Updated Integrated Development Plan for multiple expansions up to at least 19 Mtpa highlights the potential for the Kamoa-Kakula Project to become the world’s second largest copper mine

Updated Definitive Feasibility Study and phased-development plan nearing completion for Platreef PGMs-gold-nickel-copper mine

Ivanhoeissues third quarter financial results and review of mine construction progress and exploration activities

TORONTO, CANADA ‒ Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF) today announced its financial results for the nine months ended September 30, 2020. Ivanhoe Mines is a Canadian mining company advancing its three mining projects in Southern Africa: the Kamoa-Kakula copper discovery in the Democratic Republic of Congo (DRC); the Platreef palladium-platinum-rhodium-nickel-copper-gold discovery in South Africa; and the extensive upgrading of the historic Kipushi zinc-copper-silver-lead-germanium mine, also in the DRC.

The company also is exploring for new copper discoveries on its wholly-owned Western Foreland exploration licences, adjacent to the Kamoa-Kakula mining licence. All figures are in U.S. dollars unless otherwise stated.

HIGHLIGHTS

- Development of the Kakula Copper Mine, the first of multiple, planned mining areas at the Kamoa-Kakula Project, is making excellent progress. Overall progress of Kamoa-Kakula’s first phase, 3.8 million tonnes per annum (Mtpa) mining and milling operation is approximately 58% complete, with first production scheduled for July 2021. The project is a joint venture between Ivanhoe Mines (39.6%), Zijin Mining Group (39.6%), Crystal River Global Limited (0.8%) and the Government of the Democratic Republic of Congo (20%).

- The Kakula Mine is projected to be the world’s highest-grade major copper mine with an estimated average feed grade of more than 6% copper over the first five years of operation. It also will have one of the smallest footprints in terms of water, electrical energy, tailings and carbon dioxide per unit of copper produced.

- Construction of Kamoa-Kakula’s first-phase 3.8 Mtpa concentrator plant is advancing rapidly and was approximately 28% complete at the end of October. The concentrator plant is expected to be mechanically complete in Q2 2021.

- The Kamoa-Kakula Project will be powered with clean, sustainable hydro-electricity. Ongoing upgrading work at the Mwadingusha hydro-power plant in the DRC is expected to deliver approximately 72 megawatts (MW) of power to the national power grid by early 2021.

- Kamoa-Kakula is in detailed discussions with a number of parties with respect to the marketing and smelting of its copper concentrates. Kakula is expected to produce an extremely high-grade (containing over 55% copper) and clean copper concentrate. Metallurgical testwork indicates that the Kakula concentrate contain extremely low arsenic levels by world standards – approximately 0.01%. This is believed to be a critical competitive marketing advantage.

- The current estimate of Kakula’s initial capital costs is approximately $1.3 billion as of January 1, 2019, which assumes commissioning of the first concentrator plant module in July 2021 and includes pre-production ore stockpiles. The capital costs incurred by the Kamoa-Kakula joint venture in 2019 was $309 million. Additional capital costs of $403 million have been incurred by the joint venture in the nine months ended September 30, 2020, leaving the joint venture with an estimated $570 million capital costs remaining until initial production.

- Kamoa-Kakula joint-venture partners are in the process of finalizing project-level financing credit facilities to accelerate Phase 2 development.

- At the end of Q3 2020, Ivanhoe had cash and cash equivalents of approximately $376 million and no significant debt.

- The scope of facilities for Kamoa-Kakula’s Phase 2 expansion includes the underground expansion at the Kakula Mine to reach an annual production rate of 6 Mtpa; the commencement of mining operations at the nearby Kansoko Mine at a steady state 1.6 Mtpa; a second 3.8-Mtpa concentrator module at Kakula; as well as associated surface infrastructure to support expansion at the various sites.

- Underground development at the Kakula Copper Mine continues to advance ahead of schedule. More than 24.7 kilometres of underground development had been completed to the end of October ─ 7.9 kilometres ahead of plan. The pace of development is expected to continue to accelerate as additional mining crews are added.

- At the end of October, Kakula’s main access drives between the northern and southern declines had less than 100 metres remaining before they are connected in the high-grade centre of the deposit. The holing will significantly increase ventilation to the centre of the orebody, allowing for additional mining crews to begin highly-productive mining operations in Kakula’s high-grade ore zones.

- At the end of October, Kamoa-Kakula’s medium- and high-grade ore stockpiles contained approximately one million tonnes grading 3.47% copper.Mining crews produced a combined 194,000 tonnes of ore grading 4.01% copper in October from the Kakula and Kansoko mines.

- The enormous amount of pre-production development completed to date at both the Kakula and Kansoko mines has positioned the project for a significant acceleration in the tonnage, as well as a marked increase in the grade, of ore added to the project’s surface stockpiles beginning this month.

- At the Platreef tier-one, palladium-platinum-nickel-copper-gold-rhodium project in South Africa, the project’s first shaft (Shaft 1) was completed to a final depth of approximately 996 metres in July.

- Ivanhoe is finalizing a phased development plan for the Platreef Project. The plan would target significantly lower initial capital, to accelerate first production by using Shaft 1 as the mine’s initial production shaft, followed by expansions to the production rate as outlined in the 2017 definitive feasibility study (DFS).

- Concurrently, Ivanhoe is updating the Platreef Project’s 2017 DFS to take into account development schedule advancement since 2017 when the DFS was completed, updated costs and refreshed metal prices and foreign exchange assumptions. The DFS and phased development production plan are scheduled to be issued in the second half of November 2020.

- On July 27, 2020, Ivanhoe announced that it has had, and is continuing to have, strategic discussions regarding its 100%-owned Western Forelands Project that adjoins the Kamoa-Kakula mining licence; the Kipushi zinc-copper-silver-lead-germanium mine in the DRC; as well as its Platreef palladium-platinum-nickel-copper-rhodium-gold project on the Northern Limb of South Africa’s Bushveld Igneous Complex.

- On November 6, 2020, Ivanhoe’s Board appointed its two recently appointed, independent members ─ Nunu Ntshingila and Martie Janse van Rensburg ─ as Chair of the Sustainability Committee and Chair of the Compensation and Human Resource Committee, respectively.

- At the end of September 2020, Kamoa-Kakula had reached 1.64 million work hours free of a lost-time injury and Kipushi had reached 2.68 million work hours free of a lost-time injury.

Principal projects and review of activities

1. Kamoa-Kakula Project

39.6%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kamoa-Kakula Project, a joint venture between Ivanhoe Mines and Zijin Mining, has been independently ranked as the world’s fourth-largest copper deposit by international mining consultant Wood Mackenzie. The project is approximately 25 kilometres west of the town of Kolwezi and about 270 kilometres west of Lubumbashi.

Ivanhoe sold a 49.5% share interest in Kamoa Holding Limited (Kamoa Holding) to Zijin Mining in December 2015 for an aggregate consideration of $412 million. In addition, Ivanhoe sold a 1% share interest in Kamoa Holding to privately-owned Crystal River for $8.32 million – which Crystal River will pay through a non-interest-bearing, 10-year promissory note. Since the conclusion of the Zijin transaction in December 2015, each shareholder has been required to fund expenditures at the Kamoa-Kakula Project in an amount equivalent to its proportionate shareholding interest in Kamoa Holding.

A 5%, non-dilutable interest in the Kamoa-Kakula Project was transferred to the DRC government on September 11, 2012, for no consideration, pursuant to the 2002 DRC mining code. Following the signing of an agreement with the DRC government in November 2016, in which an additional 15% interest in the Kamoa-Kakula Project was transferred to the DRC government, Ivanhoe and Zijin Mining now each hold an indirect 39.6% interest in the Kamoa-Kakula Project, Crystal River holds an indirect 0.8% interest and the DRC government holds a direct 20% interest. Kamoa Holding holds an 80% interest in the project.

Health and safety at Kamoa-Kakula

Ivanhoe Mines regrets to report that a fatal accident occurred at the Kamoa-Kakula Project on August 16, 2020. The accident occurred underground at the Kakula North workings when a contractor’s employee collided with the side wall of an access drive while attempting to move a drilling rig which he was not trained or authorized to do.

At the end of September 2020, the Kamoa-Kakula Project reached 1,640,584 work hours free of a lost-time injury. The project continues to strive toward its workplace objective of zero harm to all employees and contractors.

In accordance with health guidelines from the DRC government, and in line with the country’s lifting of restrictions, Kamoa-Kakula’s Congolese workforce has gone back to normal work rotations. Rigorous testing, physical distancing, wearing face masks, frequent hand washing and contact-tracing measures still are in place to protect the safety and health of the workforce and community members.

The project has established a COVID-19 isolation facility at the Kamoa camp. Potential symptomatic patients are moved to this facility, where they will be isolated, tested and treated. Once patients have recovered and are deemed no longer infectious, they can return to work only after an additional quarantine period which is determined by the project’s medical staff.

As the pandemic evolves, the medical team at Kamoa-Kakula continues to review and update its risk mitigation protocols. The project’s preventative measures are at the highest international standards and, if there was a case internally, the risk of spreading or cross-contamination is considered to be very low.

Dr. Patrick Kasongo, Occupational Health Coordinator (left); Brett Watson, Managerial Leader, Health, Safety & Environment (middle); and Greg Hillen, Advanced Life Support Paramedic (right) ─ three key members of Kamoa-Kakula’s first-rate medical team that have been instrumental in the project successfully navigating the COVID-19 pandemic.

