth of more than 1,104 metres below surface. It will be equipped with two 40-tonne rock-hoisting skips with a capacity to hoist a total of six million tonnes of ore per year – the single largest hoisting capacity at any mine in Africa. Headgear for the permanent hoisting facility was designed by South Africa-based Murray & Roberts Cementation.

Drilling holes in preparation for the first blast at the Shaft 2 box cut.

First blast at the Shaft 2 box cut.

Removal of surface material during construction of the Shaft 2 box cut.

Members of Platreef’s shaft-sinking team in Shaft 1.

Platreef’s engineering team members surveying at the 450-metre-level station,

which will serve as an intermediate water pumping and shaft cable-termination station.

Trainee operators from the local Mokopane community with Platreef’s new

5.5-tonne, load-haul-dump machine (LHD).

Shaft 1 expected to intersect the Flatreef orebody at a depth of 783 metres

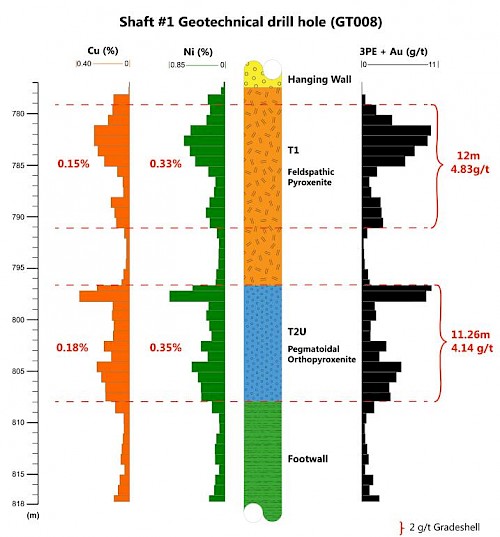

Geotechnical drill hole GT008, drilled vertically below Shaft 1, indicates that the shaft will intersect the upper contact of the Flatreef Deposit (T1 mineralized zone) at an approximate shaft depth of 783 metres. The grade for the T1 mineralized zone at this location is 4.83 grams per tonne (g/t) 3PE (platinum, palladium and rhodium) plus gold, 0.33% nickel and 0.15% copper over a vertical thickness of 12 metres (see downhole plot of drill hole GT008 below).

A well-developed chromitite stringer, marking the stratigraphic contact between the T1 and T2 mineralized zones, is expected to be intersected at a shaft depth of 792.1 metres. This will be followed by the T2 mineralized zone, which grades 4.14 g/t 3PE+gold, 0.35% nickel and 0.18% copper over a vertical thickness of 11.26 metres (at a 2 g/t 3PE+gold grade cut-off).

Downhole plot of Shaft 1 geotechnical drill hole GT008 displaying grade shells

at a 2 g/t 3PE+gold cut-off grade.

Note: Metres quoted in text are based on depth below shaft bank; metres in Figure 1 are quoted based on drill hole depth below surface.

Development focused on construction of a state-of-the-art underground mine

The Platreef Project, which contains the Flatreef Deposit, is a tier-one discovery by Ivanhoe Mines’ geologists. Based on the findings of the July 2017 independent DFS, Ivanhoe plans to develop the Platreef Mine in three phases to achieve: 1) An initial rate of four million tonnes per annum (Mtpa) to establish an operating platform to support future expansions; 2) a doubling of production to eight Mtpa; and 3) expansion to a steady-state 12 Mtpa.

As Phase 1 is being developed and commissioned, there would be opportunities to refine the timing and scope of subsequent phases of expanded production.

Given the size and potential of the Platreef Mineral Resource, Shaft 2 has been engineered with a crushing and hoisting capacity of six Mtpa. This allows for a relatively quick and

capital-efficient first expansion of the Platreef Project to six Mtpa by increasing underground development and commissioning of a third, two-Mtpa processing module and associated surface infrastructure as required.

A further expansion to more than eight Mtpa would entail converting Shaft 1 from a ventilation shaft into a hoisting shaft. This would require additional ventilation exhaust raises, as well as a further increase of underground development, commissioning of a fourth, two-Mtpa processing module and associated surface infrastructure, as described in the PEA as Phase 2 of the project.

Platreef Mine site, showing first-phase surface infrastructure and surrounding host communities.

