Additional C$67 million (US$50 million) received from Zijin Mining

through the exercise of its anti-dilution rights

Ivanhoe positioned to fully fund its share of capital costs

to bring the Kakula Copper Mine to commercial production

CITIC Metal’s Vice President Manfu Ma joins Ivanhoe Board

BEIJING, CHINA – Robert Friedland and Yufeng “Miles” Sun, Co-Chairmen of Ivanhoe Mines, today announced the completion of the second major strategic equity investment totalling C$612 million (approximately US$459 million) in Ivanhoe Mines by CITIC Metal Africa Investments Limited (CITIC Metal Africa), a direct subsidiary of CITIC Metal Co., Ltd. (CITIC Metal), one of China’s leading international resources companies.

The investment is an integral part of Ivanhoe and CITIC Metal’s long-term strategic cooperation and brings CITIC Metal’s investment in Ivanhoe Mines in less than one year to more than US$1.0 billion.

Ivanhoe Mines has issued 153,821,507 common shares to CITIC Metal Africa through a private placement at a price of C$3.98 per share. Zijin Mining has exercised its anti-dilution rights through a concurrent private placement at C$3.98 per share, which resulted in Ivanhoe Mines issuing 16,754,296 common shares to Zijin Mining and additional proceeds to Ivanhoe Mines of C$67 million (approximately US$50 million).

Upon completion of the financings, CITIC Metal now owns approximately 29.4% of Ivanhoe Mines’ issued and outstanding common shares and Zijin Mining owns approximately 9.8%.

CITIC Metal Africa and Zijin Mining each have signed standstill agreements with Ivanhoe Mines. The standstills are intended to provide sufficient time to bring the Kakula Mine to production, and to advance subsequent, planned expansions at Kamoa-Kakula, and production at the Kipushi and Platreef projects. Ivanhoe’s entire shareholder base will benefit from the economic growth and significant cash flows that result from the dawning of production at all three mines.

With today’s receipt of the combined proceeds of more than C$679 million (approximately US$509 million) from CITIC Metal Africa and Zijin, Ivanhoe now holds cash, cash equivalents and a loan receivable from High Power Exploration totalling approximately C$1.2 billion (US$902 million) – and the company has no significant debt. This strong financial position enables Ivanhoe to fully finance its share of the capital costs required to bring the Kakula Mine in the Democratic Republic of Congo (DRC) into commercial production, as well as advance the development of the Kipushi and Platreef mines, and Western Foreland exploration project.

Development of the underground six-million-tonne-per-annum (6 Mtpa) Kakula Mine, the first of multiple, planned mining areas at Kamoa-Kakula, is making steady progress in underground development and construction of the surface processing plant has commenced. Initial copper concentrate production from the Kakula Mine currently is scheduled for the third quarter of 2021.

“The investments completed today comfortably provide Ivanhoe with the equity cushion required to rapidly advance Kamoa-Kakula’s 6 Mtpa Phase 1 mine to production,” said Mr. Friedland. “CITIC and Zijin’s vote of confidence positions us to continue the rapid development of the Kipushi and Platreef projects. We also are aggressively exploring our 100%-owned Western Foreland licences, with the confidence that our talented and dedicated geological scientists will make additional tier-one copper discoveries on our tenements in the DRC.”

Ivanhoe’s Co-Chairman Mr. Sun said: “Since the initial investment in Ivanhoe Mines made by CITIC Metal last year, we have been delighted to witness the profound progress being made at Ivanhoe’s three world-class projects. All of us are excited by the rapid development at the Kamoa-Kakula copper mine as it moves toward its targeted commercial production date of 2021. The exploration breakthroughs such as the Kamoa North Bonanza Discovery and the Kamoa Far North Discovery are nothing short of spectacular. Today’s landmark and second strategic investment by CITIC Metal is not only an investment in Ivanhoe Mines and its people, but also an investment in the people of Democratic Republic of Congo and South Africa. We have been encouraged by the social and political stability that has followed the peaceful elections in the DRC late last year/early this year with the election of President Félix Tshisekedi. CITIC Metal and Ivanhoe Mines will support a prosperous investment environment with the full strength of our combined groups.”

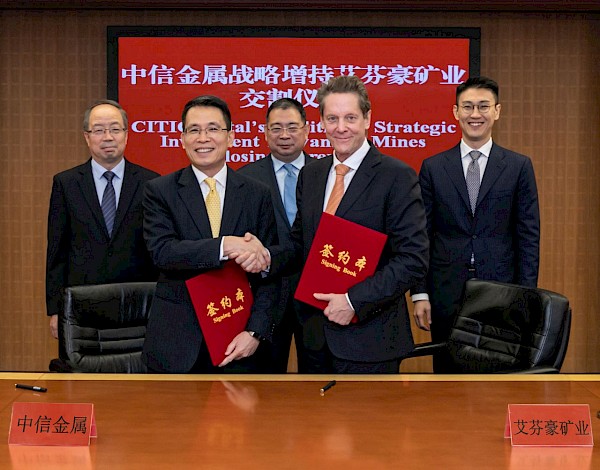

Closing ceremony of CITIC Metal’s second major investment in Ivanhoe Mines.