Outstanding economic results of the Kamoa-Kakula Integrated Development Plan 2020

On September 8, 2020, Ivanhoe Mines announced the results of an independent Integrated Development Plan (IDP) for the Kamoa-Kakula Project. The Kamoa-Kakula Integrated Development Plan 2020 encompasses three development scenarios:

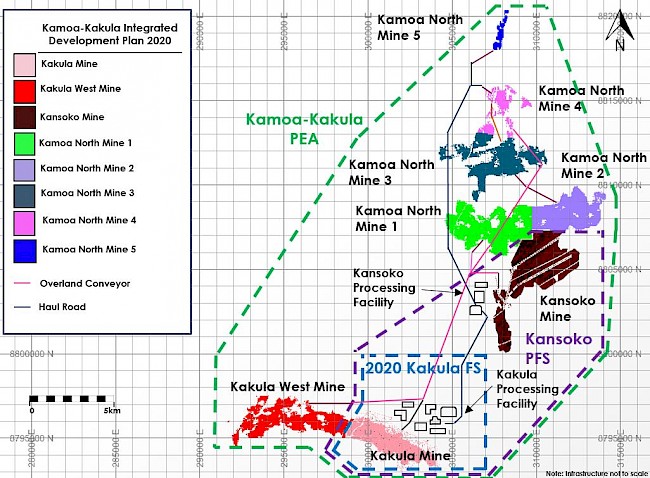

- The definitive feasibility study (DFS) for the stage one Kakula Mine development. The Kakula 2020 DFS evaluates the development of a stage one, 6-Mtpa underground mine and surface processing complex at the Kakula Deposit with a capacity of 7.6 Mtpa, built in two modules of 3.8 Mtpa, with the first already under advanced construction.

- The pre-feasibility study (PFS) including Kansoko Mine development. The Kakula-Kansoko 2020 PFS evaluates the development of mining activities at the Kansoko Deposit in addition to the Kakula Mine, initially at a rate of 1.6 Mtpa to fill the concentrator at Kakula, eventually ramping up to 6 Mtpa as the reserves at Kakula are depleted.

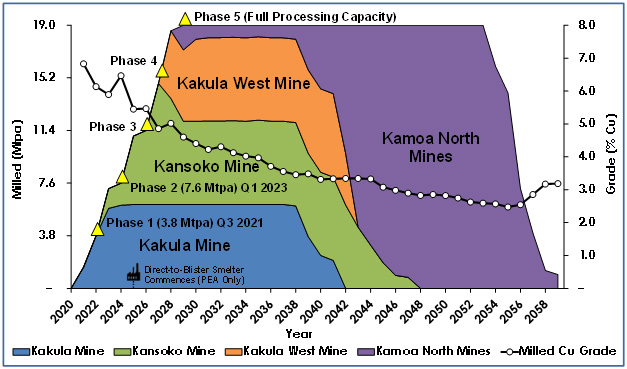

- The expanded, subsequent development to four producing mines. The Kamoa-Kakula 2020 preliminary economic assessment (PEA) includes an analysis of the potential for an integrated, 19-Mtpa, multi-stage development, beginning with initial production from the Kakula Mine, to be followed by subsequent, separate underground mining operations at the nearby Kansoko, Kakula West and Kamoa North mines, along with the construction of a direct-to-blister smelter. The Kamoa North area comprises five separate mines that would be developed as resources are mined out elsewhere, to maintain the production rate at up to 19 Mtpa, with an overall life in excess of 40 years.

The Kamoa-Kakula IDP 2020 was independently prepared on a 100%-basis by OreWin Pty Ltd. of Adelaide, Australia; China Nerin Engineering Co., Ltd., of Jiangxi, China; DRA Global of Johannesburg, South Africa; Epoch Resources of Johannesburg, South Africa; Golder Associates Africa of Midrand, South Africa; KGHM Cuprum R&D Centre Ltd. of Wroclaw, Poland; Outotec Oyj of Helsinki, Finland; Paterson and Cooke of Cape Town, South Africa; Stantec Consulting International LLC of Phoenix, USA; SRK Consulting Inc. of Johannesburg, South Africa; and Wood plc of Reno, USA.

Highlights of the Kakula 2020 DFS, initial 6 Mtpa mine at Kakula, include:

- The Kakula 2020 DFS evaluates the development of a stage one, 6-Mtpa underground mine with a surface processing complex at the Kakula Deposit with a capacity of 7.6 Mtpa, built in two modules of 3.8 Mtpa, with the first already under advanced construction. For this option, the DFS envisages an average annual production rate of 284,000 tonnes of copper at a mine-site cash cost of $0.52 per pound (lb.) copper and total cash cost of $1.16/lb. copper for the first 10 years of operations, and annual copper production of up to 366,000 tonnes by year four.

- Remaining initial capital cost of $0.65 billion for this option would result in an after-tax net present value at an 8% discount rate (NPV8%) of $5.5 billion.

- The internal rate of return of 77.0% and project payback period of 2.3 years confirm the compelling economics for the Kamoa-Kakula Project’s stage one of production.

- Kakula benefits from an ultra-high, feed grade averaging 6.6% copper over the first five years of operations, and 5.2% copper on average over a 21-year mine life.

Highlights of the Kakula-Kansoko 2020 PFS, that incorporates Kansoko mine development, include:

- The Kakula-Kansoko 2020 PFS evaluates the development of mining activities at the Kansoko Deposit in addition to Kakula, initially at a rate of 1.6 Mtpa to fill the 7.6-Mtpa concentrator at Kakula, eventually ramping up to 6 Mtpa as the reserves at Kakula are depleted. For this option, the PFS envisages an average annual production rate of 331,000 tonnes of copper at a mine-site cash cost of $0.55/lb. copper and total cash cost of $1.23/lb. copper for the first 10 years of operations, and annual copper production of up to 427,000 tonnes by year four.

- Remaining initial capital cost of $0.69 billion for this option would result in an after-tax net present value at an 8% discount rate (NPV8%) of $6.6 billion. The internal rate of return of 69.0% and project payback period of 2.5 years confirm the compelling economics of Kakula and Kansoko.

- The combined Kakula-Kansoko production benefits from an ultra-high, feed grade averaging 6.2% copper over the first five years of operations, and 4.5% copper on average over a 37- year mine life.

Highlights of the modular, integrated, expanded development option potential for the Kakula and Kamoa deposits, mining a total of 19 Mtpa, with construction of a direct-to-blister smelter, include:

- The Kamoa-Kakula 2020 PEA presents an additional development option of a multi-stage, sequential operation on Kamoa-Kakula’s high-grade copper deposits.

- Initial production from the Kakula Mine at a rate of 6 Mtpa, followed by subsequent, separate underground mining operations at the nearby Kansoko, Kakula West and Kamoa North mines, along with the construction of a direct-to- blister smelter. The Kamoa North Area comprises five separate mines that will be developed as resources are mined out elsewhere, to maintain the production rate at up to 19 Mtpa, with an overall life in excess of 40 years.

- For the integrated, 19-Mtpa, multi-stage development, the PEA envisages $0.7 billion in remaining initial capital costs. Future expansion at the Kansoko Mine, Kakula West Mine and Kamoa North mines would be funded by cash flows from the Kakula Mine, resulting in an after-tax net present value at an 8% discount rate (NPV8%) of $11.1 billion, an internal rate of return of 56.2%, and a payback period of 3.6 years.

- Under this approach, the PEA also contemplates the construction of a direct-to-blister copper smelter at the Kakula plant site with a capacity to process one million tonnes of copper concentrate per annum to be funded from internal cash flows. This would be completed in year five of operations, achieving significant savings in treatment charges and transportation costs.

- The 19-Mtpa scenario shows the potential for average annual production of 501,000 tonnes of copper at a total cash cost of $1.07/lb. copper during the first 10 years of operations and production of 805,000 tonnes of copper by year eight.

- At this future production rate, Kamoa-Kakula would rank as the world’s second largest copper mine.

The capital costs incurred by the Kamoa-Kakula joint venture in 2019 amounted to $309.1 million, of which $125.2 million was spent on the Kakula declines and mine development. A further capital cost of $403 million, that includes the costs allocated to the pre-production ore stockpiles, has been incurred in the nine months ended September 30, 2020. Ivanhoe’s share of the capital costs incurred in the nine months ended September 30, 2020, was $200 million, representing its share of approximately 40% of the initial capital costs, plus its share of capital associated with the 20% carried interest owned by the Government of the DRC, which will be repaid through future cash flows from the project. Ivanhoe has budgeted $127 million for its proportionate funding of approximately 50% for the Kamoa-Kakula Project for the remainder of 2020. As of September 30, 2020, the joint venture had an estimated $570 million of capital costs remaining until initial production.

Ivanhoe expects that it will continue to have sufficient cash resources or financing options available to cover its proportionate share of the remaining initial capital costs.

Figure 1. Kamoa-Kakula 19-Mtpa PEA long-term development plan, which would position Kamoa-Kakula as the world’s second largest copper mining complex, with peak annual copper production of more than 800,000 tonnes.

Figure by OreWin 2020

Figure 2: Overview of deposits included within the Kakula 2020 DFS (6 Mtpa ─ outlined by blue dotted line), Kakula-Kansoko 2020 PFS (7.6 Mtpa ─ outlined by purple dotted line) and Kamoa-Kakula 2020 PEA (outlined by green dotted line).