Project financing and strategic discussions progressing

During 2017, Ivanhoe announced the appointment of five leading financial institutions to arrange project financing for the development of the Platreef Project. The five Initial Mandated Lead Arrangers (IMLAs) will make best efforts to arrange a total debt financing of up to US $1 billion for the development of Platreef’s first-phase, four Mtpa mine. Preliminary expressions of interest have been received for approximately US$900 million of the targeted US$1 billion financing. Negotiation of a term sheet is ongoing. In addition, preliminary discussions have begun with leading financial institutions around the financing of the black economic empowerment partners’ contribution to the development capital.

The IMLAs appointed Export Development Canada to direct the technical, environmental and social due diligence phase of the project. Chlumsky, Armbrust & Meyer and IBIS ESG South Africa Consulting were appointed as Independent Technical Consultant and Independent Social and Environmental Consultant, respectively.

Continuing strategic discussions concerning Ivanhoe Mines and its projects are ongoing with several significant mining companies and investors across the Americas, Europe, Asia and elsewhere. Several investors that have expressed interest have no material limit on their provision of capital. There can be no assurance that the company will pursue any transaction or that a transaction, if pursued, will be completed.

Ivanhoe Mines indirectly owns 64% of the Platreef Project through its subsidiary, Ivanplats, and is directing all mine development work. The South African beneficiaries of the approved broad-based, black economic empowerment structure have a 26% stake in the Platreef Project. The remaining 10% is owned by a Japanese consortium of ITOCHU Corporation, Japan Oil, Gas and Metals National Corporation and Japan Gas Corporation.

Ivanhoe’s geologists publish a scientific paper that sets a benchmark

for future exploration on the Northern Limb of the Bushveld Complex

Ivanhoe Mines’ geologists Dr. Danie Grobler, Albie Brits and Alexandra Crossingham, together with Professor Wolfgang Maier, of Cardiff University, UK, have published a scientific paper detailing the first stratigraphic system for Ivanhoe’s Flatreef platinum-group-elements (PGE) deposit.

The paper, titled “Litho- and chemostratigraphy of the Flatreef PGE deposit, northern Bushveld Complex”, was published earlier this month in the prestigious, international, scientific journal Mineralium Deposita.

The paper documents the down-dip and along-strike litho- and chemostratigraphy of the Flatreef Discovery, and its footwall and hanging-wall rocks. Based on stratigraphic, lithological and compositional comparisons to the layered rocks in the western Bushveld Complex, the layered sequence of the Flatreef Discovery, with its chromite-bearing footwall rocks, is unequivocally correlated with the interval between the UG2 chromitite, the Merensky and the Bastard Reef.

The paper is the first detailed subdivision of the mineralized, layered magmatic sequence based on lithological and geochemical evidence. The mineralized reefs are clearly identified and correlated across the entire Platreef Project area. Ivanhoe’s geologists are of the opinion that the new stratigraphic subdivision will be applicable along strike over most of the Northern Limb’s layered sequence.

The new stratigraphic system has significantly improved Ivanhoe’s understanding of the origin of layered intrusions and their ore deposits. The implications for future exploration at the Platreef Project, and elsewhere in the Bushveld Complex, are significant.

Qualified person

The scientific and technical information in this news release has been reviewed and approved by Stephen Torr, P.Geo., Ivanhoe Mines’ Vice President, Project Geology and Evaluation, a Qualified Person under the terms of National Instrument (NI) 43-101. Mr. Torr is not independent of Ivanhoe Mines. Mr. Torr has verified the technical data disclosed in this news release.

Detailed information about assay methods and data verification measures used to support the scientific and technical information, are set out in the Platreef 2017 Feasibility Study NI 43-101 Technical Report dated September 2017, available under Technical Reports at www.ivanhoemines.com and on Ivanhoe Mines’ SEDAR profile at www.sedar.com.

About Ivanhoe Mines

Ivanhoe Mines is advancing its three principal projects in Southern Africa: 1) Mine development at the Platreef platinum-palladium-gold-nickel-copper discovery on the Northern Limb of South Africa’s Bushveld Complex; 2) mine development and exploration at the tier-one Kamoa-Kakula copper discovery on the Central African Copperbelt in the Democratic Republic of Congo (DRC); and 3) upgrading at the historic, high-grade Kipushi zinc-copper-silver-germanium mine, also on the DRC’s Copperbelt. For details, visit www.ivanhoemines.com.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Bob Williamson +1.604.512.4856

South Africa: Jeremy Michaels +27.82.772.1122

Forward-looking statements

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements of the company, the Platreef Project, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results, and speak only as of the date of this news release.