From left to right: Manfu Ma, Vice President, CITIC Metal Group Limited; Yufeng “Miles” Sun, President, CITIC Metal Group Limited and Co-Chairman, Ivanhoe Mines; Xianwen Wu, Chairman, CITIC Metal Co., Ltd.; Robert Friedland, Executive Co-Chairman, Ivanhoe Mines; and Peter Zhou, Vice President, Chief Representative China, Ivanhoe Mines.

CITIC Metal’s Vice President Manfu Ma joins Ivanhoe Board

Pursuant to the terms of the private-placement agreement with CITIC Metal Africa, Ivanhoe Mines has accepted CITIC Metal’s nomination of Manfu Ma, Vice President of CITIC Metal Group Limited, CITIC Metal’s parent company, to the Ivanhoe Mines Board of Directors. The new appointment expands the Board to 11 members.

Mr. Ma played an important role in CITIC Metal’s two strategic investments in Ivanhoe Mines in 2018 and 2019. He has more than 30 years’ experience in the mining industry, specializing in geology and mine management.

Mr. Ma joined CITIC Metal in 2007 and has served in various positions, including Chief Geologist, Deputy General Manager of Investment Department, and Assistant General Manager. Prior to joining CITIC Metal, he held senior management positions with China Gold Group and the Gold Bureau of China’s Inner Mongolia province.

Mr. Ma holds a Master’s and Bachelor’s degree in Geology from Changchun Institute of Geology.

Advisors

Ivanhoe Mines’ legal counsel is Stikeman Elliott LLP. CITIC Metal’s financial advisor is RBC Capital Markets, and legal counsel is Baker McKenzie. Legal counsel for Zijin is Fasken Martineau DuMoulin LLP.

About CITIC Metal and CITIC Limited

CITIC Metal Africa Investments and CITIC Metal are affiliates of CITIC Limited. As CITIC Limited’s arm in the business of resources and energy, CITIC Metal specializes in the importation and distribution of copper, zinc, platinum-group metals, niobium products, iron ore, coal and non-ferrous metals; trading of steel products; and investments in metals and mining projects. CITIC Metal’s major mining investments include a 15% ownership in the Las Bambas copper project in Peru and leading a Chinese consortium in acquiring a 15% ownership in the Brazil-based niobium producer CBMM. CITIC Metal Africa is an investment holding company incorporated in Hong Kong, with its 100% equity interests directly held by CITIC Metal.

CITIC Limited (SEHK:267) is China’s largest conglomerate, with total assets of more than US$900 billion. Among its diverse global businesses, CITIC Limited focuses primarily on financial services, resources and energy, manufacturing, engineering contracting and real estate.

CITIC Limited is listed on the Stock Exchange of Hong Kong, where it is a constituent of the Hang Seng Index. CITIC Group Corporation, a Chinese state-owned enterprise, owns 58% of CITIC Limited.

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on advancing its three principal projects in Southern Africa: the development of new mines at the Kamoa-Kakula copper discovery in the Democratic Republic of Congo (DRC) and the Platreef palladium-platinum-nickel-copper-gold discovery in South Africa; and the extensive redevelopment and upgrading of the historic Kipushi zinc-copper-germanium-lead mine, also in the DRC. Ivanhoe also is exploring for new copper discoveries on its wholly-owned Western Foreland exploration licences in the DRC, near the Kamoa-Kakula Project.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

Kimberly Lim +1.778.996.8510

Cautionary statement on forward-looking information

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

Such statements include without limitation: (i) statements regarding initial copper concentrate production from the Kakula Mine is scheduled for the third quarter of 2021; (ii) statements regarding Ivanhoe’s entire shareholder base will benefit from the economic growth and significant cash flows that result from the dawning of production at all three mines; and (iii) statements regarding Ivanhoe’s financial position enables the company to fully finance its share of the capital costs required to bring the Kakula Mine in the Democratic Republic of Congo into commercial production, as well as advance the development of the Kipushi and Platreef mines, and Western Foreland exploration project.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to, the factors discussed under “Risk Factors” and elsewhere in the company’s MD&A, as well as the inability to obtain regulatory approvals in a timely manner; the potential for unknown or unexpected events to cause contractual conditions to not be satisfied; unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations. Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements.

These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release. The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors set forth in the “Risk Factors” section and elsewhere in the company’s MD&A for the year ended December 31, 2018 and its Annual Information Form.

Ivanhoe Mines completes strategic equity investment of C$612 million (FRENCH)

Ivanhoe Mines completes strategic equity investment of C$612 million (JAPANESE)

English

English Français

Français 日本語

日本語 中文

中文