Excellent construction progress being made on Kakula’s concentrator plant; first production now expected in July 2021

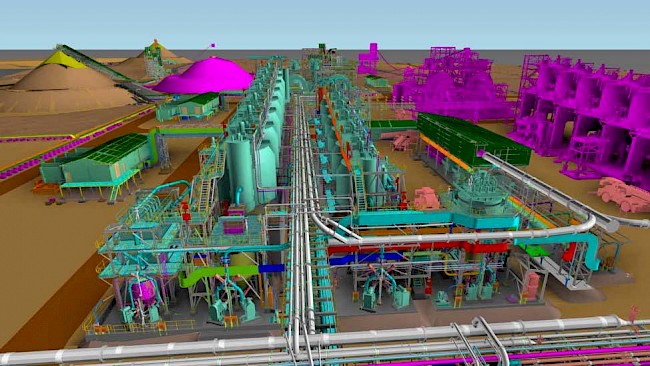

Construction of the project’s first-phase 3.8-Mtpa concentrator plant is advancing rapidly and at the end of September 2020 was approximately 28% complete. The concentrator plant is expected to be mechanically complete in Q2 2021, with first copper concentrate production scheduled for July 2021. The project and construction teams have consistently achieved the milestone dates despite the challenges presented by the COVID-19 pandemic, and have placed Kamoa-Kakula in a position to commission earlier than initially planned in 2021.

Civil works for the initial concentrator plant are nearing completion, with approximately 26,000 cubic metres of concrete poured to date. All major construction areas will be handed over to the steel, mechanical, piping and platework (SMPP) contractor imminently.

The final major pieces of equipment − two 80-MVA/220kV electrical transformers – are scheduled to arrive on site in early November 2020. Construction of the various electrical substations is progressing well.

Structural steel and platework fabrication for the concentrator plant is complete, with the bulk of the material already delivered to site. Piping is progressing according to schedule, with more than 60 kilometres (of a total of 83 kilometres) of piping already delivered at the end of October 2020. Limited electrical, controls and instrumentation (EC&I) work has started with the installation of cable racking.

At the end of October 2020, over 2,000 tonnes of steel (of a total of 5,700 tonnes) had been installed. The main focus areas are the conveyor gantries, mill building, reagent storage area, flotation area, and concentrate storage building. Construction has commenced for the plant stores, workshop and water services.

The two ball mills for the initial 3.8-Mtpa concentrator plant; with one of the 7-megawatt, variable-speed-drive motors (blue), manufactured by WEG Industries in Brazil, and the high-pressure grinding rolls stockpile under construction in the background.

A 3D illustration of the first 3.8-Mtpa concentrator plant flotation area, with the recently-initiated second 3.8-Mtpa concentrator plant shown in magenta. A comparison picture below shows progress to date.

A 3D illustration of the finished ball mills (in light green), with the next two ball mills for the recently-initiated second concentrator plant shown in magenta. A comparison picture below shows progress to date. The first-phase (dark green) and second-phase (magenta) high-pressure grinding rolls buildings are shown in the red circle.

Engineering, procurement and construction of other surface infrastructure rapidly progressing

Overall progress of Kamoa-Kakula’s first-phase, 3.8-Mtpa mining and milling operation (covering mine infrastructure, concentrator plant and surface infrastructure) was approximately 58% complete at the end of September 2020.

Beijing-based CITIC Construction is building Kakula’s first phase, backfill paste plant. The backfill plant will be used to mix tailings from the concentrator plant with cement to produce paste backfill. The backfill will be pumped back into the mine and used to help support mined-out areas. Approximately one half of the mine’s tailings will be sent back underground, significantly reducing the surface tailings storage. Construction of the backfill plant civil works is well advanced and steel erection has started.

Construction of the tailings dam is progressing well, with the aim to complete most of the earthworks before the rainy season is expected to begin later in November 2020. Installation is well advanced for the three tailings lines and the tailings return water line.

All long-lead mechanical items now have been delivered to site with the exception of the main 220kV transformers which have been off-loaded at port and currently are being transported to site by road.

The gabion wall for the surface bulk reclaim tip system that is located near Kakula’s main northern decline has been constructed and preparation has started for the civil works required at the top of the wall. The bulk reclaim tip system will be used to feed ore from Kakula’s surface stockpiles (and ore from the Kansoko Mine when second-phase operations begin) to the processing circuit.

High-grade copper ore being delivered to surface by the underground conveyor system in front of the gabion wall for the bulk reclaim tip system.

Underground development is approximately seven kilometres ahead of plan at the end of September 2020

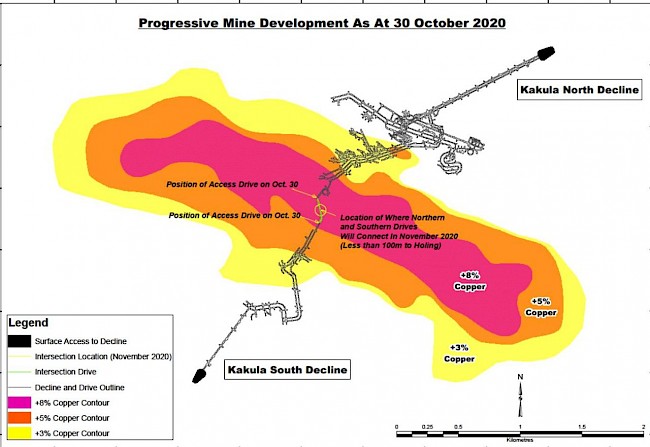

A total of 22.6 kilometres of underground development was completed by the end of September 2020, which was approximately 7 kilometres ahead of plan. A record of 2.172 kilometres of development was subsequently achieved in October 2020, further increasing the underground development to more than 24.7 kilometres which is 7.9 kilometres ahead of plan.

There currently are 10 mining crews (three owner crews and seven contractor crews) at Kakula and one mining crew at Kansoko. The project will continue to add additional crews to further accelerate development.

In the Kakula southern access drives, minor offsets across growth faults have been encountered, but adjustments to the mining has allowed the drives to follow the steeper dips of the mineralization across the faults. In the Kakula northern access drive, a larger growth fault was encountered where the mineralization of the south side of the fault was faulted down (with variable offsets). A spiral decline was developed to accommodate the offsets, and re-established mining on the mineralization.

At Kakula, both main access tunnels (drives) being advanced from the southern decline, and the spiral access drive being advanced from the northern decline, recently have accessed the high-grade zone near the centre of the deposit grading approximately +8% copper. Kakula’s main access drives between the northern and southern declines have less than 100 metres remaining before they are connected (holed) in the high-grade centre of the deposit. The holing will significantly increase ventilation to the centre of the orebody, allowing for additional mining crews to begin highly-productive mining operations in Kakula’s high-grade ore zones.

Chamec Kasatuka Mpungwe operating a piece of semi-autonomous mining equipment at the Kansoko Mine. Kamoa-Kakula is training a new generation of young Congolese women and men to safely operate modern, mechanized equipment in the world-scale underground copper mines being built at Kamoa-Kakula.

Miner Freddy Muba holds a piece of ultra-high-grade, chalcocite-rich ore at the Kakula Mine. Kakula’s high concentration of chalcocite ore – which is almost 80% copper by weight − accounts for the mine’s average feed grade of 6.6% copper over the first five years of operations, and 5.2% copper on average over a 21-year life.

In addition to advancing the main connecting access drives, underground mining crews at Kakula are focused on preparation work for developing the high grade, drift-and-fill mining blocks in the centre of the orebody. Opening up of the mining footprint for these high grade, drift-and-fill mining areas entails development work in areas of low-, medium- and high-grade ore, and is designed to coincide with the start-up of the concentrator plant next year. This will allow mining crews to deliver significant tonnage of high-grade ore directly from Kakula’s underground workings to the concentrator plant.

Kakula’s second underground ore bin (the west tip bin) is undergoing commissioning. Installation of Kakula’s ventilation shaft #2 also is progressing well, with the first of three high-capacity surface fans installed by the contractor.

Underground development at the Kansoko Mine currently is in low-to-medium-grade ore zones, grading approximately 3% copper. In October, mine development work intersected the first exposure of siltstone, marking the transition to higher copper grades at Kansoko. Siltstone is a rock type with a strong influence on copper mineralization at Kamoa-Kakula.

A recent, independent audit of Kamoa-Kakula’s greenhouse gas intensity metrics performed by Hatch Ltd. of Mississauga, Canada, confirmed that the project will be among the world’s lowest greenhouse gas emitters per unit of copper produced.

Figure 3: Underground development completed at the Kakula Mine to the end of October (in black), and the location where the northern and southern access drives will be joined. Majority of development in November will be in the initial drift-and-fill mining area within the +8% copper zone (in magenta).

Pre-production ore stockpiles now contain approximately one million tonnes grading 3.47% copper

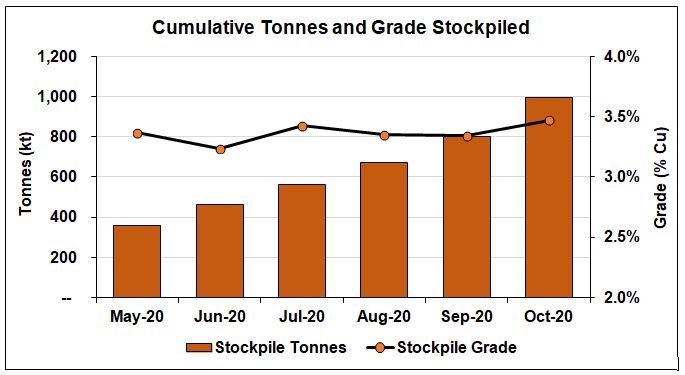

At the end of September 2020, Kakula North’s combined medium- and high- grade, pre-production ore stockpile contained approximately 540,000 tonnes grading 3.73% copper, the medium- and high-grade ore stockpile at Kakula South contained approximately 168,000 tonnes grading 2.73% copper, and stockpiles at Kansoko, contained approximately 95,000 tonnes grading 2.34% copper.