The forward-looking statements and forward-looking information in this news release include without limitation, (i) statements regarding the 750-metre station will provide initial, underground access to the high-grade orebody, and enable mine development to take place during the development of the mine’s main production shaft, Shaft 2; (ii) statements regarding the 750-metre station will allow access for the first raise-bore shaft that will provide ventilation to the underground workings during the mine’s ramp-up phase; (iii) statements regarding Shaft 1 is expected to intersect the upper contact of the Flatreef Deposit (T1 mineralized zone) at an approximate shaft depth of 783 metres; (iv) statements regarding Shaft 1 is expected to reach its projected, final depth of 980 metres below surface in 2019; (v) statements regarding Flatreef’s remarkably thick, high-grade mineralized zones that will allow Ivanhoe to be at the forefront of safe, underground bulk mining; (vi) statements regarding Ivanhoe’s continued development of shafts 1 and 2 will provide access to the high-grade orebody and help to ensure that the project is able to meet the scheduled, first phase start-up of the underground mine and concentrator; (vii) statements regarding excavation of the Shaft 2 box cut is expected to be complete by the end of the year; (viii) statements regarding Ivanhoe plans to develop the Platreef Mine in three phases: 1) An initial rate of four million tonnes per annum (Mtpa) to establish an operating platform to support future expansions; 2) a doubling of production to eight Mtpa; and 3) expansion to a steady-state 12 Mtpa; and (ix) statements regarding the five Initial Mandated Lead Arrangers (IMLAs) will make best efforts to arrange a total debt financing of up to US$1 billion for the development of Platreef’s first-phase, four Mtpa mine.

In addition, all of the results of the Platreef DFS constitute forward-looking statements and forward-looking information. The forward-looking statements include metal price assumptions, cash flow forecasts, projected capital and operating costs, metal recoveries, mine life and production rates, and the financial results of the Platreef DFS. These include statements regarding the Platreef Project IRR of 14.2% after tax, the Platreef Project’s NPV of US$916 million at an 8% discount rate after tax (as well as all other before and after taxation NPV calculations), estimated all-in cash costs (including the life-of-mine average estimate of US$351 per ounce of 3PE+Au net by-product credits and including sustaining capital costs), capital cost estimates (including pre-production capital of US$1,544 million), proposed mining plans and methods, a mine life estimate of 32 years, a project payback period of 5.3 years, the expected number of people to be employed at the Project, and the availability and development of water and electricity for the Platreef Project.

Readers are cautioned that actual results may vary from those presented.

All such forward-looking information and statements are based on certain assumptions and analyses made by Ivanhoe Mines’ management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believe are appropriate in the circumstances. These statements, however, are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information or statements including, but not limited to, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts to perform as agreed; social or labour unrest; changes in commodity prices; unexpected failure or inadequacy of infrastructure, industrial accidents or machinery failure (including of shaft sinking equipment), or delays in the development of infrastructure; and the failure of exploration programs or other studies to deliver anticipated results or results that would justify and support continued studies, development or operations. Other important factors that could cause actual results to differ from these forward-looking statements also include those described under the heading “Risk Factors” in the company’s most recently filed MD&A, as well as in the most recent Annual Information Form filed by Ivanhoe Mines. Readers are cautioned not to place undue reliance on forward-looking information or statements. Certain of the factors and assumptions used to develop the forward-looking information and statements, and certain of the risks that could cause the actual results to differ materially are presented in the “Platreef 2017 Feasibility Study, September 2017” available on SEDAR at www.sedar.com and on the Ivanhoe Mines website at www.ivanhoemines.com.

This news release also contains references to estimates of Mineral Resources and Mineral Reserves. The estimation of Mineral Resources and Mineral Reserves is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource or Mineral Reserve estimates may have to be re-estimated based on, among other things: (i) fluctuations in platinum, palladium, gold, rhodium, copper, nickel or other mineral prices; (ii) results of drilling; (iii) results of metallurgical testing and other studies; (iv) changes to proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates; and (vi) the possible failure to receive required permits, approvals and licences.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

English

English Français

Français 日本語

日本語 中文

中文