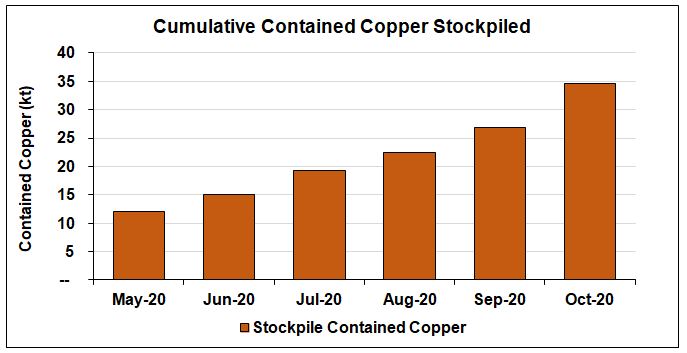

In October, crews at Kakula and Kansoko mined and transported to surface approximately 194,000 tonnes of ore grading 4.01% copper. This brings the project’s total pre-production high- and medium-grade ore stockpiles to approximately 1,000,000 tonnes at an estimated grade of 3.47% copper. An additional 622,000 tonnes of low-grade development ore also has been stockpiled on surface.

The ore being mined from the northern portion of the Kakula Mine is transported to surface via the conveyor system and placed on a blended surface stockpile that contained approximately 639,000 tonnes grading an estimated 3.71% copper at the end of October 2020.

Additional, pre-production ore stockpiles are located at the Kakula southern decline (approximately 67,000 tonnes of high-grade ore grading 5.05% copper, and 171,000 tonnes of medium-grade ore grading 2.62% copper) and the Kansoko decline (approximately 120,000 tonnes grading 2.53% copper).

The project is positioned for a significant acceleration in the tonnage, as well as a marked increase in the grade of ore added to the surface stockpiles, as more mining crews soon will begin working in the higher-grade areas of the Kakula and Kansoko mines.

Kakula’s high-grade copper ore being transported to surface on the underground conveyor system.

Chart 1: Cumulative tonnes and grade of pre-production ore stockpiles at the Kakula and Kansoko mines from May 2020 to October 2020.

Chart 2: Growth in contained copper in pre-production ore stockpiles at the Kakula and Kansoko mines from May 2020 to October 2020.

Discussions underway for the marketing of Kakula’s copper concentrates

Kamoa-Kakula is in detailed discussions with a number of parties with respect to the marketing and smelting of its copper concentrates. Kakula is expected to produce an extremely high grade and clean copper concentrate (containing over 55% copper) that will be highly coveted by copper smelters around the world. Metallurgical test work indicates that the Kakula concentrates contain extremely low arsenic levels by world standards – approximately 0.01%.

Kamoa-Kakula expected to be connected to the national power grid in December, providing clean, renewable 220-kV hydropower

The mine is receiving hydro-electric power for the Kamoa 120-kilovolt (kV) overhead line via the 18MW mobile substation, which is connected to the national grid. The mobile substation was recently relocated to the Kakula Mine from the Kansoko Mine to increase transmission capacity to Kakula. Construction of the permanent 220-kV overhead power line, the electrical switching substation (NRO substation) and the Kamoa consumer substation are underway. In December 2020, Kamoa-Kakula is expected to tie in the 35-kilometre, 220-kV power line connecting the Western Dispatch substation in Kolwezi to Kamoa-Kakula, and supply the project with reliable and clean hydro-generated electricity from the national grid.

Tresor Kalenga Musoya (top), Liang Yang (middle) and Chanzhong Yang (bottom) installing the high-tension conductors for the new 35-kilometre powerline that will carry high-voltage (220-kV) hydro-electricity from the national grid to Kamoa-Kakula.

Ongoing upgrading work enables Mwadingusha hydropower station to supply clean, sustainable electricity

The upgrading work at the 72-megawatt Mwadingusha hydropower plant is nearing completion and electricity from all of Mwadingusha’s six turbines is expected to be integrated into the national power grid in the first quarter of 2021. The two main activities remaining are the final installation of the turbines and the completion of the penstock replacement.

The work is being conducted by engineering firm Stucky of Lausanne, Switzerland, under the direction of Ivanhoe Mines and Zijin Mining, in conjunction with the DRC’s state-owned power company, La Société Nationale d’Electricité (SNEL).

Aerial view of the Mwadingusha dam and spillway. The upgrading of the Mwadingusha hydro-generation facility, in conjunction with Société Nationale d’Electricité (SNEL), is an important step in Kamoa-Kakula’s goal of producing the world’s greenest copper.

Kamoa-Kakula partners accelerate expansion plans and bring Phase 2 copper production forward

In September 2020, Kamoa-Kakula proceeded with orders for the long-lead equipment for the second, 3.8 Mtpa concentrator module at the Kakula Mine, which will double the mine’s processing capacity from 3.8 Mtpa to 7.6 Mtpa. The earlier than planned placement of the orders for the concentrator’s long-lead equipment is expected to accelerate the completion of the Phase 2 mill expansion from Q1 2023 to Q2 2022.

In order to bring forward the expansion of the Kakula concentrator plant, the Kamoa-Kakula joint venture will order long-lead items with a total commitment value of approximately $100 million in 2020, of which an estimated $25 million is expected to be spent this year. Requests for tenders for the second-phase earthworks and civil works also have been issued.

Enriching communities through sustainable development

The Sustainable Livelihoods Program started in 2010 in an effort to strengthen food security and farming capacity in the host communities near Kamoa-Kakula by establishing an agricultural training garden and support for farmers at the community level. Today, approximately 350 community farmers are benefiting from the Sustainable Livelihoods Program, producing high-quality food for their families and selling the surplus for additional income. As Kamoa gears up to take the Livelihood Program to the next level, an agronomy school, which will offer training programs to local farmers and serve as a research facility, is currently under construction. Additional non-farming related activities for 2020 include education and literacy programs, the continuation of a community brick-making program and the supply of fresh water to a number of local communities using solar powered boreholes. During 2020, 18 additional boreholes were drilled in communities, making use of local contractors. A clinic, school and facility for a sewing program are also currently under construction.

Kamoa-Kakula conducted a number of interventions in respect of COVID-19 awareness and prevention. These include the donation of rapid test kits, masks and hand-washing equipment to local communities.

Construction of resettlement houses for the second phase of the relocation program continued throughout the year with 19 families having been relocated. Relocation also took place for the third phase of the relocation program with 14 families relocated during the year. The survey for Kakula North and all crop compensation has been completed, with only six temporary structures being identified. The entire Kakula Mine area, including the tailings dam area, will be secured once these relocation phases are complete.

Dr. Guy Muswil, Kamoa Copper’s Head of Sustainability (left), with local farmers showcasing their cabbage crop in one of the project’s community gardens.

Nickson Nyundo, a member of Kamoa Copper’s landscaping team, planting grass at Kakula Mine office.

Members of the Kakula kitchen staff preparing fresh fruits and vegetables; all of which were grown locally in community-run gardens, then sold to the Kamoa-Kakula Project. Another example of the Kamoa-Kakula Sustainable Livelihoods Program supporting economic diversification in surrounding communities.

2. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project is owned by Ivanplats (Pty) Ltd (Ivanplats), which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically-disadvantaged, broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with approximately 150,000 people, project employees and local entrepreneurs. Ivanplats reached Level 4 contributor status in its most recent verification assessment on the B-BBEE scorecard. A Japanese consortium of ITOCHU Corporation, Japan Oil, Gas and Metals National Corporation, and Japan Gas Corporation, owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper and gold mineralization on the Northern Limb of the Bushveld Igneous Complex in Limpopo Province – approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane.

On the Northern Limb, platinum-group metals mineralization is primarily hosted within the Platreef, a mineralized sequence that is traced more than 30 kilometres along strike. Ivanhoe’s Platreef Project, within the Platreef’s southern sector, is comprised of two contiguous properties: Turfspruit and Macalacaskop. Turfspruit, the northernmost property, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of mining operations and properties.

Since 2007, Ivanhoe has focused its exploration and development activities on defining and advancing the down-dip extension of its original discovery at Platreef, now known as the Flatreef Deposit, which is amenable to highly mechanized, underground mining methods. The Flatreef area lies entirely on the Turfspruit and Macalacaskop properties, which form part of the company’s mining right.

Health and safety at Platreef

Ivanhoe Mines regrets to report that a fatal accident occurred at the Platreef Project on September 14, 2020. The accident occurred in Shaft 1 when the cable holding a kibble bucket was sheared in the headgear of the shaft and the kibble bucket subsequently fell down Shaft 1 and struck the northern side of the working platform (stage), where four employees were conducting routine water-pumping activities.

One of the employees was rescued from underground and airlifted to a hospital in Johannesburg. He has subsequently been discharged and is expected to make a full recovery. Sadly, the three other miners succumbed to their injuries.

The formal enquiry by the Department of Mineral Resources and Energy is still ongoing, but the preliminary finding is that this tragic accident was caused by an electronic device failure. Leading industry specialists also are assisting the Ivanplats team in determining the possible causes resulting in the accident. The Ivanplats team is in the process of assessing the extent of the damage and the work required to ensure that the shaft can resume normal operations in a safe manner.

Positive independent 2017 definitive feasibility study; Platreef projected to be Africa’s lowest-cost producer of platinum-group metals

In July 2017, Ivanhoe Mines announced the results of an independent, definitive feasibility study (DFS) for the then planned first phase of the Platreef Project’s palladium-platinum-nickel-copper-gold-rhodium mine in South Africa.

The Platreef DFS covered a 4-Mtpa, first phase of development that would include construction of a state-of-the-art underground mine, concentrator and other associated infrastructure to support initial production of concentrate. As Phase 1 is being developed and commissioned, there would be opportunities to refine the timing and scope of subsequent phases of expanded production.

Platreef phased development plan and update of the 2017 DFS

Ivanhoe is investigating a phased development plan for the Platreef Project, targeting significantly lower initial capital, to accelerate first production by using Shaft 1 as the mine’s initial production shaft. This plan will focus on initially targeting the development of mining zones accessible from Shaft 1 and maximizing the hoisting capacity of this shaft, followed by expansions to the production rate as outlined in the 2017 DFS.

Concurrently, Ivanhoe is updating the Platreef Project’s DFS to take into account development schedule advancement since 2017 when the DFS was completed, updated costs and refreshed metal prices and foreign exchange assumptions. This update, together with the study on the phased development plan, is nearing completion and is expected to be released in mid-November 2020.

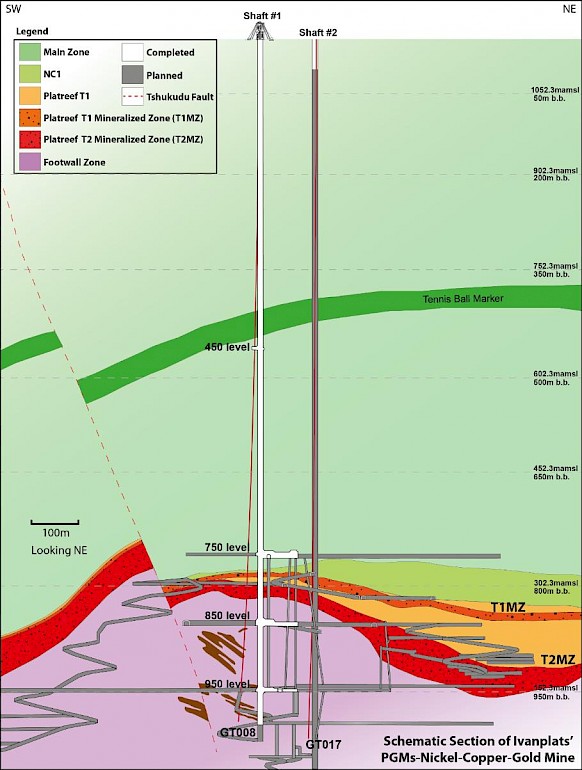

Shaft 1 successfully completed down to the final depth of 996 metres

Shaft 1 reached the top of the high-grade Flatreef Deposit (T1 mineralized zone) at a depth of 780.2 metres below surface in Q3 2018 and has since been extended to its final depth of 996 metres below surface. The thickness of the mineralized orebody (T1 and T2 mineralized zones) at Shaft 1 is 29 metres, with grades of platinum-group metals ranging up to 11 grams per tonne (g/t) 3PE (platinum, palladium and rhodium) plus gold, as well as significant quantities of nickel and copper. The 29-metre intersection yielded approximately 3,000 tonnes of ore, estimated to contain more than 400 ounces of platinum-group metals. The ore is stockpiled on surface for further metallurgical sampling.

The 750-, 850-, and 950-metre-level station developments have been completed. The three development stations will provide initial, underground access to the high-grade orebody. Shaft 1 changeover detailed designs have successfully been completed and will enable Shaft 1 to be configured for permanent rock hoisting. The changeover construction has been delayed following the September 14, 2020 accident and the Ivanplats team is in the process of assessing the work required to ensure that the shaft can resume normal operations in a safe manner. Ivanhoe is considering alternative construction sequencing to possibly speed up the changeover construction process.

Underground mining to incorporate highly-productive, mechanized methods

The mining zones in the current Platreef mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below surface. When completed, Shaft 2 is expected to provide primary access to the mining zones; secondary access is expected to be via Shaft 1. During mine production, both shafts also are expected to serve as ventilation intakes. Three additional ventilation exhaust raises are planned to achieve steady-state production.

Planned mining methods will use highly-productive, mechanized methods, including long-hole stoping and drift-and-fill mining. Each method will utilize cemented backfill for maximum ore extraction. The ore will be hauled from the stopes to a series of internal ore passes and fed to the bottom of Shaft 2, where it will be crushed and hoisted to surface.

Development of human resources and job skills

Consultation regarding the Platreef Project’s second Social and Labour Plan (SLP) is in the final stages. In this second SLP, Ivanplats plans to build on the foundation laid in the first SLP and continue with its training and development suite, which includes: 15 new mentors; internal skills training for 78 staff members; a legends program to prepare retiring employees with new/other skills; community adult education training for our host community members; core technical skills training for at least 100 community members, portable skills; and more.

Local economic development projects will contribute community water source development with the Mogalakwena Municipality boreholes program, educational program in partnership with Department of Education and significant contribution funding for sanitation infrastructure at the municipality.

The enterprise and supplier development commitments comprise of expanding the existing kiosk and laundry facilities even further and adding expanded change house facilities to be managed by a community partner in the future. A five-year integrated business accelerator and funding project will assist community members interested to obtain help with development and supplier readiness.

The Platreef Project has continued supporting a number of educational programs, including the E-learning project and the maintenance of science and computer laboratories, as well as the provision of free Wi-Fi in host communities. In pursuit of Ivanhoe’s de-carbonization agenda, the Platreef Project planted 25 trees at two local schools in the mine’s footprint area.

Schematic section of the Platreef Mine, showing Flatreef’s T1 and T2 thick, high-grade mineralized zones (red and dark orange), underground development work completed to date in shafts 1 and 2 (white) and planned development work (gray).

3. Kipushi Project

68%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kipushi copper-zinc-germanium-silver-lead mine, in the DRC, is adjacent to the town of Kipushi and approximately 30 kilometres southwest of Lubumbashi. It is located on the Central African Copperbelt, approximately 250 kilometres southeast of the Kamoa-Kakula Project and less than one kilometre from the Zambian border. Ivanhoe acquired its 68% interest in the Kipushi Project in November 2011; the balance of 32% is held by the state-owned mining company, Gécamines.

As part of the company’s cost-cutting measures announced on April 27, 2020, Ivanhoe’s board of directors allocated a reduced total budget for 2020 of $28.7 million for the Kipushi Project, of which approximately $8 million remains for the rest of the year.

Health, safety and community development

At the end of September 2020, the Kipushi Project reached a total of 2,677,310 work hours free of lost-time injuries. It has been almost two years since the last lost-time injury occurred at the Kipushi Project.

In response to government-imposed travel restrictions and emergency protocols being introduced worldwide due to the COVID-19 pandemic, Kipushi has temporarily suspended mine development operations in order to reduce the risk to the workforce and local communities. The project is maintaining a reduced workforce to conduct maintenance activities and to maintain pumping operations.

The Kipushi Project operates a potable-water station to supply the municipality of Kipushi with water. This includes power supply, disinfectant chemicals, routine maintenance, security, and emergency repair of leaks to the primary reticulation. During 2020, two additional solar-power boreholes were established, thereby availing clean potable water to a further two host communities near Kipushi.

Other community development projects included the donation of 5,000 N95 face masks to host communities, the donation of additional infrared thermometers to the Health Zone management and sponsoring a COVID-19 awareness campaign broadcast on local radio. Additional COVID-19 awareness efforts include signboards erected throughout the town and a motorized caravan which rotates within communities thrice per week. The sewing training centre project produces cloth face masks and donates approximately 2,000 masks a month to host communities.

Louis Watum (right), Kipushi Corporation’s General Manager, donating a box of COVID-19 antigen tests to Kiki Mushota (left), Kipushi Territory’s Health Administrator.

Kyungu Kabulo, Instrumentation Assistant (left), and Junior Kisula Ngoy, Instrumentation Engineer (right), installing probes and a balance disk on a grifo pump at Kipushi’s 1,200-metre-level pumping station.

Definitive feasibility study in final stages of completion

The Kipushi Project’s pre-feasibility study (PFS), announced by Ivanhoe Mines on December 13, 2017, anticipated annual production of an average of 381,000 tonnes of zinc concentrate over an 11-year, initial mine life at a total cash cost of approximately $0.48 per pound (lb.) of zinc.

Highlights of the PFS, based on a long-term zinc price of $1.10/lb., include:

- After-tax net present value (NPV) at an 8% real discount rate of $683 million.

- After-tax real internal rate of return (IRR) of 35.3%.

- After-tax project payback period of 2.2 years.

- Pre-production capital costs, including contingency, of $337 million.

- Existing surface and underground infrastructure allows for significantly lower capital costs than comparable greenfield development projects.

- Life-of-mine average planned zinc concentrate production of 381,000 dry tonnes per annum, with a concentrate grade of 59% zinc, is expected to rank Kipushi, once in production, among the world’s largest zinc mines.

All figures are on a 100%-project basis unless otherwise stated. Estimated life-of-mine average cash cost of $0.48/lb. of zinc is expected to rank Kipushi, once in production, in the bottom quartile of the cash-cost curve for zinc producers internationally.

The Kipushi Project’s DFS is in the final stages of completion, and some aspects of the design have progressed into a detailed engineering phase.

Miners Kyungu (left) and Mpoyo (right) performing regular safety procedures on Kipushi’s 650-metre level.

Project development and infrastructure

Although development and rehabilitation activities in the nine months ending September 30, 2020 were limited, significant progress has been made in recent years to modernize the Kipushi Mine’s underground infrastructure as part of preparations for the mine to resume commercial production, including upgrading a series of vertical mine shafts to various depths, with associated head frames, as well as underground mine excavations and infrastructure. A series of crosscuts and ventilation infrastructure still is in working condition and have been cleared of old materials and equipment to facilitate modern, mechanized mining. The underground infrastructure also includes a series of high-capacity pumps to manage the mine’s water levels, which now are easily maintained at the bottom of the mine.

Shaft 5 is eight metres in diameter and 1,240 metres deep and has been upgraded and re-commissioned. The main personnel and material winder has been upgraded and modernized to meet international industry standards and safety criteria. The Shaft 5 rock-hoisting winder also is fully operational with new rock skips, new head- and tail-ropes, and attachments installed. The two newly-manufactured rock conveyances (skips) and the supporting frames (bridles) have been installed in the shaft to facilitate the hoisting of rock from the main ore and waste storage silos feeding rock on the 1,200-metre level.

The main haulage way on the 1,150-metre level, between the Big Zinc access decline and Shaft 5 rock load-out facilities, has been resurfaced with concrete so the mine now can use modern, trackless, mobile machinery. A new truck-tipping bin, which feeds into the large-capacity rock crusher located directly below, has been installed on this level. The old winder at P2 Shaft has been removed and construction of the new foundation, along with assembly and installation of the new modern winder, has been completed and fully commissioned after passing safety inspection and testing procedures.

Samuel Ndembo (left) and Mbiya Africa (right) taking air flow measurements at Kipushi’s 850-metre-level electrical substation.

4. DRC Western Foreland Exploration Project

100%-owned by Ivanhoe Mines

Democratic Republic of Congo

Ivanhoe’s DRC exploration group is targeting Kamoa-Kakula-style copper mineralization through a regional exploration and drilling program on its 100%-owned Western Foreland exploration licences, located to the north, south and west of the Kamoa-Kakula Project. Exploration activities on the Western Foreland’s exploration project in the DRC will continue with a 2020 budget of $8 million, of which approximately $3 million remains for the rest of the year.

Drilling re-commenced in Q3 2020 with a total of seven new holes completed at the Makoko prospect, and an eighth drill hole was deepened. The drilling aimed to confirm the continuation of prospective lower Nguba stratigraphy westwards toward the new exploration permits. A total of 2,589 metres were drilled during the quarter. Additionally, exploration continued on the Western Foreland exploration licences with strict procedures in place to protect employees and drilling contractors from COVID-19.

The exploration team conducted exploration on eight new exploration licences in the Western Foreland region. The exploration work, as well as drilling, included stream sediment sampling, soil sampling as well as outcrop and stream mapping. In total, 181 stream sediment samples and 1,249 soil samples were collected and processed for analysis. The target of the current field season is to increase geological understanding for the new permits, as well as to generate targets for future exploration and drilling. The drill core from the program is being processed for analysis and detailed rock physical property testwork also is carried out to further geological understanding, as well as the ability of the data to be used for future larger scale geophysical testwork and analysis.

Logistical organization and mobilization commenced for the planned high-resolution magnetic and radiometric survey, while planning for an airborne gravity survey is ongoing. Both geophysical surveys are planned to commence in Q4 2020. The goal of this work is to understand the magnetic characteristics of the different lithologies and stratigraphy over the broader exploration area.

Road clearance commenced during Q3 2020 in order to extend the current exploration opportunities from the Makoko area. Work planned for Q4 2020 includes the construction of a bridge to access some of the newly acquired permits at the end of the Makoko road, as well as some road upgrades.

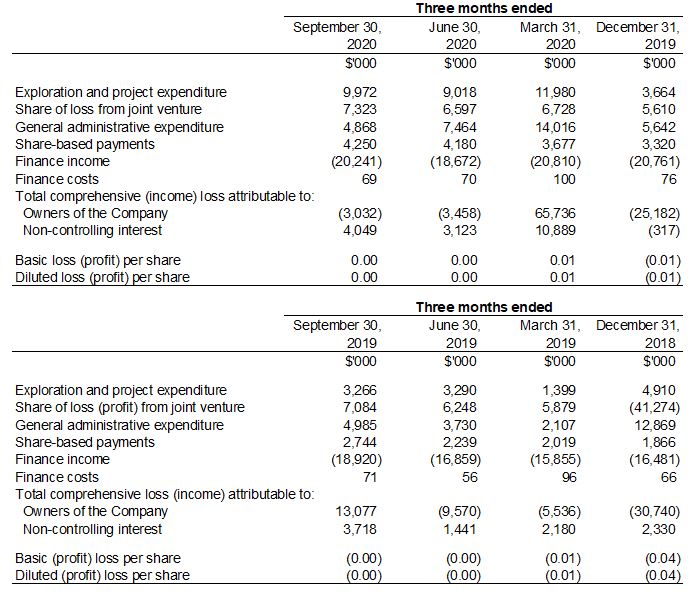

SELECTED QUARTERLY FINANCIAL INFORMATION

The following table summarizes selected financial information for the prior eight quarters. Ivanhoe had no operating revenue in any financial reporting period and did not declare or pay any dividend or distribution in any financial reporting period.

DISCUSSION OF RESULTS OF OPERATIONS

Review of the three months ended September 30, 2020 vs. September 30, 2019

The company recorded a total comprehensive loss of $1.0 million for Q3 2020 compared to loss of $16.8 million for the same period in 2019. The majority of the loss in Q3 2019 mainly was due to an exchange loss on translation of foreign operations of $17.7 million resulting from the weakening of the South African Rand by 7% from June 30, 2019, to September 30, 2019. The company recognized an exchange gain on translation of foreign operations in Q3 2020 of $4.3 million.

Finance income for Q3 2020, amounted to $20.2 million, and was $1.3 million more than for the same period in 2019 ($18.9 million). Included in finance income is the interest earned on loans to the Kamoa Holding joint venture to fund operations that amounted to $18.0 million for Q3 2020, and $13.8 million for the same period in 2019, interest increased as the accumulated loan balance increased. Interest received on cash and cash equivalents decreased due to interest rate cuts by the US Federal Reserve.

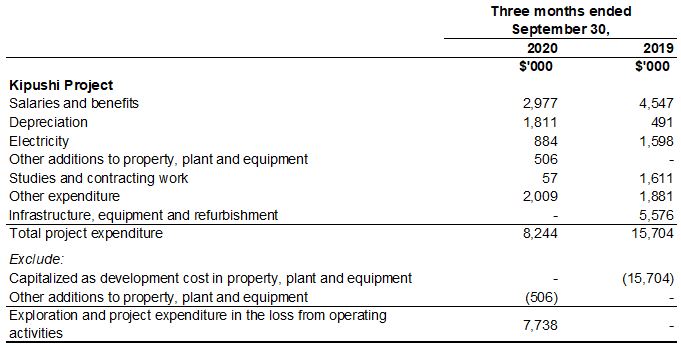

Exploration and project expenditure amounted to $10.0 million in Q3 2020 and $3.3 million for the same period in 2019. While all the exploration and project expenditure incurred in Q3 2019 related to exploration at Ivanhoe’s 100%-owned Western Foreland exploration licences, Q3 2020 also included $7.7 million spent at the Kipushi Project which incurred limited costs of a capital nature in the quarter due to reduced activities. The main classes of expenditure at the Kipushi Project in Q3 2020 and Q3 2019 are set out in the following table:

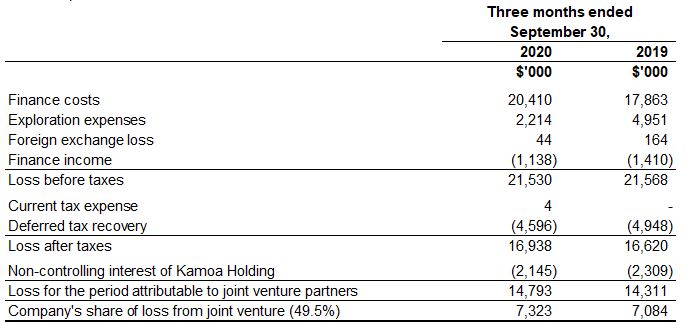

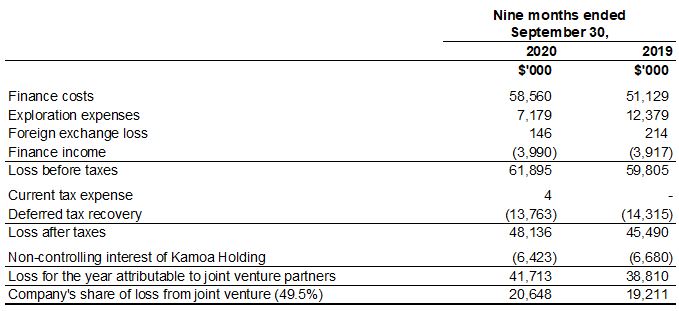

The company’s share of losses from the Kamoa Holding joint venture increased from $7.1 million in Q3 2019 to $7.3 million in Q3 2020. The following table summarizes the company’s share of the losses of Kamoa Holding for the three months ended September 30, 2020, and for the same period in 2019:

The finance costs in the Kamoa Holding joint venture relates to shareholder loans where each shareholder is required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest. The Company is advancing Crystal River’s portion on its behalf in return for an increase in the promissory note due to Ivanhoe.

Review of the nine months ended September 30, 2020 vs. September 30, 2019

The company recorded a total comprehensive loss of $77.3 million for the nine months ended September 30, 2020 compared to a loss of $5.3 million for the same period in 2019. The comprehensive loss for the nine months ended September 30, 2020 included an exchange loss on translation of foreign operations of $49.6 million, resulting from the weakening of the South African Rand by 22% from December 31, 2019, to September 30, 2020, compared to an exchange loss on translation of foreign operations of $11.9 million for the same period in 2019.

Finance income for the nine months ended September 30, 2020 amounted to $59.7 million, and was $8.1 million more than the same period in 2019 ($51.6 million). Included in finance income is the interest earned on loans to the Kamoa Holding joint venture to fund operations that amounted to $50.6 million for the nine months ended September 30, 2020, and $38.5 million for the same period in 2019, interest increased as the accumulated loan balance increased. Interest received on cash and cash equivalents for the nine months ended September 30, 2020 amounted to $4.2 million and was $5.4 million less than the same period in 2019 ($9.6 million).

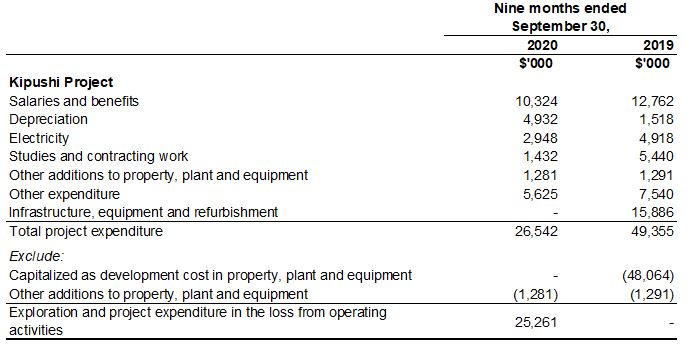

Exploration and project expenditure amounted to $31.0 million for the nine months ended September 30, 2020 and $8.0 million for the same period in 2019. While all the exploration and project expenditure incurred in 2019 related to exploration at Ivanhoe’s 100%-owned Western Foreland exploration licences, 2020 also included $25.3 million spent at the Kipushi Project which was on reduced activities and incurred limited cost of a capital nature in the year to date.

The main classes of expenditure at the Kipushi Project for the nine months ended September 30, 2020, and for the same period in 2019 are set out in the following table:

The company’s share of losses from the Kamoa Holding joint venture increased from $19.2 million for the nine months ended September 30, 2019 to $20.6 million for the same period in 2020. The following table summarizes the company’s share of the losses of Kamoa Holding for the nine months ended September 30 2020, and for the same period in 2019:

Financial position as at September 30 , 2020 vs. December 31, 2019

The company’s total assets decreased by $69.2 million, from $2,444.7 million as at December 31, 2019, to $2,375.5 million as at September 30, 2020. The company utilized $47.3 million of its cash resources in its operations and received interest of $4.2 million on cash and cash equivalents during the nine months ended September 30 2020.

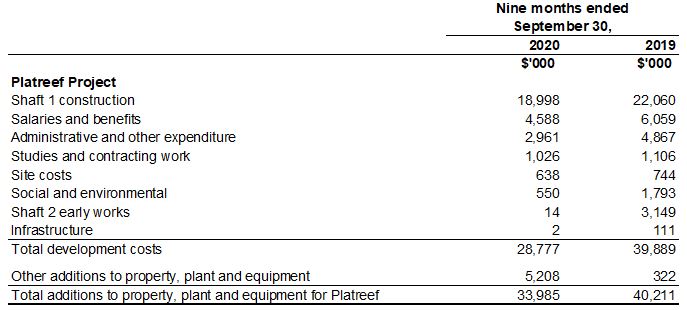

Property, plant and equipment decreased by $15.3 million, from $421.1 million as at December 31, 2019, to $405.8 million as at September 30, 2020. The decrease resulted from the foreign exchange translation of property, plant and equipment of non-US dollar operations of $47.6 million due to the weakening of the South African Rand by 22% from December 31, 2019, to September 30, 2020. A total of $35.9 million was spent on project development and to acquire other property, plant and equipment, $34.0 million of which pertained to development costs and other acquisitions of property, plant and equipment at the Platreef Project.

The main components of the additions to property, plant and equipment ─ including capitalized development costs ─ at the Platreef Project for the nine months ended September 30, 2020, and for the same period in 2019, are set out in the following table:

Costs incurred at the Platreef Project are deemed necessary to bring the project to commercial production and are therefore capitalized as property, plant and equipment.

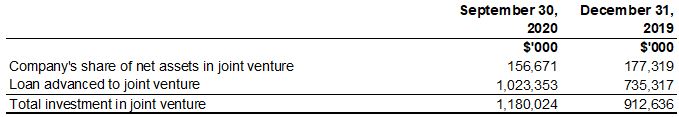

The company’s investment in the Kamoa Holding joint venture increased by $267.4 million from $912.6 million as at December 31, 2019, to $1,180.0 million as at September 30, 2020, with each of the current shareholders funding the operations equivalent to their proportionate shareholding interest. The company’s portion of the Kamoa Holding joint venture cash calls amounted to $237.4 million during the nine months ending September 30, 2020, while the company’s share of losses from the joint venture amounted to $20.6 million.

The company’s investment in the Kamoa Holding joint venture can be broken down as follows:

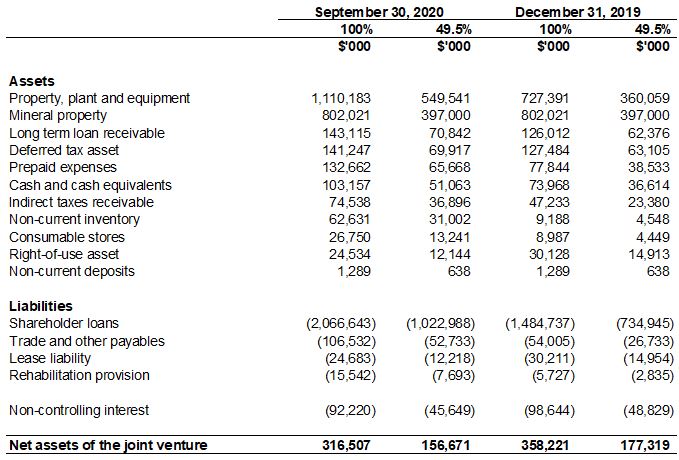

The Kamoa Holding joint venture principally uses loans advanced to it by its shareholders to advance the Kamoa-Kakula Project through investing in development costs and other property, plant and equipment, as well as continuing with exploration. This can be evidenced by the movement in the company’s share of net assets in the Kamoa Holding joint venture which can be broken down as follows:

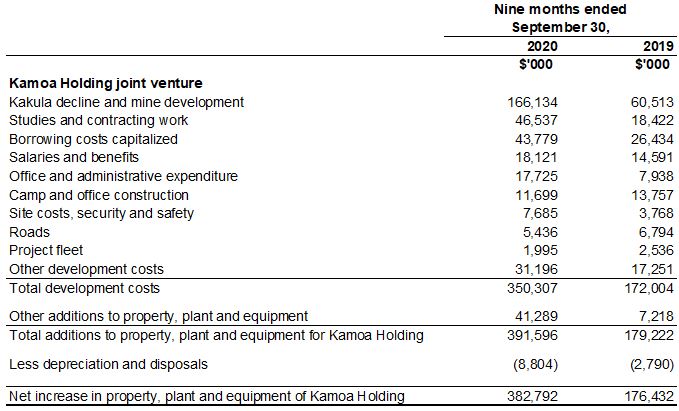

The Kamoa Holding joint venture’s net increase in property, plant and equipment from December 31, 2019, to September 30, 2020, amounted to $382.8 million and can be further broken down as follows:

The company’s total liabilities decreased by $6.3 million to $75.6 million as at September 30, 2020, from $81.9 million as at December 31, 2019, due to a $7.3 million decrease in trade and other payables.

LIQUIDITY AND CAPITAL RESOURCES

The company had $375.8 million in cash and cash equivalents as at September 30, 2020. At this date, the company had consolidated working capital of approximately $427.4 million, compared to $688.5 million at December 31, 2019.

Since December 8, 2015, each shareholder in Kamoa Holding has been required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest. The company is advancing Crystal River’s portion on its behalf in return for an increase in the promissory note due to Ivanhoe.

The Platreef Project’s current expenditure is being funded solely by Ivanhoe, through an interest bearing loan to Ivanplats, as the Japanese consortium has elected not to contribute to current expenditures.

The company has budgeted $127 million for its proportionate funding of the Kamoa-Kakula Project for the remainder of 2020, where mine development work at Kakula continues with first production now expected in July 2021. The company has implemented several cost-saving measures including: reducing its global office footprint; reducing its corporate and senior management headcount by approximately 20%; applying temporary voluntary pay reductions taken by executive management; and implementing other company-wide, cash-saving measures. Ivanhoe’s board of directors also allocated reduced 2020 budgets to its projects. The company has forecasted to spend $8 million on further development at the Platreef Project; $8 million at the Kipushi Project; $3 million on regional exploration in the DRC; and $5 million on corporate overheads for the remainder of 2020.

As Ivanhoe continues to advance its projects, the company’s management has reviewed and assessed numerous alternatives to finance its share of construction costs for the Kakula Copper Mine and to advance exploration and development initiatives at its other projects in Southern Africa. These alternatives include, but are not limited to, existing liquidity sources, including cash, receivables and investments, selling assets, project financing, streaming or royalty transactions, equipment and debt financing. While Ivanhoe expects that it will continue to have sufficient cash resources or project-related financing options available to cover its share of the initial capital costs at the Kakula Mine, the company will continue to seek out and review opportunities presented to Ivanhoe, having regard to the best interests of Ivanhoe as well as to Ivanhoe’s operations and financial position, industry conditions and geopolitical considerations.

The company has a mortgage bond outstanding on its offices in London, United Kingdom, of £3.2 million ($4.1 million). The bond is fully repayable on August 28, 2025, secured by the property and incurs interest at a rate of GBP 1 month LIBOR plus 1.9% payable monthly in arrears. Only interest will be payable until maturity.

In 2013, the company became party to a loan payable to ITC Platinum Development Limited, which had a carrying value of $31.3 million as at September 30, 2020, and a contractual amount due of $34.4 million. The loan is repayable once the Platreef Project has residual cashflow, which is defined in the loan agreement as gross revenue generated by the Platreef Project, less all operating costs attributable thereto, including all mining development and operating costs. The loan attracts interest of USD 3 month LIBOR plus 2% calculated monthly in arrears. Interest is not compounded. The difference of $3.1 million between the contractual amount due and the carrying value of the loan is the benefit derived from the low-interest loan.

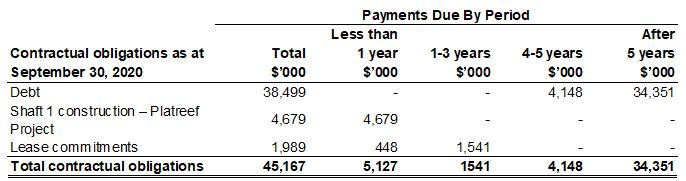

The company has an implied commitment in terms of spending on work programs submitted to regulatory bodies to maintain the good standing of exploration and exploitation permits at its mineral properties. The following table sets forth the company’s long-term obligations:

Debt in the above table represents the mortgage bond owing to Citibank and loan payable to ITC Platinum Development Limited, as described above.

The company is required to fund its Kamoa Holding joint venture in an amount equivalent to its proportionate shareholding interest.

This news release should be read in conjunction with Ivanhoe Mines’ unaudited condensed consolidated interim financial statements and Management’s Discussion and Analysis report for the three and nine months ended September 30, 2020 available at www.ivanhoemines.com and at www.sedar.com.

Qualified Persons

Disclosures of a scientific or technical nature regarding the revised capital expenditure and development scenarios at the Kamoa-Kakula Project in this news release have been reviewed and approved by Steve Amos, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Amos is not considered independent under NI 43-101 as he is the Head of the Kamoa Project. Mr. Amos has verified the technical data disclosed in this news release.

Other disclosures of a scientific or technical nature regarding the Kakula and Kansoko stockpiles in this news release have been reviewed and approved by George Gilchrist, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Gilchrist is not considered independent under NI 43-101 as he is the Vice President, Resources of Ivanhoe Mines. Mr. Gilchrist has verified the other technical data disclosed in this news release.

Other disclosures of a scientific or technical nature in this news release have been reviewed and approved by Stephen Torr, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Project Geology and Evaluation. Mr. Torr has verified the other technical data disclosed in this news release.

Ivanhoe has prepared a current, independent, NI 43-101-compliant technical report for each of the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project, which are available under the company’s SEDAR profile at www.sedar.com:

- The Kamoa-Kakula Integrated Development Plan 2020 dated October 13, 2020, prepared by OreWin Pty Ltd., China Nerin Engineering Co., Ltd., DRA Global, Epoch Resources, Golder Associates Africa, KGHM Cuprum R&D Centre Ltd., Outotec Oyj, Paterson and Cooke, Stantec Consulting International LLC, SRK Consulting Inc., and Wood plc., covering the company’s Kamoa-Kakula Project;

- The Platreef 2017 Feasibility Study Technical Report dated September 4, 2017, prepared by DRA Global, OreWin Pty. Ltd., Amec Foster Wheeler, Stantec Consulting, Murray & Roberts Cementation, SRK Consulting, Golder Associates, and Digby Wells Environmental, covering the company’s Platreef Project; and

- The Kipushi 2019 Mineral Resource Update dated March 28, 2019, prepared by OreWin Pty Ltd., MSA Group (Pty) Ltd., SRK Consulting (South Africa) (Pty) Ltd and MDM (Technical) Africa Pty Ltd. (a division of Wood PLC), covering the company’s Kipushi Project.

These technical reports include relevant information regarding the effective dates and the assumptions, parameters and methods of the mineral resource estimates on the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the Platreef Project, Kipushi Project and Kamoa-Kakula Project. Additional information regarding the company, including the company’s Annual Information Form, is available on SEDAR at www.sedar.com.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

Matthew Keevil +1.604. 558.1034

Forward-looking statements

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of the company’s Q3 2020 MD&A.

Such statements include without limitation, the timing and results of: (i) statements that the concentrator plant is expected to be mechanically complete in Q2 2021 and that first copper concentrate production at the Kakula Mine now is expected in July 2021; (ii) statements regarding the pace of underground development at the Kakula Mine is expected to continue to accelerate as additional mining crews are mobilized; (iii) statements regarding Kakula’s high-grade stockpile is projected to significantly expand in the coming months as the majority of Kakula’s underground development will be in mining zones grading +5% copper; (iv) statements regarding refurbishment of six turbines at the Mwadingusha hydro-electric power plant and associated 220-kilovolt infrastructure is progressing and that the refurbished plant is projected to deliver approximately 72 megawatts of power to the national grid in the first quarter of 2021; (v) statements that Kakula is expected to produce an extremely high grade and clean copper concentrate (containing over 55% copper) that will be highly coveted by copper smelters around the world; (vi) statements regarding accelerating expansion plans for the second, 3.8 Mtpa concentrator module at the Kakula Mine, which will double the mine’s processing capacity from 3.8 Mtpa to 7.6 Mtpa and the plans to bring forward the completion of the Phase 2 mill expansion from Q1 2023 to Q2 2022; (vii) statements that the holing at Kakula will significantly increase ventilation to the centre of the orebody, allowing for additional mining crews to begin highly-productive mining operations in Kakula’s high-grade ore zones; (viii) statements regarding a phased development plan for the Platreef Project that targets significantly lower initial capital, to accelerate first production by using Shaft 1 as the mine’s initial production shaft, followed by expansions to the production rate as outlined in the 2017 definitive feasibility study (DFS); (ix) statements regarding the timing of the results of the Platreef Project’s phased development plan and updated definitive feasibility study expected to be released in mid-November 2020; (x) statements that the Kamoa-Kakula joint venture had an estimated $570 million of capital costs remaining until initial production; (xi) statements regarding the planned mining methods at Platreef will use highly productive, mechanized methods, including long-hole stoping and drift-and-fill mining, and that each method will utilize cemented backfill for maximum ore extraction; (xii) statements regarding Ivanhoe’s expectation that it will continue to have sufficient cash resources or project-related financing options available to cover its share of the initial capital costs at the Kakula Mine; (xiii) statements regarding timing and duration of reduced activities at the Platreef and Kipushi projects; (xiv) statements that the Kamoa-Kakula joint-venture partners are in the process of finalizing project-level financing credit facilities to accelerate Phase 2 development; and (xv) statements regarding the expected expenditure for the remainder of 2020 of $8 million on further development at the Platreef Project; $8 million at the Kipushi Project; $3 million on regional exploration in the DRC; and $5 million on corporate overheads – as well as its proportionate funding of the Kamoa-Kakula Project, expected to be $127 million for the remainder of 2020.

As well, all of the results of the feasibility study for the Kakula copper mine, the Kakula-Kansoko 2020 pre-feasibility study and the updated and expanded Kamoa-Kakula Project preliminary economic assessment, the feasibility study of the Platreef Project and the pre-feasibility study of the Kipushi Project, constitute forward-looking statements or information, and include future estimates of internal rates of return, net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs and the size and timing of phased development of the projects. Furthermore, with respect to this specific forward-looking information concerning the development of the Kamoa-Kakula, Platreef and Kipushi projects, the company has based its assumptions and analysis on certain factors that are inherently uncertain. Uncertainties include: (i) the adequacy of infrastructure; (ii) geological characteristics; (iii) metallurgical characteristics of the mineralization; (iv) the ability to develop adequate processing capacity; (v) the price of copper, nickel, zinc, platinum, palladium, rhodium and gold; (vi) the availability of equipment and facilities necessary to complete development; (vii) the cost of consumables and mining and processing equipment; (viii) unforeseen technological and engineering problems; (ix) accidents or acts of sabotage or terrorism; (x) currency fluctuations; (xi) changes in regulations; (xii) the compliance by joint venture partners with terms of agreements; (xiii) the availability and productivity of skilled labour; (xiv) the regulation of the mining industry by various governmental agencies; (xv) the ability to raise sufficient capital to develop such projects; (xiv) changes in project scope or design, and (xv) political factors.

This news release also contains references to estimates of Mineral Resources and Mineral Reserves. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Estimates of Mineral Reserves provide more certainty but still involve similar subjective judgments. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production from the company’s projects, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that ultimately may prove to be inaccurate. Mineral Resource or Mineral Reserve estimates may have to be re-estimated based on: (i) fluctuations in copper, nickel, zinc, platinum group elements (PGE), gold or other mineral prices; (ii) results of drilling; (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates and/or changes in mine plans; (vi) the possible failure to receive required permits, approvals and licences; and (vii) changes in law or regulation.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to, the factors discussed below and under “Risk Factors”, and elsewhere in the company’s MD&A for the three and nine months ended September 30, 2020, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.